Speak directly to the analyst to clarify any post sales queries you may have.

Why fluidised bed sand cooling systems are becoming the reliability and quality backbone for modern high-throughput granular processing

Fluidised bed sand cooling systems have become a critical enabling technology wherever hot granular solids must be stabilized quickly and consistently before storage, conveying, coating, or downstream processing. By suspending sand or similar media in a controlled airflow, these systems deliver high heat-transfer rates, uniform temperature profiles, and predictable residence times. The result is tighter control over product quality, reduced thermal shock on mechanical handling equipment, and improved safety conditions compared with less controlled cooling approaches.Across industrial minerals, foundry operations, metal casting support processes, construction materials, and specialty granular products, operators are being pushed to do more with less: higher uptime, lower energy consumption, and better environmental performance-without compromising throughput. In this context, the fluidised bed approach stands out because it can be engineered for stable operation across variable feed temperatures, particle size distributions, and moisture levels, provided the air distribution, bed geometry, and controls are properly designed.

At the same time, buying behavior is becoming more technical and more risk-aware. Engineering teams are increasingly assessing not just cooling capacity but also dust management, noise, wear parts consumption, and ease of cleaning during product changeovers. Procurement teams, meanwhile, are factoring in lead times, trade exposure, and lifecycle support. This executive summary frames the most important shifts shaping specifications and supplier selection, and it highlights how segmentation, regional dynamics, tariffs, and competitive capabilities are influencing real-world decisions.

From commodity cooling to precision-controlled thermal conditioning as energy, compliance, and uptime pressures reshape system specifications

The landscape is shifting from “cooling as a utility step” to “cooling as a controlled quality operation.” End users increasingly treat temperature uniformity as a measurable quality attribute rather than a simple discharge condition. This is driving adoption of tighter closed-loop controls, more robust temperature sensing strategies, and better airflow management to maintain stable fluidization even as feed conditions fluctuate.In parallel, energy and emissions constraints are changing how systems are specified. Operators are scrutinizing blower efficiency, pressure drop across the distributor, and opportunities for heat recovery or hybrid configurations that reduce overall energy intensity. Facilities are also paying closer attention to dust and particulate management, which elevates the importance of integrated enclosures, improved sealing interfaces, and compatibility with downstream filtration systems. These requirements are not cosmetic; they directly affect permitting, housekeeping effort, and unplanned downtime.

Another transformative shift is the move toward maintainability-led design. As maintenance windows compress, buyers increasingly value quick-access wear components, modular air distribution plates, abrasion-resistant linings, and standardized instrumentation that can be serviced without extended shutdowns. Suppliers that can demonstrate predictable wear life, clear spares strategies, and field-proven service practices are gaining an advantage.

Digitalization is also reshaping expectations. Instead of relying solely on operator experience, plants are expanding the use of trend analytics for bed temperature, airflow, differential pressure, and vibration. This supports earlier detection of distributor fouling, channeling, or air leakage, and it helps teams correlate cooling stability with upstream feed variability. In practice, this is pushing vendors to provide better commissioning packages, control logic templates, and documentation that integrates into plant-wide automation standards.

Finally, supply chain resilience has become a design input. Buyers are increasingly asking where critical components are manufactured, how quickly spares can be delivered, and whether alternate specifications can be qualified without reengineering. The shift is particularly visible in parts such as blowers, motors, drives, and high-wear internals, where lead times and price volatility can derail project schedules. As a result, the competitive landscape is being shaped as much by execution capability and sourcing transparency as by thermal performance alone.

How United States tariffs in 2025 are compounding cost, lead-time, and sourcing decisions for fluidised bed sand cooling investments

The introduction and expansion of United States tariffs in 2025 is expected to influence procurement decisions for fluidised bed sand cooling systems in ways that extend beyond headline equipment pricing. Tariffs can affect not only imported complete systems but also a wide set of subcomponents and raw materials used in fabrication, including certain steel products, fabricated assemblies, motors, drives, control cabinets, and instrumentation. For buyers, the practical impact is an increase in total landed cost uncertainty, especially for projects with long engineering-to-delivery cycles.One immediate effect is a stronger preference for tariff-resilient sourcing strategies. End users may favor suppliers with domestic fabrication capacity, regional assembly options, or established alternative supply chains that reduce exposure to duty changes. Even when the core system is produced locally, tariff-driven volatility in upstream materials can still affect pricing; therefore, contract structures are shifting toward clearer escalation clauses and earlier lock-in of critical components.

Tariffs are also reshaping bid comparisons by changing the balance between capital expenditure and lifecycle expenditure. If a lower-priced imported package becomes less predictable in final cost, buyers may prioritize vendors that can demonstrate faster commissioning, higher operational stability, and readily available spares-benefits that reduce production risk and maintenance overhead. This tends to elevate the value of service networks, local inventory positions, and standardized component families that can be replaced quickly.

Project scheduling is another area of cumulative impact. When tariff policies create sudden demand shifts toward domestic capacity, local fabrication queues can lengthen. In response, engineering teams are increasingly designing for flexibility: specifying multiple acceptable brands for motors and drives, qualifying equivalent alloys or wear liners, and structuring control architectures that can accommodate alternative instrumentation without rewriting the entire PLC strategy.

Over time, tariffs may accelerate a “regionalization” of the supplier ecosystem. More integrators and OEMs are likely to promote locally sourced packages, while international suppliers may expand partnerships or light-assembly footprints to maintain competitiveness. For end users, the most robust approach is proactive: align technical specifications with supply availability, engage suppliers early on component provenance, and treat tariff exposure as a managed project risk rather than an afterthought.

Segmentation insights that clarify why cooler design choices, duty cycles, and end-use process demands create distinctly different buying criteria

Segmentation reveals that buying priorities vary sharply depending on how a system is built, where it sits in the process, and which performance outcomes matter most. When viewed by cooling approach and airflow management philosophy, the market separates into solutions optimized for strict temperature uniformity and solutions optimized for rugged throughput handling. Systems designed for precision often emphasize advanced air distribution, refined control logic, and multi-point temperature feedback, while more throughput-oriented designs highlight simplified mechanics, tolerance to feed variability, and ease of maintenance in abrasive environments.Differences become clearer when considering system configuration and installation model. Buyers evaluating standalone coolers frequently focus on integration with upstream discharge equipment and downstream conveying, prioritizing stable discharge temperature and minimal carryover dust. In contrast, integrated cooling sections embedded into broader process lines place more weight on automation compatibility, interlocking safety systems, and coordinated controls to prevent bottlenecks. This distinction influences vendor selection: some suppliers excel at delivering complete engineered packages, while others win on specialized cooling cores that integrators embed into turnkey plants.

Another segmentation lens centers on capacity range and duty cycle. Continuous high-throughput operations value distributor durability, blower redundancy strategies, and predictable wear part replacement intervals, because any cooling upset can cascade into major production losses. Lower-to-medium throughput users, including batch-oriented facilities, tend to prioritize operational flexibility, rapid start/stop behavior, and cleanout features that reduce cross-contamination risk. As a result, features such as access doors, quick-change liners, and simplified bed draining become disproportionately important in these environments.

End-use application segmentation also shapes technical emphasis. In foundry and metal-related sand handling, abrasion resistance and dust control dominate discussions, along with compatibility with reclaim systems and downstream screening. In construction materials and industrial minerals, moisture variability and particle size spread often drive the need for stable fluidization and robust instrumentation to avoid channeling. Specialty granular products may require tighter thermal control to protect coatings or binders, reinforcing demand for gentle handling and highly repeatable residence times.

Finally, segmentation by component and service ecosystem highlights a growing preference for suppliers that provide not just equipment but also commissioning discipline, operator training, and long-term spares planning. Where internal maintenance teams are lean, buyers increasingly differentiate vendors by documentation quality, control system transparency, and the ability to support troubleshooting remotely. Across all segmentation angles, the unifying trend is that the “right” system is defined less by generic cooling capacity and more by alignment with process variability, maintenance realities, and downstream quality constraints.

Regional insights showing how compliance intensity, service infrastructure, and industrial investment cycles shape cooler specifications worldwide

Regional dynamics are increasingly defined by industrial investment patterns, energy economics, and environmental compliance intensity, which together determine how fluidised bed sand cooling systems are specified and purchased. In the Americas, demand tends to emphasize reliability, maintainability, and rapid service response, particularly where continuous operations penalize unplanned downtime. Buyers often seek robust wear protection and straightforward control strategies that plant teams can maintain without highly specialized support, while also insisting on dust management solutions aligned with site EHS expectations.In Europe, the Middle East, and Africa, the market is more strongly shaped by regulatory rigor and diverse industrial conditions. European buyers frequently prioritize energy efficiency, noise mitigation, and emissions control integration, which encourages more sophisticated airflow optimization and enclosure designs. The Middle East presents a mix of greenfield industrial builds and modernization programs where high ambient temperatures and dust conditions influence air handling and filtration choices. Across parts of Africa, procurement can be highly project-driven, making vendor execution capability, training, and spare parts logistics decisive factors.

In Asia-Pacific, rapid industrial expansion and dense manufacturing clusters drive demand for scalable capacity and cost-effective performance, while also accelerating adoption of automation to stabilize quality at high throughput. Buyers often focus on compact footprints, integration with high-speed conveying, and the ability to operate reliably under variable feed conditions. As compliance standards tighten in several APAC markets, dust control and energy optimization are rising on the specification list, narrowing the gap with more mature regulatory environments.

Across all regions, localization strategies are becoming more important. Vendors that can assemble, service, or stock spares regionally reduce commissioning risk and shorten recovery time after failures. Additionally, regional differences in electrical standards, automation preferences, and operator training levels influence how “turnkey” a solution must be. Understanding these regional characteristics helps buyers predict not only what equipment is available, but how successfully it will be installed, supported, and sustained over its operating life.

Key company insights on how engineering credibility, lifecycle service strength, and integration depth are redefining competitive advantage

Competitive positioning in fluidised bed sand cooling systems is increasingly determined by engineering depth, field-proven reliability, and the ability to deliver predictable outcomes under abrasive, dusty, and thermally variable conditions. Leading companies differentiate through distributor plate design expertise, airflow control sophistication, and practical features that prevent channeling, dead zones, and excessive carryover. Buyers are paying closer attention to whether suppliers can demonstrate stable performance across a range of particle size distributions and moisture levels rather than only under ideal test conditions.Another major differentiator is lifecycle support capability. Companies with established commissioning teams, clear operator training programs, and disciplined spare parts planning are winning in environments where uptime is paramount and internal maintenance capacity is constrained. Service responsiveness matters, but so does the quality of documentation, recommended preventive maintenance routines, and the availability of wear part kits that reduce procurement friction during outages.

Manufacturing and sourcing transparency also play a growing role in supplier evaluation. Vendors that can clearly explain where critical components are produced, how they manage quality assurance for fabricated internals, and how they mitigate lead-time risks tend to be favored for projects with hard start-up deadlines. In addition, suppliers with flexible bill-of-material options-such as multiple approved motor and drive brands or alternate liner materials-help buyers maintain schedule certainty when certain components face constraints.

Finally, integration capability is shaping “who wins” in competitive bids. Some companies stand out by delivering complete engineered packages that include material handling interfaces, filtration tie-ins, instrumentation, and controls aligned to plant standards. Others compete successfully by offering specialized cooling modules that integrate smoothly into broader turnkey lines. In both cases, the strongest performers typically prove their value by reducing commissioning variability, stabilizing discharge temperature quickly after start-up, and providing a clear path to optimize performance once real production conditions are encountered.

Actionable recommendations to cut commissioning risk, strengthen uptime, and future-proof cooler assets against supply chain and compliance pressures

Industry leaders can improve outcomes by treating cooler selection as a cross-functional reliability and quality initiative rather than a single equipment purchase. Begin by converting downstream quality needs into measurable cooling requirements, including allowable discharge temperature variation, acceptable dust carryover, and constraints on product degradation. When these requirements are explicit, it becomes easier to compare suppliers on the factors that truly determine operational stability.Next, reduce project risk through specification discipline around airflow distribution and controls. Require evidence of stable fluidization across expected feed variability, and insist on instrumentation layouts that support troubleshooting, such as differential pressure monitoring across the bed and well-placed temperature sensing. Where possible, standardize on control architectures that your site can support long term, and validate that the vendor’s logic and alarms align with your operations philosophy.

Tariff and supply chain exposure should be managed proactively. Procurement teams can request component origin transparency, define acceptable alternates up front, and structure contracts with clear lead-time commitments and escalation mechanisms. Engineering teams can also design for maintainability by specifying modular wear components, quick-access inspection points, and a spares plan that aligns with your outage strategy.

Operational excellence gains often come after installation, so plan for post-commissioning optimization. Establish acceptance criteria that include steady-state performance and behavior during realistic process disturbances, then schedule a follow-up tuning window once operators have run the system under full production. Finally, invest in training that goes beyond basic operation and covers failure modes such as channeling, distributor fouling, air leakage, and dust control upsets-because these are the issues that determine long-term reliability.

Research methodology built on stakeholder interviews and rigorous validation to reflect real engineering trade-offs and procurement constraints

The research methodology combines structured primary engagement with rigorous secondary validation to ensure findings reflect real procurement behavior and operating realities. Primary work includes interviews with stakeholders across the value chain, such as equipment designers, plant engineers, maintenance leaders, integrators, and procurement professionals. These discussions focus on specification drivers, performance trade-offs, maintenance patterns, controls and instrumentation preferences, and the practical implications of lead times and component availability.Secondary research consolidates technical literature, regulatory context, trade and tariff updates, corporate disclosures, and publicly available project information to establish a consistent factual baseline. This step is used to validate terminology, map technology configurations, and identify common system architectures and performance considerations across end-use environments.

Insights are synthesized using triangulation, cross-checking claims from different stakeholder groups and reconciling differences through follow-up questions and contextual evaluation. Special attention is given to avoiding overgeneralization by separating application-specific needs-such as foundry sand handling versus industrial minerals-so conclusions remain grounded in how systems are actually selected and operated.

Quality control is applied through editorial review, consistency checks, and logic validation to ensure the narrative remains technically coherent and decision-useful. The outcome is an executive-ready perspective on technology trends, buying criteria, regional considerations, tariff impacts, and competitive positioning-presented without reliance on market sizing or speculative projections.

Conclusion tying together technology evolution, tariff-driven sourcing realities, and the operational playbook for reliable cooling performance

Fluidised bed sand cooling systems are evolving into high-impact process assets that shape product stability, plant cleanliness, and downstream reliability. As operators face tighter energy scrutiny, stronger EHS expectations, and higher uptime requirements, the selection criteria are shifting toward systems that can maintain stable fluidization under variable feed conditions while remaining easy to maintain in abrasive service.At the same time, the competitive environment is being reshaped by execution capability, service readiness, and sourcing resilience. The cumulative effects of tariffs and supply chain volatility are pushing buyers to demand greater transparency and flexibility, while regional differences in compliance and industrial context continue to influence what “best fit” looks like.

Ultimately, the most successful projects align technical specifications with operational realities. When engineering, maintenance, EHS, and procurement collaborate early-anchoring decisions in measurable quality outcomes and lifecycle support expectations-cooling systems deliver more than temperature reduction. They become stabilizers of throughput, protectors of downstream equipment, and enablers of consistent product performance.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Fluidised Bed Sand Cooling System Market

Companies Mentioned

The key companies profiled in this Fluidised Bed Sand Cooling System market report include:- AJAX Foundry Machinery Co., Inc.

- ASK Chemicals GmbH

- Danieli & C. Officine Meccaniche S.p.A.

- DISA Industries A/S

- Fives Group

- Gietart Industries Pvt. Ltd.

- Hernon Manufacturing, Inc.

- Inductotherm Group

- Karl W. Schmidt & Co. GmbH

- Magotteaux International SA

- Noell-KRC GmbH

- Pittsburg Foundry Machinery Co., Ltd.

- Rösler Oberflächentechnik GmbH

- Sintex Foundry Equipment Pvt. Ltd.

- Sinto America, Inc.

- StrikoWestofen GmbH

- Weber Group GmbH

- Zhangjiagang Guotai Machinery Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

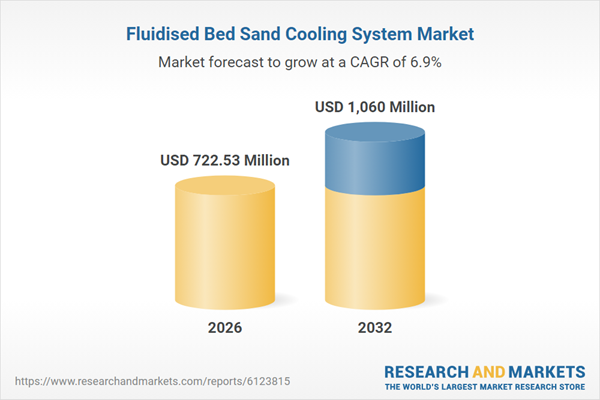

| No. of Pages | 186 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 722.53 Million |

| Forecasted Market Value ( USD | $ 1060 Million |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |