Speak directly to the analyst to clarify any post sales queries you may have.

Hemostatic materials are becoming a core wound-care capability as rapid bleeding control converges with infection prevention and streamlined healing workflows

Hemostatic materials have moved from being viewed as episodic “rescue” products to becoming central tools in modern wound care pathways. Clinicians are under constant pressure to control bleeding quickly, reduce infection risk, protect fragile tissue, and maintain a predictable healing environment, often in patients with complex comorbidities, anticoagulant use, or compromised perfusion. As a result, product selection is no longer driven only by immediate clotting performance; it increasingly reflects how well a hemostatic material integrates into broader protocols for debridement, closure, antimicrobial stewardship, and post-procedure monitoring.At the same time, the category is being reshaped by care setting shifts. Outpatient procedures, ambulatory surgery centers, and home-based wound management are handling cases that once stayed in hospitals. That redistribution elevates the importance of ease of use, training requirements, shelf stability, and consistent performance across variable environments. Consequently, manufacturers and providers are aligning around hemostatic solutions that can deliver rapid control while supporting atraumatic removal, minimizing dressing changes, and enabling smoother transitions of care.

This executive summary synthesizes the strategic dynamics affecting hemostatic materials in wound care, focusing on how technology, regulation, supply chain considerations, and buyer behavior are evolving together. It highlights the competitive implications of these trends and frames where differentiation is most likely to endure as clinical expectations and purchasing models continue to mature.

From single-function bleeding control to outcome- and workflow-driven solutions, the hemostatic wound care landscape is being reshaped by multidimensional value

Innovation in hemostatic wound care is increasingly defined by “dual-purpose” performance rather than single-attribute claims. Users are prioritizing materials that not only stop bleeding but also support moisture balance, conformability, and tissue compatibility. This shift is especially visible in scenarios where clinicians must avoid excessive pressure, reduce trauma during removal, or manage oozing in anatomically challenging sites. Accordingly, product development is leaning toward bioactive surfaces, improved adhesion control, and formats that maintain performance in the presence of blood dilution or complex exudate profiles.Another transformative shift is the tightening connection between clinical evidence and purchasing authority. Hospital value analysis committees and integrated delivery networks are demanding clearer justifications related to outcomes, workflow efficiency, and standardization across service lines. In practice, this means that materials once chosen by surgeon preference are increasingly evaluated through cross-functional lenses that include nursing, infection prevention, supply chain, and finance. As these stakeholders converge, adoption tends to favor products with simplified training requirements, more consistent results across users, and packaging configurations that reduce waste.

Digitalization is also reshaping the landscape, even when the hemostatic product itself is not “smart.” Traceability, inventory optimization, and procedure-level cost attribution are pushing suppliers to improve labeling, lot tracking, and data readiness. In parallel, provider organizations are expanding protocol-driven care to reduce variability, which can influence which hemostatic materials become preferred options in emergency departments, operating rooms, and outpatient settings.

Finally, sustainability and responsible sourcing are moving from aspirational goals to practical criteria in procurement discussions. Materials that reduce single-use plastics, minimize excess packaging, or demonstrate more efficient manufacturing footprints are gaining attention, particularly in health systems with formal environmental targets. Taken together, these shifts are transforming competition from a performance-only contest into a multidimensional race that includes usability, evidence credibility, supply resilience, and operational fit.

United States tariffs in 2025 are poised to reshape sourcing, validation, and contracting dynamics, turning supply resilience into a competitive differentiator

The cumulative impact of United States tariffs anticipated in 2025 is less about a single price shock and more about sustained operational friction across the hemostatic materials value chain. Many hemostatic products depend on globally sourced inputs, specialized textiles, biologically derived components, chemicals, packaging materials, and precision manufacturing equipment. Tariff exposure can therefore appear indirectly, raising the landed cost of upstream inputs even when the finished product is assembled domestically.In response, suppliers are likely to intensify dual-sourcing strategies, qualify alternate materials, and expand regional manufacturing options to reduce concentration risk. While these steps improve resilience, they can also lengthen validation timelines, increase quality assurance workload, and require new regulatory documentation. For biologically derived or highly engineered products, substituting components is rarely a straightforward procurement move; it may trigger performance re-verification, biocompatibility reviews, and stability testing, all of which add cost and slow change implementation.

Provider procurement teams may react by tightening contract terms, demanding greater price transparency, and requesting commitments on supply continuity. This can shift negotiations toward longer-term agreements that share risk, but it can also disadvantage smaller suppliers with limited balance sheet flexibility or narrower manufacturing footprints. At the same time, distributors and group purchasing organizations may push for broader standardization to reduce SKU complexity, which can amplify competitive pressure on suppliers that rely on niche variants rather than scalable platforms.

Over the medium term, tariffs can influence innovation sequencing. When input costs rise and uncertainty persists, organizations may prioritize line extensions and format improvements that leverage existing validated materials rather than pursuing entirely new substrate chemistries. Even so, well-capitalized firms may use the moment to invest in domestic capacity, automation, and vertically integrated control of key inputs. The net effect is an environment where supply chain strategy becomes inseparable from product strategy, and commercial success depends on how credibly a supplier can protect availability while maintaining performance and compliance.

Segmentation reveals that product selection hinges on clinical context, material behavior, and care setting workflows rather than one-size-fits-all hemostasis

Segmentation insights in hemostatic materials for wound care increasingly reflect how buyers match product attributes to specific clinical contexts rather than choosing a single solution for all bleeding scenarios. By product type, the decision logic typically separates mechanical and passive options from active and flowable solutions, with each category valued for different balances of speed, conformability, and tissue interaction. Mechanical formats often win where simplicity, immediate availability, and low training burden matter, while active agents are more frequently prioritized when bleeding risk is higher or when patient factors reduce clotting efficiency.By material composition, the market continues to differentiate between collagen-based matrices, oxidized regenerated cellulose, gelatin sponges, chitosan-based dressings, alginate-derived products, fibrin-based sealants, and synthetic polymer systems. The selection trade-offs tend to center on biocompatibility, absorption behavior, swelling characteristics, and removal considerations. For example, materials that swell substantially can complicate use in confined anatomical spaces, while those that resorb predictably may be preferred where follow-up access is limited. Concerns about immunogenicity, patient sensitivities, and handling characteristics further sharpen how clinicians and committees narrow approved options.

By formulation and format, the contrast between sheets, pads, sponges, powders, granules, and flowable matrices has become more strategic as care shifts to ambulatory and office-based settings. Flowables and powders can provide coverage in irregular geometries, yet they also raise questions about visualization, migration, and cleanup. Conversely, sheets and pads can offer tactile control and easier placement, but may be less adaptable in deep cavities. These format-level choices increasingly intersect with workflow design, including how quickly staff can prepare the product, how easily it integrates with suturing or closure, and how reliably it performs across varying operator experience.

By application area, surgical use cases, trauma and emergency care, dental procedures, chronic wound management, and burn care each impose distinct expectations for speed, durability, and compatibility with adjunct therapies. Surgical settings often favor products validated for intraoperative reliability and minimal interference with healing, while trauma workflows prioritize rapid deployment and performance under less controlled conditions. Chronic wounds and burns elevate the need to preserve fragile tissue, manage exudate, and maintain a stable wound environment, which can shift preference toward materials that combine hemostasis with dressing-like behavior.

By end user, hospitals, ambulatory surgery centers, specialty clinics, and home healthcare environments differ significantly in training capacity, storage conditions, and procurement governance. Hospitals can support broader formularies but may standardize aggressively across departments; ambulatory centers often seek products that reduce turnaround time and simplify documentation; specialty clinics focus on procedure-specific handling and patient comfort; home settings reward straightforward application and predictable wear time. Across these segments, the strongest commercial positions tend to come from suppliers that can articulate not just what the product does, but why it fits a specific workflow, patient profile, and value framework.

Regional adoption patterns are shaped by procurement structures, clinical protocol maturity, and access realities across the Americas, Europe, Middle East, Africa, and Asia-Pacific

Regional dynamics in hemostatic wound care are shaped by how healthcare systems balance procedural volume, regulatory expectations, and purchasing centralization. In the Americas, demand is closely tied to high surgical throughput, strong adoption of advanced wound care protocols, and rigorous value analysis processes. Buyers often expect clear evidence narratives and consistent supply performance, and they increasingly assess products through standardized pathways that connect operating rooms, emergency departments, and outpatient follow-up.In Europe, the market reflects a mix of nationally structured procurement and diverse clinical practice patterns across countries. Emphasis on quality standards and compliance can accelerate uptake for well-documented technologies, while budget discipline and tendering can intensify price competition. As health systems prioritize efficiency, products that reduce time to hemostasis, minimize re-intervention, or simplify nursing workload can be advantaged, particularly when supported by strong training and implementation resources.

In the Middle East, modernization of hospital infrastructure and investment in specialty care are elevating demand for advanced hemostatic solutions, particularly in tertiary centers and private networks. Procurement models vary widely, and suppliers often succeed when they provide robust clinician education, reliable distribution partnerships, and clear guidance for protocol integration. In Africa, access and affordability remain decisive, but there is also growing attention to scalable solutions that can perform reliably across variable storage conditions and resource constraints.

In Asia-Pacific, heterogeneity is the defining feature. Advanced markets with high procedural volumes and sophisticated hospital systems may adopt premium technologies and emphasize clinical differentiation, while emerging markets often prioritize cost-effective performance, local availability, and distributor reach. As outpatient care expands and chronic disease burden rises across the region, demand for user-friendly formats and consistent outcomes is expected to intensify, rewarding suppliers that can tailor portfolios and support services to local clinical realities.

Company success increasingly depends on portfolio coherence, clinical evidence, and implementation support that withstands procurement scrutiny across care settings

Competition among key companies in hemostatic materials for wound care is increasingly defined by portfolio breadth, evidence strategy, and the ability to serve multiple care settings with consistent quality. Large diversified medtech and healthcare manufacturers often leverage established hospital relationships, contracting infrastructure, and training programs to secure formulary placement. Their advantages typically include scale in manufacturing, mature regulatory capabilities, and the resources to run multi-site evaluations that align with value analysis requirements.Specialist players and innovation-led firms, by contrast, frequently compete through focused differentiation in material science, format design, or application-specific performance. They may excel in targeted segments such as dental bleeding control, minimally invasive surgery, or chronic wound environments where handling and tissue compatibility are critical. However, these firms can face pressure to prove supply resilience and service capacity as provider organizations consolidate purchasing and standardize product sets.

Across company types, strategic partnerships are becoming more common. Collaborations with contract manufacturers, raw material suppliers, and distribution networks help reduce lead times and improve continuity. In parallel, co-development relationships with clinicians and academic centers can strengthen product credibility and refine use protocols, particularly for novel chemistries or biologically derived solutions that require careful education to avoid misuse.

Brand strength in this market is increasingly earned through implementation support rather than marketing alone. Companies that provide clear instructions for use, practical in-servicing, and troubleshooting guidance tend to reduce variability in outcomes, which in turn supports renewals and expansion across departments. Over time, the most defensible positions are likely to belong to those that pair material performance with dependable availability, consistent training, and documentation that withstands procurement scrutiny.

Leaders can win by aligning products to protocols, proving supply resilience, generating procurement-ready evidence, and simplifying portfolios without losing clinical fit

Industry leaders can strengthen their position by treating hemostatic materials as part of an integrated wound care system rather than a standalone SKU. Aligning product design and messaging to protocol-based care will be essential, particularly where hospitals and ambulatory centers are standardizing pathways. This requires translating features into workflow benefits such as reduced application time, easier removal, fewer dressing changes, and clearer compatibility with closure methods and antimicrobial approaches.Building tariff and supply disruption readiness should be elevated from an operations topic to a commercial commitment. Leaders can preempt procurement concerns by transparently communicating sourcing strategies, qualifying alternate inputs proactively, and documenting change-control practices that protect performance. Where feasible, investing in regional manufacturing, safety stock policies, and supplier diversification can help convert resilience into a differentiator during contracting cycles.

Evidence generation should be designed for real purchasing decisions, not only clinical publication value. Practical endpoints such as time to hemostasis in routine workflows, re-bleed management, ease of use across varied staff experience, and impact on procedure turnover can be more persuasive to committees than narrowly defined benchmarks. Additionally, developing education modules that reduce misuse and standardize technique can protect outcomes and reduce variability that undermines product reputation.

Finally, leaders should refine segmentation-led portfolios without overcomplicating choice. A coherent “core and complement” approach can help organizations offer a small number of primary options supported by clearly defined adjuncts for higher-risk cases or specialized anatomies. This balances standardization pressures with the clinical reality that no single material fits every wound type, enabling suppliers to win broader adoption while preserving premium positioning where it is justified.

A triangulated methodology blending regulatory review, clinical literature, and stakeholder interviews builds a decision-ready view of hemostatic wound care dynamics

The research methodology for this market analysis combines structured secondary research with targeted primary insights to build a decision-ready view of hemostatic materials in wound care. Secondary work includes systematic review of regulatory databases, publicly available product documentation, corporate filings, standards and guidance relevant to wound management, and peer-reviewed clinical literature to map technology types, indications, and evolving practice patterns.Primary research is conducted through interviews and structured discussions with stakeholders across the ecosystem, including clinicians involved in surgery, trauma, emergency care, and wound management, as well as procurement and supply chain professionals who influence formulary decisions. These conversations are used to validate real-world usage patterns, identify adoption barriers, clarify evaluation criteria, and understand how training, packaging, and logistics affect product preference in different care settings.

Data triangulation is applied throughout to reconcile differences between published information and field perspectives. Product-level comparisons emphasize attributes that drive selection, such as handling, compatibility with anatomical sites, resorption behavior, and integration into clinical workflows. Competitive analysis considers portfolio positioning, evidence approach, distribution reach, and operational capabilities, with attention to how external forces such as tariffs, standardization, and sustainability expectations are likely to influence strategy.

Quality control steps include consistency checks across sources, terminology harmonization across material classes, and peer review of key assumptions to reduce bias. The result is a narrative that prioritizes actionable insights for decision-makers while maintaining methodological rigor and transparency.

Hemostatic wound care is entering a protocol-driven era where durable differentiation comes from real-world usability, resilience, and evidence-led adoption

Hemostatic materials in wound care are advancing into a more strategic, protocol-driven category where performance must be proven not only in controlled settings but also across diverse workflows and increasingly decentralized sites of care. As clinical demands expand, the winning solutions are those that combine rapid bleeding control with predictable handling, tissue compatibility, and straightforward integration into broader healing strategies.Meanwhile, external pressures are reshaping how products are evaluated and supplied. Procurement centralization, sustainability expectations, and the operational impact of tariff-related uncertainty are pushing manufacturers to compete on resilience and implementation support as much as on technical attributes. This environment rewards companies that can reduce variability in real-world outcomes through training, evidence aligned to purchasing decisions, and portfolios designed around clear clinical use cases.

Taken together, the market is entering a phase where differentiation will be sustained by practical value delivery. Organizations that understand how segmentation, regional requirements, and supply chain realities interact will be better positioned to support clinicians, satisfy procurement stakeholders, and build durable customer relationships.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Hemostatic Materials in Wound Care Market

Companies Mentioned

The key companies profiled in this Hemostatic Materials in Wound Care market report include:- 3M Company

- Ansell Limited

- Arthrex, Inc.

- Avanos Medical, Inc.

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Cardinal Health, Inc.

- ConvaTec Group plc

- Ethicon, Inc.

- Hemostasis LLC

- Integra LifeSciences Corporation

- Johnson & Johnson Services, Inc.

- Medline Industries, L.P.

- Medtronic plc

- QuikClot

- Smith & Nephew plc

- Smiths Group plc

- Stryker Corporation

- Teleflex Incorporated

- Zimmer Biomet Holdings, Inc.

Table Information

| Report Attribute | Details |

|---|---|

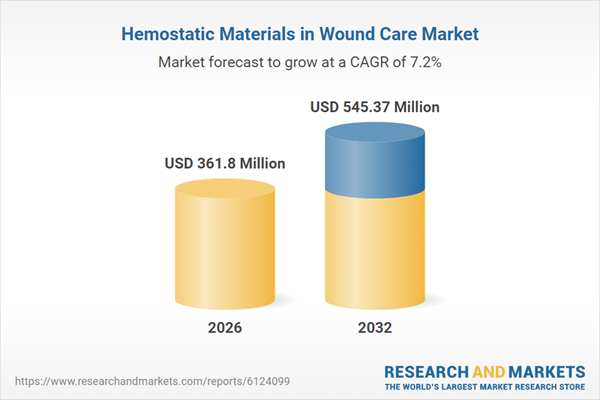

| No. of Pages | 184 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 361.8 Million |

| Forecasted Market Value ( USD | $ 545.37 Million |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |