Speak directly to the analyst to clarify any post sales queries you may have.

e-Procurement purchasing system software is now the spend-control nerve center, aligning compliance, supplier risk, and user experience at scale

e-Procurement purchasing system software has shifted from a transactional tool into a strategic control plane for how organizations spend money, manage risk, and coordinate suppliers. What once centered on digitizing requisitions and purchase orders now extends into policy enforcement, supplier governance, sustainability reporting, and continuous savings identification. This expansion is happening because procurement is being asked to do more with less while simultaneously improving compliance, speed, and resilience across increasingly complex supply chains.In parallel, the buying center has widened. Procurement may sponsor the initiative, but finance needs tighter controls and auditability, IT needs secure integration patterns and manageable architecture, and business units need intuitive experiences that do not slow down operations. As a result, modern platforms compete on far more than catalogs and approvals; they are judged by how well they connect to ERP, manage supplier data, support guided buying, and enable intelligent automation.

Against this backdrop, the executive conversation is no longer whether to adopt e-Procurement software, but how to select and deploy it in a way that delivers measurable control without creating friction. The rest of this summary frames the shifts shaping the market, the pressure introduced by the 2025 U.S. tariff environment, and the segmentation and regional dynamics that influence adoption and vendor fit.

User-centric automation, real-time spend intelligence, and supplier-risk governance are redefining what modern purchasing platforms must deliver

The landscape is being reshaped by the convergence of automation, data governance, and end-user experience. Organizations increasingly expect guided buying that feels consumer-grade while still enforcing policy, preferred suppliers, and budget controls. This expectation has elevated UX design, workflow configurability, and in-app assistance from “nice to have” to baseline requirements, especially in decentralized environments where adoption determines realized value.At the same time, procurement teams are moving from periodic reporting to continuous intelligence. Embedded analytics, category insights, and exception management are becoming central because stakeholders want to see what is being bought, from whom, and under what terms in near real time. This is driving tighter integration with ERP and finance systems, more robust master data management, and stronger supplier identity resolution to reduce duplicates, improve contract compliance, and support audit readiness.

Another major shift is the broader reach of procurement platforms into supplier collaboration and risk management. Increasing geopolitical volatility, logistics disruption, and regulatory scrutiny have made supplier onboarding, qualification, and monitoring more consequential. As a result, platforms that can connect sourcing, contracting, purchasing, and supplier performance into a coherent workflow are gaining attention, particularly where organizations need to document due diligence, manage certifications, or respond quickly to supply interruptions.

Finally, the market is rebalancing between suite consolidation and best-of-breed specialization. Some organizations prefer fewer vendors and deeper ERP alignment, while others select modular tools to optimize specific processes such as invoice matching, catalog management, or supplier onboarding. This tension is pushing providers to offer flexible deployment models, open APIs, and partner ecosystems so buyers can assemble a fit-for-purpose procurement stack without creating integration debt.

Tariff volatility in 2025 is accelerating demand for adaptive purchasing controls, auditable decisions, and rapid supplier substitution capabilities

United States tariff actions and related trade policy uncertainty in 2025 amplify the need for procurement systems that can respond quickly to cost shocks and sourcing constraints. When tariffs change the landed cost of categories, procurement teams must revisit supplier selections, renegotiate terms, adjust order strategies, and document rationale for internal stakeholders. Manual processes struggle under this pace, particularly when multiple business units purchase similar goods through different channels.In this environment, purchasing systems become a mechanism for enforcing adaptive policy. Organizations increasingly need the ability to redirect demand toward approved alternatives, apply region- or commodity-specific rules, and control maverick spend that undermines negotiated savings. Configurable approval flows, dynamic buying channels, and catalog governance help ensure that changes in sourcing strategy translate into actual buying behavior.

Tariff volatility also increases the importance of supplier diversification and the traceability of purchasing decisions. Procurement leaders are being asked to prove that they evaluated alternatives, considered total cost, and complied with internal controls. Platforms that provide strong audit trails, contract linkage, and clear visibility into supplier attributes can reduce decision friction while improving defensibility. Additionally, organizations are strengthening collaboration between procurement, finance, and logistics to reconcile price changes, lead-time impacts, and inventory policies.

Over time, the cumulative impact is a shift toward resilience-oriented procurement operations. Rather than optimizing solely for unit cost, many organizations are embedding risk indicators, contingency suppliers, and scenario planning into purchasing governance. e-Procurement systems that can support multi-supplier catalogs, flexible sourcing rules, and tighter integration to supplier and item master data are better positioned to operationalize these resilience strategies under continued trade pressure.

Segmentation insights show how deployment preferences, process scope, and organizational complexity determine what “best fit” really means

Key segmentation dynamics reveal that buying priorities vary sharply by deployment approach, enterprise scale, industry needs, and the maturity of existing procurement processes. Cloud-forward organizations tend to emphasize speed of configuration, frequent feature updates, and easier integration through modern APIs, whereas on-premises or hybrid preferences remain stronger where data residency, legacy ERP constraints, or highly customized workflows dominate. These differences shape vendor selection criteria, implementation timelines, and the level of internal IT involvement required for long-term success.Solution expectations also diverge by how broadly the platform is intended to operate across the source-to-pay lifecycle. Some buyers focus narrowly on purchasing execution, optimizing requisition-to-order processes, approvals, catalogs, and receiving. Others prioritize linkage to sourcing, contract management, and supplier management to ensure that negotiated terms translate into controlled buying and measurable compliance. This segmentation affects how organizations define “value,” whether through faster cycle times, tighter spend under management, or improved supplier governance.

Another important lens is organizational structure and spend complexity. Centralized procurement models often optimize standardization, shared catalogs, and uniform policy enforcement, while decentralized models prioritize flexibility, localized supplier options, and configurable controls that still maintain guardrails. In multi-entity environments, the ability to support entity-based approval hierarchies, tax and invoicing variations, and shared supplier records becomes decisive. Meanwhile, mid-market organizations frequently seek rapid time-to-value and packaged best practices, whereas large enterprises demand extensibility, deep integration, and advanced controls.

Finally, segmentation by user community and purchasing channels has become more pronounced. Indirect spend-heavy organizations value guided buying, punchout catalogs, and strong requisition experiences that drive adoption among occasional users. Direct materials or operations-centric environments often require tighter alignment with inventory, plant-level receiving, and supplier delivery performance. Across both contexts, the segmentation underscores a common theme: the strongest platforms are those that can be configured to match process realities without compromising governance or creating an overly complex user experience.

{{SEGMENTATION_LIST}}

Regional insights reveal how compliance, localization, and digital maturity shape adoption patterns and platform requirements worldwide

Regional dynamics in e-Procurement purchasing system software adoption reflect differences in regulatory requirements, digital maturity, and procurement operating models. In more mature procurement technology environments, buyers increasingly prioritize integration depth, advanced analytics, and supplier governance features that support multi-tier visibility. In fast-growing digital markets, the emphasis often shifts toward usability, accelerated rollout, and support for local invoicing, taxation, and supplier onboarding practices.Cross-border purchasing adds another layer of complexity. Multinational organizations need consistent policy enforcement alongside local flexibility, especially where language, currency, tax rules, and supplier practices vary widely. Regions with higher regulatory scrutiny often drive stronger demand for audit trails, approvals, and document management, while regions experiencing frequent logistics disruption tend to emphasize supplier redundancy and the ability to pivot to alternatives without breaking process controls.

Data privacy and security expectations also vary by region, influencing deployment decisions and vendor evaluation criteria. Some markets push buyers toward in-region hosting, stricter access controls, and more robust governance over supplier and employee data. Elsewhere, the primary concern is interoperability with existing ERP and finance systems and the availability of implementation partners who understand local compliance norms.

Ultimately, regional insight highlights the importance of selecting a platform that can standardize core processes while adapting to local requirements without expensive customization. Organizations that succeed typically establish a global procurement template, then configure region-specific rules for approvals, taxation, and supplier documentation to ensure both adoption and compliance.

{{GEOGRAPHY_REGION_LIST}}

Company insights highlight differentiation in guided buying, supplier enablement, integration depth, and the services ecosystems that drive adoption

Company differentiation in this market increasingly hinges on how well providers combine usability, control, and ecosystem integration. Leaders are moving beyond basic requisitioning to deliver guided buying, configurable workflows, and policy enforcement that reduces off-contract purchasing. At the same time, they are investing in analytics that elevate procurement from reporting to proactive management, enabling teams to spot exceptions, track compliance, and identify savings opportunities without waiting for month-end reconciliation.Another axis of differentiation is supplier enablement. Providers that streamline onboarding, data validation, and supplier collaboration tend to reduce the operational burden on procurement teams and improve data quality over time. This matters because many procurement pain points trace back to inconsistent supplier records, incomplete tax and banking information, and poorly governed catalogs. Platforms that can automate validation steps, support supplier self-service, and maintain clean master data help organizations scale without adding headcount.

Integration strategy also separates strong contenders from the rest. Buyers prefer platforms that connect cleanly to ERP, finance, identity management, and data platforms, and that can support both standardized and complex enterprise architectures. Vendors with robust APIs, prebuilt connectors, and proven implementation approaches reduce project risk and speed up time-to-value. Equally important is the ability to support modular adoption, allowing organizations to start with purchasing and expand into adjacent processes as internal maturity grows.

Finally, services and partner ecosystems matter more than many buyers expect. Implementation quality, change management support, and the availability of regional partners influence adoption outcomes, especially in multi-country rollouts. Companies that pair product capability with strong enablement resources and clear governance frameworks often achieve higher utilization, better compliance, and more sustainable value realization.

Actionable recommendations focus on embedding policy into user experience, strengthening data governance, and scaling with integration-led rollouts

Industry leaders can strengthen outcomes by treating e-Procurement as an operating model change rather than a software installation. Start by defining non-negotiable controls such as approval thresholds, preferred supplier rules, and contract linkage, then design the user experience so compliant buying is the easiest path. When policy is embedded into guided buying and catalogs, adoption rises and enforcement becomes less dependent on manual reviews.Next, invest early in data foundations. Establish governance for supplier master data, item and service taxonomy, and contract metadata, and align ownership across procurement, finance, and IT. Clean data improves everything from search relevance to spend visibility and audit readiness, and it reduces downstream friction in invoicing and receiving. In tariff-volatile categories, ensure the system can capture country-of-origin attributes and support rapid substitution of items or suppliers without creating duplicate records.

Leaders should also prioritize integration and architecture decisions that avoid long-term complexity. Map critical touchpoints to ERP, accounts payable, identity and access management, and data warehouses, and design for extensibility through APIs and event-driven patterns where possible. This approach supports future automation, including smarter approvals, anomaly detection, and supplier risk signals, without requiring disruptive re-implementation.

Finally, build a pragmatic rollout strategy. Pilot in a controlled scope where compliance gains are visible, then expand using a repeatable global template with local configuration. Pair training with targeted change management for occasional buyers, because their experience often determines overall adoption. Establish performance indicators around cycle time, compliance to preferred suppliers, exception rates, and user satisfaction, and use those metrics to drive continuous improvement after go-live.

Research methodology connects functional evaluation with segmentation and regional context to reflect how platforms perform in real procurement environments

The research methodology combines structured market analysis with a practical lens on procurement operations and software capabilities. It begins with defining the solution boundary for e-Procurement purchasing system software, distinguishing core purchasing workflows from adjacent source-to-pay modules while still assessing integration patterns that influence real-world deployments. This framing ensures that functional comparisons remain consistent and relevant to how organizations buy, implement, and scale these platforms.Next, the methodology applies a segmentation-driven approach to evaluate how requirements change across different organizational contexts. This includes assessing deployment preferences, process scope, buyer maturity, and the realities of centralized versus decentralized procurement. Regional considerations are incorporated to reflect localization needs, compliance requirements, and differing expectations around security, hosting, and supplier enablement.

The analysis also evaluates vendor positioning by examining product capabilities, integration approach, configurability, and the breadth of supporting services that affect time-to-value. Attention is paid to workflow flexibility, catalog management, approvals, auditability, analytics, and supplier onboarding because these features frequently determine adoption and compliance outcomes. Where relevant, the methodology considers partner ecosystems and implementation support as part of the overall value proposition.

Finally, findings are synthesized into decision-oriented insights designed to help leaders move from feature checklists to fit-for-purpose selection criteria. The emphasis is on understanding trade-offs, identifying risk areas in deployment, and clarifying which capabilities best support resilient procurement operations under evolving regulatory and tariff conditions.

Conclusion emphasizes resilient procurement operations, where usability and governance converge to meet tariff pressure and compliance demands

e-Procurement purchasing system software is increasingly central to how organizations control spend, enforce policy, and build supply resilience. The market is moving toward solutions that combine consumer-grade experiences with enterprise-grade governance, and buyers are raising expectations for analytics, supplier enablement, and integration flexibility. As procurement’s mandate expands, the software chosen must support both day-to-day efficiency and strategic adaptability.The tariff environment in 2025 reinforces these priorities by forcing faster decision cycles, stronger documentation, and more responsive purchasing controls. Organizations that can redirect demand, maintain clean supplier data, and link purchases to contracts and approvals are better positioned to manage cost shocks and compliance scrutiny.

In this context, successful selection and rollout depend on aligning stakeholders early, grounding decisions in data governance and integration design, and treating adoption as a continuous program rather than a one-time project. Platforms that balance configurability with usability, and standardization with local flexibility, are most likely to deliver durable procurement performance.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China e-Procurement Purchasing System Software Market

Companies Mentioned

The key companies profiled in this e-Procurement Purchasing System Software market report include:- Aptos, Inc.

- Basware Corporation

- Bonfire Interactive Inc.

- Coupa Software Inc.

- Fairmarkit, Inc.

- GEP, Inc.

- Ivalua SAS

- Jaggaer, Inc.

- Kissflow, Inc.

- Oracle Corporation

- Proactis Holdings Limited

- Procurify, Inc.

- SAP SE

- Tipalti, Inc.

- Tradeshift ApS

- Workday, Inc.

- Xeeva, Inc.

- Zycus, Inc.

Table Information

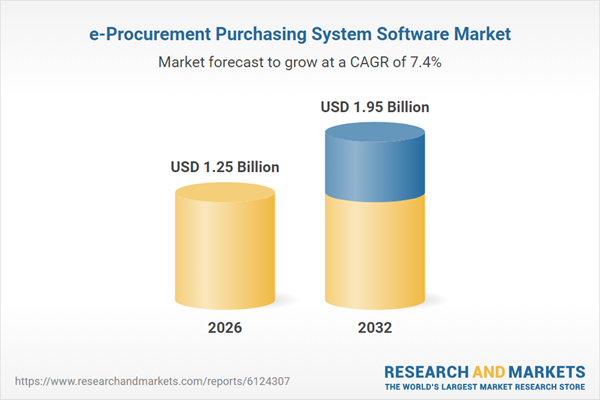

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.25 Billion |

| Forecasted Market Value ( USD | $ 1.95 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |