Speak directly to the analyst to clarify any post sales queries you may have.

PCIe M.2 Connectors Become Strategic Design Choices as Bandwidth, Thermal Limits, and Platform Density Redefine What “Compatible” Means

PCIe M.2 connectors sit at the convergence of two forces that are reshaping modern electronics: the relentless push for higher bandwidth and the equally strong pressure to compress functionality into thinner, lighter, and more power-conscious designs. What began as a practical internal interface for small-form-factor SSDs has expanded into a broader ecosystem supporting storage, wireless modules, accelerators, and embedded expansion across consumer devices, enterprise platforms, and industrial systems. As a result, connector selection is no longer a routine bill-of-material decision; it influences performance headroom, thermal behavior, assembly yield, and long-term serviceability.In parallel, the market’s expectations of M.2 implementations have become less forgiving. System architects increasingly treat signal integrity as a first-class design constraint, especially as PCIe generations advance and margin shrinks across the channel. Connector geometry, plating, contact normal force, and housing materials directly affect insertion loss and crosstalk, while PCB footprint and keep-out zones constrain routing and heat spreading options. Consequently, the connector’s mechanical design and electrical characteristics must be evaluated alongside the storage device’s controller behavior, board stack-up, and enclosure airflow.

Another defining feature of today’s PCIe M.2 environment is the diversity of deployment contexts. A single connector family may be expected to support thin-and-light notebooks, thermally constrained mini PCs, rugged edge gateways, and dense server backplanes through adapters or carrier cards. That diversity multiplies qualification needs and complicates sourcing because buyers must balance interoperability with application-specific constraints such as vibration, shock, repeated mating cycles, and exposure to contaminants.

This executive summary frames the PCIe M.2 connector landscape through the lens of technological change, supply chain and policy disruption, segmentation logic, and regional dynamics. It highlights how leading companies differentiate, where adoption pressures are most acute, and which strategic actions can help stakeholders secure reliable supply while meeting the performance and compliance targets that next-generation platforms demand.

From Simple Interconnect to Channel-Critical Component: How Speed, Heat, and Supply Resilience Are Transforming PCIe M.2 Connector Priorities

The PCIe M.2 connector landscape is undergoing a series of transformative shifts driven by higher interface speeds, evolving form factors, and the growing complexity of platform integration. One of the most visible changes is the transition from “fit and function” connector selection to “channel-aware” selection. As platforms move deeper into PCIe Gen4 and Gen5, designers pay closer attention to insertion loss, impedance control, and skew contributions from the connector itself. This shift is pushing suppliers to refine contact design, reduce discontinuities, and tighten manufacturing tolerances, while buyers increasingly require detailed compliance documentation and test collateral.Thermal management has also become a differentiator. In many client and edge systems, the M.2 device sits under heat spreaders, near batteries, or beneath tight chassis clearances, and the connector’s location and height influence heatsink strategy and airflow. As SSD power envelopes rise and sustained performance becomes a selling point, connector designs that enable better mechanical support and compatibility with thermal pads, shields, and retention hardware become more valuable. This is especially true where system integrators are trying to avoid throttling without increasing fan noise or chassis thickness.

Another shift is the broadening usage of the M.2 ecosystem beyond SSD storage. Wireless modules, GNSS, and specialized accelerators use M.2 variants, and this diversification is changing procurement behavior. Buyers seek connector families that can span multiple module types and maintain consistent assembly processes, reducing the number of unique parts and streamlining qualification. At the same time, the risk profile changes: wireless module performance is sensitive to grounding and placement, while storage modules pressure the PCIe channel. This duality elevates the importance of application-specific connector validation rather than assuming that “M.2 is M.2.”

Manufacturing and reliability expectations are evolving as well. Higher board densities and more compact layouts increase the sensitivity to coplanarity, solder joint robustness, and pick-and-place accuracy. Suppliers have responded with features that improve self-alignment, solder wetting, and mechanical anchoring, while OEMs are tightening incoming inspection and process controls. Additionally, sustainability and materials compliance influence design decisions, with procurement teams increasingly scrutinizing plating chemistry, halogen-free materials, and traceability.

Finally, the landscape is being reshaped by supply chain resilience strategies. Dual sourcing, regional manufacturing footprints, and longer-term capacity reservations are becoming common, particularly for connectors that sit on critical build paths. This change favors companies that can provide stable lead times, transparent change management, and strong technical support, because the cost of late-stage connector substitution can be disproportionately high when signal integrity and mechanical fit are finely tuned.

United States Tariffs in 2025 Reshape Sourcing Economics, Driving Multi-Site Production, Qualification Rigor, and Design-for-Resilience Choices

United States tariff policy in 2025 is expected to continue influencing electronics supply chains, and PCIe M.2 connectors are directly exposed because they are high-volume electromechanical components often produced within globally distributed manufacturing networks. Tariffs can affect not only the finished connectors but also upstream materials and subcomponents, including stamped contacts, plated finishes, engineered resins, and packaging inputs. As a result, the cumulative impact is less about a single line item increase and more about multi-layer cost and logistics effects that compound across the procurement cycle.One notable outcome is accelerated supplier diversification. Buyers increasingly seek alternate qualified sources or request second-site manufacturing to reduce exposure to country-specific tariff risks. This is particularly relevant for programs with long product lifecycles, such as industrial systems, networking equipment, and embedded platforms, where a tariff-driven cost swing can persist across multiple quarters and disrupt contractual pricing models. In response, suppliers may restructure production allocations, expand assembly capacity in lower-risk regions, or adjust distribution strategies to better serve U.S.-bound demand.

Tariffs also influence design-for-availability behavior. Engineering teams are more likely to standardize on connector footprints and retention hardware that can be met by multiple suppliers, reducing dependency on a single part number. However, this approach has trade-offs: high-speed PCIe implementations can be sensitive to subtle connector differences, so cross-vendor interchangeability must be validated with realistic channel simulations and compliance testing. In practice, tariffs push organizations to invest earlier in multi-source qualification rather than treating it as a late-stage contingency.

Procurement and finance teams are also revisiting commercial terms. Longer validity windows for quotes, indexed pricing clauses, and buffer inventory strategies are becoming more common, especially for mission-critical platforms. At the same time, excess inventory carries obsolescence risk when connector vendors issue product changes or when new PCIe performance targets alter preferred connector characteristics. This tension encourages closer coordination between engineering, sourcing, and supply planning to avoid “cost avoidance” decisions that create technical or lifecycle liabilities.

Ultimately, the 2025 tariff environment reinforces a broader shift toward supply chain transparency. Buyers increasingly value suppliers who provide clear country-of-origin documentation, proactive notification of manufacturing changes, and credible continuity plans. For PCIe M.2 connectors, where small mechanical differences can cascade into assembly or compliance issues, predictability and change control become as important as unit price.

Segmentation Reveals Divergent Needs Across Keying, Height, Mounting Style, and End-Use Contexts as M.2 Connectors Serve More Than SSDs

Key segmentation patterns in PCIe M.2 connectors emerge when viewing the market through the lenses of connector type, pitch and contact count expectations, mounting style, keying options, height profiles, end-application requirements, and sales channel behaviors. Across standard socket designs used for SSDs, decision-makers increasingly prioritize electrical performance documentation and validated compatibility with high-speed PCIe signaling, while in specialized configurations supporting non-storage modules, mechanical stability and grounding approaches can carry equal weight. This divergence influences how suppliers position product families and how OEMs rationalize part selections across multiple programs.When analyzed by keying and supported module types, demand separates into storage-centric implementations and broader modular expansion use cases. Storage-centric deployments tend to emphasize sustained throughput, thermal robustness around the module area, and retention strategies that reduce micro-movement under vibration or repeated thermal cycling. Meanwhile, module expansion scenarios often prioritize form-factor flexibility, repeated insertion cycles during servicing, and reliable contact behavior even when modules vary by vendor and board thickness. In both cases, the segmentation highlights a growing preference for connector ecosystems that include matching screws, standoffs, shielding options, and guidance on keep-out zones.

Mounting and assembly method segmentation reveals another important distinction. High-volume consumer electronics programs often favor connector designs optimized for automated placement, consistent coplanarity, and fast inspection, because minor assembly variability can translate into costly rework at scale. Industrial and embedded systems, by contrast, may accept slightly different assembly profiles if they gain mechanical reinforcement, higher durability, or improved resistance to shock and vibration. This segmentation drives suppliers to offer variants that share electrical fundamentals while tailoring mechanical features to different manufacturing and field conditions.

Height and profile segmentation is increasingly tied to system architecture. Thin platforms push toward low-profile connectors that fit under shields and heatsinks, yet these designs can tighten tolerances and intensify concerns about module bowing and contact stability. Taller or reinforced profiles can enable more robust mechanical retention and better clearance for thermal interfaces, which appeals to performance-focused desktops, workstations, and edge systems with higher sustained power. As platforms evolve, connector height is becoming a strategic parameter rather than a secondary mechanical detail.

Finally, segmentation by customer type and procurement model shapes how products are evaluated and supported. Large OEMs and hyperscale-adjacent buyers often demand deep technical engagement, lifecycle management, and formal change control, whereas smaller manufacturers and ODM-driven ecosystems may prioritize readily available stock, broad distributor support, and drop-in compatibility. Across these segments, the common thread is that buyers increasingly weigh supplier responsiveness and validation resources alongside the connector’s datasheet specifications.

Regional Dynamics Highlight How Manufacturing Concentration, Compliance Priorities, and Infrastructure Investment Shape PCIe M.2 Connector Demand Worldwide

Regional dynamics for PCIe M.2 connectors reflect where platforms are designed, where electronics are assembled, and where compliance and supply chain risk considerations are most pronounced. In the Americas, demand is shaped by strong enterprise and data-centric system development alongside significant client-device consumption. Buyers in this region frequently emphasize supply continuity, tariff-aware sourcing strategies, and robust documentation, particularly for programs serving regulated or long-lifecycle markets such as industrial automation and critical infrastructure.In Europe, adoption patterns are influenced by automotive-adjacent electronics, industrial computing, and stringent environmental and materials compliance expectations. Design teams often place additional emphasis on traceability, change notification discipline, and adherence to evolving sustainability requirements. As edge computing expands across manufacturing and transportation use cases, connector choices increasingly reflect durability needs, vibration tolerance, and long-term availability rather than purely cost-optimized sourcing.

The Middle East and Africa region shows growth opportunities tied to expanding digital infrastructure, telecommunications modernization, and increasing deployment of ruggedized compute at the edge. Buyers here often rely on global distribution networks and value availability, lead-time predictability, and proven interoperability. The region’s projects may be sensitive to logistical constraints, making supplier support and regional stocking strategies particularly influential in procurement decisions.

In Asia-Pacific, the landscape is shaped by the concentration of electronics manufacturing, strong notebook and consumer device ecosystems, and a rapidly evolving base of enterprise and cloud infrastructure investment. The region’s OEM and ODM networks push for connectors that support high-speed compliance while maintaining high-yield assembly characteristics. Additionally, the competitive cadence of platform refresh cycles in Asia-Pacific places pressure on connector suppliers to deliver consistent quality at scale and provide fast engineering support for footprint optimization, signal integrity review, and reliability testing.

Across regions, one unifying theme is the rising value of resilient supply chains. While performance remains a baseline requirement, regional policy, logistics realities, and manufacturing concentration are pushing buyers to evaluate connector suppliers not only on product capability but also on their ability to support multi-region fulfillment and disciplined lifecycle management.

Company Differentiation Centers on High-Speed Validation, Variant-Rich Portfolios, and Supply Assurance as Buyers Demand Both Performance and Predictability

Competition among key companies in the PCIe M.2 connector space is increasingly defined by engineering depth, portfolio breadth, and operational reliability rather than by commoditized pricing alone. Leading suppliers differentiate through high-speed capable connector designs backed by test data, application notes, and reference footprints that help OEMs reduce design iterations. As PCIe speeds climb and platform margins tighten, the ability to provide channel guidance and collaborate early with system designers becomes a meaningful competitive advantage.Another area of differentiation is product breadth across mechanical variants. Strong players tend to offer families that span multiple heights, keying options, and reinforcement styles while maintaining consistent manufacturing quality and predictable revision control. This matters because OEMs often try to reuse footprints across multiple device tiers; suppliers that can support that strategy with compatible variants help reduce complexity and accelerate program timelines.

Operational execution is equally important. Companies with multi-site manufacturing, mature quality systems, and disciplined process control are better positioned to support high-volume programs with stringent defect thresholds. Buyers also place high value on transparent product change notifications, stable part numbering practices, and long-term availability commitments, especially in industrial and embedded segments where redesigns are costly.

Finally, distributor and ecosystem support shape purchasing decisions. Suppliers that enable broad availability through authorized channels, maintain reliable inventory strategies, and provide responsive technical support tend to win designs in fast-moving consumer and commercial markets. Conversely, programs with strict qualification gates may prioritize direct supplier engagement, on-site failure analysis support, and customized sampling plans. The most successful companies increasingly combine both approaches, ensuring that engineering collaboration and scalable fulfillment reinforce each other rather than operating in silos.

Actionable Moves for Leaders: Align Connector Choice with PCIe Roadmaps, Qualify Alternates Rigorously, and Build Supply Resilience into Design Controls

Industry leaders can strengthen their position by treating PCIe M.2 connector decisions as part of an end-to-end platform strategy rather than a late-stage sourcing task. Early in the design cycle, teams should align connector selection with PCIe generation targets, board stack-up decisions, and thermal architecture. This includes requesting detailed electrical models, validating channel performance with realistic routing constraints, and ensuring the connector’s mechanical tolerance stack-up is compatible with expected module thickness and heatsink pressure.To reduce disruption risk, organizations should formalize multi-sourcing strategies that are grounded in technical equivalency, not just mechanical fit. That means qualifying alternates with compliance testing, assembly trials, and reliability evaluation under thermal cycling and vibration profiles that match the end application. Where interchangeability is a goal, designing footprints and retention hardware to accommodate more than one supplier can provide flexibility, but it must be balanced against the risk that small connector differences affect high-speed margins.

Leaders should also strengthen supplier governance. Establishing clear expectations for change notification, traceability, and lifecycle support helps prevent surprises during production ramps. In parallel, inventory strategies should be tied to lifecycle realities: buffer stock can protect builds, but it should be paired with monitoring for revision changes, plating updates, or resin substitutions that could impact compliance or solderability.

Finally, organizations can gain a competitive edge by integrating manufacturability considerations into connector choice. Collaborating with manufacturing teams to validate placement accuracy, solder joint inspection accessibility, and rework feasibility can meaningfully improve yield and reduce field failures. When combined with consistent documentation and cross-functional alignment between engineering, sourcing, and operations, these actions turn the connector from a potential bottleneck into a controllable, optimized element of the platform roadmap.

Methodology Built for Technical and Commercial Decisions: Structured Taxonomy, Expert Validation, and Supply-Chain Context for PCIe M.2 Connector Choices

The research methodology for this report is designed to translate a technically nuanced component category into decision-ready insights for engineering, sourcing, and executive stakeholders. The approach begins with structured secondary research to map the PCIe M.2 connector ecosystem, including interface standards context, typical application architectures, and product portfolio positioning across major connector families. This step establishes a consistent taxonomy to compare offerings that may differ subtly in mechanical design yet meaningfully in performance and qualification expectations.Primary research is then used to validate how buyers and suppliers interpret requirements in real deployments. Interviews and consultations focus on design considerations such as signal integrity margins at higher PCIe generations, thermal-mechanical interactions near the M.2 zone, manufacturability constraints in dense PCB layouts, and reliability expectations in rugged or long-life systems. Inputs are cross-checked to reduce bias, reconcile differing terminology, and ensure the findings reflect practical decision criteria rather than purely theoretical specifications.

The analysis also incorporates supply chain and policy scanning to capture how procurement strategies evolve under logistics volatility and tariff exposure. This includes evaluating how organizations approach dual sourcing, regional manufacturing footprints, qualification timing, and change control practices. The objective is to connect technical selection factors with operational realities that influence total program risk.

Finally, insights are synthesized into a coherent narrative that links segmentation logic, regional dynamics, and competitive positioning. Throughout, emphasis is placed on actionable interpretation, with attention to how connector attributes translate into platform-level outcomes such as compliance confidence, assembly yield, serviceability, and lifecycle stability. This methodological structure supports repeatable, transparent reasoning that decision-makers can use to guide both near-term sourcing and long-term platform planning.

Closing Perspective: PCIe M.2 Connectors Now Sit at the Crossroads of Performance, Reliability, and Trade-Driven Supply Strategy

PCIe M.2 connectors have evolved into high-consequence components that influence platform performance, reliability, and supply continuity. As PCIe generations advance and device power densities increase, the connector’s electrical and mechanical behavior becomes intertwined with signal integrity margins, thermal constraints, and manufacturability outcomes. This reality is pushing organizations to engage earlier with connector strategy, validate more thoroughly, and treat documentation and change control as core requirements rather than optional add-ons.At the same time, external pressures such as tariff exposure and logistics volatility are reshaping how companies source and qualify these parts. The most resilient strategies combine technical rigor with procurement flexibility, enabling programs to adapt without sacrificing compliance or introducing latent reliability risks.

Taken together, the landscape favors organizations that can integrate engineering, sourcing, and operations into a single playbook for M.2 connectivity. Those that do will be better positioned to deliver consistent platform performance, reduce late-stage redesigns, and maintain predictable production in an environment where both standards and supply chains continue to shift.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China PCIe M.2 Connector Market

Companies Mentioned

The key companies profiled in this PCIe M.2 Connector market report include:- 3M Company

- Amphenol Corporation

- BizLink Technology, Inc.

- EDAC Technologies, Inc.

- Foxconn Interconnect Technology Inc.

- HARTING Technologiegruppe

- Hirose Electric Co., Ltd.

- Japan Aviation Electronics Industry, Limited

- Kyocera AVX Corporation

- LUMBERG GmbH

- Molex, LLC

- Panasonic Corporation

- Phoenix Contact GmbH & Co. KG

- Rosenberger Hochfrequenztechnik GmbH & Co. KG

- Samtec, Inc.

- Sumitomo Electric Industries, Ltd.

- TE Connectivity Ltd.

- Yamaichi Electronics Co., Ltd.

Table Information

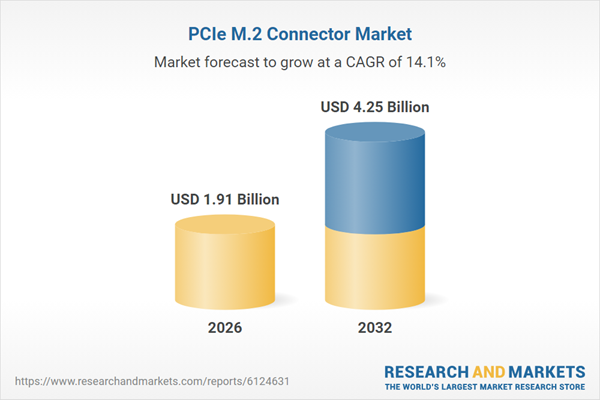

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.91 Billion |

| Forecasted Market Value ( USD | $ 4.25 Billion |

| Compound Annual Growth Rate | 14.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |