Speak directly to the analyst to clarify any post sales queries you may have.

Why weighing type screw feeders are becoming mission-critical metering assets for accuracy, compliance, and resilient operations

Weighing type screw feeders sit at the center of modern bulk solids handling because they turn a difficult material behavior problem into a controlled dosing outcome. Industries that rely on powders, granules, and flakes increasingly need repeatable feed rates, traceable mass balance, and stable process control despite variability in material properties such as bulk density, flowability, moisture, and particle size distribution. In practice, the weighing function-whether through loss-in-weight or gain-in-weight architectures-elevates the screw feeder from a simple conveying device into a metering instrument that directly influences yield, product quality, and downstream equipment stability.Across process industries, the role of these feeders is expanding as operations pursue tighter recipe compliance, reduced giveaway, and faster changeovers. Producers are also demanding better containment for dusty or hazardous materials, improved cleanability for allergen or cross-contamination control, and safer maintenance access. As a result, the competitive conversation is no longer limited to screw geometry and motor selection; it includes control algorithms, digital diagnostics, integration readiness, hygienic design, and total lifecycle performance.

At the same time, procurement teams face a tougher operating environment shaped by supply-chain volatility, higher compliance expectations, and evolving trade policies. That combination is pushing decision-makers to standardize specifications, qualify multiple suppliers, and prioritize feeders that can sustain accuracy while minimizing unplanned downtime. This executive summary frames how the market landscape is changing, what the most decision-relevant segments look like, and which strategic actions help organizations convert feeder investments into measurable operational gains.

How digital integration, hygienic engineering, and performance-based specifications are redefining competition in gravimetric screw feeding

The landscape for weighing type screw feeders is being reshaped by a shift from component-led purchasing to performance-led system design. Buyers increasingly specify outcomes-steady-state accuracy, turndown, short-term rate stability, and drift control-rather than simply selecting a feeder size. This is accelerating adoption of advanced control strategies that blend gravimetric feedback with adaptive tuning, enabling feeders to compensate for refill disturbances, changing head pressure, and material inconsistencies without requiring constant operator intervention.Another transformative shift is the convergence of feeder mechanics with digital operations. Plants are modernizing controls to support centralized monitoring, electronic batch records, and predictive maintenance. As a result, features such as high-resolution weight signal processing, automated calibration routines, event logging, and remote diagnostics are moving from “nice-to-have” to “baseline.” This is especially visible in multi-ingredient blending lines where coordinated dosing across multiple feeders determines overall line capability and quality compliance.

Hygienic and safety expectations are also rising, widening the gap between commodity equipment and engineered solutions. Food and pharmaceutical environments are driving demand for sanitary finishes, tool-less disassembly, clean-in-place or washdown-compatible architectures, and validated materials of construction. In parallel, chemical and minerals applications emphasize robust wear protection, dust-tight sealing, explosion protection where needed, and designs that minimize leakage and housekeeping burdens. These requirements influence not only feeder selection but also upstream and downstream interfaces such as flexible connections, hoppers, agitation devices, and dust collection.

Sustainability and energy discipline are changing how equipment is justified. Plants want improved material yield, fewer off-spec batches, and reduced purge and rework, which elevates the value of stable, repeatable feeding. Moreover, producers are seeking compact designs that fit into retrofit spaces while still enabling safe access and faster maintenance. Consequently, suppliers are differentiating through modular platforms, standardized subassemblies, and configurations that simplify spares strategies across multiple lines.

Finally, competitive dynamics are shifting toward “solution packages” that combine the feeder, controls, and application engineering. End users are prioritizing vendors that can run material trials, recommend screw profiles, mitigate bridging or rat-holing, and validate performance under realistic process conditions. This consultative approach is becoming a key determinant of supplier preference, particularly for challenging powders and for plants seeking rapid commissioning without extensive on-site tuning.

What the 2025 U.S. tariff environment changes for feeder sourcing, component strategies, and lifecycle cost control

The 2025 tariff environment in the United States is amplifying cost and lead-time uncertainty for equipment that depends on globally sourced components. Weighing type screw feeders often incorporate precision load cells, instrumentation electronics, gearmotors, variable-frequency drives, stainless fabrications, and specialized wear materials. When tariffs affect steel and stainless inputs, fabricated housings, or subassemblies, the impact is rarely confined to headline pricing; it can ripple into delivery schedules, supplier qualification timelines, and the economics of stocking critical spares.One immediate operational consequence is a stronger preference for supply-chain transparency. Buyers are pressing vendors to clarify country-of-origin exposure for key components and to propose tariff-aware alternatives without compromising performance or compliance. In response, suppliers are rebalancing bills of materials toward domestically sourced fabrications or regionally produced subcomponents, while maintaining globally sourced instrumentation where technical equivalence is difficult to achieve. This dual sourcing strategy can reduce risk but may introduce additional validation steps for regulated industries.

Tariffs are also influencing contracting behaviors. Rather than one-off purchases, organizations are negotiating framework agreements that stabilize terms, lock in pricing windows, and define escalation mechanisms tied to specific indices or material categories. Engineering teams are aligning feeder specifications to modular platforms so that substitution among qualified suppliers or component variants becomes easier during periods of disruption. For plants operating under strict quality systems, these moves are paired with documentation packages that support change control and traceability.

In parallel, the tariff-driven push toward localized production is affecting service models. Customers increasingly value vendors with U.S.-based assembly, application testing, and field service coverage that can respond quickly when imported parts are delayed. This is raising the importance of maintainability, standardized wear parts, and designs that allow rapid swap-out of screws, tubes, seals, and bearings. Ultimately, the cumulative effect of 2025 tariffs is not simply higher acquisition costs; it is a strategic shift toward resilient sourcing, engineered interchangeability, and lifecycle planning that protects throughput and compliance even when global trade conditions tighten.

Segmentation insights that explain why feeder architecture, control strategy, and end-use compliance create distinct buying criteria

Segmentation reveals that buying criteria shift materially depending on whether the feeder is configured as loss-in-weight or gain-in-weight and on how the metering task interacts with the broader process. Loss-in-weight approaches are often selected when continuous, high-accuracy dosing is required into a steady downstream process such as extrusion, continuous mixing, or continuous chemical reaction. In these settings, users prioritize stable rate control, rapid recovery after refill, and strong filtering of weight signals so the control loop remains responsive without overcorrecting. Gain-in-weight configurations, by contrast, tend to align with batch-oriented operations where discrete additions to a vessel must be verified for recipe compliance, making fill speed, cutoff repeatability, and reliable in-flight compensation central to performance.The interplay between single-screw and twin-screw architectures further shapes purchasing decisions. Single-screw designs commonly serve free-flowing or moderately cohesive materials where simplicity, lower maintenance burden, and efficient throughput are valued. Twin-screw configurations become more compelling when materials are poorly flowing, aeratable, prone to bridging, or require gentler handling with consistent refill behavior. In many plants, the decision is influenced as much by material conditioning as by throughput, including whether agitation, live-bottom hoppers, or specialized inlet geometries are needed to ensure consistent feed.

End-use segmentation highlights how regulatory and quality drivers translate into engineering requirements. Food and beverage users focus on hygienic design, allergen management, washdown capability, and fast disassembly to support sanitation schedules, while still demanding repeatable dosing to reduce giveaway and stabilize texture or flavor outcomes. Pharmaceutical and nutraceutical environments add stringent documentation expectations, material traceability, and design choices that simplify validation and prevent cross-contamination. Chemicals users place a premium on containment, corrosion resistance, and compatibility with hazardous area classifications, while plastics and polymer compounding emphasize tight ratio control across multiple feeders and robust integration with extruder control strategies. Minerals, cement, and other abrasive-duty applications push wear protection, dust sealing, and rugged mechanical designs to the forefront.

Automation and control segmentation is increasingly decisive because feeder performance is inseparable from signal integrity and control logic. Plants adopting modern PLC and SCADA frameworks prioritize open communication protocols, secure remote access, and standardized alarms and diagnostics that integrate with maintenance workflows. Where advanced analytics are being deployed, the feeder becomes a data source for mass-flow verification, batch reconciliation, and early detection of mechanical wear or material changes.

Finally, capacity and precision requirements segment buyers into distinctly different solution paths. Micro-ingredient feeding favors precise, low-flow screws, minimal pulsation, and stable weighing platforms that can resolve small mass changes, often coupled with specialized refill strategies to avoid disturbances. Higher-throughput applications demand robust drives, consistent material presentation, and designs that maintain accuracy while handling larger refill events and fluctuating upstream head pressure. Across these segments, the strongest solutions are those that combine mechanical suitability for the material with controls that can maintain stability under real operating disturbances.

Regional insights showing how modernization priorities, compliance pressures, and service ecosystems shape feeder selection worldwide

Regional dynamics underscore that adoption patterns are closely linked to manufacturing modernization, regulatory expectations, and the local availability of application engineering support. In the Americas, investment often centers on upgrading legacy lines for better accuracy and traceability, with strong interest in retrofit-friendly designs, domestic service coverage, and tariff-resilient sourcing. Users commonly prioritize standardized platforms that can be deployed across multiple plants to simplify training, spares, and validation, especially in food, chemicals, and plastics operations.In Europe, the Middle East, and Africa, compliance and safety requirements play an outsized role, influencing demand for containment, dust management, and designs aligned with stringent hygiene or hazardous-area needs. Engineering decisions frequently emphasize lifecycle reliability and documentation, and there is notable receptivity to energy-efficient drives and solution packages that reduce waste and improve process stability. In industrial hubs with established process equipment ecosystems, buyers expect strong application testing and formal performance verification.

Across Asia-Pacific, expansion and capacity additions coexist with rapid automation adoption. Many facilities are moving directly toward integrated digital controls, higher-line speeds, and scalable modular equipment to support diverse product portfolios. Demand is shaped by a mix of cost sensitivity and a growing emphasis on quality consistency for export-oriented production, which elevates the role of gravimetric feeding in meeting tighter specifications. The region’s breadth also drives a need for flexible configurations that can handle a wide range of materials, from food powders to specialty chemicals and polymer additives.

Taken together, regional insights indicate that successful strategies depend on aligning product offerings with local service capability, documentation norms, and integration requirements. Vendors and end users that treat commissioning, training, and ongoing optimization as part of the solution-rather than a one-time install-tend to achieve more consistent performance across geographies, especially when product recipes and raw-material sources vary by region.

What distinguishes leading feeder suppliers today: application engineering depth, controls integration, and lifecycle service reliability

Company positioning in weighing type screw feeders is increasingly defined by the ability to deliver repeatable results across diverse materials, not simply by catalog breadth. Leading providers differentiate through application engineering depth, including material testing, screw and hopper design optimization, and control tuning that accounts for refill dynamics and process disturbances. This capability matters because the same nominal feeder can perform very differently depending on powder behavior, aeration, head pressure, and environmental vibration.Another major differentiator is controls and integration maturity. Companies that offer robust gravimetric control platforms, intuitive HMIs, and straightforward integration into plant PLC or MES environments tend to win in multi-feeder systems where coordinated dosing determines overall performance. Buyers also favor vendors that provide comprehensive diagnostics, calibration support, and data logging features that help quality teams reconcile consumption and support audits.

Manufacturing quality and service reach remain decisive, particularly as customers manage tariff risk and component lead times. Vendors with regional assembly, reliable spares availability, and field service networks reduce commissioning risk and minimize downtime when wear parts need replacement. Equally important are documentation packages, especially for regulated environments, including material certificates, surface finish verification, and change-control friendly configurations.

Finally, companies are being evaluated on how well they support lifecycle optimization. This includes training for operators and maintenance teams, standardized preventive maintenance plans, and clear guidance on how to detect early signs of screw wear, seal degradation, or load cell drift. Suppliers that treat post-install performance as a managed outcome-supported by periodic audits and process optimization-are better positioned to build long-term accounts and to expand from single feeder sales into plant-wide standardization.

Actionable steps to improve dosing accuracy, integration readiness, and tariff-resilient sourcing while reducing downtime risk

Industry leaders can strengthen performance and reduce risk by treating weighing type screw feeders as part of a metering system rather than as standalone equipment. Start by formalizing a material characterization workflow that captures bulk density range, cohesion, compressibility, moisture sensitivity, and abrasion potential, then translate those parameters into screw selection, hopper geometry, agitation needs, and wear protection. When feasible, require pre-award material trials under realistic refill and operating conditions so accuracy and stability are verified before installation.Next, standardize around integration and data requirements. Define a baseline for communications, alarm philosophy, and calibration procedures so feeders can be deployed consistently across lines and plants. This improves operator adoption and makes performance benchmarking possible, particularly when multiple feeders must maintain tight ratios. Additionally, build maintenance readiness into specifications by requiring accessible wear-part replacement, clear inspection points, and documented service intervals that align with planned shutdown windows.

Given the 2025 tariff environment, adopt sourcing strategies that reduce exposure to component disruptions. Qualify alternate suppliers where practical, negotiate lead-time commitments and escalation terms, and request transparency on country-of-origin and substitution rules for critical subcomponents. For regulated operations, implement a documented change-control pathway that allows tariff-driven substitutions without compromising validation status.

Finally, invest in capability building. Provide targeted training on gravimetric control behavior-especially refill recovery and disturbance handling-so operators know how to interpret trends and alarms. Encourage periodic performance audits that compare expected versus actual consumption, identify drift sources, and validate that mechanical wear has not eroded accuracy. These actions convert feeder investments into sustained process control improvements, rather than one-time commissioning successes that gradually degrade over time.

Methodology built on stakeholder interviews, technical validation, and triangulation to reflect real-world feeder selection and use

The research methodology integrates structured primary engagement with rigorous secondary validation to ensure conclusions reflect real procurement behavior and operating constraints in bulk solids metering. Primary work emphasizes discussions with equipment stakeholders, including plant engineering, operations, maintenance leaders, integrators, and supplier-side application specialists, focusing on selection drivers such as material handling challenges, control performance expectations, hygiene and safety requirements, and commissioning experiences.Secondary research consolidates technical literature, regulatory frameworks relevant to hygiene and hazardous area design, and publicly available company information such as product documentation, certifications, and service offerings. This step is used to verify technical claims, map solution architectures, and understand how suppliers position capabilities across industries and geographies.

Analytical treatment prioritizes triangulation across sources to reduce bias. Inputs are compared across end-use contexts and feeder configurations to identify consistent themes, such as the operational impact of refill disturbances, the importance of signal stability, and the tradeoffs among screw geometries for different powders. The methodology also evaluates how external constraints-such as tariffs and component lead times-change buyer preferences in sourcing, standardization, and lifecycle planning.

Quality control is maintained through iterative review of assumptions, terminology normalization across supplier catalogs, and consistency checks that link user requirements to engineering choices. The resulting insights are presented to support decision-making around specification development, supplier qualification, integration planning, and long-term operational excellence.

Closing perspective on why gravimetric screw feeding is shifting from equipment choice to a sustained operational capability

Weighing type screw feeders are becoming a strategic lever for manufacturers seeking tighter control over recipes, higher consistency, and improved compliance in environments where powders rarely behave predictably. The market’s direction is shaped by performance-based specifications, deeper digital integration, and rising expectations for hygiene, safety, and maintainability. As these demands intensify, the most successful implementations combine the right mechanical architecture with robust gravimetric control and disciplined integration into plant systems.The cumulative effects of U.S. tariffs in 2025 add another layer to decision-making by elevating supply-chain resilience and lifecycle planning. Organizations that standardize specifications, validate alternatives, and build serviceability into designs are better positioned to maintain accuracy and uptime despite procurement uncertainty.

Ultimately, the leaders in this space-both buyers and suppliers-will be those who treat feeding as an engineered outcome supported by data, service, and continuous optimization. When gravimetric feeding is managed with the same rigor as other critical process controls, it becomes a reliable foundation for quality, efficiency, and scalable growth across diverse product lines.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

19. China Weighing Type Screw Feeder Market

Companies Mentioned

The key companies profiled in this Weighing Type Screw Feeder market report include:- Brabender GmbH & Co. KG

- Bühler AG

- Coperion GmbH

- Eriez Manufacturing Co.

- Flexicon Corporation

- GEA Group Aktiengesellschaft

- Gericke AG

- Haver & Boecker OHG

- Hosokawa Micron Corporation

- Schenck Process GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | January 2026 |

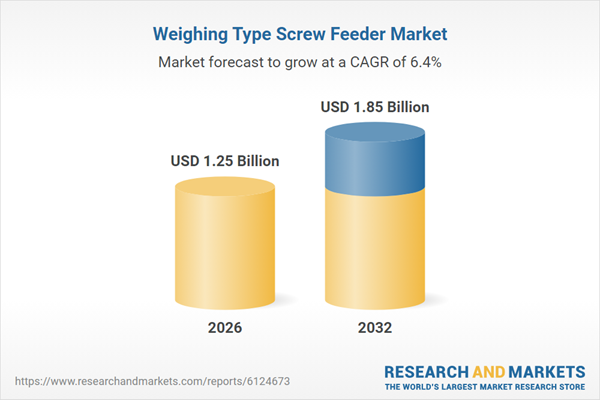

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.25 Billion |

| Forecasted Market Value ( USD | $ 1.85 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |