Speak directly to the analyst to clarify any post sales queries you may have.

Why protective high performing foam packaging is becoming a strategic lever for product integrity, compliance, and supply chain resilience

Protective high performing foam packaging sits at the intersection of product safety, cost control, sustainability expectations, and operational speed. As products become more fragile, higher value, and more tightly regulated-from precision electronics to temperature-sensitive healthcare goods-companies are leaning on engineered foam solutions to absorb shock, dampen vibration, manage compression set, and maintain pack integrity across complex shipping routes.At the same time, the industry is undergoing a practical redefinition of “performance.” It no longer refers only to cushioning curves or drop-test results; it also includes compatibility with automation, consistency under varying humidity and temperature, traceability for regulated shipments, and fit-for-purpose design that minimizes material while maintaining protection. In many organizations, foam packaging decisions have moved upstream into product development and supply chain strategy, because packaging is increasingly treated as a risk-management layer rather than a downstream expense.

This executive summary synthesizes the most important themes shaping the protective high performing foam packaging landscape. It highlights how demand patterns are shifting, where trade policy is changing sourcing assumptions, which segmentation dimensions reveal the most actionable insights, and what leaders can do now to strengthen resilience without sacrificing pack performance or customer experience.

Transformative shifts redefining foam packaging performance: omnichannel stress, sustainability compliance, digital design, and resilience-first sourcing

The landscape is being reshaped by a set of mutually reinforcing shifts, starting with the acceleration of parcel and omnichannel logistics. Distribution networks are moving more units through more nodes, with more handoffs and less dwell time. This raises the value of foams that deliver predictable performance over wide temperature ranges and repeated vibration exposure, while also enabling faster pack-out. Consequently, engineered inserts, end caps, and multi-component foam assemblies are being optimized for both protection and takt time, especially where automated or semi-automated packaging lines are deployed.In parallel, sustainability requirements are moving from aspirational to operational. Brand owners and logistics partners are scrutinizing material choices for recyclability, recycled content, and end-of-life pathways. This does not eliminate demand for high performance foams, but it does change design priorities. Lightweighting, right-sizing, and redesign for reuse are becoming standard levers, while “design for recovery” is influencing resin selection, colorants, adhesives, and hybrid constructions that pair foam with fiber-based structures. Regulatory pressure and customer procurement scorecards are also accelerating documentation needs, such as material declarations and chain-of-custody reporting, which favors suppliers with strong compliance systems.

Technology is also shifting competitive advantage. Simulation-led design, digital twins of pack-outs, and expanded testing protocols are reducing time-to-qualification and supporting rapid iteration across SKUs. As more companies deploy sensors and data loggers to validate in-transit conditions, packaging specifications are being refined based on real shipping profiles rather than generic assumptions. This feedback loop rewards foam platforms that maintain energy absorption after aging, resist creep under stacking loads, and perform consistently across production lots.

Finally, geopolitical and macroeconomic uncertainty is changing how packaging leaders think about risk. Dual sourcing, regionalized production, and inventory strategies are being reconsidered with a sharper focus on cross-border exposure. Foam packaging, once treated as a locally sourced commodity in some applications, is increasingly evaluated through the lens of supply continuity, tariff sensitivity, and the ability to reformulate or redesign without reopening lengthy qualification cycles.

How United States tariff realities in 2025 are reshaping sourcing, qualification, and landed-cost strategies for high performing foam packaging

United States tariff conditions in 2025 are reinforcing a structural shift toward landed-cost discipline and sourcing optionality. Even when tariffs do not directly target finished foam components, they can affect upstream inputs, additives, tooling, and related packaging materials, creating cascading cost effects. As a result, procurement teams are expanding their analysis beyond unit price and evaluating total delivered cost, lead-time variability, and the risk of sudden policy adjustments.For manufacturers supplying U.S. customers, tariff-driven pressure is accelerating regionalization strategies. Some firms are increasing North American converting capacity for foam-in-place, fabricated inserts, and custom assemblies to reduce cross-border exposure and improve responsiveness. Others are qualifying alternate resin families or blended formulations that can be sourced from different origins without compromising validated performance requirements. The critical implication is that packaging engineers are being brought into tariff-response planning earlier, because material substitutions can change compression behavior, recovery, and long-term dimensional stability.

Tariff dynamics are also influencing customer negotiations and contract structures. Buyers are increasingly requesting transparent escalation clauses, documentation of country of origin, and contingency plans for supply disruption. In turn, suppliers that can demonstrate multi-site production, resilient raw material access, and rapid requalification pathways are positioned to win strategic programs. The cumulative impact is a market that rewards operational preparedness: those who can manage compliance documentation, maintain consistent quality across sites, and redesign quickly under constraints will be better equipped to protect margins while meeting service-level expectations.

Importantly, tariffs interact with sustainability commitments in complex ways. A shift to domestic sourcing may reduce transportation emissions and simplify traceability, yet it can also constrain access to certain recycled feedstocks or specialty chemistries. Industry leaders are therefore balancing three priorities at once-cost, continuity, and sustainability-by building broader supplier ecosystems and standardizing testing methods so that changes in material origin do not trigger prolonged qualification delays.

Segmentation insights that explain why foam type, format, end-use risk, and shipping channel jointly determine qualification rigor and design priorities

Segmentation reveals that the most meaningful differences in buyer behavior emerge from the interaction between foam type, packaging format, end-use requirements, and the channel through which products ship. When viewed through the lens of material platforms, polyethylene and polypropylene foams are frequently selected for durability, moisture resistance, and reuse potential, while polyurethane solutions remain important where softness, conformability, and energy absorption profiles are critical. Polystyrene-based options continue to appear in certain protective use cases, yet redesign efforts increasingly focus on reducing material intensity and addressing disposal concerns. Bio-based and recycled-content innovations are being evaluated more rigorously, with adoption often tied to the availability of credible end-of-life pathways and the ability to maintain consistent mechanical performance.Packaging format segmentation highlights another layer of differentiation. Foam sheets, rolls, pouches, and laminated structures support flexible operations and broad SKU coverage, whereas custom fabricated inserts, corner blocks, end caps, and molded components provide superior immobilization for high-value goods. Foam-in-place systems are gaining attention where variability is high and right-sizing is a priority, though users weigh benefits against equipment footprint, operator training, and material handling requirements. In many organizations, the decision is not binary; hybrid pack-outs that combine foam with corrugated or molded fiber elements are being engineered to achieve both protection and sustainability objectives.

End-use segmentation clarifies why qualification rigor varies widely. Electronics and semiconductors demand tight control over static, particulate generation, and dimensional consistency, which elevates the importance of anti-static grades, cleanliness, and supplier process discipline. Automotive and industrial equipment emphasize vibration damping, compression resistance, and performance under stacking loads, favoring engineered foams with predictable creep behavior. Healthcare and medical devices add sterilization compatibility, regulatory documentation, and traceability needs, often requiring suppliers to support validation packages and change-control processes. Food and beverage applications prioritize hygiene and temperature performance in certain shipments, which can influence material selection and barrier constructions.

Finally, segmentation by distribution and service model-such as direct-to-consumer parcel, business-to-business freight, cold chain, and returnable transit packaging-exposes different optimization goals. Parcel-driven programs prioritize lightweighting and damage prevention under high drop frequency, while freight shipments may prioritize unitization, compression strength, and stability over long transit cycles. Returnable systems shift the focus to durability, cleanability, and total lifecycle economics. Across these segmentation dimensions, the most competitive suppliers are those that translate application requirements into measurable specifications, then pair them with design-for-manufacture and design-for-recovery principles that scale across customer portfolios.

{{SEGMENTATION_LIST}}

Regional insights connecting regulation, manufacturing concentration, logistics intensity, and recovery infrastructure to foam packaging adoption patterns worldwide

Regional dynamics in protective high performing foam packaging are shaped by manufacturing footprints, regulatory regimes, logistics patterns, and the maturity of recycling and recovery infrastructure. In North America, demand is strongly influenced by parcel shipment intensity, advanced manufacturing, and a growing preference for sourcing strategies that reduce cross-border uncertainty. Customers often prioritize consistent quality, short lead times, and the ability to support rapid engineering changes, which favors suppliers with local converting capacity and robust technical service.In Europe, policy pressure and corporate sustainability commitments exert outsized influence on material selection and packaging redesign. Extended producer responsibility frameworks, packaging waste directives, and retailer requirements encourage solutions that reduce overall material use, enable reuse, or align with established recycling streams. This environment supports innovation in mono-material structures, take-back models, and hybrid designs that reduce dependency on materials perceived as difficult to recover. It also increases the importance of documentation, labeling, and claims substantiation.

Asia-Pacific remains a pivotal region due to its concentration of electronics manufacturing, industrial production, and export-oriented supply chains. The region’s scale supports high-volume fabrication and rapid iteration, while performance requirements in electronics and precision components drive demand for specialized grades and tight tolerances. At the same time, companies shipping from Asia-Pacific to other regions are increasingly attentive to trade exposure and the operational complexity of qualifying alternate sources, pushing some to diversify production across multiple countries.

In Latin America, growth in manufacturing and distribution networks supports rising demand for protective packaging that can withstand variable transit conditions and infrastructure constraints. Buyers often value solutions that simplify pack-out, reduce damage-related costs, and remain stable in warmer climates and humid environments. Supplier success is closely tied to the ability to provide consistent supply, localized technical support, and packaging designs that accommodate a wide range of product mixes.

In the Middle East & Africa, industrial development, infrastructure projects, and expanding healthcare distribution are shaping requirements for protective packaging performance and reliability. The region’s logistics corridors and climate conditions elevate the importance of thermal stability and moisture resistance in certain applications. Across all regions, the direction of travel is similar: buyers want performance they can verify, sustainability they can defend, and supply chains that can absorb disruption without compromising customer experience.

{{GEOGRAPHY_REGION_LIST}}

Competitive insights on leading foam packaging companies: material science depth, multi-site converting, validation discipline, and sustainability-ready service models

Key companies in protective high performing foam packaging compete on a blend of material science, converting capabilities, design engineering, and service reliability. Leaders differentiate by offering a broad portfolio of foam chemistries and densities, supported by application labs that translate shipping hazards into testable packaging specifications. Their ability to provide rapid prototyping, simulation-led design, and repeatable fabrication at scale increasingly defines preferred-supplier status, particularly for customers managing thousands of SKUs.Another major differentiator is operational reach. Companies with multi-site converting networks and standardized quality systems can support regional sourcing strategies while keeping performance consistent. This matters not only for continuity, but also for change control: when customers request alternate materials due to cost shocks, sustainability requirements, or tariffs, suppliers with disciplined documentation and validation support can shorten requalification timelines. In regulated end uses, the capability to maintain traceable lots, provide compliance documentation, and manage controlled process changes can be as important as the foam itself.

Competitive intensity is also rising among specialists. Niche players often excel in high-precision fabrication, anti-static and cleanroom-compatible packaging, or returnable transit solutions designed for closed-loop logistics. Others focus on foam-in-place and on-demand systems that reduce inventory and enable right-sized protection. As sustainability expectations intensify, companies that can integrate recycled content responsibly, offer take-back partnerships, or redesign pack-outs to reduce total material are gaining a strategic edge. Across the board, the most effective companies present themselves not simply as foam suppliers, but as protective packaging partners who reduce damage, improve pack-out efficiency, and support measurable ESG progress without sacrificing performance.

Actionable recommendations for foam packaging leaders to improve protection performance, sustainability outcomes, and tariff-resilient supply continuity

Industry leaders can take immediate steps to strengthen both performance and resilience. First, standardize packaging requirements around measurable hazards and acceptance criteria rather than legacy material callouts. When specifications define shock, vibration, compression, and environmental exposure targets, it becomes easier to qualify alternate foam platforms and reduce dependency on a single supplier or geography.Next, invest in design-for-operations alongside design-for-protection. Pack-outs that reduce touches, simplify orientation, and accommodate automation can lower labor variability and improve throughput, especially in high-mix environments. This is also the moment to consolidate packaging footprints by creating modular foam components that span multiple SKUs, enabling procurement leverage and reducing the qualification burden when materials or sites change.

Third, treat sustainability as an engineering constraint, not a marketing afterthought. Evaluate recycled content, bio-based options, and hybrid designs using the same rigor applied to performance testing, including aging, compression set, and repeated-use scenarios where relevant. Align material choices with realistic recovery pathways in each region, and ensure claims are supported by defensible documentation.

Fourth, build tariff and disruption readiness into supplier management. Contract structures should anticipate volatility through clear mechanisms for cost adjustments, origin transparency, and alternative sourcing. At the same time, establish playbooks for rapid requalification: pre-approved test protocols, documented equivalency criteria, and cross-functional sign-off processes that can be activated quickly.

Finally, use field data to close the loop. Incorporate damage analytics, sensor feedback, and returns data into packaging redesign cycles, then partner with suppliers who can translate that data into actionable design changes. Over time, this approach reduces hidden costs, improves customer experience, and turns protective foam packaging into a durable competitive capability rather than a recurring firefight.

Research methodology built for decision-ready packaging insights through primary value-chain validation, secondary triangulation, and rigorous segmentation analysis

The research methodology for this report is built to convert complex market signals into decision-ready insights for packaging, procurement, and operations stakeholders. The approach begins with structured primary engagement across the value chain, including conversations with foam material producers, converters and fabricators, packaging engineers, brand owners, logistics stakeholders, and relevant channel partners. These discussions are used to clarify adoption drivers, qualification practices, innovation priorities, and common constraints affecting material selection and supply decisions.Primary inputs are complemented by comprehensive secondary review of technical publications, standards and test protocols, regulatory and policy updates, corporate sustainability disclosures, investor communications, patent and innovation signals, and publicly available company information. This triangulation helps validate claims, identify points of consensus and disagreement, and map how technology and compliance requirements are evolving across end uses.

Analytical work emphasizes segmentation logic and comparative assessment rather than simple generalization. Material platforms and packaging formats are evaluated against application requirements such as shock and vibration mitigation, compression behavior, temperature tolerance, ESD considerations, cleanliness needs, and reuse potential. Regional analysis accounts for regulatory environments, logistics patterns, manufacturing concentration, and the maturity of recycling and recovery infrastructure. Competitive analysis examines portfolio breadth, technical service models, converting footprints, and the ability to support change control and documentation.

Quality assurance is maintained through iterative validation, consistency checks, and expert review to ensure the final narrative reflects current industry realities. The result is a methodology designed to support practical decisions-such as platform selection, supplier qualification, packaging redesign prioritization, and risk mitigation-while remaining grounded in verifiable information and transparent analytical reasoning.

Conclusion on where protective high performing foam packaging is headed as performance, sustainability, and supply risk converge into one mandate

Protective high performing foam packaging is evolving into a strategic discipline shaped by logistics intensity, sustainability imperatives, digital design capabilities, and trade-driven risk. Buyers are asking for packaging that performs reliably under harsher distribution conditions while also aligning with corporate environmental commitments and increasingly formalized compliance expectations. In response, suppliers are expanding beyond material supply into engineering services, documentation support, and multi-site production models that help customers scale protection with confidence.The most important takeaway is that performance, sustainability, and resilience are no longer separate conversations. They are converging into a single set of requirements that demands clearer specifications, faster qualification pathways, and tighter collaboration across procurement, packaging engineering, operations, and sustainability teams. Companies that build adaptable packaging standards and data-driven redesign cycles will be best positioned to reduce damage, improve pack-out efficiency, and navigate volatility without sacrificing customer experience.

As the industry continues to recalibrate, the winners will be those who can prove outcomes: lower damage rates, consistent quality across regions, and credible sustainability progress supported by defensible documentation. Protective foam packaging is not just what surrounds the product; it is part of how organizations protect revenue, reputation, and operational continuity in a more complex global environment.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Protective High Performing Foam Packaging Market

Companies Mentioned

The key companies profiled in this Protective High Performing Foam Packaging market report include:- ACH Foam Technologies

- Arkema Group

- Armacell International S.A.

- BASF SE

- Berry Global, Inc.

- Covestro AG

- Dow Inc.

- FoamPartner Group

- Huntsman Corporation

- Intertape Polymer Group, Inc.

- Jabil Inc.

- JSP Corporation

- Kaneka Corporation

- Plastifoam Company

- Pregis LLC

- Recticel NV/SA

- Rogers Corporation

- Sealed Air Corporation

- Sonoco Products Company

- Storopack Hans Reichenecker GmbH

- Synthos S.A.

- UFP Technologies, Inc.

- Wisconsin Foam Products

- Zotefoams plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

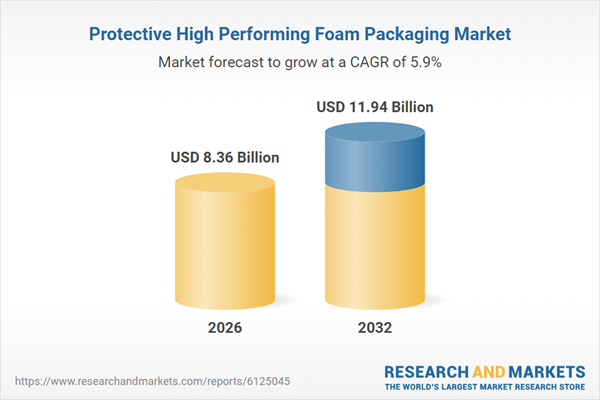

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 8.36 Billion |

| Forecasted Market Value ( USD | $ 11.94 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |