Speak directly to the analyst to clarify any post sales queries you may have.

Reclaimed water equipment is becoming essential infrastructure as drought pressure, compliance demands, and reuse economics converge on practical investment decisions

Reclaimed water equipment sits at the intersection of climate resilience, regulatory compliance, and operational efficiency. As drought frequency, aquifer depletion, and competing water demands intensify, utilities and industrial operators are increasingly treating wastewater not as a liability but as a dependable input to be refined for fit-for-purpose reuse. This shift is not simply philosophical; it is reshaping capital planning and driving renewed scrutiny of treatment trains, automation architectures, and lifecycle operating costs.At the same time, expectations for reclaimed water quality are rising. End users now require tighter control over nutrients, pathogens, salinity, trace organics, and emerging contaminants, and they want that control verified with transparent monitoring and auditable data. Consequently, equipment decisions are increasingly made with a systems mindset, linking unit processes to sensor networks, process controls, and digital reporting. When reclaimed water is used in higher-value applications, such as industrial process water, indirect potable reuse, or aquifer recharge, risk tolerance drops sharply and redundancy, validation, and reliability become central design criteria.

Finally, delivery certainty has become a differentiator. Lead-time volatility for membranes, electrical components, and specialty materials has elevated the importance of supplier qualification, service coverage, and parts availability. Organizations that treat reclaimed water equipment procurement as a strategic program-rather than a collection of discrete purchases-are better positioned to build reuse capacity quickly while maintaining compliance, community confidence, and long-term operating stability.

Technology, policy, and delivery models are reshaping reclaimed water equipment toward fit-for-purpose treatment, digital operations, and modular scalability

The landscape for reclaimed water equipment is undergoing transformative shifts driven by both technology maturation and policy momentum. One of the most significant changes is the move from one-size-fits-all treatment to fit-for-purpose architectures. Rather than over-treating all effluent to the highest standard, many operators are creating multiple reclaimed streams-each engineered for a defined end use-so they can meet quality targets efficiently while controlling energy and chemical demand. This approach is accelerating interest in modular systems that can be expanded or reconfigured as demand evolves.Another shift is the rapid elevation of membrane and advanced oxidation solutions from niche to mainstream in many reuse projects. Higher expectations for pathogen reduction and control of trace organics are pushing designs toward combinations of membrane filtration, ultraviolet disinfection, ozone-based oxidation, and activated carbon polishing. In parallel, nutrient removal requirements and watershed protections are increasing the value of process intensification and biological optimization, particularly where reclaimed water is tied to discharge permits, reuse permits, or regional water-quality objectives.

Digitalization is also changing how reclaimed water equipment is selected and operated. Smart instrumentation, remote monitoring, predictive maintenance, and cybersecurity-aware control systems are no longer optional add-ons for mission-critical reuse facilities. Operators are demanding better visibility into membrane integrity, UV dose delivery, chemical feed stability, and residuals handling, as well as streamlined reporting for regulators and stakeholders. This pushes OEMs and integrators to provide validated performance envelopes, interoperable data layers, and service models that extend beyond commissioning.

Lastly, project delivery models are evolving. More owners are leveraging design-build and progressive procurement to reduce schedule risk and to align performance guarantees with equipment capabilities. This has increased the influence of EPC firms and integrators on technology choices and has intensified competition among suppliers to offer packaged systems, standardized skids, and robust service agreements. In this environment, vendors that can demonstrate reliable uptime, repeatable compliance performance, and fast-response support are gaining strategic advantage.

Tariff dynamics in 2025 are reshaping reclaimed water equipment sourcing by increasing cost volatility, tightening lead times, and elevating lifecycle support risks

United States tariffs entering 2025 are expected to have a cumulative impact on reclaimed water equipment procurement by amplifying cost uncertainty and altering sourcing strategies across treatment trains. Even when tariffs do not directly target a specific finished system, they can affect upstream inputs such as stainless steel, specialty alloys, electrical enclosures, instrumentation components, and fabricated modules. For owners and EPC teams, the practical consequence is less about a single price increase and more about the variability of quotes, shortened validity windows, and the need to lock specifications earlier to protect budgets.Membrane-based systems are particularly exposed to supply-chain complexity because modules, housings, pressure vessels, and ancillary components may be manufactured across multiple countries before final assembly. Tariff pressure can therefore cascade through the bill of materials, influencing not only capital cost but also the availability of compatible spares. This creates a new operational risk: equipment selections that look equivalent on paper may differ significantly in long-term serviceability if replacement elements face higher landed costs or delayed import clearance.

Electrical and automation packages can also be affected because variable frequency drives, PLC components, analyzers, and network hardware often rely on globally distributed manufacturing. When tariff schedules change, suppliers may shift production footprints or substitute components, which can introduce qualification and cybersecurity considerations. Owners should be prepared for increased documentation requirements, including country-of-origin disclosures, product substitution approvals, and more rigorous factory acceptance testing to ensure that last-minute component changes do not compromise performance.

Over the course of 2025, the most resilient procurement strategies are likely to emphasize dual sourcing, design flexibility, and clearer contract language. Projects that standardize around a narrow set of proprietary consumables may face higher exposure, whereas designs that preserve interchangeability and allow alternative suppliers for key consumables can better absorb trade policy shifts. In short, tariffs are reinforcing an industry trend already underway: prioritizing total delivered value, lead-time reliability, and lifecycle support over nominal equipment price.

Segmentation insights show how reclaimed water equipment decisions vary by treatment objective, technology pathway, application criticality, and end-user risk tolerance

Segmentation insights highlight how equipment priorities change depending on the treatment objective, the quality of influent, and the risk profile of the end use. Across product-type considerations, disinfection and polishing steps are increasingly treated as integral to the process rather than optional safeguards, especially where reuse is expanding beyond irrigation into industrial and municipal applications that demand stronger assurance of microbial and trace organic control. As a result, buyers are evaluating equipment not just on nameplate capacity but on validated removal performance, redundancy concepts, and the stability of operations under variable loading.When examined by technology orientation, membrane-driven configurations are gaining adoption where consistent reclaimed water quality is required, yet they are being paired more deliberately with upstream pretreatment to protect integrity and reduce fouling. In these projects, the “best” equipment choice often depends on how well the system manages solids, oils, and scaling potential, which in turn shapes choices around screening, clarification, and chemical conditioning. Meanwhile, advanced oxidation and adsorption are being selected more frequently as targeted barriers for specific constituents, and procurement teams are placing greater emphasis on monitoring packages that confirm dose delivery, oxidant residual management, and byproduct control.

Insights by application point to a growing divergence between reuse categories that can tolerate variability and those that cannot. In segments aligned with agriculture and landscape irrigation, reliability, energy efficiency, and ease of maintenance frequently outrank ultra-low contaminant targets, encouraging robust conventional trains complemented by dependable disinfection and nutrient management where required. Conversely, in segments tied to industrial process water, cooling, boiler makeup, groundwater recharge, or indirect potable reuse, the equipment narrative shifts toward multi-barrier designs, tighter instrumentation, and comprehensive validation protocols that support stakeholder confidence.

End-user segmentation further clarifies purchasing behavior. Municipal operators often prioritize standardized, serviceable equipment with strong local support and clear compliance documentation, while industrial buyers tend to focus on water chemistry stability, integration with existing utilities, and measurable reductions in operational disruptions. Across both, the procurement function is increasingly sensitive to supply assurance for consumables such as membranes, media, lamps, and chemicals, which is driving interest in designs that support interchangeability, straightforward retrofits, and flexible operating modes.

Finally, capacity and deployment segmentation reveals continued momentum for modular and packaged solutions, particularly where reuse demand is ramping in phases or where permitting timelines and construction windows are tight. Skid-mounted systems and containerized units can compress schedules and simplify commissioning, but they require careful attention to hydraulics, redundancy, and maintainability. Accordingly, successful buyers are those who align equipment form factors with long-term operations, ensuring that expandability, access for maintenance, and spares strategies are designed in from the start.

Regional insights reveal how climate stress, regulation, and infrastructure maturity shape reclaimed water equipment choices across major global operating theaters

Regional dynamics are strongly influenced by climate exposure, regulatory frameworks, infrastructure age, and the maturity of reuse markets. In the Americas, persistent drought conditions and growth pressures are accelerating investments in reuse and pushing equipment choices toward proven reliability, strong service coverage, and designs that can be expanded as distribution networks grow. The region also reflects a heightened focus on resilience planning, which is strengthening demand for redundancy, energy-aware operation, and treatment trains capable of maintaining performance under variable influent conditions.Across Europe, the Middle East & Africa, the landscape is shaped by a mix of stringent water-quality expectations, water scarcity, and ambitious national strategies for reuse. Many projects are characterized by advanced treatment, robust monitoring, and a preference for technologies that can document compliance transparently. In water-stressed areas, reclaimed water is treated as a strategic resource for agriculture, industry, and municipal resilience, which elevates the importance of reliable disinfection, salinity management where relevant, and operating models that can perform consistently even with constrained energy or chemical supply.

In Asia-Pacific, rapid urbanization, industrial expansion, and tightening environmental oversight are expanding the range of reclaimed water applications. The region’s diversity creates multiple equipment narratives at once: large-scale municipal systems focused on capacity and reliability, industrial clusters requiring stable process water quality, and fast-deploying modular systems suited to new developments and decentralized reuse initiatives. Additionally, increasing attention to digital operations and remote management is encouraging adoption of instrumentation-rich solutions and automation packages designed for scale.

Across all regions, a common thread is the move from pilot-scale experimentation toward repeatable programs. Regions with established reuse frameworks are refining standards and emphasizing verification, while developing reuse markets are prioritizing quick wins through packaged systems and targeted upgrades. For equipment providers and buyers alike, the most effective regional strategies are those that adapt to local compliance expectations, supply-chain realities, and the availability of skilled operators and service networks.

Company insights emphasize integrated treatment platforms, lifecycle service strength, and accountable partnerships that reduce interface risk in reuse project delivery

Company-level insights in reclaimed water equipment increasingly differentiate suppliers by their ability to deliver integrated performance rather than individual components. Leading participants are strengthening portfolios that connect pretreatment, primary separation, advanced treatment, disinfection, and residuals handling into coherent trains supported by instrumentation, controls, and service. This integration matters because reclaimed water projects are often judged on consistent compliance outcomes, not just peak throughput, and owners are placing greater value on suppliers who can validate performance across variable influent conditions.Another competitive theme is lifecycle partnership. Suppliers that maintain strong field service networks, training programs, and parts logistics are positioned to win repeat deployments, particularly as reuse facilities operate continuously and downtime carries reputational and regulatory consequences. In response, many companies are expanding service agreements that include remote monitoring, optimization support, and planned maintenance frameworks. This service orientation also encourages more standardized equipment platforms, enabling quicker commissioning and more predictable maintenance.

Innovation remains important, but buyers are increasingly pragmatic. They favor technologies with clear operational references, transparent consumables strategy, and a credible pathway to manage emerging contaminants and evolving standards. As a result, companies that can pair proven core technologies with flexible add-on barriers-such as targeted adsorption or oxidation-are able to address a wider set of use cases without forcing owners into overly complex designs.

Finally, strategic collaboration is rising. OEMs, integrators, EPC firms, and digital solution providers are partnering to shorten delivery timelines and to present unified accountability for performance guarantees. For procurement teams, this can reduce interface risk, but it also increases the importance of contract clarity and of verifying how responsibilities are divided across design, supply, commissioning, and long-term optimization.

Actionable recommendations focus on resilient specifications, supply-chain risk controls, verification-first operations, and governance that builds confidence in reuse

Industry leaders can strengthen reclaimed water programs by building procurement and design strategies around resilience, verification, and lifecycle cost control. Start by treating reclaimed water quality targets as operational commitments rather than design-point aspirations. That means specifying measurement, validation, and alarm philosophies early, aligning them with regulatory expectations and internal risk tolerance, and ensuring that instrument selection and calibration plans are embedded in the equipment scope.Next, reduce supply-chain exposure by designing for maintainability and substitutability. Where practical, avoid overdependence on single-source consumables and ensure that critical elements such as membranes, UV components, and chemical dosing parts have qualified alternatives or clearly defined lead-time protections. Contract terms should address product substitutions, factory testing, and cybersecurity requirements for automation components so that schedule-driven changes do not create long-term operational surprises.

Operational excellence should be designed into the treatment train. Upstream pretreatment and solids management deserve priority because they protect downstream assets and stabilize performance. Similarly, invest in automation that supports operator decision-making, including trend analytics, integrity testing, and predictive maintenance signals. This reduces unplanned downtime and improves compliance confidence, especially for higher-criticality reuse applications.

Finally, align stakeholder engagement with transparent performance evidence. Community and regulator confidence is strengthened when projects can clearly articulate multi-barrier protection, monitoring rigor, and response procedures. Leaders who pair strong engineering with clear governance-covering sampling, reporting, incident response, and continuous improvement-are better equipped to scale reclaimed water use while maintaining trust and regulatory alignment.

Methodology combines stakeholder interviews, standards and regulatory review, and triangulated analysis to translate technical complexity into decision-ready insight

The research methodology for this report combines structured primary engagement with rigorous secondary analysis to ensure practical relevance for decision-makers. Primary inputs include interviews and consultations with stakeholders across the reclaimed water ecosystem, such as utilities, industrial end users, EPC partners, technology suppliers, and service providers. These discussions are used to clarify purchasing criteria, operational pain points, technology adoption drivers, and evolving compliance expectations.Secondary research consolidates publicly available technical literature, regulatory updates, standards documentation, tender and procurement patterns, and corporate disclosures to map how reclaimed water equipment requirements are changing. This step emphasizes validation of technology claims, identification of common treatment architectures, and assessment of operational considerations such as maintainability, energy and chemical intensity, and monitoring requirements.

The analysis framework applies triangulation to reconcile differing viewpoints and to reduce bias. Equipment categories and use cases are cross-checked against application requirements and regional conditions to ensure that conclusions reflect real-world constraints rather than theoretical performance. Quality control includes consistency checks across definitions, normalization of terminology for treatment processes, and editorial review to maintain clarity for both technical and executive audiences.

Throughout, the methodology prioritizes decision usefulness. The goal is to provide insights that support technology selection, procurement planning, and risk management, including considerations tied to lead times, serviceability, compliance verification, and the evolving role of digital operations in reclaimed water facilities.

Conclusion highlights reclaimed water equipment as outcome-driven infrastructure where verification, modularity, and procurement resilience determine long-term success

Reclaimed water equipment is entering a phase where programmatic scale, not isolated projects, will define success. The convergence of water scarcity, tighter quality expectations, and growing acceptance of reuse is driving a more sophisticated approach to treatment trains, monitoring, and lifecycle support. In this environment, equipment selection is increasingly about assured outcomes-consistent quality, verified performance, and resilient operations-rather than about individual unit processes in isolation.Meanwhile, technology pathways are diversifying. Modular systems, advanced disinfection, membrane solutions, and targeted barriers for trace constituents are being combined in fit-for-purpose architectures that reflect the risk profile of each end use. Digital capabilities and service models are becoming part of the equipment value proposition, particularly where compliance verification and uptime are mission critical.

Finally, procurement strategy is becoming inseparable from engineering strategy. With tariffs, supply constraints, and component substitution risks influencing schedules and lifecycle costs, organizations that build flexibility, maintainability, and validated monitoring into their specifications will be better positioned to deliver reliable reclaimed water at scale. The decisions made now will shape operating stability and stakeholder confidence for years to come.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Reclaimed Water Equipment Market

Companies Mentioned

The key companies profiled in this Reclaimed Water Equipment market report include:- Alfa Laval Corporate AB

- Aquatech International LLC

- Calgon Carbon Corporation

- Danaher Corporation

- Dow Chemical Company

- DuPont de Nemours, Inc.

- Evoqua Water Technologies Corp.

- GE Water & Process Technologies

- Hitachi, Ltd.

- IDE Technologies

- Koch Separation Solutions

- Kubota Corporation

- Ovivo Inc.

- Pentair plc

- Suez SA

- Toray Industries, Inc.

- Trojan Technologies

- Veolia Environnement SA

- WesTech Engineering, Inc.

- Xylem Inc.

Table Information

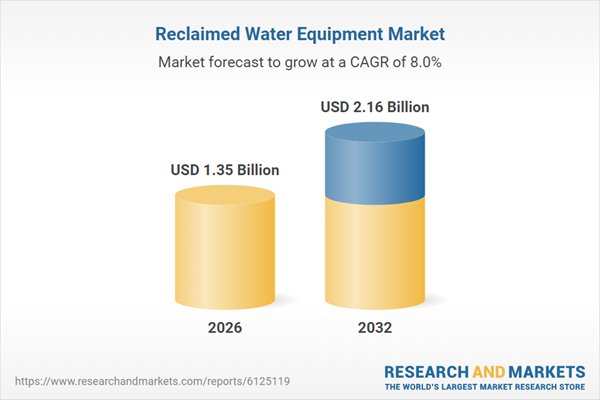

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.35 Billion |

| Forecasted Market Value ( USD | $ 2.16 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |