Speak directly to the analyst to clarify any post sales queries you may have.

Polyester polyols for elastomers are becoming a strategic lever for durability and sustainability as specifications tighten across demanding applications

Polyester polyols sit at the heart of elastomer innovation because they translate molecular design into real-world performance. By tuning backbone chemistry, molecular weight distribution, and end-group functionality, producers can influence tensile strength, abrasion resistance, hydrolysis stability, low-temperature flexibility, and compatibility with isocyanates across polyurethane elastomer systems. As end markets demand longer service life and more sustainable material choices, polyester polyols are increasingly selected not only for baseline mechanical properties but also for their ability to meet evolving durability and regulatory expectations.This executive summary frames how the polyester polyols for elastomers landscape is changing under the combined pressure of performance-driven specifications, shifting feedstock economics, and tightening environmental policies. In addition, it highlights how supply chain resilience and regional manufacturing strategies are becoming as decisive as formulation know-how. As the industry advances, decision-makers must connect application requirements with chemistry selection while simultaneously navigating procurement risk, compliance obligations, and customer expectations for transparency.

Against this backdrop, the market is moving toward more differentiated portfolios where suppliers provide tailored grades, technical service, and documentation support rather than only commodity intermediates. Consequently, success increasingly depends on an integrated strategy spanning R&D, sourcing, quality, and customer collaboration to accelerate qualification cycles and secure reliable, compliant supply.

Performance multi-targeting, sustainability qualification, and resilience-led sourcing are redefining how polyester polyols compete in elastomer value chains

Material performance requirements are shifting from single-property optimization to multidimensional targets that balance abrasion resistance, chemical exposure tolerance, dynamic fatigue, and long-term aging. This is transforming how polyester polyols are engineered and selected. In practice, formulators are evaluating not only soft segment characteristics but also how polyol structure affects phase separation, hard segment cohesion, and processing windows in casting, extrusion, and reactive injection molding. As a result, collaboration between polyol producers and elastomer manufacturers is deepening, with more joint development work focused on application-specific trade-offs.Sustainability has moved from a corporate narrative to a qualification criterion. Brand owners and industrial customers increasingly request traceability, recycled or bio-based content options, and documentation that supports life-cycle and emissions reporting. This shift is pushing suppliers to invest in circular feedstocks, mass-balance approaches where applicable, and process improvements that reduce energy intensity. At the same time, it is creating a premium on consistent quality because alternative feedstocks can introduce variability unless managed with robust controls.

The competitive landscape is also being reshaped by operational resilience. After several years of logistics volatility and uneven capacity utilization across regions, procurement teams are re-evaluating single-region dependency and seeking dual sourcing for critical grades. This has accelerated efforts to regionalize production, qualify additional suppliers, and build inventory strategies that reflect not just cost but also continuity of supply. Furthermore, tighter regulatory oversight on chemicals management and worker safety is encouraging manufacturers to choose partners capable of providing comprehensive compliance data and responsive technical support.

Digitalization is another transformative shift. Data-driven formulation development, faster lab-to-plant scaling, and tighter process monitoring are reducing time-to-qualification for new elastomer systems. When paired with customer-facing technical platforms and better documentation workflows, these capabilities help suppliers embed themselves earlier in the design cycle. Ultimately, the industry is moving toward a service-and-solutions model in which value is created through performance assurance, sustainability enablement, and supply reliability rather than through chemistry alone.

United States tariff actions in 2025 are accelerating regionalization, compliance rigor, and multi-origin sourcing strategies for polyester polyols and inputs

The introduction and adjustment of United States tariffs in 2025 are reinforcing a more regional and risk-aware procurement posture across chemical intermediates, including polyester polyols and key upstream inputs. Even when tariffs do not apply uniformly across all grades or origins, the uncertainty they introduce can alter contracting behavior. Buyers are increasingly prioritizing clarity on country-of-origin, transshipment risk, and the robustness of trade-compliance documentation, because the administrative burden and potential cost exposure can rival the headline duty rate.Cost effects are not limited to the polyol itself. Polyester polyols are linked to upstream diacids/anhydrides, diols, catalysts, and energy inputs, so trade actions that influence any part of the chain can amplify total landed cost changes. Consequently, formulators may revisit specification flexibility, such as accepting alternate viscosity bands or hydroxyl number ranges where performance allows, to broaden the qualified supply base. However, qualification timelines in elastomers can be lengthy, so companies with pre-qualified alternates are better positioned to respond quickly.

Tariffs are also shaping supplier selection and manufacturing footprints. Domestic and nearshore producers can gain relative advantage when imported material faces additional cost or administrative friction, but only if they can meet tight quality requirements and provide reliable lead times. At the same time, importers and distributors are adapting by diversifying origin countries, increasing use of bonded inventory strategies, and negotiating contract clauses that address tariff pass-through. This environment favors commercial models that share risk transparently and avoid surprise cost escalation.

Over the medium term, the most significant impact may be strategic rather than purely financial. Trade policy volatility encourages investment in regional capacity, backward integration where feasible, and stronger supplier partnerships centered on joint forecasting and inventory planning. For elastomer producers, the key is to balance cost control with continuity, ensuring that tariff-driven sourcing adjustments do not compromise consistency, regulatory compliance, or end-use performance.

Segmentation across type, form, molecular weight, viscosity, application, and end users shows where performance, processing, and service create advantage

Segmentation by type reveals a clear divide between performance-led specialties and broad-use workhorses. Aromatic polyester polyols continue to be chosen where toughness, abrasion resistance, and cost-performance balance are critical, especially in applications that can tolerate comparatively lower hydrolysis resistance. In contrast, aliphatic polyester polyols are increasingly favored in environments where moisture exposure, weathering, and long-term stability matter, even when this requires tighter process control or higher input costs. This distinction is pushing suppliers to differentiate not only by chemistry but also by consistency, impurity control, and tailored functionality.Segmentation by form highlights the importance of logistics and handling. Liquid grades remain central for many processors because they integrate easily into standard polyurethane workflows, support metering accuracy, and reduce dissolution complexity. Meanwhile, solid or semi-solid formats can make sense for certain supply chains and manufacturing setups, but they often demand additional melting or conditioning steps that influence energy use and throughput. As processors look to streamline operations, the practicalities of handling are becoming a more explicit part of the value proposition.

Segmentation by molecular weight is strongly connected to elastomer feel, flexibility, and mechanical balance. Lower molecular weight options can enable higher crosslink density and hardness targets, while higher molecular weight grades can support softer elastomers and improved elongation. However, the relationship is not linear; molecular weight distribution, end-group functionality, and compatibility with chain extenders all affect phase behavior and final properties. As a result, suppliers that provide narrow distributions and application guidance can shorten customers’ development cycles.

Segmentation by viscosity similarly reflects processing realities. Lower viscosity grades can improve pumpability, mixing, and dispersion at lower temperatures, which is valuable for energy efficiency and cycle time. Higher viscosity grades may be selected to achieve specific performance targets or to fit existing formulation architectures, but they can raise challenges in metering and consistency unless temperature control is robust. Increasingly, buyers are specifying viscosity stability over shelf life and across batches, making quality systems and analytics a competitive differentiator.

Segmentation by application underscores where demand for polyester polyols is most technically sensitive. In footwear, the emphasis often falls on abrasion resistance, rebound, and comfort, with strong pressure to incorporate more sustainable inputs without sacrificing consistency. Automotive elastomers focus heavily on heat aging, vibration damping, and resistance to oils and fluids, while also facing strict regulatory and OEM qualification requirements. Industrial elastomers demand durability under load, cut resistance, and reliability across varied environments, which places a premium on predictable performance and support for troubleshooting. Other niche applications, including coatings-adjacent elastomer uses and specialized components, tend to reward suppliers that can customize grades and provide rapid technical iteration.

Segmentation by end user also shapes procurement and qualification dynamics. Manufacturers, distributors, and compounders each value different service attributes, from direct technical co-development to inventory availability and flexible packaging. Therefore, winning strategies align product design with channel needs, ensuring that documentation, lead times, and technical assistance match how the material is purchased and deployed.

Regional priorities diverge across the Americas, Europe, Middle East, Africa, and Asia-Pacific as regulation, capacity, and demand patterns evolve

Regional dynamics for polyester polyols in elastomers are increasingly shaped by the interplay of industrial demand, regulatory frameworks, and supply chain structure. In the Americas, purchasing decisions are strongly influenced by the need for resilient supply and predictable compliance documentation, particularly as buyers respond to trade policy uncertainty and push for shorter lead times. Manufacturing concentration and proximity to major elastomer end markets support regional sourcing strategies, while sustainability requirements from large brands continue to raise expectations for traceability and consistent quality.In Europe, the transition toward circularity and stricter chemicals management is a defining force. Customers frequently require deeper disclosure on composition and environmental attributes, and they often prioritize suppliers that can support audits and provide robust product stewardship. This environment encourages investment in lower-impact processes and alternative feedstocks, but it also elevates the importance of performance validation because elastomer applications in industrial, mobility, and consumer sectors cannot tolerate property drift.

The Middle East is positioned as a strategic production and export hub due to integrated petrochemical value chains and expanding chemical manufacturing capabilities. As regional players move beyond commodity positioning, technical service and application development are becoming more important for gaining share in elastomer-focused polyols. At the same time, logistics connectivity to Europe, Asia, and Africa influences how suppliers structure inventory and customer support.

Africa presents a more varied picture where industrialization pace, infrastructure, and import reliance differ significantly by country. Demand in elastomers is often linked to construction, transportation, and general industrial goods, and buyers may prioritize availability and cost stability. Nonetheless, as local manufacturing and standards evolve, opportunities grow for suppliers and distributors that can provide consistent material, reliable lead times, and practical technical guidance.

Asia-Pacific remains the most diverse and production-intensive region, combining large-scale manufacturing with fast-moving application development. Competition is strong, and qualification cycles can be rapid when suppliers offer responsive technical support and consistent supply. Sustainability expectations are rising, particularly among exporters and multinational supply chains, which is pushing broader adoption of improved documentation and lower-impact options. Across the region, the ability to serve both high-volume requirements and specialized elastomer niches is a key differentiator.

Leading suppliers are winning with tighter specifications, sustainability proof-points, and customer-embedded technical service beyond commodity competition

Company strategies in polyester polyols for elastomers increasingly converge on three themes: differentiated performance, reliable supply, and sustainability credibility. Leading producers are expanding portfolios to cover both aromatic and aliphatic chemistries and to offer grades tuned for specific elastomer outcomes such as abrasion resistance, hydrolysis stability, and controlled hardness. Rather than competing only on catalog breadth, many are emphasizing tighter specifications, better batch-to-batch consistency, and deeper technical engagement to help customers accelerate qualification and reduce formulation risk.Investment in operational excellence has become a core competitive lever. Companies with strong process controls, analytical capabilities, and disciplined change management are better positioned to meet elastomer manufacturers’ expectations for consistency, especially when alternative or circular feedstocks are introduced. In parallel, suppliers are strengthening stewardship capabilities, including safety data quality, regulatory support, and traceability systems, because these services now influence preferred-supplier status.

Commercial differentiation is increasingly tied to how companies serve the channel. Some suppliers focus on direct engagement with large elastomer manufacturers, providing co-development and troubleshooting support. Others build advantage through distribution networks, local inventory, packaging flexibility, and fast fulfillment for small-to-mid customers. Across both models, the most successful players treat technical service as part of the product, not as an add-on, and they use structured feedback loops to guide product upgrades.

Finally, partnerships and targeted investments are reshaping competitive positions. Collaboration with recycling and bio-based feedstock providers, as well as selective capacity expansions in strategically located sites, are helping companies reduce risk while aligning with customer sustainability goals. This shift favors organizations that can integrate R&D, operations, and commercial teams into a single narrative of performance, compliance, and dependable supply.

Leaders can de-risk supply, accelerate qualification, and monetize sustainability by integrating R&D, procurement, and stewardship into one roadmap

Industry leaders can strengthen competitiveness by treating polyester polyols as a strategic platform rather than a replaceable input. Start by aligning R&D priorities with the most value-dense elastomer requirements, including hydrolysis resistance, dynamic fatigue, and aging stability, and translate those priorities into clear grade roadmaps with controlled variability. When sustainability claims are part of the offering, ensure they are backed by auditable documentation, stable quality, and a transparent explanation of how recycled or bio-based content affects performance.On the supply side, reduce exposure to trade and logistics shocks by qualifying multi-origin sources for key grades and by building contingency formulations that preserve performance while widening acceptable specifications. At the same time, strengthen contracts with clearer terms for tariff pass-through, lead-time commitments, and change notifications. These steps help prevent urgent reformulation or production disruptions when policy or freight conditions change.

Commercially, differentiate through application-specific support. Establish joint development frameworks with elastomer customers that include standardized test protocols, accelerated aging data, and processing guidance to reduce qualification time. For mid-market customers served through distribution, invest in technical enablement tools and localized support so that service quality does not depend solely on proximity to a central lab.

Operationally, prioritize analytics and digital quality systems that can detect drift early and support root-cause analysis. When introducing alternative feedstocks, implement stricter incoming controls and process windows to prevent variability from reaching customers. Finally, build a coherent compliance strategy that anticipates evolving restrictions and reporting requirements, ensuring that product stewardship keeps pace with customer audits and regulatory change.

A triangulated methodology blends primary industry input with technical and policy analysis to validate insights across the elastomer polyols value chain

The research methodology integrates primary engagement with industry participants and structured secondary analysis of publicly available technical, regulatory, and trade information. Primary work emphasizes capturing how elastomer producers, formulators, distributors, and polyol suppliers translate performance needs into purchasing specifications, and how they manage qualification timelines, quality expectations, and documentation requirements. These insights are used to map decision criteria across applications and to identify the operational and commercial practices that consistently influence supplier selection.Secondary research focuses on understanding the material science context, upstream value chain linkages, and policy environment that affect polyester polyols for elastomers. This includes reviewing standards and compliance frameworks relevant to chemicals management and product stewardship, along with trade and customs developments that influence sourcing and landed-cost risk. Company-level information is assessed to understand portfolio direction, capacity and footprint signals, and stated sustainability initiatives.

Findings are validated through triangulation, cross-checking themes across multiple inputs and reconciling differences through follow-up analysis. Throughout the process, emphasis is placed on consistency of definitions, clear segmentation logic, and practical relevance to decision-makers. The result is a coherent view of how technology, policy, and supply chain realities interact, enabling readers to act on the insights with confidence.

The path forward favors suppliers and buyers who pair elastomer performance leadership with resilient sourcing, verified sustainability, and compliance readiness

Polyester polyols for elastomers are entering a phase where chemistry excellence must be matched by supply resilience and sustainability credibility. As customers demand materials that perform under harsher conditions and meet higher transparency expectations, suppliers that can deliver consistent quality, documentation, and application support will be positioned to build durable partnerships. At the same time, procurement strategies are evolving to account for tariff volatility, logistics risk, and upstream cost sensitivity.The competitive field is moving toward differentiated solutions grounded in application outcomes. Aromatic and aliphatic pathways will continue to coexist, but selection will increasingly depend on lifetime performance, processing efficiency, and compliance readiness rather than on legacy formulations. Across regions, regulatory and customer expectations are raising the baseline for stewardship and traceability, while rapid development cycles reward organizations that can collaborate effectively across the value chain.

For decision-makers, the path forward centers on disciplined segmentation choices, proactive qualification planning, and investments that connect R&D with operational control. Those who act early to align portfolios, sourcing, and compliance with these shifts will be better prepared to capture opportunity while managing risk.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Polyester Polyols for Elastomers Market

Companies Mentioned

The key companies profiled in this Polyester Polyols for Elastomers market report include:- Arkema S.A.

- BASF SE

- Bayer AG

- Covestro AG

- Dow Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Hexion Inc.

- Huntsman Corporation

- Kumho Petrochemical Co., Ltd.

- Lanxess AG

- LG Chem, Ltd.

- Lonza Group AG

- Mitsui Chemicals, Inc.

- Perstorp Holding AB

- Shell Chemicals Ltd

- Wanhua Chemical Group Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

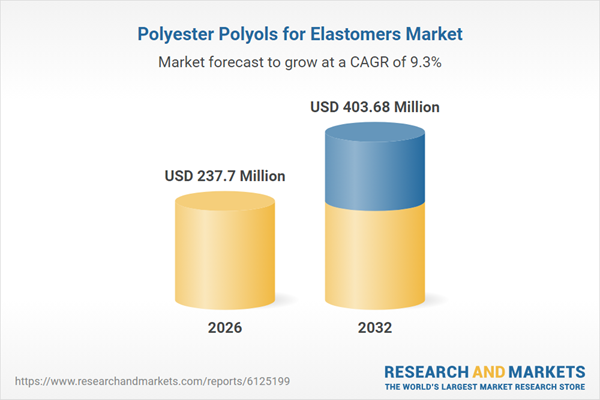

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 237.7 Million |

| Forecasted Market Value ( USD | $ 403.68 Million |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |