Speak directly to the analyst to clarify any post sales queries you may have.

Why Water for Injection equipment is becoming a strategic manufacturing platform for sterile, biologic, and advanced therapy operations worldwide

Water for Injection (WFI) equipment sits at the intersection of patient safety, regulatory compliance, and manufacturing efficiency. As sterile injectables, biologics, cell and gene therapies, and high-potency formulations expand across global pipelines, the demand for consistently controlled, contamination-free water systems has become more operationally central than ever. WFI is not simply a utility; it is a quality-critical raw material that touches cleaning, formulation, and sometimes final product contact, which means its generation, storage, and distribution systems must perform predictably under strict oversight.At the same time, expectations for data integrity, traceability, and lifecycle management have risen. Modern WFI installations are increasingly designed as integrated assets that unify purification, generation, storage, distribution, and monitoring with automation layers capable of producing defensible records. This places engineering teams, quality units, and procurement under shared pressure: deliver systems that meet evolving standards, minimize downtime, and remain adaptable as product portfolios and capacity requirements shift.

Against this backdrop, WFI equipment decisions now require a tighter alignment between technology selection and operational strategy. The most successful organizations are those that treat WFI as a platform capability-standardizing where possible, tailoring where necessary, and building governance that reduces deviations and accelerates qualification without compromising control.

Transformative shifts reshaping WFI equipment as digital, sustainable, and risk-based designs displace legacy procurement habits across the industry

The WFI equipment landscape is undergoing a decisive shift from isolated hardware procurement toward holistic, risk-based system engineering. A key transformation is the broader acceptance and operationalization of membrane-based and hybrid approaches where appropriate, supported by stronger monitoring, tighter microbiological control strategies, and robust sanitization regimes. While distillation remains a benchmark for many facilities, especially where legacy standards, high feed variability, or specific risk postures dominate, organizations are increasingly evaluating technology fit through the lens of total lifecycle performance rather than tradition.Digitization is another structural change. Plants are moving beyond basic conductivity and TOC measurement toward richer instrumentation, contextualized alarms, and historian-driven trending that supports proactive maintenance and faster deviation closure. This shift is reinforced by regulatory expectations for sound data governance and by the practical reality that WFI systems are frequently among the most audited utilities in sterile facilities. As a result, suppliers are differentiating through automation architectures, cybersecurity-aware control designs, and documentation packages that reduce validation friction.

Sustainability and resilience have also become non-negotiable design constraints. Energy intensity, cooling water consumption, and heat recovery potential influence choices between multi-effect distillation, vapor compression distillation, and alternative generation routes. Additionally, the operational impact of supply interruptions has pushed sites to re-examine redundancy, hold times, sanitization frequency, and critical spares planning. These resilience measures increasingly extend to consumables and serviceability, including modular skid concepts, remote support, and accelerated commissioning playbooks.

Finally, the industry is shifting toward standardized specifications and repeatable design patterns across networks. Global manufacturers aim to replicate validated designs from site to site, reducing engineering effort and improving comparability in performance data. In practice, this favors vendors that can deliver consistent build quality, strong change control discipline, and a clear path for upgrades over the system lifecycle.

How the cumulative impact of United States tariffs in 2025 is changing WFI equipment sourcing, lead times, qualification risk, and project economics

United States tariff dynamics in 2025 are shaping WFI equipment programs through both direct cost pressure and indirect supply chain behavior. Because WFI systems rely on stainless steel fabrications, precision instrumentation, control panels, specialty valves, and sometimes imported subassemblies, tariff exposure can surface in multiple layers of a project-not only in the headline skid price. Even where final assembly occurs domestically, upstream components may carry country-of-origin implications that complicate budgeting and procurement.One cumulative impact is a stronger preference for early supplier engagement and firmer commercial locking mechanisms. Project teams are increasingly negotiating indexed pricing, defined escalation clauses, and clearly bounded validity windows tied to material costs and lead-time realities. This has prompted many buyers to freeze specifications earlier than they might prefer, trading some design flexibility for improved cost certainty. In parallel, suppliers are reevaluating their sourcing maps, qualifying secondary vendors, and adjusting inventory strategies to reduce volatility in critical parts.

Tariff conditions are also influencing equipment configuration decisions. For example, organizations may prioritize designs that minimize specialty imported components, simplify fabrication, or consolidate instrumentation in ways that preserve control intent while reducing procurement complexity. In some cases, this pushes buyers toward more standardized platforms with readily available parts and service support in the United States, especially for multi-site operators that need consistent maintenance practices.

Lead-time risk has become as important as price. Tariffs can trigger supplier congestion, customs delays, and unplanned requalification of substituted parts. Consequently, quality and engineering teams are placing greater emphasis on approved vendor lists, documented equivalency frameworks, and change notification requirements that protect validated states. The overall effect is a more disciplined procurement posture in which commercial strategy, quality risk management, and project scheduling are tightly coupled from the earliest design stages.

Segmentation insights show how equipment type, generation technology, integration level, and end-use priorities fundamentally change WFI buying criteria

Segmentation reveals that buying behavior diverges sharply when viewed through equipment type, technology pathway, end-use environment, and the level of integration expected at handoff. In product categories such as distillation systems, vapor compression units, membrane-based generation, storage tanks, distribution loops, and point-of-use components, customers are not simply purchasing hardware-they are purchasing a control strategy. Distillation-oriented buyers often emphasize thermal robustness and proven microbial control, while teams evaluating membrane or hybrid architectures focus on monitoring intensity, sanitization repeatability, and the discipline of preventive maintenance programs.Technology choices also map to facility maturity and operational philosophy. Greenfield projects may favor integrated skids that bundle generation, storage, and distribution with pre-engineered automation to accelerate commissioning. Brownfield upgrades, by contrast, frequently prioritize interoperability with existing loops, minimal downtime tie-ins, and phased validation plans that keep production running. Across both contexts, the selection of single-pass versus double-pass arrangements, hot versus cold distribution, and continuous circulation versus demand-driven concepts tends to reflect a site’s risk tolerance, microbial control model, and utilities footprint.

When segmented by application needs, the decision criteria shift again. Facilities focused on sterile injectables and aseptic processing usually treat WFI as a continuous, high-availability utility where alarm management, redundancy, and sanitization speed are critical. Biologics and advanced modalities may require additional attention to endotoxin control, cross-contamination prevention, and campaign changeover efficiency, elevating the importance of drainability, sampling design, and documentation rigor. Meanwhile, hospital and research environments often seek compact footprints, simplified operation, and serviceability, even if their throughput requirements differ from large commercial plants.

Finally, segmentation by system scale and delivery model-whether fully customized engineered systems, modular platforms, or packaged units-clarifies vendor differentiation. Standardized modular offerings appeal to organizations that value repeatability and rapid deployment, while bespoke engineering remains attractive where constraints are complex or where legacy integration dominates. Across these segments, the most consistent purchasing theme is a preference for solutions that reduce validation burden through strong documentation, factory testing transparency, and clear change control practices.

Regional insights across the Americas, Europe, Middle East & Africa, and Asia-Pacific reveal distinct compliance priorities, build-out patterns, and service needs

Regional dynamics for WFI equipment are shaped by regulatory interpretation, investment patterns in sterile capacity, and the maturity of local engineering and service ecosystems across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, expansion and modernization efforts often emphasize standardization across multi-site networks, with strong attention to audit readiness, documentation completeness, and reliable service coverage. The region also shows heightened sensitivity to procurement risk, including lead-time and component availability, which elevates the value of robust project management and validated-equivalent substitution controls.Europe reflects a mature compliance environment where sustainability and energy efficiency are increasingly embedded in user requirements. Facilities often pursue optimization of thermal loads, heat recovery, and water consumption, and they may apply rigorous expectations for materials of construction, hygienic design, and data integrity. Cross-border standardization is common for large operators, but implementation frequently varies by site constraints and local qualification traditions, reinforcing the need for adaptable automation and clear validation strategies.

In the Middle East & Africa, greenfield projects and capacity build-outs in select hubs are creating demand for turnkey execution, training, and long-term service capability. Buyers frequently prioritize vendor depth in commissioning support, documentation delivery, and operator readiness, particularly when local talent pipelines are still developing. System robustness under variable feed-water conditions and the ability to maintain performance in hot climates can also shape equipment configuration choices.

Asia-Pacific remains a focal point for capacity expansion, spanning both domestic manufacturing scale-up and export-oriented quality upgrades. In this region, speed to operational readiness can be a decisive factor, which increases interest in modularization, repeatable designs, and supplier support that accelerates qualification. At the same time, competitive manufacturing economics encourage careful evaluation of lifecycle costs, including utilities consumption, maintenance complexity, and uptime protection. Across all regions, harmonization of expectations around digital records, cybersecurity awareness, and service responsiveness is tightening the criteria for vendor selection.

Key company insights highlight how suppliers win through integrated systems, validation-ready documentation, lifecycle service depth, and execution reliability

Company positioning in WFI equipment increasingly depends on the ability to deliver complete, auditable systems rather than standalone components. Leading suppliers differentiate through integrated offerings that combine generation technology, hygienic storage and distribution design, advanced instrumentation, and automation that supports traceable operations. Equally important is the quality of engineering documentation, including clear design rationale, weld and material traceability, calibration strategies, and test protocols that align with customer validation expectations.Another axis of competition is execution reliability. Buyers scrutinize factory acceptance testing depth, commissioning competence, and the supplier’s ability to manage changes without destabilizing qualification plans. Vendors that have institutionalized project governance-through configuration management, disciplined software development practices, and standardized document sets-tend to reduce friction across quality, engineering, and operations stakeholders. This matters because WFI systems are often on the critical path for facility readiness, and delays cascade into broader manufacturing timelines.

Service capability has become a core differentiator as well. Organizations are looking for predictive maintenance options, responsive field support, and accessible spares strategies that reduce downtime risk. Suppliers that can provide remote diagnostics, operator training, and lifecycle upgrade paths for controls and instrumentation are better positioned in environments where plants are expected to run continuously and compliance expectations intensify over time.

Finally, partnership behavior shapes long-term value. The most trusted companies collaborate early in URS development, help customers translate regulatory expectations into practical design decisions, and remain accountable after handover. In a market where change control discipline is essential, vendors that communicate transparently about component sourcing, software revisions, and substitution policies are more likely to earn repeat deployments across multi-site networks.

Actionable recommendations to improve WFI equipment outcomes through standardization, tariff-aware procurement, modern monitoring, and risk-based qualification

Industry leaders can strengthen outcomes by treating WFI equipment programs as enterprise-standard platforms with clearly defined governance. Standardizing core design principles-such as materials of construction, slope and drainability requirements, sampling philosophies, and alarm strategies-reduces engineering reinvention and helps quality teams apply consistent risk assessments. At the same time, leaders should preserve controlled flexibility for site-specific constraints, using pre-approved design variants rather than ad hoc customization.Procurement strategy should be elevated to a cross-functional discipline that includes quality and validation from the outset. Contracting should require transparent country-of-origin reporting for critical components, explicit change notification obligations, and well-defined acceptance criteria for functional testing and documentation. Where tariff and lead-time volatility persists, leaders should consider dual sourcing for high-risk parts and negotiate spares packages aligned to the first two years of operation, when infant-mortality failures and tuning needs are most likely.

Operational excellence depends on embedding a modern monitoring and maintenance model. Leaders should invest in instrumentation that supports meaningful trending, define alert limits that reflect process understanding rather than generic defaults, and ensure data governance is consistent with audit expectations. Preventive maintenance and sanitization strategies should be designed as part of the control approach, not bolted on after startup, with clear accountability for schedule adherence and deviation response.

Finally, leaders should accelerate project delivery by aligning qualification planning with engineering decisions. A risk-based commissioning and qualification approach can shorten timelines when supported by robust factory testing, traceable document sets, and clear linkage between design requirements and verification evidence. Selecting partners who can execute this end-to-end-while maintaining disciplined change control-reduces the hidden costs that often exceed the apparent savings of lowest-price bids.

Research methodology grounded in stakeholder interviews and rigorous triangulation of technical and regulatory evidence to reflect real WFI purchasing behavior

The research methodology integrates primary engagement with industry stakeholders and structured analysis of publicly available technical, regulatory, and corporate information relevant to WFI equipment. Inputs are designed to reflect how decisions are made in practice across engineering, quality, procurement, and operations, emphasizing technology selection criteria, validation expectations, and lifecycle service considerations.Primary work emphasizes qualitative insights from knowledgeable participants such as plant engineers, validation and quality leaders, project managers, and supplier-side experts involved in designing, building, commissioning, and maintaining WFI systems. These engagements focus on real-world drivers including compliance trends, common failure modes, commissioning bottlenecks, control strategy preferences, and supply chain constraints. Responses are triangulated to reduce single-source bias and to distinguish widely observed patterns from site-specific experiences.

Secondary analysis draws from standards and guidance widely used in pharmaceutical water system design and qualification, alongside manufacturer technical materials, product documentation, patent filings where relevant, trade publications, and regulatory communications that inform expectations for water systems and data integrity. The methodology emphasizes consistency checks across sources, ensuring that technical claims align with established engineering principles and recognized compliance frameworks.

Throughout the process, insights are synthesized using a structured framework that maps decision factors to equipment categories, end-use contexts, and regional operating environments. This approach supports a practical narrative: how WFI equipment is specified, selected, validated, and operated, and how external pressures such as tariffs, sustainability targets, and digital governance are shaping near-term priorities.

Conclusion synthesizing how compliance, resilience, and lifecycle execution discipline define the next era of Water for Injection equipment strategy

WFI equipment strategy is increasingly a boardroom-relevant operational issue because it links directly to product quality, facility readiness, and long-term manufacturing flexibility. The market environment rewards organizations that select technologies based on risk-based fit, design systems for audit-ready operations, and plan for lifecycle realities such as component obsolescence, cybersecurity expectations, and evolving sustainability constraints.Across technology options and system configurations, a consistent message emerges: execution discipline and documentation quality can be as decisive as the generation method itself. Projects that align procurement, engineering, and validation early tend to reduce change friction and compress timelines without sacrificing control. Conversely, fragmented decision-making amplifies tariff exposure, increases lead-time surprises, and creates validation rework that can delay operational readiness.

Moving forward, competitive advantage will favor those who institutionalize standard designs, invest in actionable monitoring, and build resilient supplier relationships. By treating WFI systems as integrated, data-governed platforms rather than isolated utilities, manufacturers can improve uptime, strengthen compliance posture, and support the rapid scaling demanded by modern sterile and biologic portfolios.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Water for Injection Equipment Market

Companies Mentioned

The key companies profiled in this Water for Injection Equipment market report include:- Aqua-Chem, Inc.

- BRAM-COR S.r.l.

- BWT AG

- Evoqua Water Technologies LLC

- MECO S.r.l.

- Merck Group

- Pall Corporation

- Pentair plc

- Sartorius AG

- STERIS Corporation

- Stilmas S.r.l.

- SUEZ Water Technologies & Solutions

- Syntegon Technology GmbH

- Truking Technology Co., Ltd.

- Veolia Water Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | January 2026 |

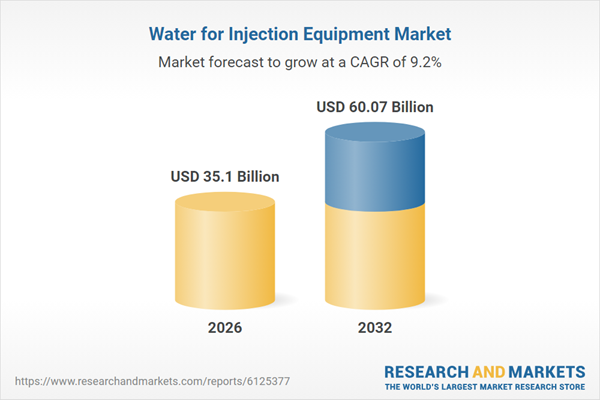

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 35.1 Billion |

| Forecasted Market Value ( USD | $ 60.07 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |