Speak directly to the analyst to clarify any post sales queries you may have.

Remote internship websites are evolving into end-to-end early-career talent platforms where trust, verification, and outcomes now matter as much as reach

Remote internship websites have moved from being simple posting boards to becoming full-stack talent access platforms that influence how early-career candidates discover opportunities, how employers evaluate skills, and how universities verify learning outcomes. As remote and hybrid work norms stabilized, internships followed the same trajectory, expanding beyond traditional corporate hubs and enabling students to gain experience without relocating. Consequently, the market has become a battleground for workflow depth-matching quality, compliance readiness, and credentialing credibility-not merely traffic volume.At the same time, stakeholders are asking harder questions about value and trust. Employers want predictable pipelines and evidence of job readiness, while candidates want transparency on pay, expectations, and mentorship. Educational institutions and workforce organizations increasingly care about documentation, equity, and alignment with curricula. This combination has elevated remote internship websites into an ecosystem role, where product decisions must serve multiple constituencies without degrading user experience.

Against this backdrop, executive leaders need a coherent summary of the forces reshaping demand, the segments where differentiation is most defensible, and the operational implications of policy and macroeconomic shifts. The following analysis synthesizes these dynamics into actionable insights for decision-makers building, investing in, or partnering with remote internship websites.

Platform competition is shifting from listing volume to verified workflows, AI-augmented matching, portable credentials, and enterprise-grade integration demands

The competitive landscape is being transformed by a shift from generalized listings toward verified, workflow-driven marketplaces. Platforms are increasingly embedding structured role definitions, standardized skill taxonomies, and guided application journeys that reduce friction for candidates while improving signal quality for employers. This shift is reinforced by the rising expectation that an internship should produce measurable outputs-projects, portfolios, and competency evidence-rather than ambiguous “exposure.” As a result, websites that can operationalize outcomes through assessments, mentor checkpoints, and artifact submission are earning stronger employer confidence.Another transformative change is the normalization of AI across the entire experience, not only in search and matching but also in content generation, candidate coaching, and screening. AI-assisted job descriptions, candidate fit scores, interview preparation modules, and automated communications are becoming common. However, with increased automation comes heightened scrutiny around fairness, transparency, and privacy. Platforms are responding by adding explainability layers, consent workflows, and bias-monitoring practices, particularly when serving regulated employers or education-linked programs.

A third shift is the acceleration of credential portability. Micro-credentials, verified certificates, and skill badges are increasingly integrated into profiles, enabling candidates to demonstrate capability beyond school pedigree. This is especially powerful in remote contexts where hiring managers cannot rely on in-person impressions. Consequently, partnerships with learning providers, assessment vendors, and digital credential standards bodies have become more strategic than purely promotional partnerships.

Finally, enterprise buying behavior is changing. Employers are consolidating vendors, demanding integration with applicant tracking systems and identity providers, and requiring better analytics on conversion, diversity outcomes, and time-to-fill. This pushes remote internship websites to behave more like SaaS platforms than media businesses. The winners are likely to be those that combine marketplace liquidity with enterprise-grade administration, compliance tooling, and measurable ROI narratives.

United States tariff dynamics in 2025 are reshaping internship demand through budget sensitivity, supply-chain realignment, and higher compliance expectations for platforms

The cumulative impact of United States tariffs in 2025 is felt less through a direct linkage to digital services pricing and more through second-order effects that reshape employer hiring appetites, internship program budgets, and cross-border operational decisions. As tariff pressure influences input costs in certain industries, some employers respond by tightening discretionary spending, delaying expansion plans, or revisiting workforce planning assumptions. Internship programs-often funded from departmental budgets-can become a variable cost line item, which affects posting volume, program length, and the willingness to pay for premium sourcing.At the same time, tariff-driven supply chain adjustments can trigger workforce rebalancing. Companies that accelerate reshoring or diversify suppliers may reconfigure where teams sit and which projects are prioritized. This can increase demand for remote interns in functions tied to supplier management, analytics, procurement operations, logistics optimization, and compliance documentation, while reducing demand in areas directly exposed to short-term uncertainty. In practice, this raises the importance of category-level insights within platforms so that candidates can be guided toward resilient internship tracks.

Tariffs can also amplify the strategic value of domestic talent pipelines. Employers seeking to reduce reliance on global sourcing in products and operations may simultaneously invest in local talent development, including early-career programs that feed long-term hiring. Remote internship websites that can support structured cohorts, university partnerships, and verification of work outputs become more relevant under this lens, because they help employers build pipelines without requiring geographic concentration.

Finally, the policy environment encourages closer attention to compliance and reputational risk. Employers may apply stricter vendor reviews, especially for platforms handling candidate data, assessments, or cross-border placements. This increases the premium on robust data governance, clear worker classification guidance, and transparent internship standards. In effect, tariff-related volatility strengthens the case for platforms that help employers run internships with predictable administration, auditable processes, and reduced operational surprises.

Segmentation reveals where platforms win: by type, internship structure, end-user needs, pricing approach, and integration maturity that shapes trust and adoption

Segmentation clarifies where remote internship websites should prioritize depth versus breadth, because buyer expectations vary sharply by how platforms create value and how users engage. In the segmentation by platform type, aggregator-style destinations tend to win on discovery and scale, but they face pressure to improve listing quality and reduce spam. Conversely, marketplace and managed-program models are more defensible when they provide verification, standardized workflows, and support services that lower employer effort. Across this divide, a platform’s ability to prove outcomes-through assessments, project artifacts, and mentor validation-has become a key differentiator.When viewed through the segmentation by internship type, the strongest engagement is increasingly concentrated in roles with clear deliverables and digital-first collaboration patterns. Project-based internships can be packaged with milestone tracking and portfolio creation, which supports candidate employability and employer confidence. Traditional semester-long structures still matter, particularly when aligned with university credit systems, but they require stronger documentation and supervisory expectations to avoid low-quality experiences. Meanwhile, paid versus unpaid dynamics continue to influence conversion rates and brand trust, pushing platforms to emphasize transparency and to provide employers with guidance on equitable program design.

The segmentation by end user highlights distinct purchase motivations. Employers prioritize funnel efficiency, fit quality, and administrative burden reduction, which makes integrations, analytics, and compliance tooling decisive. Candidates prioritize legitimacy, clarity of expectations, and career progression, which elevates verified employer profiles, mentorship signals, and skills-based matching. Universities and workforce intermediaries care about verification, learning outcomes, and reporting, creating demand for structured templates, approval workflows, and exportable documentation.

The segmentation by pricing model further shapes platform strategy. Freemium and posting-based models can accelerate liquidity but often struggle with quality control and long-term retention. Subscription and seat-based models align better with enterprise procurement and enable investment in support, analytics, and integrations. Commission or success-fee structures can appeal to budget-sensitive employers, yet they require precise attribution and careful incentive design to avoid undermining candidate experience.

Finally, segmentation by deployment and integration posture underscores a widening gap between consumer-first sites and enterprise-ready systems. Platforms that offer configurable workflows, API access, single sign-on, and governance controls are better positioned for larger employers and institution-linked programs. Those that remain primarily web-front experiences can still compete effectively in high-volume discovery segments, but they must compensate with trust features such as verification, moderation, and transparent internship standards.

Regional dynamics shape adoption through policy, privacy, language, and employer maturity, making localization and trust features central to global scale

Regional dynamics influence both supply and demand for remote internships, as labor norms, academic calendars, language requirements, and employer risk tolerance differ widely. In North America, employer demand is shaped by a mix of early-career talent competition and heightened expectations for compliance, pay transparency, and structured evaluation. Platforms that support standardized skill frameworks, reporting, and integration with enterprise systems tend to resonate, particularly with larger employers that require repeatable hiring processes.In Europe, cross-border hiring complexity and data privacy expectations elevate the importance of clear consent management, documentation, and localized workflows. The region’s diverse academic systems also make verification and credit alignment more important for internship placements connected to universities. As a result, platforms that can adapt to multi-country requirements and support multilingual experiences are better positioned, especially when they offer tools that help employers manage eligibility, supervision, and outcomes reporting.

In Asia-Pacific, growth in digital skills training and a large population of early-career candidates create strong momentum for remote internship pathways, particularly in technology, digital marketing, design, and analytics. However, the region’s diversity means platforms must handle varying employer maturity levels, from startups seeking flexible project help to enterprises building structured pipelines. Partnerships with training providers and credentialing mechanisms can be especially influential, as they help candidates stand out and help employers evaluate skill readiness at scale.

In Latin America, remote internships often intersect with cross-border opportunity seeking and the need for credible pathways into global work. Platforms that emphasize legitimacy, employer verification, and secure communication can reduce risk perceptions for candidates. Additionally, features that support asynchronous collaboration and time-zone coordination can improve completion rates and employer satisfaction, particularly for project-based roles.

In the Middle East and Africa, remote internship demand is shaped by youth employment initiatives, expanding digital infrastructure, and increasing interest from both local employers and international organizations. Here, the ability to provide structured programs, mentorship scaffolding, and skills validation can be decisive, especially when internships are positioned as employability accelerators. Across regions, the common thread is that “remote” does not eliminate localization needs; it raises the bar for trust, clarity, and operational rigor adapted to local realities.

Leading companies are differentiating through traffic scale, niche community focus, or workflow infrastructure, with trust, verification, and analytics as core moats

Company strategies in remote internship websites increasingly cluster around three competitive archetypes: high-traffic discovery platforms, specialized vertical networks, and workflow-centric talent marketplaces. High-traffic brands focus on breadth, SEO authority, and candidate acquisition, then work to improve conversion through better filtering, alerts, and employer reputation signals. Their challenge is maintaining listing integrity and differentiating beyond audience size as employers demand higher match quality.Specialized platforms differentiate by serving a niche, such as technology, creative roles, social impact, or early-career programs tied to specific education pathways. Their advantage is community and relevance; they can curate roles, produce tailored content, and build partnerships that increase trust. However, specialization requires disciplined category expansion to avoid diluting brand identity, and it often depends on maintaining strong employer-side value that justifies premium pricing or tighter acceptance criteria.

Workflow-centric marketplaces compete on infrastructure rather than reach alone. They invest in verification, assessments, structured projects, mentor tooling, and employer dashboards. Many are integrating with enterprise HR ecosystems and offering analytics that quantify funnel performance and program outcomes. This approach tends to win with employers that want repeatability and governance, but it requires sustained investment in product, support, and risk management.

Across these archetypes, leading companies are strengthening authenticity signals through employer verification, scam detection, and clearer internship standards. They are also integrating learning and credentialing layers-either through partnerships or native modules-to convert internships into proof-of-skill experiences. Additionally, companies are refining monetization by packaging services, such as managed cohorts, candidate shortlists, and branded program pages, rather than relying solely on postings.

Another shared theme is defensibility through data and network effects. Platforms that capture structured skill data, project outcomes, and feedback loops can improve matching and recommendations over time. Yet this advantage depends on maintaining user trust and regulatory compliance, particularly as AI-driven decisions become more visible. Companies that treat transparency and governance as core product features-not legal afterthoughts-are increasingly better positioned to retain enterprise buyers and institutional partners.

Leaders can win by investing in trust infrastructure, outcomes-based workflows, enterprise integrations, and resilient packaging that withstands budget volatility

Industry leaders should prioritize trust architecture as a growth lever, not a compliance cost. That means investing in employer verification, listing moderation, and clear internship quality standards that reduce candidate risk and improve employer brand confidence. Strengthening these foundations can also improve organic growth by reducing negative experiences that erode word-of-mouth and repeat usage.Next, leaders should treat outcomes as the platform’s central product narrative. Building structured project templates, milestone tracking, portfolio export, and competency tagging helps candidates articulate value while giving employers clearer evaluation signals. Over time, these features can create a proprietary dataset that improves matching and supports differentiated analytics, especially when combined with candidate feedback and supervisor reviews.

In parallel, enterprise readiness should be approached with a deliberate roadmap. Integrations with applicant tracking systems, single sign-on, and configurable workflows reduce procurement friction and expand contract sizes, but only if paired with strong governance controls and transparent AI use policies. Leaders should define clear boundaries for automation, provide explainability for recommendations, and implement privacy-by-design practices that withstand buyer scrutiny.

Partnership strategy is another decisive lever. Collaborations with universities, workforce programs, and credential providers can generate qualified supply while strengthening legitimacy. However, partnerships should be structured around mutual operational benefit-verification, reporting, and documented learning outcomes-rather than superficial co-marketing.

Finally, leaders should build resilience against macro volatility by diversifying demand sources and enhancing pricing flexibility. Packaging options that range from self-serve postings to managed cohorts allows employers to maintain engagement even when budgets tighten. By aligning product tiers to distinct buyer jobs-to-be-done, platforms can protect retention while still enabling upsell when hiring confidence improves.

Methodology blends stakeholder interviews with policy and product evidence, triangulating employer, candidate, and institutional needs into decision-ready insights

The research methodology for this analysis combines structured primary engagement with rigorous secondary synthesis to ensure relevance for executives and product owners. Primary research emphasizes interviews with employers running remote or hybrid internship programs, candidates actively applying for remote internships, and institutional stakeholders such as university career services and workforce intermediaries. These conversations are used to map buying criteria, pain points, and adoption barriers across different program models and maturity levels.Secondary research focuses on synthesizing publicly available regulatory guidance, labor standards, academic program frameworks, and company disclosures related to early-career hiring, remote work policy, and digital credentialing. Industry documentation, product releases, integration announcements, and partnership activity are reviewed to understand competitive positioning and platform capability evolution. This helps validate whether interview findings reflect broader market behavior.

Analytical techniques include thematic coding of qualitative inputs to identify recurring decision drivers, followed by comparative capability mapping across platform archetypes to highlight differentiation patterns. Special attention is paid to trust and risk mechanisms, including verification practices, privacy controls, and AI transparency measures, because these factors increasingly influence enterprise procurement and institutional approvals.

Quality control is maintained through triangulation across stakeholder groups, consistency checks between observed platform features and claimed value propositions, and iterative review to ensure conclusions remain grounded in verifiable developments. The outcome is a decision-oriented narrative that emphasizes what is changing, why it matters, and how leaders can act on it without relying on speculative sizing or unsupported projections.

The market is maturing toward verified outcomes and lower risk, favoring platforms that unite employers, candidates, and institutions around measurable value

Remote internship websites now sit at the intersection of talent acquisition, education-aligned credentialing, and remote collaboration infrastructure. As the market matures, competitive advantage is increasingly determined by who can deliver reliable outcomes and reduced risk, not simply who can attract the most applicants. Platforms that build verification, transparency, and structured experiences into their core workflows are better positioned to meet rising expectations from employers, candidates, and institutions.The landscape is also being shaped by AI adoption, enterprise procurement standards, and macro forces that alter hiring confidence. These pressures reward platforms that can demonstrate responsible automation, measurable program value, and operational rigor. At the same time, regional differences in policy, privacy, and labor norms mean that global scale requires localization and governance, not one-size-fits-all expansion.

Ultimately, the strongest strategies align product investments with the real jobs-to-be-done: helping employers hire with confidence, helping candidates build credible proof of skill, and helping institutions validate learning outcomes. Leaders who focus on trust architecture, outcomes-based design, and partnership ecosystems will be best positioned to sustain relevance as remote early-career pathways continue to evolve.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Remote Internship Websites Market

Companies Mentioned

The key companies profiled in this Remote Internship Websites market report include:- AIESEC International ASBL

- CareerBuilder, LLC

- Chegg, Inc.

- College Recruiter, LLC

- Forage Limited

- Handshake Holdings, Inc.

- InternMatch

- Internshala, Pvt. Ltd.

- Jobbatical OÜ

- Monster Worldwide, Inc.

- Parker Dewey, LLC

- Remote.co, Inc.

- Riipen Inc.

- SimplyHired, LLC

- Symba Labs, Inc.

- Talent.com, Inc.

- Virtual Internships Ltd.

- WayUp Network, Inc.

- ZipRecruiter, Inc.

Table Information

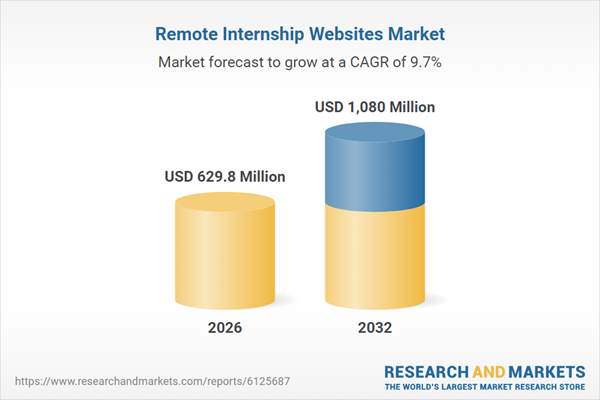

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 629.8 Million |

| Forecasted Market Value ( USD | $ 1080 Million |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |