Speak directly to the analyst to clarify any post sales queries you may have.

Solid and dry lubricants are becoming mission-critical as industry demands higher reliability under extreme conditions and stricter compliance expectations

Solid and dry lubricants have moved from being niche “problem solvers” to becoming core enablers of modern reliability programs across heavy industry, precision manufacturing, electronics, and mobility. As equipment designers push for tighter tolerances, higher operating temperatures, and longer service intervals, lubrication strategies increasingly must perform in regimes where oils and greases underdeliver-such as boundary lubrication, vacuum exposure, extreme heat, or environments where outgassing, contamination, or wash-off cannot be tolerated.At the same time, sustainability and compliance pressures are reshaping formulation decisions. Users are scrutinizing not only friction and wear performance, but also worker exposure, volatile organic compounds, regulatory labeling, and end-of-life impact. In response, suppliers are investing in cleaner chemistries, more consistent particle engineering, and application-ready formats that integrate into automated production.

This executive summary frames the market through the lens of technical necessity and strategic risk management. It connects what is changing in materials science, industrial operations, and trade policy to the practical choices buyers and suppliers must make-ranging from product selection and qualification to supplier diversification and regional manufacturing strategy.

Performance-led differentiation, engineered lubrication systems, and supply-chain resilience are redefining how dry lubrication solutions are developed and purchased

The competitive landscape is shifting from commodity-style supply toward performance-led differentiation, where proof of durability under real duty cycles matters as much as coefficient-of-friction claims. Buyers increasingly require application-specific validation, including wear scar testing, corrosion resistance, particulate control, and compatibility with polymers, elastomers, and lightweight metals. As a result, suppliers that can co-develop with OEMs and provide robust technical service are gaining an advantage.Another transformative shift is the widening gap between “materials” and “systems.” Dry lubrication is no longer only a powder or coating; it is frequently engineered as a multi-layer stack, a surface treatment combined with a topcoat, or a composite formulation optimized for a specific contact geometry. This systems approach is accelerated by advances in deposition methods, including improved coating uniformity, controlled thickness, and better adhesion on challenging substrates.

Operational realities are also reshaping demand. Maintenance teams are trying to reduce relubrication frequency, eliminate grease points in hard-to-access areas, and prevent lubricant-induced failures such as varnish, coking, or contamination. These needs are driving adoption in conveyors, kilns, bearings exposed to heat, and high-load sliding interfaces, while clean manufacturing pushes low-outgassing and low-particulate solutions.

Finally, supply chains are being redesigned for resilience. Customers are qualifying second sources, requesting regional stocking, and prioritizing suppliers with tighter control over feedstocks and consistent quality. This shift rewards companies with diversified manufacturing footprints and disciplined quality systems, while smaller players face higher barriers unless they offer highly specialized performance or application know-how.

United States tariffs in 2025 are poised to reshape sourcing, qualification, and cost-to-serve dynamics, elevating supply assurance alongside performance

The 2025 tariff environment in the United States is expected to influence the solid and dry lubricants ecosystem through cost structures, sourcing strategies, and qualification timelines rather than through demand destruction. Many dry lubricant supply chains rely on globally traded inputs, including specialty minerals, processed powders, binders, and coating intermediates. When tariffs increase landed costs or introduce classification ambiguity, procurement teams tend to respond by shifting to alternative origins, renegotiating long-term contracts, or accelerating domestic and nearshore sourcing.For manufacturers selling into U.S. industrial and mobility end markets, the most immediate impact is margin pressure paired with heightened scrutiny of total delivered cost. Even when the lubricant itself represents a small fraction of a system’s overall cost, buyers are sensitive to compounding price increases across consumables, spare parts, and services. This encourages a stronger value narrative focused on total cost of ownership, including extended component life, reduced downtime, and fewer maintenance interventions.

Tariffs also reshape product strategy by changing the relative attractiveness of formats. In some cases, finished coatings or pre-formulated products may face different tariff treatment than base powders or intermediates, which can shift the make-versus-buy calculus. Companies may respond by importing upstream inputs while expanding U.S.-based compounding, coating, or packaging to reduce exposure and improve responsiveness.

In parallel, compliance and documentation demands tend to rise during tariff transitions. Buyers request clearer certificates of origin, harmonized tariff classification support, and auditable traceability. Over time, this favors suppliers that can provide disciplined trade compliance, stable lead times, and contingency planning. It also increases the likelihood of dual-qualification efforts, where customers qualify both an incumbent material and a technically comparable alternative to reduce single-point exposure.

Ultimately, the tariff impact is likely to accelerate an existing trend: supply assurance and manufacturability are becoming as important as friction and wear performance. Companies that proactively restructure sourcing, communicate transparently, and support customer qualification will be better positioned to convert policy volatility into competitive advantage.

Segmentation shows that material choice, delivery format, and application failure modes jointly determine adoption, not performance claims in isolation

Segmentation reveals a market defined by how a lubricant is delivered, where it is used, and what performance constraints dominate the selection process. By product type, graphite, molybdenum disulfide, PTFE, boron nitride, tungsten disulfide, and emerging ceramic or hybrid solid lubricants each compete on distinctive strengths such as load-carrying capacity, temperature stability, chemical inertness, and suitability for vacuum or clean environments. This distinction becomes critical when customers balance friction reduction against electrical conductivity, corrosion behavior, or interaction with dissimilar metals.By form, powders, dispersions, pastes, sprays, coatings, and bonded films map directly to the user’s application pathway. Powders and dispersions often support formulation flexibility and integration into manufacturing processes, while sprays and pastes enable maintenance-driven adoption with minimal process change. Coatings and bonded films, in contrast, align with design-in decisions where consistent thickness, adhesion, and lifecycle performance justify up-front qualification.

By application, bearings, gears, chains, valves, slides, fasteners, and seals illustrate that dry lubrication is frequently chosen to solve very specific failure modes. Chains and conveyors often demand resistance to dust loading and high temperatures; fasteners and threaded assemblies prioritize anti-seize and consistent torque; slides and linear motion components emphasize stick-slip reduction; and valves and seals require chemical compatibility and long-term stability under static or intermittent motion.

By end-use industry, automotive, aerospace, industrial manufacturing, energy and power, mining, construction, marine, electronics, food processing, and medical device production reflect distinct regulatory, reliability, and contamination constraints. Aerospace and electronics, for instance, place heavy weight on outgassing control and cleanliness, while mining and construction tend to prioritize load, abrasion resistance, and ease of field application. Food processing adds the requirement of incidental contact compliance and washdown durability, shifting the performance conversation toward safety-aligned formulations and robust coating integrity.

Across these segmentation lenses, a common insight emerges: the highest-value opportunities concentrate where conventional lubrication fails due to temperature, cleanliness, accessibility, or chemical exposure. Suppliers that translate these conditions into repeatable application playbooks-supported by test protocols and qualification guidance-are better positioned to win programs and reduce customer switching friction.

Regional adoption diverges by industrial mix, compliance intensity, and manufacturing maturity, creating distinct pathways to scale across major markets

Regional dynamics are shaped by industrial mix, regulatory pressure, and the maturity of advanced manufacturing ecosystems. In the Americas, demand is strongly influenced by heavy industry modernization, aerospace quality requirements, and the push to localize critical supply chains. Users increasingly prioritize consistent lead times, documented traceability, and technical support for qualification, especially for bonded coatings and specialty solid lubricants used in high-consequence components.In Europe, the market is characterized by stringent environmental and worker-safety expectations alongside strong engineering-driven adoption in automotive, industrial automation, and aerospace supply chains. Buyers often look for solutions that reduce lubricant migration, enable cleaner production, and help meet increasingly demanding chemical management obligations. This creates favorable conditions for low-emission formulations, durable coatings that reduce relubrication, and application methods that integrate with automated manufacturing.

The Middle East and Africa reflect a mix of energy, marine, and infrastructure-driven use cases, where reliability under heat, dust, and corrosive environments is central. Dry lubricants gain attention in equipment exposed to high ambient temperatures and intermittent maintenance windows. Suppliers that can provide robust field-ready formats, training, and regional distribution tend to perform well as operators prioritize uptime and simplified maintenance.

Asia-Pacific remains a crucial center of manufacturing scale and process innovation, with demand spanning electronics, automotive, machinery, and high-throughput industrial production. In addition to price-performance expectations, there is strong pull for consistent quality, contamination control, and compatibility with automated application methods. As production ecosystems become more sophisticated, opportunities expand for engineered coatings, advanced solid lubricant powders, and application-specific solutions that deliver stable performance across large volumes.

Taken together, regional insights underscore that the same lubricant chemistry can succeed differently depending on local compliance regimes, manufacturing sophistication, and service expectations. Companies that align go-to-market execution with regional purchasing behaviors-whether design-in at OEMs, maintenance-driven adoption, or distributor-led reach-can improve conversion and retention.

Competitive advantage is consolidating around materials science depth, coating and application know-how, and the ability to support qualification at scale worldwide

Leading companies in solid and dry lubricants are increasingly defined by their ability to deliver repeatable performance through formulation control, surface engineering expertise, and application support. Competitive advantage often rests on deep materials science capabilities, including particle size control, purity management, and the ability to tailor binders and carriers for adhesion, temperature stability, and chemical resistance. As customers demand longer intervals and fewer failures, suppliers that can link product selection to validated testing protocols and field outcomes build stronger credibility.Another differentiator is vertical and adjacent integration. Firms that participate across powders, dispersions, coatings, and application equipment can reduce friction in customer adoption by offering compatible systems rather than standalone materials. This is particularly important where customers require consistent coating thickness, controlled curing, or substrate preparation guidance to prevent early-life failures.

Global reach paired with local responsiveness also matters. Industrial users and OEMs increasingly expect regional stocking, rapid troubleshooting, and stable supply of critical inputs. Companies with diversified manufacturing footprints, disciplined quality management, and proven trade compliance processes can better absorb policy shocks and raw-material volatility.

Finally, collaboration is becoming a hallmark of market leaders. Co-development programs with OEMs, coating houses, and maintenance organizations enable faster qualification and better alignment with real-world duty cycles. In a market where switching costs can be high due to requalification, suppliers that embed themselves early in design and process decisions can sustain longer-term relationships and defend positions against lower-cost alternatives.

Leaders can win by bundling chemistry with qualification support, reinforcing supply resilience, and shifting value conversations toward lifecycle outcomes

Industry leaders can strengthen their position by treating dry lubrication as a portfolio of application-specific solutions rather than a catalog of products. This starts with mapping customer equipment and process pain points-such as high-temperature failure, contamination risk, inaccessible relubrication points, or torque inconsistency-and aligning them with validated solution bundles that include the right chemistry, the right form factor, and clear application instructions.Next, leaders should accelerate qualification enablement. Providing standardized test packages, substrate preparation guidance, and clear compatibility data reduces the burden on customer engineering teams and shortens time to adoption. Where feasible, building partnerships with coating applicators and maintenance service providers can ensure the lubricant’s performance is not compromised by inconsistent application practices.

Given the evolving tariff and trade environment, leaders should also harden supply resilience. Dual-sourcing critical inputs, clarifying country-of-origin documentation, and evaluating selective regionalization of compounding or finishing steps can reduce exposure while improving responsiveness. Commercial teams should be equipped to shift conversations from unit price to lifecycle value, backed by credible evidence of reduced downtime, fewer changeovers, or extended component life.

Innovation priorities should remain grounded in customer constraints. Investments in low-outgassing, low-particulate, and environmentally considerate formulations can unlock growth in clean manufacturing and regulated industries. In parallel, enhancements in adhesion, corrosion resistance, and durability under mixed motion regimes can expand adoption in industrial machinery where oils and greases struggle.

Finally, leaders should strengthen feedback loops from the field. Capturing performance data, failure analysis, and application conditions-then translating insights into updated specifications and training-creates a compounding advantage. Over time, this operational learning becomes as valuable as the underlying chemistry.

A triangulated methodology combines technical literature, value-chain interviews, and segmentation-based validation to reflect real-world selection and use

The research methodology integrates technical, commercial, and operational perspectives to produce a decision-ready view of the solid and dry lubricants landscape. It begins with structured secondary research to map product categories, application environments, regulatory considerations, and technology pathways, ensuring the market is framed by how dry lubrication is specified, qualified, and deployed in real operations.Primary research then deepens the analysis through interviews and consultations across the value chain, including manufacturers, formulators, distributors, coating applicators, and end users across multiple industries. These conversations focus on selection criteria, qualification hurdles, switching dynamics, and emerging requirements such as cleanliness, outgassing control, and documentation needs. Insights are triangulated to reduce bias and reconcile differences between supplier claims and user experience.

The study applies segmentation analysis to connect material types and delivery formats to end-use requirements and operating conditions. This approach emphasizes why certain solutions win in particular environments and how regional factors influence procurement, compliance, and application practices. Competitive analysis evaluates differentiation through product breadth, technical service capacity, manufacturing footprint, and the ability to support customer qualification.

Finally, quality assurance steps are applied throughout. Findings are cross-checked for internal consistency, terminology is normalized to prevent misinterpretation across industries, and themes are validated against real-world constraints such as lead times, process capability, and maintenance practices. The result is a structured narrative that supports both strategic planning and near-term execution.

Dry lubrication is shifting from niche problem-solving to strategic reliability infrastructure, shaped by validation demands and supply-chain realities

Solid and dry lubricants are increasingly central to modern reliability, especially as operating conditions become harsher and tolerances tighter. The market’s direction is shaped by a practical reality: many high-value applications demand performance where conventional oils and greases cannot deliver due to temperature, cleanliness, chemical exposure, or access limitations.As the landscape shifts toward engineered systems and application-specific validation, suppliers and buyers alike must rethink how they evaluate success. Performance differentiation is now inseparable from application discipline, coating consistency, and qualification support. In parallel, trade and tariff volatility-especially in the United States-reinforces the need for resilient sourcing, transparent documentation, and regional execution strategies.

Organizations that align materials science with manufacturability, compliance, and field support will be best positioned to capture durable relationships. Those that treat dry lubrication as a strategic capability rather than a consumable purchase can reduce operational risk, improve uptime, and build a more defensible competitive posture.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Solid & dry Lubricants Market

Companies Mentioned

The key companies profiled in this Solid & dry Lubricants market report include:- Castrol Limited

- Compagnie de Saint-Gobain S.A.

- E. I. du Pont de Nemours and Company

- Endura Coatings LLC

- Freudenberg & Co. KG

- Fuchs Petrolub SE

- Graphite Products Corporation

- Henkel AG & Co. KGaA

- Klüber Lubrication München SE & Co. KG

- ROCOL Limited

- SKF Aktiebolag

- Solvay SA

- The Chemours Company

- The Dow Chemical Company

- Whitford Worldwide Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

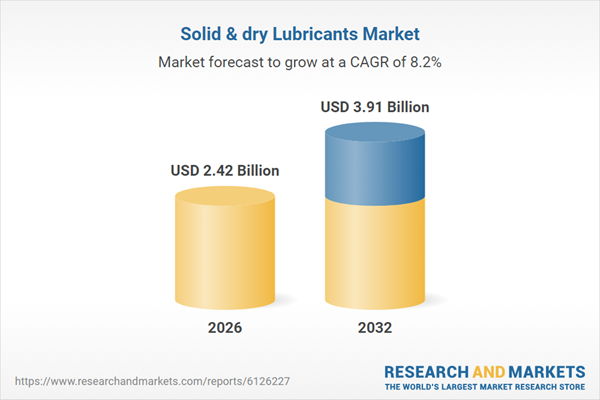

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 2.42 Billion |

| Forecasted Market Value ( USD | $ 3.91 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |