Speak directly to the analyst to clarify any post sales queries you may have.

Large volume pipette tips are becoming engineered enablers of reliable laboratory outcomes, linking accuracy, contamination control, and scalable throughput

Large volume pipette tips sit at the intersection of accuracy, contamination control, and operational efficiency in modern laboratories. Whether supporting routine clinical workflows, high-throughput screening, bioprocess development, or analytical sample preparation, these consumables have moved beyond “standard plastics” into engineered components that directly influence data integrity and instrument uptime. As laboratories push for tighter error tolerances and higher daily run counts, the choice of tip design, resin quality, sterility assurance, and compatibility profile becomes a strategic decision rather than a tactical purchase.At the same time, laboratories are balancing competing demands: expanding automation, evolving quality frameworks, heightened contamination awareness, and pressure to reduce waste without compromising performance. These realities have elevated evaluation criteria such as lot-to-lot consistency, low retention behavior, extractables and leachables control, and packaging formats that support clean handling. Consequently, procurement teams and lab leaders increasingly require evidence-based guidance to standardize tip selection across sites and instruments.

This executive summary synthesizes the core dynamics shaping the large volume pipette tips market environment. It outlines how technology and operations are changing in tandem, why policy and trade developments matter to supply continuity, what segmentation reveals about performance expectations, and which strategic actions best position industry participants to deliver reliability at scale.

Technology, automation, contamination control, and resilience are reshaping expectations, moving pipette tips from commodities to validated system components

The landscape is undergoing a shift from generic compatibility claims toward verified system performance across instruments, workflows, and regulatory contexts. As labs consolidate platforms and standardize methods, tips are increasingly qualified not just by nominal volume range but by fit precision, seal integrity, aspiration and dispense behavior, and the ability to maintain performance at speed. This has raised the bar for manufacturers to provide tighter dimensional control, clearer compatibility documentation, and stronger quality traceability.Another transformative change is the growing centrality of contamination risk management. Heightened awareness of nucleic acid contamination in molecular workflows and the downstream sensitivity of qPCR and NGS methods have reinforced demand for robust barrier designs and validated sterilization approaches. Meanwhile, biopharmaceutical and cell therapy workflows have increased scrutiny on particulates, endotoxins, and extractables, pushing suppliers to strengthen material qualification and adopt cleaner manufacturing practices.

Automation is also reshaping buying behavior. As liquid handling becomes more integrated and multi-site, labs increasingly prioritize tips that reduce error rates and stoppages in unattended runs. This favors tip geometries optimized for robotic pick-up and ejection, stable rack formats, and packaging that minimizes deformation during shipping and storage. As a result, the commercial conversation is evolving from “unit cost” to total cost of operation, where downtime, rework, failed runs, and qualification burden can outweigh savings from lower-priced consumables.

Sustainability has begun to influence specification, but it is playing out pragmatically. Many organizations are exploring reduced-plastic designs, improved nesting and packaging density, or resin strategies that lower environmental footprint without altering performance. However, labs remain unwilling to trade assay reliability for sustainability claims, which means progress is most successful when it is engineered into product and packaging changes that preserve sterility, fit, and consistency.

Finally, resilience has become a defining theme. Supply interruptions and extended lead times have pushed end users to dual-source, qualify alternates, and build safety stock strategies. In turn, manufacturers are reassessing regional production footprints, inventory policies, and distribution models to reduce disruption risk while maintaining compliance with clean manufacturing expectations.

United States tariff dynamics in 2025 amplify landed-cost volatility and accelerate dual-sourcing, qualification rigor, and regional manufacturing strategies

United States tariff conditions anticipated for 2025 intensify the focus on landed cost volatility and sourcing optionality for laboratory plastics, including large volume pipette tips and adjacent consumables. Even when tariff schedules do not target tips directly, cost pressure can propagate through upstream inputs such as resins, packaging materials, tooling components, and logistics services. For suppliers operating global manufacturing networks, this creates a need to revalidate cost models frequently and communicate transparently with customers about drivers of price adjustments.From an operational standpoint, tariff uncertainty tends to accelerate supplier diversification and nearshoring discussions. Laboratories with centralized procurement increasingly seek manufacturing provenance clarity and prefer suppliers that can offer alternative ship-from locations or regional production, particularly for high-usage tips where stocking strategies must be continuous. This environment can advantage companies with flexible manufacturing capacity, strong customs compliance practices, and documented origin control.

Tariff-related friction also affects qualification and change control. When suppliers adjust manufacturing routes, resin sources, or packaging configurations to respond to duties, regulated labs may require documentation packages that support internal validation and audit readiness. Consequently, suppliers that treat change control as a customer-facing capability-complete with notification timelines, equivalency testing, and stability of specifications-are better positioned to retain long-term contracts.

In parallel, distributors and group purchasing arrangements may renegotiate terms to hedge risk, influencing how discounts and service levels are structured. This can shift competitive dynamics away from purely catalog pricing toward contract frameworks that include contingency clauses, inventory commitments, and allocation policies during disruptions.

Overall, tariffs in 2025 are less about a single policy line item and more about amplifying the market’s existing pivot toward supply chain transparency, regional redundancy, and stronger supplier governance. Organizations that proactively align procurement, quality, and operations will be best able to maintain continuity while controlling the hidden costs of disruption.

Segmentation reveals diverging needs across filter versus non-filter designs, volume ranges, materials, sterility formats, applications, and end-user validation demands

Segmentation by product type highlights that user expectations diverge sharply between filter tips and non-filter tips as workflows become more sensitive and more automated. Filter tips are increasingly treated as risk-mitigation tools in molecular biology and other contamination-sensitive assays, where barrier performance, aerosol protection, and batch consistency are critical. Non-filter tips remain essential for many routine transfers and high-volume tasks, yet they are being evaluated more carefully for fit precision, low-retention behavior, and plastic purity as labs aim to reduce repeat testing and improve reproducibility.Segmentation by volume range underscores how performance requirements change as volumes increase. Larger volume applications place greater emphasis on structural rigidity, consistent inner diameter, and predictable liquid release, particularly when dispensing viscous reagents or when fast aspiration-dispense cycles are used. In these conditions, slight variations in geometry can affect droplet formation, residual hold-up, or dispense accuracy, making manufacturing tolerances and resin flow behavior central to product differentiation.

Segmentation by material indicates an ongoing preference for polymers that balance chemical resistance, clarity, and mechanical stability while meeting extractables expectations. Polypropylene remains foundational due to its broad compatibility and manufacturability, but buyers increasingly ask for documentation on additives, pigmentation, and resin traceability to support sensitive assays. As a result, suppliers that can validate material cleanliness and maintain consistent resin sourcing earn greater trust, especially in regulated or high-stakes environments.

Segmentation by sterility and packaging format is also shaping purchasing decisions. Sterile offerings are not merely an upsell; they are often a workflow requirement where contamination risk or regulatory expectations are high. However, the practicalities of packaging-racked versus bulk, reload options, and protective sealing-can be equally influential because they affect handling time, waste volume, and the likelihood of introducing contamination during setup. Labs with high-throughput operations often prioritize formats that reduce touchpoints and speed deck preparation while maintaining confidence in sterility assurance.

Segmentation by end user reveals distinct procurement and qualification behaviors. Pharmaceutical and biotechnology organizations frequently emphasize documentation depth, lot traceability, and consistency across long validation cycles, while clinical and diagnostic settings prioritize reliability, supply continuity, and operational simplicity. Academic and research institutions can show more variability in instrument mix and budget constraints, yet they still demand dependable performance to protect publication-quality data. These differences influence how suppliers tailor technical support, sampling programs, and contract structures.

Segmentation by application further clarifies why a single “best tip” rarely exists. Routine liquid transfer emphasizes usability and broad compatibility, molecular workflows elevate contamination control, and sample preparation for analytical methods prioritizes low retention and cleanliness. This segmentation reality rewards suppliers that can position coherent families of tips with clear use-case guidance, minimizing customer confusion and reducing the cost of internal standardization.

Regional priorities diverge across the Americas, Europe, Middle East & Africa, and Asia-Pacific as automation, regulation, sustainability, and supply resilience evolve

Regional dynamics show how laboratory infrastructure maturity, regulatory intensity, and local manufacturing capacity shape purchasing priorities. In the Americas, demand is strongly influenced by automation adoption, consolidated procurement, and the need for dependable supply under shifting trade conditions. Users often expect robust compatibility information and consistent availability for high-usage SKUs, while quality teams increasingly seek traceability and documentation that supports standardized operations across multiple facilities.In Europe, the Middle East & Africa, procurement decisions are frequently shaped by stringent quality expectations, sustainability initiatives, and cross-border distribution realities. Many organizations favor suppliers that can demonstrate stable specifications, clear compliance positioning, and packaging strategies that reduce waste without compromising sterility or performance. Regional diversity also means vendors must handle variable logistics complexity, language and labeling needs, and differing facility standards.

In Asia-Pacific, growth in research capacity, biomanufacturing investment, and expanding diagnostic activity drives broad-based adoption of large volume pipette tips across both manual and automated workflows. Buyers may prioritize scalable supply, competitive value, and rapid lead times, while increasingly demanding higher-grade options for sensitive molecular and bioprocess applications. As local manufacturing capabilities strengthen, competition intensifies around quality consistency, instrument compatibility, and customer support for qualification.

Across all regions, supply resilience has become a common denominator, but the path to resilience differs. Some markets favor localized production and shorter shipping lanes, while others rely on multi-country distribution networks and distributor partnerships. Suppliers that can adapt their fulfillment strategies to these regional realities-without introducing uncontrolled specification changes-are better positioned to win long-term standardization decisions.

Competitive advantage is defined by manufacturing discipline, automation-ready performance validation, contamination-control credibility, and resilient distribution execution

Company strategies in large volume pipette tips increasingly center on translating manufacturing discipline into customer outcomes, particularly for automated and contamination-sensitive workflows. Leading participants differentiate through dimensional consistency, strong quality systems, and validated product claims tied to specific instruments or application classes. As labs push to standardize across sites, suppliers that can offer stable catalogs, controlled change management, and dependable replenishment are often favored over those competing primarily on price.Another area of competitive separation is the ability to support automation ecosystems. Companies that collaborate with liquid handler and pipette system providers-or that maintain robust internal testing on common platforms-can reduce adoption friction for customers. This support may include fit and seal verification, guidance on optimizing aspiration and dispense parameters, and packaging designs that reduce robotic errors during tip pick-up and ejection.

Innovation is also visible in efforts to reduce retention and improve dispensing behavior at larger volumes. Geometry refinement, surface treatment approaches, and resin selection all play roles, but customers increasingly look for reproducible benefits under real operating conditions rather than marketing claims. In parallel, suppliers that invest in cleaner production environments and improved quality analytics are better able to meet rising expectations around particulates and assay interference.

Commercially, companies are investing in distribution partnerships, regional warehousing, and inventory strategies to reduce lead time risk. Some are expanding sterile and racked portfolios to support high-throughput labs, while others compete by offering flexible bulk formats or reload systems that balance cost with operational efficiency. Across the board, the most credible suppliers align technical documentation, service responsiveness, and supply continuity into a single, auditable value proposition.

Leaders can win through standardized qualification, practical dual-sourcing, packaging-to-workflow alignment, supplier change-control governance, and measurable sustainability

Industry leaders can strengthen their position by treating large volume pipette tips as a managed system component rather than a commodity line item. Standardizing qualification criteria across departments is a high-impact first step, ensuring that procurement, lab operations, and quality teams align on fit, performance, contamination control, and documentation requirements. This reduces the cycle time for onboarding new SKUs and prevents costly fragmentation where each lab group selects tips independently.Next, leaders should operationalize dual-sourcing without multiplying complexity. The goal is not simply to approve two suppliers, but to ensure equivalency is demonstrable across instruments, assays, and packaging formats. Establishing a structured equivalency protocol-covering dimensional fit, dispense accuracy, retention behavior, and contamination checks-helps prevent surprises during a disruption-driven switch.

To improve total cost of operation, decision-makers should examine how packaging format influences throughput and error rates. Racked formats may reduce handling time and contamination risk in high-throughput settings, while bulk formats may suit less sensitive, manual workflows. Aligning packaging to workflow, rather than defaulting to a single format, can reduce waste, lower labor time, and increase run stability.

Leaders should also prioritize change control governance with suppliers. Clear notification timelines, documentation standards, and defined triggers for customer revalidation protect regulated operations and reduce unplanned downtime. Where possible, embedding these expectations into supply agreements creates accountability and helps both sides plan for resin changes, tooling updates, or site transfers.

Finally, sustainability should be pursued through measurable operational improvements. Reducing unnecessary packaging volume, increasing shipping efficiency, and exploring reload systems can lower waste without compromising sterility or performance. By pairing sustainability targets with reliability metrics, organizations can advance environmental goals while maintaining the primary mandate of accurate, contamination-free results.

A rigorous methodology combining stakeholder interviews, technical documentation review, and triangulated validation builds decision-grade insights for tip selection

The research methodology integrates primary engagement with industry participants and structured secondary analysis to build a defensible view of product, workflow, and procurement dynamics for large volume pipette tips. The process begins by defining the scope around tip categories, volume-use contexts, sterility formats, and end-user environments, ensuring that insights are tied to how laboratories actually specify, qualify, and consume these products.Primary research emphasizes interviews and discussions with stakeholders across manufacturing, distribution, laboratory operations, quality, and procurement functions. These conversations are used to validate real-world decision criteria such as instrument compatibility challenges, contamination control expectations, packaging and handling pain points, and the operational impact of supply disruptions. Inputs are cross-checked to separate broad trends from organization-specific preferences.

Secondary research draws on technical documentation, regulatory and standards context, corporate publications, trade and customs considerations, and publicly available information on product portfolios and manufacturing capabilities. This step helps triangulate claims about materials, sterility assurance, and quality practices while mapping how suppliers position their offerings across different use cases.

Finally, findings are synthesized through an internal consistency framework that tests whether conclusions hold across multiple segments and regions. The goal is to present actionable, decision-oriented insights that reflect current laboratory realities, highlight areas of risk and opportunity, and support practical supplier and product selection decisions without relying on speculative assumptions.

Reliability, validation, and supply resilience define success as large-volume tips become critical to automation, sensitive assays, and standardized lab operations

Large volume pipette tips are increasingly central to laboratory reliability, not because they are complex devices, but because they mediate the interface between instruments, samples, and results. As automation expands and assays become more sensitive, labs are demanding tighter consistency, stronger contamination safeguards, and packaging formats that protect speed and cleanliness. In this environment, suppliers must compete on validated performance, documentation depth, and operational resilience.Trade and policy uncertainty, including tariff-related cost pressure, reinforces the need for transparent sourcing and disciplined change control. Meanwhile, segmentation patterns make clear that no single tip configuration can optimize every workflow; success comes from aligning tip type, volume behavior, material cleanliness, and sterility format to specific applications and end-user constraints.

Ultimately, the organizations that excel will be those that combine strong manufacturing execution with customer-facing qualification support and resilient fulfillment strategies. By building procurement and quality alignment internally-and by selecting partners that can prove consistency at scale-laboratories can reduce risk, protect data integrity, and sustain throughput even as requirements evolve.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Large Volume Pipette Tips Market

Companies Mentioned

The key companies profiled in this Large Volume Pipette Tips market report include:- Avantor, Inc.

- Biohit Oyj

- BRAND GmbH + Co KG

- BrandTech Scientific, Inc.

- CAPP ApS

- Corning Incorporated

- Eppendorf AG

- GenFollower Biotech Co., Ltd.

- Gilson, Inc.

- Greiner Bio-One GmbH

- Hamilton Company

- INTEGRA Biosciences AG

- Labcon North America Inc.

- Mettler-Toledo International Inc.

- NEST Scientific USA, Inc.

- Sartorius AG

- Scientific Specialties, Inc.

- Socorex Isba SA

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

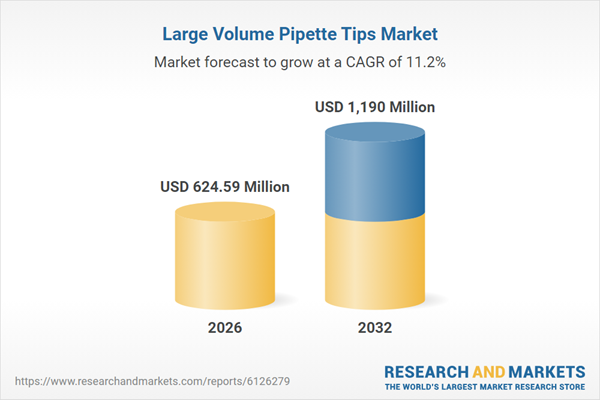

| Estimated Market Value ( USD | $ 624.59 Million |

| Forecasted Market Value ( USD | $ 1190 Million |

| Compound Annual Growth Rate | 11.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |