Speak directly to the analyst to clarify any post sales queries you may have.

A performance-and-compliance inflection point is redefining bike dry chain lube as riders demand cleanliness, durability, and trust in formulations

Bike dry chain lube sits at the intersection of performance maintenance, rider habits, and evolving product chemistry. As cycling expands across commuting, fitness, recreation, and competitive disciplines, drivetrain care has become both a routine necessity and a point of differentiation for brands that can credibly deliver clean running, low friction, and longer intervals between applications. Dry lubes, in particular, have moved beyond niche status because they promise a “cleaner” riding experience-less fling, reduced grime adhesion, and simplified post-ride cleanup-especially in dusty or mixed conditions.At the same time, the category is being reshaped by scrutiny of ingredients, aerosol propellants, VOC profiles, and packaging sustainability. Riders now compare not only how a lube feels in the first ride, but also how it behaves over multiple hours, how it sounds under load, and how quickly it attracts contamination. That more discerning demand has pushed brands to communicate with greater specificity about application method, cure time, carrier evaporation, and compatibility with modern drivetrains.

This executive summary synthesizes the forces influencing the bike dry chain lube landscape, explains how trade policy and cost structures are likely to affect sourcing and pricing tactics, and highlights where segmentation and regional dynamics create tangible opportunities. The emphasis throughout is practical: how to translate market complexity into product strategy, channel execution, and operational resilience.

From one-size-fits-all to condition-science and compliance-ready chemistry, dry chain lube competition is being rebuilt around credibility and repeat use

The landscape has undergone a decisive shift from generic “all-conditions” positioning to usage-specific solutions designed around contamination type, drivetrain design, and rider expectations. Dry lubes are increasingly engineered for predictable film formation and controlled carrier evaporation, with brands emphasizing how quickly the product “sets,” how it resists dust pickup, and how it minimizes black paste buildup that riders associate with inefficient maintenance. This has elevated technical storytelling from marketing fluff to a measurable purchase driver, particularly among enthusiasts who track wear and noise.In parallel, product development is being influenced by a broader rethinking of environmental and health profiles. Formulators are navigating constraints around VOCs, solvents, and PFAS-adjacent concerns in certain performance additives, while also responding to consumer preference for lower odor, skin-friendly handling, and easier cleanup. The result is a visible experimentation cycle: reformulations, line extensions, and clearer instructions designed to reduce user error, such as over-application or failing to wipe excess.

Channel behavior has also changed meaningfully. Specialty bike retail remains influential for credibility and education, yet e-commerce has become central for replenishment and comparison, especially when riders subscribe to maintenance routines. This shift rewards brands that can translate technical performance into persuasive digital content-application videos, compatibility guidance, and realistic claims about longevity across conditions. Meanwhile, the category increasingly benefits from cross-selling in maintenance “systems” that include degreasers, brushes, and microfiber accessories, positioning dry lube as one step in a repeatable ritual.

Finally, the growth of gravel riding and the continued sophistication of road and MTB drivetrains have sharpened the need for condition-specific guidance rather than one-size-fits-all recommendations. Riders switch between dry and wet lubes, or between drip wax-like products and traditional lubes, based on weather and terrain. As that behavior normalizes, brands are compelled to earn a place in a rider’s maintenance wardrobe by clarifying where dry lube excels, where it does not, and how to transition between products without compromising performance.

Tariffs in 2025 reshape costs, assortment discipline, and sourcing resilience, turning packaging and inputs into strategic levers - not back-office details

United States tariff dynamics in 2025 introduce a cumulative cost-and-complexity effect that touches far more than finished bottles on a shelf. Even when a brand manufactures domestically, upstream exposure can persist through imported inputs such as specialty additives, packaging components, applicator tips, aerosol valves, aluminum cans, labels, and certain petrochemical derivatives. The practical implication is that tariff pressure can surface as margin erosion, retail price adjustments, or formulation and packaging redesigns-often in combination rather than isolation.For brands importing finished lubricants, tariffs can force a re-optimization of SKU architecture. Lower-velocity sizes and secondary variants become harder to justify when landed costs rise and inventory risk increases. That tends to compress assortments toward hero SKUs, while simultaneously raising the bar for differentiation among the remaining products. In response, some suppliers may lean into value engineering through packaging standardization, consolidated bottle formats across product lines, or localized filling partnerships that reduce exposure to finished-goods duties.

Tariffs also influence negotiating leverage across the supply chain. Distributors and retailers typically resist abrupt price increases, particularly for consumables where substitution is easy and private label options exist. As a result, brands may need to offer alternative levers: improved trade terms, tighter MAP governance, or bundled kits that protect perceived value without explicitly raising the unit price of the lube. Over time, this can alter how brands allocate promotional spend, with a greater focus on education-led conversion rather than discount-driven volume.

Another underappreciated impact is operational risk management. Tariff uncertainty encourages multi-sourcing, regionalization of suppliers, and a closer look at component dependencies. It also increases the importance of customs classification accuracy and documentation discipline, because small administrative errors can translate into outsized cost penalties. For category leaders, the strategic response in 2025 is less about reacting to tariffs once and more about building an operating model that absorbs policy volatility-through supplier diversification, modular packaging, and clearer cost-to-serve visibility by channel.

Segmentation now hinges on formulation chemistry, delivery format, and rider context, with credibility earned by matching performance trade-offs to use cases

Segmentation in bike dry chain lube is increasingly defined by how riders buy, apply, and evaluate performance, rather than by simple brand recognition. Across product type, the market behavior differs between wax-based dry lubes that emphasize ultra-clean running and reduced dirt adhesion, PTFE-free alternatives that respond to tightening regulatory and consumer scrutiny, and hybrid dry formulations that aim to balance longevity with cleanliness. These differences matter because riders often attribute drivetrain noise and shifting quality to the lube choice, pushing brands to be explicit about the trade-offs between initial smoothness, reapplication intervals, and residue management.Packaging and delivery format segmentation is similarly consequential. Drip bottles remain the default for precision application and minimal overspray, while aerosol formats appeal to convenience seekers but face increasing attention around VOCs, propellants, and workshop ventilation. Concentrated or refill-oriented approaches, where present, resonate with sustainability-minded consumers and high-frequency riders who view lubrication as a recurring operational expense. This format diversity also shapes merchandising: drip bottles sell on clarity of instructions and perceived control, whereas aerosols require stronger trust in “clean use” claims.

Application context segmentation reveals why a single dry lube message underperforms. Road cyclists prioritize quiet operation, efficiency feel, and low mess on frames and kit. Mountain and gravel riders focus on dust resistance, grit shedding, and consistency after stream crossings or variable terrain, often pairing dry lube with more frequent cleaning cycles. Urban commuters, meanwhile, value low odor, ease of use, and minimal staining, especially when bikes are stored indoors. These context-driven priorities affect not only product selection but also tolerance for price and willingness to adopt a more rigorous prep routine.

End-user segmentation also influences the decision journey. DIY consumers tend to rely on digital content, peer reviews, and straightforward instruction sets that reduce the chance of over-application. Bike shops and service centers prioritize predictability, compatibility across diverse drivetrains, and time efficiency, favoring products that integrate cleanly into service workflows. Competitive and enthusiast segments are more willing to follow multi-step processes-deep clean, apply, cure, wipe-if the payoff is lower friction feel and extended component life. Across all segments, credibility is won when brands align claims with the user’s reality: their time constraints, their riding conditions, and their tolerance for maintenance complexity.

Regional demand is shaped by climate, regulation, and channel structure, making localized education and compliance-forward design decisive for adoption

Regional dynamics in bike dry chain lube are shaped by climate patterns, cycling culture, retail structure, and regulatory expectations around chemicals and packaging. In the Americas, strong participation in road, gravel, and mountain categories sustains demand for dry lubes positioned around dust resistance and cleanliness, while the prominence of e-commerce accelerates comparison shopping and brand switching unless value is reinforced through clear use-case guidance. Retailers and distributors in this region also tend to push for dependable supply and consistent pricing, making logistics execution as important as product claims.Across Europe, Middle East & Africa, the region’s regulatory orientation and sustainability sensibilities amplify the importance of ingredient transparency, labeling clarity, and packaging responsibility. Dense urban cycling ecosystems encourage products that are clean to apply and less likely to stain clothing or interiors. At the same time, diverse weather patterns and riding disciplines across the region create a strong need for education: when to use dry lube, how to prep a chain, and when to switch to wet or more water-resistant alternatives. Brands that localize messaging and instructions-without fragmenting their SKU strategy-tend to build stronger trust.

In Asia-Pacific, manufacturing ecosystems, fast-growing cycling participation in certain markets, and a wide range of purchasing power create a layered competitive environment. Value-oriented buyers may prioritize affordability and availability, while enthusiast communities increasingly seek premium formulations and performance narratives comparable to global leaders. Digital commerce and social platforms can quickly elevate a product’s reputation, especially when supported by short-form maintenance content and credible demonstrations. Distribution breadth and consistency are particularly important here, as riders often purchase consumables opportunistically alongside other bike supplies.

Across all regions, the most resilient strategies connect product design with local realities: dust intensity, humidity patterns, indoor storage norms, and prevailing retail channels. Dry lube succeeds when it is marketed not as a universal fix, but as a high-confidence choice for specific conditions-supported by localized education that reduces misuse and the dissatisfaction it creates.

Company advantage is shifting toward formulation trust, education-as-a-product, and disciplined channel execution that defends premium positioning without overpromising

Competition among key companies is increasingly driven by three dimensions: formulation trust, instructional clarity, and channel execution. Established maintenance brands leverage deep distribution, workshop credibility, and broader “system” selling that bundles lubes with cleaners and tools. Their advantage often lies in repeat purchase economics and the ability to maintain shelf presence across multiple retail formats, from specialty stores to large online marketplaces.Premium specialists and performance-led entrants compete by translating lab-like language into rider-relevant outcomes, such as reduced chain noise, less grime buildup, and easier wipe-down after rides. Many emphasize rigorous prep and cure time, effectively repositioning lubrication as a process rather than a quick spray. This approach can deepen loyalty among enthusiasts, but it also raises the importance of education and reduces tolerance for inconsistent batch performance. Brands that pair performance claims with clear, conservative usage guidance tend to avoid the backlash that follows overpromising.

Private label and value-tier offerings apply pressure by meeting baseline expectations at accessible price points, particularly in channels where consumers treat lube as a commodity. However, dry lube is less forgiving than some consumables because user experience varies dramatically based on application technique and chain cleanliness. That creates space for branded players to defend premium positioning through better instructions, more reliable dispensers, and clearer compatibility statements for modern drivetrains.

Across company types, product line architecture is becoming more deliberate. Leaders streamline overlapping SKUs, clarify the boundary between dry and wet products, and invest in packaging that supports precise dosing and less mess. The companies that perform best in this environment treat content as part of the product: application steps, troubleshooting, and realistic expectations are integrated into labels, QR-linked videos, and retailer training.

Leaders can win by aligning chemistry to use cases, building tariff-resilient sourcing, and converting demand through education-led commerce rather than discounting

Industry leaders can strengthen their position by tightening the link between formulation design and real-world use conditions. That starts with clear product role definition: articulate where the dry lube delivers superior outcomes, where it is merely adequate, and where a different solution is more appropriate. When brands proactively set expectations-especially around chain preparation, wipe-down, and reapplication cadence-they reduce returns, negative reviews, and churn driven by misuse.Supply-chain strategy should be treated as a competitive differentiator in 2025. Leaders can reduce tariff and volatility exposure by mapping component dependencies, qualifying alternate suppliers for packaging and key additives, and designing packaging that is modular across SKUs. In parallel, a cost-to-serve lens by channel helps avoid blunt price moves; for example, different pack sizes or bundles can protect value perception online while preserving margins in wholesale.

Commercial execution should prioritize education that converts rather than discounts that temporarily inflate volume. Rich product pages, concise “how to apply” video assets, and retailer-facing training materials translate into fewer customer mistakes and better repeat rates. Brands can also differentiate through service workflow compatibility by offering shop-friendly formats, consistent availability, and clear guidance on how dry lube integrates with common degreasing practices.

Finally, innovation should focus on measurable user benefits that matter: cleaner drivetrains, quieter operation, and consistent performance over time. Packaging improvements-better nozzles, anti-clog caps, and labels that survive workshop handling-can create outsized gains in customer satisfaction. Leaders that treat these “small” improvements as strategic investments are more likely to earn long-term loyalty in a category where switching costs are low.

A triangulated methodology combines stakeholder interviews with validated public signals to translate product chemistry, channels, and policy risk into decisions

The research methodology for this report blends structured primary inputs with disciplined secondary validation to build a practical view of the bike dry chain lube landscape. The process begins by defining the product scope, clarifying inclusion criteria across dry lube chemistries and delivery formats, and mapping the value chain from ingredient sourcing through manufacturing, branding, distribution, and end use. This creates a consistent framework for comparing offerings and interpreting competitive behavior.Primary research incorporates interviews and consultations with industry participants such as brand and product leaders, distributors, retailers, mechanics, and informed users who can articulate how performance is assessed in practice. These conversations focus on buying criteria, application behaviors, channel dynamics, formulation and packaging trends, and operational constraints that influence assortment decisions. Insights are triangulated to reduce single-source bias and to distinguish widely observed patterns from anecdotal experiences.

Secondary research synthesizes publicly available information including company communications, product documentation, safety and regulatory references, patent and ingredient disclosures where available, retail listings, and channel merchandising signals. This layer supports cross-checking of claims, identification of portfolio strategies, and understanding of how products are positioned across regions and channels.

Throughout the process, findings are pressure-tested for internal consistency across segments and geographies, with attention to regulatory and trade-policy context relevant to 2025. The goal is to deliver decision-grade insights that are actionable for product, procurement, and commercial teams, emphasizing clear implications rather than abstract theory.

The category rewards brands that turn chemistry, instructions, and sourcing resilience into trust, ensuring repeat purchase in a low-switching-cost market

Bike dry chain lube is no longer a simple accessory purchase; it is a maintenance decision shaped by performance expectations, regulatory considerations, and evolving channel behavior. As riders demand cleaner drivetrains and more predictable outcomes, brands must compete on credible formulation narratives and on the practical guidance that ensures users achieve the promised results.The market’s direction favors companies that can simplify complexity without diluting technical integrity. That means sharper use-case positioning, fewer but stronger SKUs, and packaging that improves the application experience. It also means operational resilience-especially in the face of tariff-driven cost pressure and input variability-so that availability and pricing remain dependable.

Across segments and regions, the consistent theme is trust. When brands connect chemistry, instructions, and distribution execution into a coherent experience, they earn repeat purchase in a category where loyalty is built ride after ride. The organizations that act on these insights will be best positioned to defend their margins, strengthen their channels, and deepen rider confidence.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Bike Dry Chain Lube Market

Companies Mentioned

The key companies profiled in this Bike Dry Chain Lube market report include:- Castrol India Ltd.

- CeramicSpeed A/S

- Fenwick's Bike Cleaner

- Finish Line Technologies, Inc.

- Gulf Oil Lubricants India Ltd.

- Maxima Lubricants USA, Inc.

- Motorex-Bucher Group AG

- Motul S.A.

- Muc-Off Ltd.

- Peaty's Products Ltd.

- Pedro's North America

- Putoline Oil

- Rock N Roll Lubrication

- Shell plc

- Silca

- Smoove Lube

- Squirt Cycling Products

- The WD-40 Company

- Yamaha Motor Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

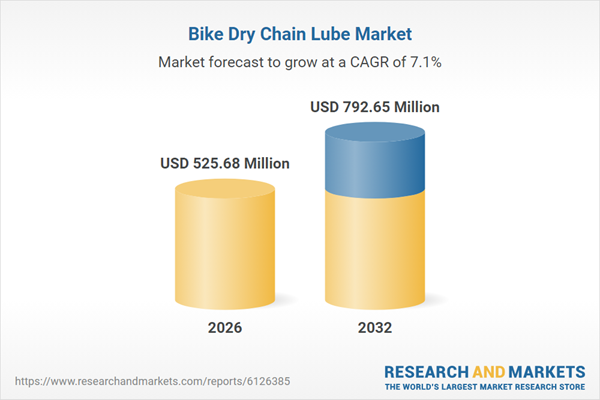

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 525.68 Million |

| Forecasted Market Value ( USD | $ 792.65 Million |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |