Speak directly to the analyst to clarify any post sales queries you may have.

Industrial air quality has become a strategic lever for safety, productivity, and compliance, elevating dust and fume extraction from utility to necessity

Dust and fume extraction systems have moved from being a background facility utility to a frontline capability that directly influences worker health, product quality, uptime, and regulatory resilience. In manufacturing, fabrication, processing, and materials handling, airborne contaminants are no longer viewed as episodic issues handled by ad hoc ventilation. Instead, they are treated as measurable operational risks that can trigger safety incidents, increase housekeeping burdens, damage sensitive equipment, and create avoidable process variability.This market is shaped by the convergence of stricter exposure expectations, heightened awareness of combustible dust hazards, and the steady rise of higher-throughput production environments. As plants pursue leaner layouts and more automation, the need for dependable capture at the source-paired with effective filtration and safe discharge or recirculation-has become more prominent. At the same time, decision-makers are asking for systems that are easier to maintain, more energy efficient, and more transparent in their performance.

Against this backdrop, the competitive landscape is widening. Traditional industrial ventilation providers are being joined by specialists in filtration media, sensor-enabled controls, and modular system design. The result is a market where solution differentiation increasingly depends on total lifecycle performance: capture efficiency, filter longevity, dust handling safety, noise management, and service response. Understanding how these requirements vary by application, facility type, and regulatory posture is essential for making robust equipment choices.

From generic ventilation to smart, modular, source-capture engineering, the market is transforming around performance verification and lifecycle cost control

The landscape is undergoing a clear shift from generalized ventilation toward engineered, source-capture solutions tailored to the contaminant and the process. Welding fumes, laser and plasma cutting byproducts, combustible dust from wood or grain handling, and fine powders from pharmaceuticals or battery materials each behave differently in air. Consequently, system design is becoming more application-specific, with more attention paid to hood geometry, duct velocities, capture distances, and containment strategies that reduce re-entrainment.In parallel, filtration technology is advancing beyond “one-size-fits-all” approaches. Buyers are increasingly matching filter media and coatings to particle characteristics and humidity conditions, selecting options that extend service intervals while protecting downstream equipment such as fans. This is complemented by growing adoption of differential pressure monitoring and filter health indicators that turn maintenance into a planned activity rather than an emergency response. As a result, plants are reducing unplanned downtime and stabilizing long-term operating costs.

Another transformative shift is the drive toward modularity and scalability. Facilities are adding new workcells, robots, and production lines more frequently, which makes rigid, centralized systems harder to justify unless they are designed with expansion in mind. Modular collectors, flexible ducting strategies, and quick-change capture devices support faster reconfiguration, particularly in high-mix manufacturing. This modular trend also aligns with capital discipline, allowing phased deployments that target the highest-risk or highest-value areas first.

Energy and sustainability requirements are also changing procurement criteria. Many facilities are re-evaluating make-up air strategies, heat recovery opportunities, and the conditions under which filtered air can be safely recirculated. Even when recirculation is restricted by policy or regulation, energy-efficient fans, smarter controls, and better system balancing can lower operating costs. Ultimately, performance is no longer judged only by initial capture; it is judged by a system’s ability to maintain performance over time with predictable energy and maintenance profiles.

Finally, digitization is emerging as a meaningful differentiator. While not every site is ready for full connectivity, there is growing openness to remote diagnostics, alarms, and trending that can identify leaks, blocked ducts, or overloaded filters early. Over time, this data-centric approach is expected to reshape service models, with suppliers offering more proactive maintenance support and plants seeking stronger documentation to demonstrate ongoing compliance and internal governance.

United States tariffs in 2025 are reshaping sourcing strategies, lead-time risk, and specification flexibility for critical extraction and filtration components

The introduction of United States tariffs in 2025 has added a new layer of complexity to sourcing and project planning for dust and fume extraction systems. Even when the collector itself is assembled domestically, key cost drivers-such as specialty steel, motors, variable frequency drives, electronic controls, sensors, and certain grades of filter media-may be affected through direct import exposure or upstream cost pass-through. As a result, quotations are showing greater variability, and procurement teams are placing more emphasis on price validity windows, indexed adjustments, and clearer definitions of what constitutes a change order.This tariff environment is also influencing lead times and supplier selection. Buyers are increasingly favoring vendors with diversified manufacturing footprints, strong domestic inventory positions, or established alternative sourcing for critical subcomponents. In practice, that can translate into a more rigorous pre-qualification process that evaluates not only technical compliance, but also supply continuity, service capacity, and the ability to provide documented traceability for components tied to regulated or safety-critical applications.

Moreover, tariffs are amplifying the importance of design-to-availability. Engineering teams are revisiting specifications that may inadvertently lock projects into constrained components, such as a narrowly defined motor frame or a specific control brand. Where feasible, systems are being designed with acceptable alternates and standardized parts that reduce dependency on a single source. This does not mean compromising on safety or filtration performance; rather, it encourages disciplined functional specifications that define outcomes-capture efficiency, airflow stability, safe dust handling-while allowing flexibility in how those outcomes are delivered.

On the commercial side, tariffs are accelerating total-cost-of-ownership thinking. If upfront equipment costs rise, the business case increasingly depends on reducing operating expenses through lower pressure drop, longer filter life, and smarter controls. Buyers are also scrutinizing installation complexity and ductwork scope, since field labor can become an even larger share of the total project when equipment prices are volatile. Consequently, packaged solutions and modular collectors that shorten installation time are receiving renewed attention.

In the longer term, the tariff impact may catalyze more domestic production of certain components and encourage deeper partnerships between equipment OEMs and filter media providers. However, the near-term reality is that tariff-driven uncertainty is pushing stakeholders to coordinate earlier-engineering, EHS, procurement, and finance-to avoid late-stage redesigns and to secure capacity for critical path items.

Segmentation reveals application-specific engineering priorities across dust versus fume control, collector types, architectures, end uses, and buying channels

Segmentation patterns show that purchase decisions are primarily anchored in the nature of the contaminant and the production context, with solution selection varying materially across dust extraction systems and fume extraction systems. Dust-heavy operations tend to prioritize safe dust handling, explosion risk management where applicable, and robust pre-separation or spark mitigation strategies, while fume-centric environments place greater weight on source-capture ergonomics, mobility, and filtration suited to submicron particulates. In practice, hybrid facilities increasingly need architectures that can accommodate both profiles without overcomplicating maintenance.Differences become clearer when viewed through the lens of collector design choices such as cartridge collectors, baghouse collectors, cyclone separators, wet scrubbers, electrostatic precipitators, and portable extractors. Cartridge-based approaches are commonly selected where footprint is constrained and fine particulate loading is manageable, while baghouse configurations remain compelling for high dust loads and demanding duty cycles. Cyclone separators continue to be used as pre-cleaners where heavier particulate can be removed efficiently before final filtration, and wet scrubbers retain relevance in scenarios involving sticky, combustible, or temperature-sensitive particulate profiles, though they bring water management considerations. Electrostatic precipitators remain important for specific fume and mist applications, especially where very fine particles or oil aerosols are involved.

Application-driven segmentation-welding, cutting and grinding, woodworking, pharmaceuticals, food and beverage, chemical processing, mining and minerals, cement, and foundries-reveals that compliance, product integrity, and process continuity weigh differently by sector. Welding environments often demand flexible capture arms, high-efficiency filtration, and easy filter changeouts to limit exposure. Cutting and grinding operations emphasize spark control, abrasion resistance, and ducting durability. Woodworking settings bring combustible dust concerns to the forefront, influencing choices around grounding, spark detection, and housekeeping integration. In pharmaceuticals and food and beverage, contamination control and hygienic maintenance routines can be as important as airflow.

System architecture choices between centralized systems and decentralized systems are increasingly shaped by facility layout volatility and the need for phased investment. Centralized systems can deliver strong control when production is stable and duct routing is optimized, but they require disciplined balancing and can create single points of failure if redundancy is not built in. Decentralized systems, including portable extractors and cell-level collectors, are favored where lines change frequently or where quick deployment is needed to address localized issues. Many operators are adopting a mixed approach, using centralized collectors for steady-state processes and decentralized units for temporary or variable work.

End-use segmentation across manufacturing, construction, and automotive further highlights how procurement criteria shift. Manufacturing buyers often prioritize uptime, service access, and predictable operating cost, while construction settings may require portability, ruggedization, and rapid setup. Automotive environments, with their mix of welding, coating, and machining, tend to standardize equipment across plants to simplify training and spares while insisting on documented performance.

Finally, distribution channel dynamics across direct sales and distributors reflect how buyers balance engineering support with responsiveness. Direct engagement is frequently preferred for complex central systems requiring detailed airflow engineering and commissioning, whereas distributors play a vital role in fast-turn needs, replacement filters, and localized service for portable and mid-sized systems. Across all segments, buyers increasingly expect consultative support that connects capture design, filtration choice, and maintenance planning into a single, accountable solution.

Regional adoption varies by industrial mix, enforcement rigor, and service readiness across the Americas, EMEA, and Asia-Pacific operating environments

Regional dynamics demonstrate that adoption patterns and technical preferences are tightly coupled to industrial mix, enforcement intensity, energy costs, and the maturity of local service ecosystems. In the Americas, demand is strongly influenced by modernization of legacy plants, heightened attention to worker exposure, and ongoing investments in advanced manufacturing. Facilities often emphasize robust service coverage and rapid parts availability, reflecting the high cost of downtime and the practical need to keep systems operating at design airflow.In Europe, the Middle East, and Africa, purchasing decisions frequently reflect stricter site-level governance, energy-efficiency expectations, and a strong preference for documented compliance and performance validation. This encourages deeper attention to engineered capture solutions, acoustic controls, and filtration strategies aligned with specific particulate risks. In parts of the Middle East and Africa, industrial expansion and infrastructure-related growth can coexist with service and supply-chain constraints, making durable designs and straightforward maintenance routines especially valuable.

Across Asia-Pacific, the diversity of manufacturing intensity creates a wide spectrum of requirements. High-volume electronics, automotive, and metal fabrication centers tend to prioritize compact footprints, scalability, and rapid deployment, while heavy industry clusters focus on high dust-load handling and durability in harsh operating environments. As environmental enforcement and corporate standards tighten in several Asia-Pacific markets, plants are increasingly adopting higher-performing filtration and better monitoring to reduce variability and demonstrate continuous improvement.

Across regions, one unifying theme is the rising importance of service models and consumables availability. Filtration performance is only as reliable as the maintenance program supporting it, and many operators are placing greater value on local technical support, training, and standardized consumable logistics. Consequently, vendors that combine engineered solutions with dependable after-sales support are better positioned to win multi-site deployments and long-term standardization initiatives.

Competitive advantage is shifting to lifecycle performance, filtration expertise, service responsiveness, and verifiable commissioning that sustains compliance over time

Company competition in dust and fume extraction is increasingly defined by the ability to deliver verified performance over the full lifecycle rather than by equipment catalogs alone. Leading suppliers differentiate through application engineering depth, including capture device design, duct optimization, and commissioning support that ensures systems perform as intended in real operating conditions. Buyers are also evaluating how well suppliers can translate complex standards and site policies into practical, auditable solutions.Another major differentiator is filtration and consumables strategy. Companies with strong in-house filter media expertise or close partnerships can offer better guidance on media selection, coatings, and changeout intervals, which directly affects uptime and operating cost. Just as importantly, strong inventory planning for filters, valves, and controls reduces the risk of extended downtime when unexpected conditions arise. In tariff-impacted environments, supplier resilience and transparency in sourcing are becoming part of competitive advantage.

Service and digital support are moving to the center of company evaluation. Suppliers that provide clear maintenance documentation, remote troubleshooting options, and performance monitoring capabilities can help customers sustain airflow and comply with internal exposure goals. Where plants operate multiple shifts or multiple sites, standardization programs-supported by training, common spares, and consistent filter SKUs-are often decisive in vendor selection.

Finally, companies that offer flexible system architectures are aligning well with current buyer priorities. Modular collectors, portable fume extractors for rapidly changing workcells, and scalable centralized systems that anticipate expansion help customers avoid repeated redesign cycles. As customers increasingly demand measurable outcomes, suppliers that can provide testing, validation, and commissioning evidence are positioned to strengthen trust and secure long-term partnerships.

Leaders can reduce risk and downtime by aligning hazard-driven design, tariff-resilient sourcing, and maintenance verification into a single operating discipline

Industry leaders can strengthen outcomes by treating extraction as a process control system rather than an auxiliary utility. That begins with a disciplined hazard and exposure assessment that ties each emission source to a capture strategy, airflow requirement, and filtration approach. When these requirements are documented early, engineering teams can avoid common pitfalls such as undersized ducting, poorly positioned hoods, or filters mismatched to particle characteristics.To manage tariff-driven uncertainty and supply risk, procurement and engineering should collaborate on functional specifications that permit qualified alternates for motors, drives, and controls while preserving non-negotiable safety and performance criteria. Contracting approaches that clarify escalation mechanisms, define acceptable substitutions, and lock in critical-path components early can reduce late-stage schedule disruption. Where possible, leaders should consider modular deployments that prioritize the highest-risk areas first while building a roadmap for expansion.

Operationally, plants should invest in maintainability and verification. Designing for safe filter changeout, accessible service clearances, and straightforward dust disposal reduces exposure during maintenance and improves consistency. In addition, differential pressure monitoring and airflow verification points enable maintenance teams to detect degradation before it affects production. These practices support predictable operating cost and reduce the likelihood of compliance surprises.

Finally, leaders should elevate training and governance. Clear standard work for inspections, housekeeping integration, and lockout procedures is essential, particularly in environments with combustible dust or mixed contaminant profiles. When paired with supplier-supported training and well-managed consumables logistics, these measures help sites sustain performance beyond the initial installation and create a platform for multi-site standardization.

A triangulated methodology blends stakeholder interviews, technical and regulatory review, and cross-validation to produce decision-ready operational insights

This research methodology is built to translate real-world operational needs into decision-ready insights about dust and fume extraction systems. The work begins with structured primary research across stakeholders who influence selection and outcomes, including EHS leaders, plant managers, maintenance heads, engineers, and procurement professionals, supplemented by interviews with manufacturers, distributors, and service providers. These conversations focus on application requirements, failure modes, commissioning practices, maintenance realities, and the commercial terms that shape total cost of ownership.To complement primary insights, the study uses rigorous secondary research that reviews publicly available technical documentation, regulatory and standards frameworks, product literature, patent and technology signals, and corporate communications. This step is designed to validate terminology, map technology evolution, and understand how suppliers position performance claims across different applications and geographies.

Findings are synthesized using triangulation, cross-checking perspectives from buyers, suppliers, and technical references to ensure internal consistency. The analysis emphasizes qualitative clarity over unsupported numerical claims, highlighting how selection criteria differ by contaminant type, collector design, architecture, and end-use context. Throughout, the approach is designed to reflect current industry conditions, including supply chain constraints, tariff effects, and the growing role of monitoring and service models.

Quality control includes iterative reviews to ensure that statements are technically plausible, aligned with established engineering practices, and coherent across sections. The result is a practical foundation for strategy, sourcing, and operational planning, enabling readers to move from broad market understanding to application-specific decision frameworks.

Sustained success depends on verified capture performance, maintainable filtration, and resilient sourcing strategies as regulations and operations intensify

Dust and fume extraction systems are now central to how industrial organizations manage safety, quality, and operational continuity. The market is being shaped by application-specific engineering, more sophisticated filtration choices, modular deployment models, and a clear shift toward monitoring and verification. At the same time, buyers are balancing performance expectations with new cost and lead-time pressures influenced by tariff dynamics and supply chain volatility.Organizations that succeed in this environment will be those that specify outcomes clearly, design systems for maintainability, and partner with suppliers capable of proving performance in the field. As regional requirements and industrial mixes continue to diverge, decision-makers benefit from a structured view of how technologies, architectures, and service models align with their specific contaminant profiles and operational priorities.

Ultimately, the strongest programs treat air quality as an ongoing management system-supported by consistent maintenance, training, and documentation-rather than a one-time capital project. That mindset enables safer workplaces, more stable production, and greater resilience as regulations, technologies, and supply conditions continue to evolve.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

19. China Dust & Fume Extraction System Market

Companies Mentioned

The key companies profiled in this Dust & Fume Extraction System market report include:- AAF International LLC

- ABICOR BINZEL & Lincoln Electric

- Camfil AB

- CECO Environmental Corp.

- Donaldson Company, Inc.

- Filtration Group Corporation

- FLSmidth & Co. A/S

- Kemper GmbH

- MANN+HUMMEL GmbH

- Nederman Holding AB

- Parker-Hannifin Corporation

- Plymovent International B.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | January 2026 |

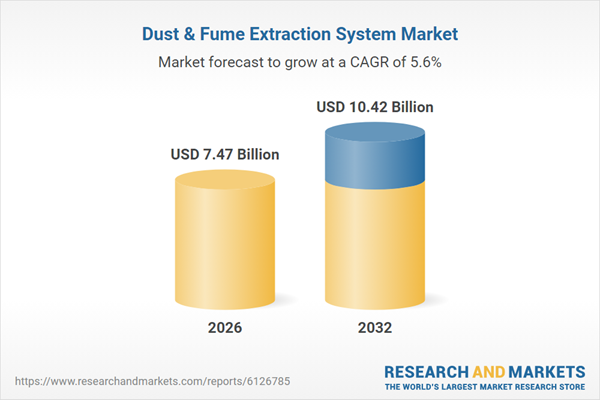

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 7.47 Billion |

| Forecasted Market Value ( USD | $ 10.42 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |