Speak directly to the analyst to clarify any post sales queries you may have.

Why all-in-one inventory management software is becoming the operational backbone for cash efficiency, customer trust, and scalable fulfillment

All-in-one inventory management software has moved from “nice-to-have” operational tooling to a core system of record for revenue integrity. As organizations diversify sales channels, shorten delivery promises, and broaden supplier networks, inventory becomes the connective tissue linking customer experience, cash flow discipline, and service-level reliability. This category now encompasses far more than stock counts; it orchestrates purchasing, receiving, put-away, cycle counting, kitting, order routing, returns, and exception handling while synchronizing with finance and customer systems.A key driver of adoption is the growing cost of inaccuracy. Overstocks trap working capital and raise carrying costs, while stockouts trigger lost sales, expedited shipping, and damaged brand trust. Modern platforms address these issues by combining real-time visibility, configurable workflows, and automated replenishment signals, increasingly supported by analytics. In practice, this means fewer manual reconciliations, tighter inventory turns, and improved on-time fulfillment, especially when operations span multiple warehouses, stores, and third-party logistics partners.

At the same time, decision-makers are demanding systems that fit their operating model without turning every change into a development project. The best solutions balance configurability with guardrails, provide role-based controls, and expose clean APIs to integrate with ERP, e-commerce marketplaces, shipping carriers, and manufacturing systems. In this environment, the executive question is shifting from whether to modernize inventory management to how to choose a platform that scales with product complexity, channel growth, and regulatory pressure while maintaining data integrity across the enterprise.

How cloud delivery, real-time inventory intelligence, and edge automation are redefining expectations for modern inventory platforms

The landscape is being reshaped by the convergence of commerce, supply chain volatility, and software delivery innovation. Cloud-native architectures have become the default expectation, enabling faster deployment, more frequent updates, and elastic performance during seasonal demand spikes. This shift is also changing vendor competition: usability, time-to-value, and ecosystem integrations are now as decisive as feature depth, particularly for organizations that cannot afford long implementation cycles.Another transformative shift is the move from periodic inventory snapshots to continuous inventory intelligence. Platforms increasingly unify transaction-level data-purchases, transfers, picks, adjustments, returns-into a single operational ledger that supports real-time decisioning. As a result, workflows such as dynamic reorder points, allocation logic by channel, and exception-based management are becoming standard. Leaders are redesigning processes around alerting and automation, reducing reliance on spreadsheets and tribal knowledge.

Automation at the edge is also accelerating. Mobile-first warehouse apps, barcode scanning, and lightweight automation tools are turning receiving and picking into guided, verifiable processes. In parallel, integrations with shipping, tax, and marketplace systems are tightening the loop from order capture to delivery confirmation. This makes fulfillment more predictable and improves the quality of downstream financial reporting, especially when returns and exchanges are significant.

Finally, governance and security expectations have risen. As inventory systems become central hubs connecting customer data, supplier information, and financial transactions, buyers demand stronger audit trails, granular permissions, and compliance readiness. This is pushing vendors to invest in administrative controls, data lineage, and standardized integration patterns, while customers are formalizing master data management for SKUs, locations, and units of measure. Together, these shifts are turning inventory management from a departmental application into an enterprise platform capability.

Why United States tariff shifts in 2025 elevate landed-cost agility, sourcing flexibility, and traceability as core inventory software requirements

United States tariff adjustments expected in 2025 are intensifying the need for inventory systems that support cost agility and sourcing flexibility. When tariff schedules change, landed cost becomes a moving target, and organizations must quickly understand how duties affect margins, replenishment timing, and pricing strategies. All-in-one inventory platforms that can model and propagate updated cost components-such as duties, freight, and broker fees-help operations and finance maintain alignment without waiting for manual recalculations.These tariff dynamics also amplify the operational value of multi-sourcing and regional diversification. Businesses that qualify alternate suppliers or shift production locations need accurate supplier-level lead times, minimum order quantities, and receiving performance history. Inventory software that centralizes supplier records and purchasing workflows enables teams to execute supplier switches without losing control of reorder logic, safety stock thresholds, or quality checkpoints. Over time, this reduces the disruption that typically accompanies sourcing pivots.

In addition, tariff-driven uncertainty tends to increase the frequency of partial shipments, split lots, and expedited replenishment. This raises the cost of inventory errors and the burden of reconciliation across warehouses and third-party logistics partners. Platforms with strong lot tracking, serial control where relevant, and exception management help teams preserve traceability while maintaining throughput. The result is fewer chargebacks, fewer customer delivery misses, and more defensible audit trails when disputes arise.

Tariffs can also shift demand patterns as prices change and buyers substitute products. Inventory systems that support faster rebalancing-through inter-warehouse transfers, allocation controls, and channel prioritization-are better positioned to protect service levels for high-margin or strategic accounts. In this sense, tariff pressure is not only a cost problem; it is an orchestration problem, and it is accelerating investment in systems that can turn complex trade conditions into manageable operational rules.

What segmentation reveals about buying priorities across deployment, organization size, industry needs, and feature depth in inventory platforms

Segmentation across offering type highlights a widening gap between solutions positioned as modular add-ons and platforms designed as operational hubs. Organizations favoring end-to-end control increasingly prioritize suites that unify purchasing, warehouse execution, and order management in one workflow, while teams with mature ERP footprints often select inventory layers that complement existing financial controls. As a consequence, vendor differentiation is increasingly tied to how cleanly inventory workflows connect to accounting, procurement approvals, and customer service processes rather than to isolated feature checklists.Deployment preferences also shape adoption behavior. Cloud deployments continue to expand because they reduce infrastructure burden and speed up rollout to distributed sites, yet certain regulated or highly customized environments still retain hybrid or on-premises components. What matters most is not the hosting model alone but the operational continuity it supports: update cadence, disaster recovery readiness, and the ability to roll out configuration changes without disrupting warehouse performance. Buyers are also evaluating how well platforms handle offline scenarios for mobile devices in facilities with inconsistent connectivity.

When viewed through the lens of organization size, needs diverge sharply. Small and mid-sized businesses often seek rapid implementation, intuitive interfaces, and packaged integrations with leading e-commerce and shipping tools, using automation to replace manual coordination. Larger enterprises and fast-scaling brands tend to emphasize governance, role-based controls, multi-entity support, and auditability, with a stronger focus on standardizing processes across sites. This creates a practical segmentation where ease-of-use and time-to-value compete with extensibility and controls, and leading vendors are those that can serve both without forcing trade-offs.

Industry verticals further influence buying criteria. Retail and e-commerce operators prioritize real-time stock accuracy across channels, returns handling, and marketplace synchronization, while manufacturers and distributors place heavier weight on bill-of-materials, kitting, lot traceability, and supplier performance. Healthcare and food-adjacent operations often demand stronger compliance workflows and recall readiness, which elevates traceability and documentation. Across verticals, the common thread is the need for a single, trusted inventory record that can withstand operational stress.

Finally, segmentation by functionality reveals where spending is concentrating: multi-warehouse visibility, demand-aware replenishment, barcode-enabled execution, and integration breadth. Organizations are increasingly selecting platforms that can grow from foundational inventory control into advanced capabilities such as forecasting inputs, intelligent order routing, and performance analytics. In effect, segmentation shows that buyers are not only purchasing software; they are purchasing a maturity path toward tighter control and faster decisions.

How regional operating realities shape inventory software priorities across the Americas, EMEA, and Asia-Pacific without changing the need for accuracy

Regional dynamics reflect different starting points in operational maturity and different catalysts for modernization. In the Americas, the adoption narrative is shaped by multi-channel commerce, distributed warehousing, and high expectations for delivery speed. Organizations focus on real-time visibility, integration with parcel and last-mile services, and resilient processes for returns and exchange-heavy business models. As labor constraints persist, there is also strong interest in mobile-guided workflows that reduce training time and improve pick accuracy.In Europe, Middle East, and Africa, regulatory and cross-border complexity often drives platform requirements. Multi-country operations place emphasis on standardized item masters, localization needs, and consistent audit trails that can withstand scrutiny across jurisdictions. Cross-border movements, VAT considerations, and multi-language operations elevate the value of configurable documentation and flexible warehouse structures. At the same time, sustainability reporting and waste reduction initiatives increase attention on inventory accuracy, shrink control, and expiry-aware management for relevant categories.

In Asia-Pacific, rapid growth, manufacturing depth, and dense supply networks shape demand for scalable systems. Organizations balancing domestic and export channels often prioritize multi-location control, supplier collaboration, and high-throughput warehouse execution. The region’s diversity also reinforces the need for adaptable integrations with local marketplaces, payment ecosystems, and logistics networks. As more businesses expand internationally, the ability to harmonize inventory definitions and processes across countries becomes a competitive advantage rather than a back-office refinement.

Across all regions, a common shift is visible: inventory management is being treated as a strategic capability that underpins customer experience and cash efficiency. Regional differences mainly influence the order in which capabilities are adopted-execution first in high-growth settings, governance and compliance in complex regulatory environments, and channel synchronization where commerce fragmentation is most intense.

How leading vendors differentiate through platform breadth, integration ecosystems, and operational proof points that reduce implementation and performance risk

Company strategies in this market cluster around three themes: platform breadth, ecosystem depth, and operational credibility. Vendors positioned as comprehensive platforms emphasize unified workflows from purchasing through fulfillment, aiming to reduce tool sprawl and data reconciliation. Their product roadmaps typically invest in configurable process engines, stronger analytics, and embedded automation that guides users to resolve exceptions quickly.A second group competes through ecosystem leverage, winning by offering prebuilt integrations with e-commerce platforms, ERPs, shipping carriers, and marketplace connectors. For many buyers, integration reliability becomes a proxy for implementation risk, and vendors that can prove stable connectors and clear data mappings gain an advantage. These companies often differentiate with onboarding tooling, template libraries, and partner networks that reduce time-to-value.

Operational credibility is emerging as a decisive differentiator. Buyers increasingly ask for evidence that platforms perform under peak order volumes, support multi-warehouse complexity, and provide audit-friendly traceability. This places emphasis on role-based access controls, configurable approvals, and detailed event logs. Vendors that can support both warehouse execution teams and finance stakeholders-without forcing parallel recordkeeping-tend to earn broader executive sponsorship.

Competition is also being shaped by adjacent categories. ERP vendors continue to extend inventory modules, warehouse specialists expand upward into purchasing and order orchestration, and commerce platforms add inventory synchronization features. In response, leading companies clarify their value in terms of reducing inventory distortion, improving fulfillment reliability, and accelerating decisions. The winners will be those that convert feature breadth into operational outcomes, supported by implementation playbooks and measurable process improvements.

Practical moves industry leaders can take to reduce inventory distortion, accelerate fulfillment, and build tariff-ready resilience through smarter operations

Industry leaders can turn inventory modernization into a measurable advantage by anchoring decisions in operational outcomes rather than feature accumulation. Start by defining a single set of performance targets-such as pick accuracy, order cycle time, stockout frequency, and reconciliation effort-and require vendors to demonstrate how workflows, controls, and reporting will move those metrics. This keeps selection grounded in value and reduces the risk of adopting a platform that looks strong in demos but fails in day-to-day execution.Next, treat data as the first implementation milestone. Establish SKU governance, location hierarchies, units-of-measure standards, and barcode conventions before migrating. When master data is inconsistent, automation amplifies errors faster than people can correct them. In parallel, design integration ownership across ERP, commerce, and shipping systems so that each field has a clear source of truth, and ensure exception handling is part of the process design, not an afterthought.

To prepare for tariff and supply volatility, build landed-cost and supplier agility into operating rhythms. Implement disciplined receiving with reason codes, enforce supplier performance tracking, and configure replenishment logic that can be tuned as lead times change. Where product categories justify it, invest in lot or serial tracking early to protect traceability and support recalls, returns, or warranty workflows without manual reconstruction.

Finally, scale operational adoption through training design and change management. Use role-based interfaces, standard work instructions, and mobile workflows that minimize cognitive load for warehouse teams. Pair this with executive dashboards that highlight exceptions, not just totals, so leadership intervenes where it matters. By aligning governance, execution, and analytics, organizations can convert inventory software from an IT project into a sustained operating capability.

A decision-grade methodology combining stakeholder interviews, capability validation, and comparable evaluation criteria to assess inventory platforms reliably

The research methodology integrates primary and secondary approaches to ensure a balanced, decision-oriented view of the all-in-one inventory management software landscape. Primary research focuses on structured conversations with stakeholders across operations, supply chain, finance, and IT, capturing real-world requirements, adoption barriers, and implementation lessons. This is complemented by interviews with vendors and solution partners to understand product direction, deployment models, integration patterns, and common use cases.Secondary research includes systematic review of vendor documentation, product materials, technical integration references, security and compliance statements, and publicly available customer validation such as case narratives and implementation guides. The goal is to triangulate claims against observable product capabilities and documented workflows. In addition, competitive mapping is used to identify how vendors position against adjacent categories such as ERP modules, warehouse execution tools, and commerce-driven inventory sync offerings.

A key methodological emphasis is comparability. Findings are normalized around consistent evaluation dimensions including workflow coverage, configuration depth, integration readiness, scalability considerations, governance controls, and operational usability. Where capabilities vary by edition or packaging, distinctions are documented to avoid overstating baseline functionality. The analysis also considers organizational context, recognizing that success factors differ between multi-site enterprises and smaller teams prioritizing rapid deployment.

Quality assurance includes editorial review for internal consistency and terminology alignment, along with cross-checking of definitions for inventory events and control points. This approach supports a practical narrative that helps decision-makers understand not just what the platforms do, but how those capabilities translate into implementable operational change.

Bringing it all together: inventory platforms win when they turn visibility into disciplined execution, resilient cost control, and scalable growth

All-in-one inventory management software is increasingly the system that determines whether an organization can scale without sacrificing accuracy, service levels, or financial discipline. The category is evolving toward real-time operational ledgers, guided execution, and stronger governance, reflecting the growing cost of errors in multi-channel and multi-location environments. Cloud delivery, ecosystem integrations, and automation at the warehouse edge are raising baseline expectations while narrowing tolerance for manual workarounds.Looking ahead, tariff volatility and shifting sourcing patterns further increase the premium on cost agility, traceability, and fast reconfiguration. Organizations that can rapidly adjust landed costs, rebalance inventory across nodes, and maintain audit-ready records will be better positioned to protect margins and customer commitments even as external conditions change.

Ultimately, the most successful investments will be those that pair software selection with disciplined master data management, clearly defined sources of truth across integrations, and training designed for operational reality. When these elements align, inventory becomes less of a constraint and more of a controllable lever for growth, resilience, and customer trust.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China All-In-One Inventory Management Software Market

Companies Mentioned

The key companies profiled in this All-In-One Inventory Management Software market report include:- Acumatica, Inc.

- Brightpearl Ltd.

- Cin7 Pty Ltd.

- Epicor Software Corporation

- ERPAG LLC

- Fishbowl Inventory LLC

- IBM Corporation

- Infor, Inc.

- Intuit Inc.

- Katana MRP Ltd.

- Khaos Control Systems Ltd.

- Microsoft Corporation

- Odoo S.A.

- Oracle Corporation

- Sage Group plc

- SAP SE

- Square, Inc.

- Zoho Corporation Pvt. Ltd.

Table Information

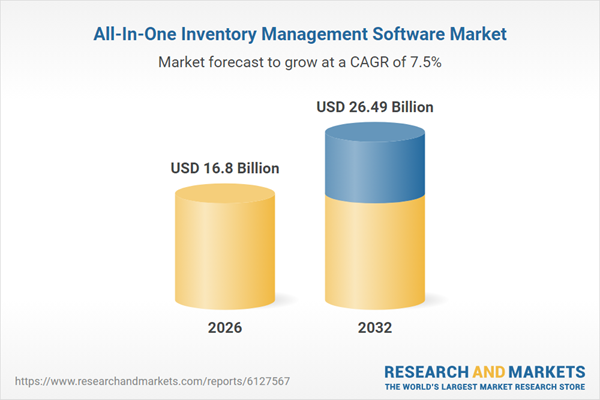

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 16.8 Billion |

| Forecasted Market Value ( USD | $ 26.49 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |