Speak directly to the analyst to clarify any post sales queries you may have.

Why dynamic aerators are becoming mission-critical for oxygen transfer, process resilience, and energy-smart operations across water and aquaculture

Dynamic aerators sit at the center of modern oxygen management, translating mechanical energy into dissolved oxygen transfer that supports biological treatment, aquatic health, and process stability. Across wastewater treatment plants, industrial basins, lagoons, and aquaculture systems, operators rely on aeration to stabilize performance under variable influent loads, seasonal temperature swings, and tightening discharge requirements. Yet the decision set has expanded beyond basic oxygenation. Buyers now evaluate energy efficiency, mixing uniformity, resilience to fouling, noise and vibration constraints, and the ability to integrate with supervisory controls.At the same time, aeration is increasingly treated as a controllable process rather than a fixed asset. Facilities are revisiting setpoints, rebalancing basin hydraulics, and adding instrumentation to ensure oxygen is delivered where and when it is needed. This shift elevates the role of dynamic aerators that can support robust mixing and adaptable operation across a range of depths and solids concentrations. In parallel, the industry is seeing renewed interest in retrofit-friendly designs that minimize civil works, reduce downtime during installation, and simplify maintenance for teams facing labor constraints.

As capital committees and plant managers scrutinize lifecycle cost more aggressively, the conversation has moved toward total performance: oxygen transfer reliability, energy draw under real operating conditions, maintainability in harsh environments, and long-term parts availability. Consequently, understanding how technology choices, application needs, and regional regulations intersect has become essential for decision-makers seeking predictable outcomes and defensible procurement decisions.

The dynamic aerator market is being reshaped by energy accountability, smart controls integration, maintainability demands, and sustainability-led procurement

The competitive landscape for dynamic aerators is undergoing a notable transformation driven by a convergence of operational, regulatory, and technological pressures. First, energy performance has shifted from a “nice-to-have” differentiator to a procurement requirement. With aeration often representing a major share of electricity use in biological treatment, facilities are prioritizing equipment that performs efficiently across turndown ranges rather than only at nameplate conditions. This has pushed manufacturers to refine impeller geometries, improve drivetrain efficiency, and provide application-specific performance curves that reflect real basin conditions.Second, controls and instrumentation are reshaping expectations. The adoption of dissolved oxygen sensors, ammonia and nitrate monitoring, and advanced control strategies is rising, particularly where utilities and industrial operators pursue consistent effluent quality and lower energy intensity. Dynamic aerators increasingly must fit into automated regimes that modulate aeration based on demand, which places a premium on stable mechanical response, compatibility with variable frequency drives, and predictable mixing under changing speeds. As a result, the boundary between “equipment vendor” and “process partner” is blurring, with suppliers expected to support commissioning, optimization, and ongoing performance troubleshooting.

Third, reliability and maintainability have become strategic differentiators as staffing constraints persist. Many plants are standardizing on designs that reduce grease points, simplify seal replacement, and enable faster field service. Remote monitoring, condition-based maintenance, and improved corrosion-resistant materials are gaining attention, especially in industrial environments with aggressive chemistries or high solids. This is changing how buyers score proposals: service coverage, spare parts logistics, and documented mean time between failures can outweigh modest differences in initial purchase price.

Finally, sustainability and community impacts are exerting new influence. Odor control, aerosol management, and noise restrictions affect aerator selection in peri-urban installations and environmentally sensitive areas. In parallel, climate resilience concerns-such as higher peak temperatures and more intense storm events-are pushing operators toward aeration approaches that can recover quickly after shocks, handle fluctuating loads, and maintain mixing during extreme conditions. Together, these shifts are accelerating innovation while raising the bar for proof of performance, transparency in testing, and clarity in lifecycle economics.

How United States tariff pressures in 2025 can ripple through aerator components, delivery risk, supplier strategies, and total project certainty

United States tariff dynamics anticipated in 2025 introduce cumulative effects that extend beyond headline duty rates, touching pricing, lead times, sourcing strategies, and project risk management. Dynamic aerators draw on a bill of materials that can include electric motors, gearboxes, bearings, stainless and coated steels, castings, fasteners, variable frequency drives, and instrumentation. When tariffs affect any of these upstream components, the impact can compound through multiple tiers of suppliers, creating cost volatility that is difficult to isolate to a single line item.One near-term outcome is heightened uncertainty in procurement cycles. Municipal and industrial buyers, already navigating extended delivery windows for certain electromechanical components, may see additional variability in lead times if import routes shift or if domestic suppliers face demand spikes. In response, EPCs and owners are increasingly building more conservative schedules, tightening specifications around approved alternates, and requesting clearer documentation of country of origin and component traceability.

Tariffs also influence engineering choices. Some projects may favor modular designs that simplify substitution of motors or drives from alternate suppliers, reducing dependence on any single import channel. Others may prioritize standardized platforms with widely available consumables and spare parts, improving maintenance continuity even if new equipment deliveries face delays. In parallel, suppliers may rebalance assembly footprints-importing subcomponents while final-assembling domestically-to improve compliance and reduce landed-cost unpredictability.

Over time, the cumulative impact can reshape competitive positioning. Vendors with diversified supply chains, strong domestic service networks, and the ability to qualify multiple component sources often manage tariff exposure more effectively than those reliant on concentrated import pathways. Buyers, for their part, are placing greater emphasis on contract terms that address price adjustment mechanisms, warranty coverage under substituted components, and spare-part availability commitments.

Strategically, tariffs can act as a catalyst for localization and supplier development, but that transition is neither immediate nor frictionless. Qualification testing, documentation updates, and performance validation take time, especially for aeration equipment where reliability is proven through operational history. The practical implication for decision-makers is clear: tariff-driven risk must be managed as an engineering and operations issue-not merely a finance issue-through design flexibility, supplier audits, and disciplined commissioning and acceptance testing.

Segmentation insights show dynamic aerator demand is defined by context - type, mounting, application, capacity, end-user needs, and go-to-market support models

Segmentation reveals that demand patterns for dynamic aerators are less about a single “best” technology and more about fit to operating context across type, mounting, application, capacity, end-user, and distribution channel. In type-driven decisions, buyers balance oxygen transfer needs with mixing intensity and basin geometry, often weighing aspirating configurations against surface and sub-surface approaches depending on depth, solids loading, and whether mixing or oxygenation is the limiting factor. This creates distinct adoption paths: shallow basins and lagoons may prioritize robust surface agitation and ease of access, while deeper or process-sensitive environments often focus on controlled oxygen delivery and consistent mixing gradients.Mounting and installation segmentation influences retrofit economics. Floating and pontoon-mounted solutions can reduce civil work and speed deployment, which is attractive where downtime is costly or where basin configurations vary seasonally. Fixed and bridge-mounted designs, by contrast, may appeal where long-term alignment stability, predictable hydraulics, and simplified cable routing are priorities. These choices also shape maintenance workflows, affecting how quickly teams can access seals, impellers, and drive components.

Application segmentation highlights divergent performance requirements. Municipal wastewater facilities typically value stable dissolved oxygen control, energy efficiency under variable loading, and compliance-driven reliability, particularly when nutrient removal is sensitive to oxygen setpoints. Industrial wastewater applications can be more heterogeneous, with higher variability in temperature, pH, and contaminants; here, material selection, fouling resistance, and mechanical robustness often dominate selection criteria. Aquaculture and waterbody restoration contexts emphasize gentle but effective oxygenation, avoidance of harmful shear, and minimized disturbance to aquatic life, with an increasing focus on portability and rapid redeployment.

Capacity and scale segmentation further differentiates the buying criteria. Smaller installations frequently prioritize simplicity, lower maintenance overhead, and quick serviceability, while larger installations are more likely to incorporate redundancy planning, condition monitoring, and standardized fleets to streamline spares. End-user segmentation introduces procurement complexity: public utilities often require formal qualification and documented performance validation, while private operators may move faster but demand clear lifecycle cost justification tied to production or discharge risk.

Finally, distribution channel segmentation shapes how solutions are packaged and supported. Direct engagement can be critical where process optimization and commissioning support influence outcomes, whereas integrator and distributor-led models may succeed where standardized equipment and rapid availability are paramount. Across these segmentation lenses, the most consistent insight is that “performance” must be defined in context-oxygen transfer, mixing, controllability, serviceability, and resilience-and then translated into specifications that reduce ambiguity during bidding and acceptance testing.

Regional realities - from energy prices to climate stressors - shape aerator specifications and buying priorities across the Americas, Europe, Middle East, Africa, and Asia-Pacific

Regional dynamics shape dynamic aerator priorities through regulatory regimes, infrastructure maturity, energy pricing, and climatic conditions. In the Americas, the operating environment emphasizes compliance reliability and lifecycle cost discipline, with heightened attention to energy optimization and maintainability as utilities modernize aging assets. Industrial activity in select corridors adds demand for rugged designs that tolerate variable effluent characteristics, while waterbody management initiatives in parts of the region support interest in flexible deployment options for lakes and reservoirs.In Europe, stringent environmental standards and high energy costs reinforce the push toward efficient, controllable aeration and strong documentation of performance. Buyers often expect advanced integration with plant automation and a mature service model, while circular-economy objectives can elevate requirements around durability, refurbishment options, and parts longevity. Cold-climate considerations in northern areas also influence material and mechanical design choices to ensure reliable starts and stable operation in seasonal extremes.

Across the Middle East, water scarcity, rapid urban development, and large-scale infrastructure projects drive demand for dependable aeration that performs in high temperatures and challenging water chemistries. Here, corrosion resistance, heat-tolerant drivetrains, and responsive service support can be decisive, especially where plants operate continuously and downtime carries outsized risk. Project-based procurement also places weight on supplier coordination with EPC timelines and commissioning rigor.

Africa presents a mix of emerging infrastructure needs and highly variable operating contexts. In many settings, solutions that balance robustness with operational simplicity can outperform more complex systems that require frequent calibration or specialized maintenance. Logistics and spare parts availability play a particularly strong role, encouraging equipment choices that use widely available components and can be serviced with local capabilities.

In Asia-Pacific, rapid urbanization, industrial expansion, and aquaculture intensity create diverse demand pockets. Some markets prioritize high-throughput municipal and industrial treatment performance with increasing adoption of automation, while others favor rugged, cost-effective aeration for lagoons and decentralized treatment. Climatic diversity-from tropical heat to monsoon-driven variability-adds emphasis on resilience and adaptability. Across the region, supplier responsiveness, local presence, and proven field performance can be as influential as technical specifications when buyers aim to de-risk long operating lifecycles.

Company differentiation increasingly hinges on performance assurance, modular product platforms, controls compatibility, and lifecycle service strength beyond the hardware itself

Key company activity in dynamic aerators is increasingly defined by how well suppliers reduce operating risk while improving controllability and service outcomes. Leading participants tend to differentiate through a combination of mechanical design depth, process application expertise, and the ability to support commissioning and optimization. Rather than competing solely on equipment hardware, many companies position around “performance assurance,” offering clearer duty-point guidance, application engineering, and documentation that aligns with procurement and compliance expectations.Product strategies frequently emphasize modular platforms that can be configured for different basin geometries and duty cycles without reinventing core components. This modularity supports faster manufacturing and simplifies parts management, while also enabling tailored options such as upgraded coatings, specialized impeller designs, or enhanced sealing packages for aggressive wastewater. In parallel, companies are expanding compatibility with variable frequency drives and plant control architectures, recognizing that aeration is increasingly tuned dynamically to influent and process conditions.

Service and lifecycle support have become central to competitive standing. Companies with established field teams, regional service hubs, and predictable spare-part fulfillment build confidence with buyers who prioritize uptime. Preventive maintenance kits, refurbishment programs, and condition-monitoring add-ons are common levers to strengthen customer retention and differentiate on total cost of ownership rather than initial procurement price.

Partnership ecosystems also matter. Collaboration with EPC firms, system integrators, and instrumentation providers can improve project execution and reduce commissioning delays. In regions where tendering is highly specification-driven, suppliers that contribute to clearer performance definitions and acceptance protocols often gain an advantage. Overall, the companies that lead in this space tend to combine proven mechanical reliability with modern controls readiness, translating aeration from a static utility into a manageable, optimizable process asset.

Actionable steps to cut aeration energy risk and downtime: tighten specifications, demand controllability, modernize maintenance, and pilot before scaling

Industry leaders can act now to reduce energy exposure, project risk, and operational variability by treating aeration as a controllable system with clear performance governance. Start by aligning internal stakeholders-operations, maintenance, engineering, procurement, and compliance-around a shared definition of success that goes beyond nameplate oxygen transfer. This definition should include mixing requirements, turndown behavior, noise constraints where relevant, maintainability expectations, and acceptance-testing criteria tied to actual basin conditions.Next, strengthen specifications to improve comparability across bids. Require suppliers to provide duty-point assumptions, performance curves under variable speed operation, materials and coating details suited to your wastewater characteristics, and documented guidance on instrumentation and control integration. Where tariffs and supply variability present risk, incorporate requirements for component traceability, alternate-source qualification plans, and spare-part availability commitments. Contract structures should also clarify how substitutions will be handled without eroding warranty coverage or long-term serviceability.

Operationally, prioritize measurement-driven optimization. Expanding dissolved oxygen sensing coverage, validating sensor placement, and using trend data to detect mixing dead zones can unlock meaningful improvements without major civil changes. Pair this with maintenance modernization: standardize critical spares, adopt condition-based checks for bearings and seals, and document failure modes to inform future procurement. Where staffing is limited, evaluate vendor service agreements that include periodic inspections and performance tuning.

Finally, plan aeration upgrades as staged risk reductions rather than single events. Pilot installations in representative basins, compare performance across seasons, and codify lessons into updated standards. This approach improves stakeholder confidence, reduces the chance of underperforming retrofits, and helps ensure dynamic aerators deliver predictable oxygen transfer and mixing across the full range of real-world operating conditions.

Methodology built on triangulated secondary and primary inputs to validate aerator performance drivers, buyer behavior, and supply-chain realities

The research methodology integrates structured secondary research with rigorous primary validation to ensure a practical, decision-oriented view of the dynamic aerator landscape. Secondary research begins with a review of technical literature, regulatory and standards frameworks relevant to aeration and wastewater operations, public procurement documentation, and product literature to map technology variants, application requirements, and common performance claims. This stage also establishes a baseline view of supply-chain considerations, component ecosystems, and the evolving role of automation in aeration control.Primary research then validates and refines insights through interviews and consultations spanning stakeholders such as equipment manufacturers, channel partners, integrators, engineering firms, and end-users in municipal, industrial, and aquaculture settings. These discussions focus on selection drivers, operational pain points, commissioning and acceptance-testing practices, maintenance realities, and the practical implications of supply constraints and tariffs. Inputs are cross-checked to reconcile differences between stated capabilities and field experience.

Analysis emphasizes triangulation and consistency checks. Claims regarding efficiency, reliability, and suitability are assessed against application context, with careful attention to basin geometry, wastewater characteristics, and control strategy. Segmentation is used to organize insights by how buyers actually specify and deploy dynamic aerators, while regional analysis accounts for regulatory pressure, climate, service coverage, and procurement norms.

Quality control is maintained through iterative review, terminology normalization, and logic checks that ensure conclusions flow from verified inputs rather than assumptions. The result is a methodology designed to support procurement clarity, reduce technical ambiguity, and help decision-makers translate aeration requirements into defensible equipment and supplier choices.

Dynamic aeration success now depends on controllability, lifecycle resilience, and disciplined specifications that align equipment performance with real basin conditions

Dynamic aerators are moving into a more demanding era where energy accountability, tighter discharge requirements, and operational resilience determine technology choices. Buyers no longer evaluate aeration as a standalone mechanical device; they evaluate it as part of a controlled biological and hydraulic system that must perform across variable loads, changing temperatures, and evolving compliance expectations.As the landscape shifts, differentiation is increasingly anchored in controllability, maintainability, and service readiness, reinforced by modular designs and stronger integration with instrumentation and automation. Meanwhile, tariff-related uncertainty and supply-chain variability elevate the importance of sourcing transparency, component flexibility, and contract terms that protect uptime and lifecycle outcomes.

In this environment, the most successful decision-makers will be those who define performance in application-specific terms, require clear documentation and acceptance criteria, and invest in measurement-driven optimization after installation. By pairing disciplined specifications with realistic maintenance planning and supplier accountability, organizations can turn dynamic aeration into a reliable lever for process stability and long-term operating efficiency.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Dynamic Aerator Market

Companies Mentioned

The key companies profiled in this Dynamic Aerator market report include:- Alfa Laval AB

- Danaher Corporation

- Evoqua Water Technologies LLC

- Grundfos A.S.

- Kurita Water Industries Ltd.

- Otterbine Barebo Inc.

- Pentair plc

- SSI Aeration, Inc

- SUEZ S.A.

- Sulzer Ltd.

- VA Tech Wabag Ltd.

- Veolia Environnement S.A.

- Xylem Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

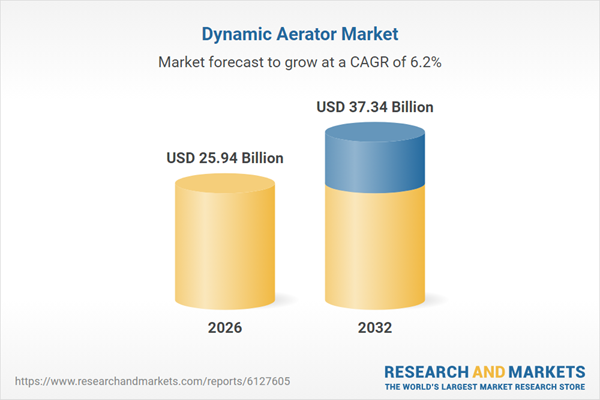

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 25.94 Billion |

| Forecasted Market Value ( USD | $ 37.34 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |