Speak directly to the analyst to clarify any post sales queries you may have.

Precision oil application is now a core process control lever, elevating food-grade oil spray machines from utility equipment to strategic assets

Food-grade oil spray machines have become a pivotal enabler of modern food production, bridging the gap between product quality expectations and the operational discipline required for consistent, high-throughput manufacturing. Across packaged foods, bakery, snack processing, ready meals, and commercial kitchens, producers rely on controlled oil application to manage taste, texture, release performance, and visual appeal while limiting waste and improving repeatability. What once could be handled with manual application or coarse dispensing now demands precise, validated spraying to meet tighter specifications and a broader range of oil types, including high-oleic blends and specialty oils.At the same time, the role of oil spraying has expanded beyond simple lubrication or flavor delivery. It increasingly supports downstream processing stability by controlling adhesion, improving seasoning pickup, and reducing sticking on belts, trays, molds, and pans. These practical outcomes influence overall equipment effectiveness, sanitation cycles, and yield. Consequently, buyers are evaluating oil spray machines not only as standalone units but as integrated process tools that affect changeover times, allergen management, and line automation.

This executive summary frames the market through the lens of shifting customer requirements, technology advancements, and policy conditions that reshape purchasing decisions. It highlights how manufacturers are approaching system selection, where demand is intensifying, and what strategic actions can strengthen competitiveness in a landscape that rewards precision, hygiene-by-design, and resilient supply chains.

Evolving hygiene standards, automation-led process control, and sustainability pressures are redefining what “best-in-class” oil spraying looks like in food plants

The landscape for food-grade oil spray machines is being transformed by a convergence of quality demands, regulatory expectations, and smarter factory architectures. First, precision and repeatability are moving from “nice to have” to mandatory, particularly for products that rely on controlled sheen, browning, crispness, or seasoning adhesion. Producers are seeking tighter control of droplet size, spray angle, and flow modulation to reduce over-application and to stabilize sensory outcomes from batch to batch. In parallel, continuous improvement programs are pushing for measurable reductions in oil consumption, cleaning downtime, and rework.Second, hygienic design expectations are rising, shaped by stronger internal food safety governance and a broader adoption of preventive controls. Equipment purchasers are increasingly attentive to sanitary construction, tool-less disassembly, clean-in-place compatibility, and the elimination of crevices that can trap residues. This is particularly relevant for systems that handle oils that can oxidize, polymerize, or carry allergens, where material selection and thermal management can influence both flavor stability and microbiological risk management.

Third, automation and data visibility are reshaping what buyers consider “standard.” Modern plants increasingly treat oil application as a controllable parameter within recipe management, tying spray rates to conveyor speed, product weight, and line feedback. This drives demand for programmable control, integration with PLCs and supervisory systems, and sensor-assisted verification such as pressure monitoring or flow confirmation. As a result, the competitive bar is rising for machine builders that can deliver not only mechanical reliability but also robust controls, documentation, and service support.

Finally, sustainability and cost resilience are changing the value proposition. With ongoing attention to energy usage, waste reduction, and material efficiency, oil spray systems that can deliver uniform coverage with minimal overspray are gaining preference. Additionally, sourcing strategies are being influenced by supply chain volatility and lead-time risk, encouraging buyers to favor suppliers with regional support footprints, standardized spares, and flexible configuration options that can be adapted without extensive re-engineering.

U.S. tariff dynamics expected in 2025 are shifting equipment sourcing toward risk-managed designs, localized components, and contracts built for cost volatility

United States tariff actions anticipated in 2025 are poised to influence procurement strategies for food-grade oil spray machines, especially where equipment, subassemblies, or controls rely on imported components. Even when final assembly occurs domestically, exposure can remain through stainless steel inputs, precision nozzles, pumps, valves, motors, and electronic modules. The immediate implication for buyers is increased emphasis on total landed cost clarity, supplier declarations of origin, and contract terms that address duties and price adjustments.In practical terms, tariffs can reshape purchasing timing and vendor selection. Some processors and integrators may accelerate orders to reduce uncertainty, while others may postpone capital commitments until pricing stabilizes or alternative sourcing is validated. For machine builders, this environment elevates the importance of dual sourcing, modular designs that allow substitution of equivalent components, and transparent documentation that helps customers understand compliance and risk. It also increases the value of service readiness, since extending the life of installed equipment through refurbishment and spare-parts assurance can become a more attractive option when new equipment costs rise.

Tariff impacts can also influence innovation pathways. If certain imported control components or specialty spray technologies face higher costs, manufacturers may seek redesign opportunities that preserve performance while using domestically available parts. This can accelerate localization of subassemblies, stimulate partnerships with regional suppliers, and encourage standardization around broadly available industrial components. Over time, these shifts may strengthen supply chain resilience, but the transition period can be disruptive for project planning.

For end users, the key is to treat tariffs as a scenario-planning variable rather than a one-time pricing event. A disciplined approach involves qualifying alternate suppliers, specifying performance-based requirements instead of overly brand-specific parts where feasible, and building serviceability into the specification. In this environment, procurement teams and engineering stakeholders benefit from shared decision frameworks that connect food safety, performance validation, and cost risk-ensuring that tariff-driven substitutions do not compromise hygienic design, reliability, or process outcomes.

Segmentation highlights that spray precision, cleaning validation, and integration depth vary widely by application intensity, oil behavior, and retrofit constraints

Segmentation patterns in the food-grade oil spray machine space reveal that buying priorities differ sharply based on how and where oil is applied, and the degree of control required at the point of use. In applications where uniform coverage is essential to product identity-such as snacks requiring consistent seasoning adhesion or bakery items demanding stable release and browning-buyers gravitate toward systems that offer tight flow control, consistent atomization, and repeatable spray patterns across varying line speeds. In contrast, operations focused on equipment lubrication or pan release may emphasize robustness, quick cleaning, and low-maintenance operation, accepting simpler control schemes when product risk is lower.Differences in deployment context further shape demand. High-throughput industrial lines often prioritize integrated systems that synchronize spray with conveyors and recipe parameters, particularly when multiple SKUs run on the same line. Here, the ability to store settings, validate changeovers, and prevent cross-contact can materially affect uptime and audit readiness. Smaller producers and test kitchens, by comparison, may prioritize compact footprints, straightforward setup, and flexible placement that supports frequent experimentation and short runs.

Oil characteristics and handling needs introduce another layer of segmentation. Systems designed for low-viscosity oils may not perform equivalently with thicker oils or blends that behave differently across temperature ranges. As customers diversify oil inputs for nutritional positioning, flavor, or supply considerations, machines that support temperature conditioning, stable pressure delivery, and nozzle configurations optimized for different viscosities gain an advantage. Additionally, companies with strict allergen segregation requirements are more likely to value dedicated circuits, purge-friendly designs, and cleaning validation features.

Purchasing behavior also diverges between new line builds and retrofit projects. In greenfield installations, buyers can design spray systems into the process architecture, aligning controls, safety interlocks, and hygienic zoning from the outset. In retrofit settings, compatibility with existing conveyors, enclosures, and utilities becomes decisive, and suppliers that can provide application engineering support and rapid customization tend to win. Across these segmentation dynamics, performance verification is becoming more explicit: customers increasingly request evidence of spray uniformity, documentation for materials and hygienic design, and service plans that protect long-term reliability.

Regional demand varies by automation readiness and hygiene expectations, with the Americas, Europe, Asia-Pacific, and MEA showing distinct buying triggers

Regional dynamics in the market reflect differences in manufacturing maturity, regulatory emphasis, and the pace of automation adoption across the Americas, Europe, the Middle East, Africa, and Asia-Pacific. In the Americas, demand is strongly influenced by large-scale packaged food production, extensive co-manufacturing networks, and a growing focus on consistency and labor efficiency. Buyers often look for scalable designs that can be standardized across multiple plants, supported by strong after-sales service and rapid availability of spares.In Europe, purchasing decisions are frequently shaped by stringent hygiene expectations, energy efficiency considerations, and a strong culture of engineering documentation and validation. This encourages adoption of equipment with sanitary design features, clear traceability of materials, and controls that support repeatable operation and process verification. Additionally, European manufacturers often prioritize equipment that supports rapid product changeovers, reflecting diverse product portfolios and frequent SKU rotations.

Across Asia-Pacific, growth in processed foods, expanding cold-chain infrastructure, and modernization of production facilities are key demand drivers. Many producers are upgrading from basic dispensing to more controlled spraying, particularly as brands scale and seek consistent product experiences across geographies. The region’s diversity means requirements range from cost-sensitive systems for emerging manufacturers to highly automated, integrated installations for advanced plants.

In the Middle East and Africa, investment patterns often reflect capacity expansion, import substitution initiatives, and the need for durable equipment that performs reliably under variable utility conditions. Buyers may place a premium on ruggedness, simplified maintenance, and training support, particularly where specialized technical labor is constrained. Across all regions, multinational food companies are pushing harmonized standards, which increasingly spreads best practices in sanitary construction, digital controls, and validation-oriented documentation-raising expectations for suppliers competing in cross-border tenders.

Competitive advantage is shifting toward vendors with application engineering rigor, audit-ready hygienic designs, and lifecycle support built for multi-site operations

Company strategies in food-grade oil spray machines increasingly differentiate along three axes: application engineering depth, hygienic design credibility, and lifecycle support. Suppliers that can translate product requirements into nozzle selection, pump sizing, and spray enclosure design are better positioned, because end users are under pressure to achieve measurable outcomes such as reduced oil usage, stable seasoning pickup, and fewer sanitation-related stoppages. This has elevated the importance of trials, sample testing, and on-site commissioning that validates performance under real production conditions.Hygienic design has become a competitive necessity rather than a premium add-on. Leading vendors emphasize stainless construction, food-contact compliance, and designs that streamline cleaning and inspection. Beyond materials, buyers pay close attention to how quickly a system can be disassembled, whether it supports clean-in-place protocols, and how effectively it prevents drip, misting, or overspray that can create safety hazards and sanitation burdens. Vendors that supply robust documentation-drawings, maintenance guides, and validation support-tend to align better with audit-driven procurement.

Lifecycle support is increasingly decisive, especially for multi-plant operators. The strongest organizations build regional service capabilities, maintain parts availability, and offer preventive maintenance programs that minimize unplanned downtime. Training and operator enablement are also gaining prominence, because spray performance is sensitive to setup discipline, nozzle condition, and oil preparation. In addition, partnerships with controls providers, conveyor OEMs, and system integrators are becoming more common, enabling suppliers to deliver turnkey solutions that reduce coordination burden for end users.

Competition is also shaped by how suppliers respond to supply chain uncertainty. Companies that maintain flexible BOM strategies, qualify alternate components without sacrificing performance, and communicate lead times transparently are more likely to secure long-term relationships. As customers seek to standardize across sites, vendors that offer configurable platforms-rather than one-off builds-can support faster replication and lower total cost of ownership while preserving application-specific performance.

Leaders can win by specifying spray performance as a controllable parameter, hardening hygiene governance, and building procurement resilience into designs

Industry leaders can strengthen outcomes by treating oil spraying as a controlled process step with clear performance specifications, rather than as a utility. This starts with defining measurable requirements tied to the product and line-such as acceptable coverage uniformity, allowable overspray, target oil consumption ranges, and cleaning time expectations-then using those requirements to guide equipment selection and factory acceptance criteria. When specifications focus on performance and hygiene outcomes, teams can avoid over-constraining designs around particular component brands, which also helps mitigate sourcing disruption.Next, leaders should institutionalize validation and governance for oil application. Standard operating procedures that address oil conditioning, filtration, nozzle inspection, and parameter locking reduce drift and strengthen repeatability. Where allergen or flavor cross-contact is a concern, organizations benefit from documented changeover protocols and equipment designs that support purgeability and inspection. Investing in operator training pays back quickly because small setup deviations can translate into uneven coverage, product defects, or sanitation burdens.

Supply chain and tariff readiness should be embedded into capital planning. Procurement and engineering teams can collaborate to qualify alternates for high-risk components, negotiate contracts with clear duty and escalation clauses, and require serviceability considerations such as interchangeable nozzles, standardized fittings, and readily available wear parts. For global operators, developing a preferred equipment platform with regionally supported variants can reduce both technical and commercial risk.

Finally, digital integration should be approached pragmatically. Connecting spray systems to line controls, capturing key parameters, and enabling recipe-driven adjustments can improve repeatability and troubleshooting without overcomplicating operations. Organizations that pair data visibility with disciplined maintenance-tracking nozzle wear, pressure stability, and cleaning intervals-can improve performance consistency while reducing unplanned downtime. Taken together, these actions create a roadmap that improves quality, reduces waste, and increases resilience against policy and supply volatility.

A triangulated methodology combining expert interviews, technical documentation review, and application mapping converts equipment complexity into decisions

The research methodology for this report is designed to translate complex equipment and application realities into decision-ready insights. It begins with structured mapping of the food-grade oil spraying value chain, connecting component technologies such as nozzles, pumps, controls, and enclosures to end-use requirements in food manufacturing and foodservice environments. This foundation helps clarify how technical design choices influence operational outcomes such as sanitation effort, reliability, and application consistency.Primary research emphasizes expert interviews across the ecosystem, including equipment manufacturers, component suppliers, system integrators, and end-user stakeholders involved in engineering, quality, sanitation, and procurement. These conversations focus on current purchasing criteria, common failure modes, maintenance practices, and emerging requirements such as validation documentation and integration with plant automation. Interview findings are cross-checked to reduce bias and to ensure that insights reflect both supplier perspectives and real operational constraints.

Secondary research complements these inputs by reviewing publicly available technical documentation, regulatory guidance relevant to hygienic design and food-contact materials, and company disclosures that indicate strategic direction. The analysis uses triangulation to reconcile differences among sources and to ensure conclusions are consistent with observed industry practices. Throughout the process, special attention is given to avoiding overgeneralization across applications, recognizing that performance needs differ substantially between high-precision coating tasks and more utilitarian release or lubrication use cases.

Finally, the report synthesizes findings into an integrated narrative supported by segmentation and regional lenses. This approach ensures that recommendations remain actionable for decision-makers, linking technology selection and supplier evaluation to operational priorities such as uptime, sanitation capacity, changeover speed, and supply continuity.

As precision, sanitation, and supply resilience become inseparable priorities, oil spray machine decisions now shape quality, uptime, and scalability

Food-grade oil spray machines are moving into a new era where precision, hygiene, and integration define competitiveness. As producers face tighter tolerances for quality, increasing scrutiny of sanitation and documentation, and persistent pressure to reduce waste, oil application has become a process step that warrants engineering rigor and measurable control. Equipment selection now carries implications well beyond the spray zone, affecting safety, uptime, and the ability to scale consistent product experiences.Simultaneously, policy and supply chain conditions-especially those linked to tariffs and component sourcing-are reinforcing the value of resilient designs and transparent vendor partnerships. Buyers are responding by prioritizing service readiness, configurable platforms, and validation-oriented support. These expectations reward suppliers that can prove performance, streamline cleaning, and integrate smoothly into automated lines.

Taken together, the market is best understood as a set of application-driven needs shaped by regional operating realities and a shifting cost-risk environment. Organizations that align engineering, quality, and procurement around clear performance requirements-and that invest in governance for setup, cleaning, and maintenance-will be better positioned to achieve consistent outcomes while navigating uncertainty.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Food-Grade Oil Spray Machine Market

Companies Mentioned

The key companies profiled in this Food-Grade Oil Spray Machine market report include:- Almatec GmbH

- Colfax Corporation

- Graco Inc.

- IDEX Corporation

- Lutz Pumpen GmbH

- Mangal Machines Pvt. Ltd.

- Nordson Corporation

- ProMinent GmbH

- SPX Flow, Inc.

- Tapflo AB

- Verder Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

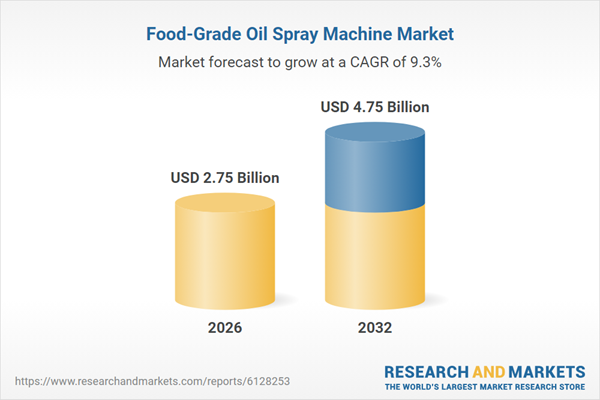

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 2.75 Billion |

| Forecasted Market Value ( USD | $ 4.75 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |