Speak directly to the analyst to clarify any post sales queries you may have.

Connected safety is redefining residential risk management as smart home gas detectors become an always-on, integrated layer of household protection

Smart home gas detectors have moved from being a “nice-to-have” accessory to a core layer of residential risk management. As households adopt connected thermostats, smart locks, and intelligent smoke alarms, expectations are rising that gas detection should be equally integrated, always-on, and easy to interpret. In this environment, the product value is no longer limited to an audible alarm; it also includes real-time notifications, automated ventilation or shutoff workflows, and a clear incident trail that supports faster decision-making.This market sits at the intersection of safety hardware, wireless connectivity, home automation platforms, and evolving building practices. The modern buyer-whether a homeowner, landlord, or property manager-expects detectors to be unobtrusive, reliable, and straightforward to maintain. Meanwhile, professional stakeholders such as installers, insurers, and municipal safety authorities increasingly influence purchase decisions through compliance requirements, recommended practices, and risk-reduction incentives.

As a result, competition is intensifying around trusted sensing performance, differentiated user experience, and interoperability. Companies that treat the gas detector as a connected safety endpoint-rather than a standalone device-are best positioned to meet rising expectations around prevention, responsiveness, and long-term serviceability.

From standalone alarms to automated, interoperable safety endpoints, the smart home gas detector landscape is shifting toward reliability, security, and lifecycle value

The landscape is undergoing a decisive shift from isolated alarms to connected, automated safety systems. Early products focused on detecting a narrow set of gases and sounding an alert locally. Today’s leading approaches emphasize multi-channel communication, mobile-first notification, and the ability to trigger routines such as turning on ventilation fans, shutting off gas valves, or alerting designated contacts. Consequently, product roadmaps increasingly mirror broader smart home patterns: seamless onboarding, platform compatibility, and remote diagnostics.At the same time, sensing and design expectations are rising. Buyers are paying closer attention to false alarm rates, calibration stability, and end-of-life signaling, especially as devices are deployed in rental portfolios and multi-dwelling buildings where maintenance must be predictable. This pushes manufacturers toward higher-quality sensing elements, improved drift compensation, and more transparent user guidance. In parallel, aesthetic integration is becoming more important, as consumers prefer safety devices that blend into living spaces without sacrificing audibility or visibility.

Cybersecurity and data handling have also become central to product acceptance. Because connected detectors can transmit alerts, usage patterns, and diagnostic data, stakeholders increasingly demand secure firmware, encrypted communication, and clear policies for data retention. Moreover, interoperability standards and platform ecosystems are influencing procurement; decision-makers want confidence that devices will continue working across router upgrades, app changes, and future smart home expansions. Taken together, these shifts are transforming smart home gas detection from a single transaction into an ongoing trust relationship built on reliability, security, and lifecycle support.

Trade policy and tariff pressure in 2025 may rewire sourcing, pricing discipline, and product modularity for smart home gas detectors sold into the United States

United States tariff actions anticipated in 2025 are poised to reshape near-term cost structures and sourcing decisions across connected safety hardware, including smart home gas detectors. Because many devices rely on globally sourced components-such as sensors, microcontrollers, wireless modules, and power management parts-tariff-related cost pressure can appear unevenly across bill-of-materials lines. Even modest duty changes can cascade through pricing, margin planning, and promotional calendars, particularly for mass retail and entry-tier devices where price elasticity is high.In response, manufacturers and brand owners are likely to revisit supplier concentration and country-of-origin exposure. This can accelerate dual-sourcing strategies for critical components, push more final assembly closer to end markets, and increase the attractiveness of modular product architectures that allow substitution of comparable parts without redesigning the entire device. However, these adaptations require engineering discipline and certification awareness, since changes to sensors or radio modules can trigger retesting or documentation updates.

Tariffs may also influence channel dynamics. Brands that rely heavily on import-dependent private label programs could face pressure to adjust packaging configurations, bundle strategies, or warranty terms to preserve perceived value. Conversely, companies with more diversified supply chains may gain flexibility to stabilize pricing, maintain availability, and negotiate shelf space from a position of strength. Over time, the cumulative impact is likely to reward organizations that treat supply chain resilience as a product feature-protecting continuity, reducing substitution risk, and sustaining customer trust during periods of trade volatility.

Segmentation reveals distinct buying logic across detection targets, sensing methods, connectivity choices, power formats, end users, and routes to market

Key segmentation patterns highlight how purchasing logic changes based on what a detector is designed to sense, how it connects, and where it is installed. Across product types such as standalone smart detectors, combo detectors integrating smoke or carbon monoxide functions, and system-integrated detectors paired with automatic shutoff valves, the perceived value increasingly centers on end-to-end outcomes. Buyers looking for simple upgrades tend to prioritize quick installation and app alerts, while safety-driven households and property operators lean toward integrated solutions that can actively reduce hazard escalation.When viewed by sensing technology, electrochemical elements are often associated with precision for certain target gases, while metal-oxide semiconductor approaches are frequently selected for broad sensitivity and cost efficiency, and infrared sensing is commonly evaluated for stability and select applications. These technology choices influence maintenance expectations, calibration behavior, and long-term reliability, which in turn shape warranty design and customer support requirements. As decision-makers become more informed, messaging that links sensing choice to practical benefits-such as reduced nuisance alarms, clearer end-of-life indications, or stable detection performance-tends to resonate more than generic “smart” claims.

Connectivity segmentation further clarifies the competitive battleground. Wi-Fi-enabled devices typically win where direct-to-cloud notifications and broad consumer familiarity matter, while Zigbee and Z-Wave devices often succeed in hub-based ecosystems that emphasize reliability and low-power networking. Bluetooth options can appeal to cost-sensitive or privacy-focused buyers who prefer local control, whereas emerging Matter-aligned strategies are increasingly evaluated for future-proofing and cross-platform compatibility. Power source segmentation also remains decisive: hardwired units support continuous operation and are often preferred in new builds or renovations, battery-powered devices enable fast retrofits, and plug-in configurations can suit specific room layouts while requiring careful user education about outlet availability and tamper risk.

End-use segmentation introduces a distinct set of priorities. Residential homeowners frequently focus on convenience, aesthetics, and mobile alerts; renters and landlords prioritize easy maintenance cycles and tamper resistance; and commercial or light-industrial settings often require stricter compliance alignment and more rigorous durability expectations even when the product is “smart home” adjacent. Finally, distribution channel segmentation-spanning online marketplaces, consumer electronics retail, home improvement stores, professional installer networks, and security service providers-shapes how trust is established. Online channels reward clear reviews and frictionless setup, while professional channels reward certification clarity, predictable replacement programs, and dependable post-install support.

Regional adoption diverges across the Americas, EMEA, and Asia-Pacific as infrastructure, housing patterns, standards, and channel influence shape demand

Regional dynamics show that adoption is shaped as much by housing stock, fuel usage, and regulatory emphasis as by consumer interest in connected living. In the Americas, demand is often linked to a mix of retrofit activity and insurance or municipal safety expectations, with strong interest in app-based alerts and integration with broader home security ecosystems. Buyers in this region also respond to installer recommendations and retail visibility, making channel execution and education especially important.Across Europe, the Middle East, and Africa, market behavior varies widely by country-level standards, construction practices, and the prevalence of natural gas infrastructure. In many European markets, product acceptance is influenced by established safety norms and expectations for quality certification, while smart home adoption is steadily expanding via platform ecosystems and energy-management use cases. In the Middle East, premium residential developments can accelerate uptake of integrated safety solutions, while parts of Africa may emphasize affordability, durability, and power resilience, encouraging simplified connectivity approaches and clear maintenance guidance.

In Asia-Pacific, momentum is supported by rapid urbanization, high-density housing, and growing participation in connected-device ecosystems. New apartment builds and smart community initiatives can create natural pathways for bundled safety deployments, especially when property developers standardize on interoperable devices. At the same time, the region’s diversity in building quality and network infrastructure means products must balance connectivity sophistication with robust offline alarm behavior. As regional strategies mature, companies that localize certification readiness, language support, and installer training are better positioned to convert interest into sustained deployment.

Competitive advantage is shifting toward trusted sensing performance, ecosystem interoperability, security-by-design, and lifecycle support that sustains customer confidence

Competition is evolving across consumer electronics brands, specialized safety manufacturers, and smart home platform participants. Established safety players tend to compete on detection credibility, certification readiness, and long product lifecycles, while consumer-tech entrants often differentiate through user experience, app design, and ecosystem integration. Increasingly, both camps are converging: safety incumbents are upgrading connectivity and automation features, and tech-led brands are investing in reliability signals such as improved self-testing, clearer device health reporting, and more robust customer support.Key company strategies commonly cluster around ecosystem partnerships, product line expansion, and recurring service attachment. Interoperability with voice assistants, security systems, and automation hubs is frequently used to reduce friction and boost retention. In addition, many vendors broaden portfolios to include complementary safety devices-such as smoke, carbon monoxide, and water leak detection-so buyers can manage a unified safety dashboard. This bundling strategy strengthens cross-selling and increases the likelihood that a household standardizes on one app environment.

Another notable area of differentiation is lifecycle management. Companies that simplify device replacement, provide transparent end-of-life alerts, and offer responsive firmware updates tend to build stronger trust, which matters deeply in safety categories. As data security expectations rise, vendors are also separated by their ability to communicate security posture clearly, maintain update discipline, and design products that remain safe even during connectivity interruptions. Overall, the most competitive organizations treat smart gas detection as a safety service delivered through hardware, software, and support-not merely a device on a shelf.

Leaders can win by prioritizing outcome-driven safety design, resilient sourcing, and clearer education that reduces friction across consumer and professional channels

Industry leaders can strengthen position by designing for outcomes rather than features. That starts with aligning detection performance, offline-safe behavior, and actionable alerting so the device remains valuable even when the network is down. From there, companies should expand automation capabilities thoughtfully, prioritizing integrations that reduce incident impact-such as controlled ventilation triggers or compatibility with shutoff valves-while ensuring users can understand and override actions when needed.Next, build supply chain resilience into the product roadmap. Modularizing radio and sensing subsystems can reduce redesign risk when component sourcing changes, and dual-sourcing critical parts can protect availability during tariff or logistics disruptions. In parallel, documentation, certification planning, and controlled change management should be treated as strategic capabilities, because rapid substitutions can create compliance bottlenecks in regulated safety categories.

Finally, improve go-to-market effectiveness through education and trust signals. Clear installation guidance, transparent maintenance instructions, and well-designed in-app device health status reduce returns and increase satisfaction. For professional channels, offer predictable replacement programs, installer training materials, and consistent technical support. For consumer channels, ensure packaging and product pages explain what gases are detected, where the device should be placed, and what integrations are supported. By combining reliability, resilience, and clarity, leaders can earn long-term adoption in a category where trust is the primary currency.

A triangulated methodology combining secondary validation and stakeholder interviews builds a practical, decision-ready view of smart home gas detector dynamics

The research methodology integrates structured secondary research, targeted primary inputs, and rigorous synthesis to ensure a practical view of the smart home gas detector landscape. Secondary research includes analysis of publicly available regulatory guidance, certification frameworks, company disclosures, product documentation, patent activity signals where relevant, and channel observations across e-commerce and retail. This foundation is used to map technology options, interoperability trends, and common customer experience patterns.Primary research is conducted through interviews and discussions with stakeholders such as product managers, sensing and hardware engineers, channel partners, installers, and procurement decision-makers. These conversations focus on real-world performance expectations, maintenance behavior, integration requirements, and purchasing drivers, as well as constraints created by certification, installation environments, and component availability. Inputs are cross-checked to reduce single-source bias and to distinguish aspirational roadmaps from deployable capabilities.

Finally, findings are consolidated through triangulation and qualitative validation. Themes are compared across regions, end users, and distribution routes to identify consistent patterns and meaningful points of divergence. The result is an executive-ready narrative that highlights strategic opportunities, adoption barriers, and competitive approaches without relying on speculative assumptions. This methodology is designed to support decisions across product development, partnerships, and commercial execution.

Smart home gas detection now rewards trust at scale, combining reliable sensing, resilient operations, and seamless integration into everyday connected living

Smart home gas detectors are increasingly defined by integration, trust, and operational simplicity. As connected households become mainstream, stakeholders expect gas detection to deliver more than a siren-providing timely, understandable alerts and fitting naturally into broader safety and automation routines. This elevates the importance of interoperability, cybersecurity discipline, and product behaviors that remain dependable under real-world conditions.Meanwhile, external pressures such as tariff-driven sourcing shifts and component volatility are pushing organizations to treat resilience as a competitive differentiator. Companies that modularize designs, professionalize change control, and maintain certification readiness can respond faster while preserving reliability. At the same time, segmentation patterns show that no single configuration fits all: sensing technologies, connectivity, power formats, and channel strategies must align with the buyer’s environment and risk tolerance.

Ultimately, the category rewards firms that earn confidence over time. Those that pair credible detection performance with clear user guidance, robust lifecycle support, and smart ecosystem alignment are best positioned to build durable adoption in a safety market where reputation and reliability drive repeat selection.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Smart Home Gas Detector Market

Companies Mentioned

The key companies profiled in this Smart Home Gas Detector market report include:- Airthings AS

- BRK Brands, Inc.

- Carrier Global Corporation

- D-Link Corporation

- Elitech Technology, Inc.

- Forensics Detectors

- Honeywell International Inc.

- Johnson Controls International plc

- Kidde

- Klein Tools, Inc.

- Legrand SA

- Nest Labs, Inc.

- Resideo Technologies, Inc.

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Schneider Electric SE

- Siemens AG

- Xiaomi Inc.

- XSY Electric Appliances Co., Ltd.

Table Information

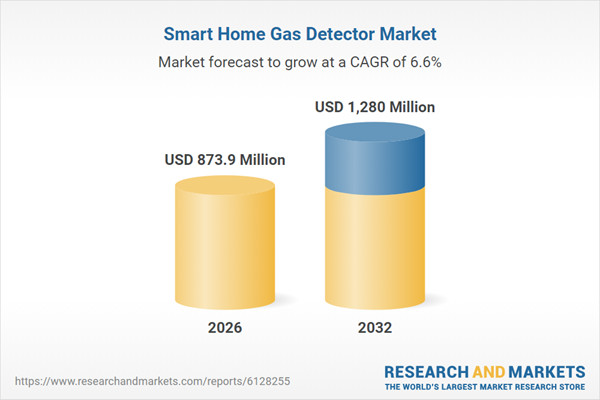

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 873.9 Million |

| Forecasted Market Value ( USD | $ 1280 Million |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |