Speak directly to the analyst to clarify any post sales queries you may have.

Online reading software is evolving into a mission-critical layer for learning and work, reshaping user expectations across devices, content, and AI

Online reading software has shifted from a convenience layer on top of digital content into a core productivity system for learning, work, and regulated information access. What began as basic e-book viewers and web readers has matured into multi-modal environments that combine text rendering, annotation, content management, personalization, collaboration, and analytics. As organizations and individuals rely more heavily on digital-first materials, the software experience increasingly determines reading comprehension, accessibility outcomes, knowledge retention, and even operational efficiency.At the same time, expectations have expanded. Readers now assume seamless continuity across devices, instant search and summarization, offline resilience, and frictionless integration with learning management systems, document repositories, and identity platforms. Publishers and institutions expect robust rights management, detailed usage insights, and distribution controls that do not sacrifice user experience. Consequently, online reading software sits at the intersection of content ecosystems, device platforms, privacy regulations, and emerging AI capabilities.

This executive summary frames the market through the forces reshaping buyer requirements, the policy and supply-chain variables influencing cost structures, the segmentation patterns that reveal where adoption is accelerating, and the regional differences that alter implementation playbooks. Together, these perspectives provide a coherent foundation for strategic decisions in product development, partnerships, procurement, and commercialization.

From passive consumption to governed, AI-augmented reading workflows, the landscape is shifting toward interoperability, accessibility, and trust

The most transformative shift is the redefinition of “reading” as an interactive workflow rather than a passive activity. Modern platforms increasingly support active recall, spaced repetition, contextual lookup, and structured note capture that turns highlights into study assets or work artifacts. As a result, vendors are building reading environments that behave more like productivity suites, blending content consumption with writing, task capture, and collaborative review.In parallel, AI is changing the center of gravity for product differentiation. On-device and cloud-based models are enabling features such as adaptive summaries, vocabulary scaffolding, reading-level adjustments, citation extraction, and multi-document synthesis. However, buyers are also scrutinizing the provenance of AI outputs, data retention policies, and model training boundaries. This creates a premium for transparent AI, configurable controls, and governance tooling that can satisfy schools, enterprises, and public-sector agencies.

Another important shift is the growing weight of accessibility and inclusive design. Compliance with accessibility standards is no longer limited to specific sectors; it is increasingly viewed as a baseline requirement. Screen reader compatibility, dyslexia-friendly modes, font and spacing controls, read-aloud synchronization, and multilingual support are becoming standard expectations, and platforms that treat accessibility as an add-on risk churn and procurement exclusion.

Finally, interoperability has become a make-or-break factor. Institutions want to avoid lock-in while still maintaining consistent user experiences and rights protection. Support for common content formats, identity standards, and integrations with learning and content systems is driving platform selection. As these shifts converge, the landscape is being reshaped by vendors that can balance user delight with enterprise-grade governance and publisher-grade rights controls.

Potential 2025 U.S. tariff ripple effects may reshape device refresh cycles, cloud cost structures, and procurement risk tolerance for reading platforms

United States tariff actions expected in 2025, along with the broader trend toward tighter trade controls and supply-chain localization, are poised to influence online reading software in less obvious but meaningful ways. While software itself is not typically tariffed like physical goods, the ecosystem it depends on-devices, peripherals, networking equipment, and data center hardware-can experience cost and availability swings that ripple through adoption and deployment decisions.First, device procurement cycles may tighten for schools, libraries, and enterprises that rely on large fleet refreshes. If tariffs increase the landed cost of tablets, e-readers, laptops, or key components, institutions may extend device lifetimes and prioritize lightweight, browser-based reading experiences that run well on older hardware. This dynamic favors platforms optimized for performance, offline caching, and graceful degradation, and it penalizes solutions that require heavy local processing or the newest operating system features.

Second, infrastructure and hosting economics may shift. Tariffs that affect servers, storage, and networking components can influence the cost basis of cloud and colocation providers. Over time, that can surface as pressure on software vendors’ margins or as pricing adjustments passed on to customers. In response, vendors are likely to accelerate efficiency efforts such as content delivery optimization, compression, edge caching, and more disciplined AI compute usage. This is especially relevant for AI-enhanced reading features that can be compute-intensive when scaled.

Third, tariffs can interact with compliance and security priorities. When supply-chain risk becomes more salient, regulated buyers often re-evaluate vendor dependencies, including where data is processed and which third parties are involved. As a result, software providers may see stronger demand for regional hosting options, clearer subprocessor disclosures, and flexible deployment models, including private cloud or hybrid configurations.

Taken together, the cumulative impact is a market that may become more cost-sensitive and risk-aware in procurement, with heightened emphasis on platform efficiency, deployment flexibility, and transparent operational governance. Vendors that proactively align their architecture and pricing to these constraints will be better positioned to sustain adoption even if macro conditions introduce friction.

Segmentation highlights distinct buying triggers across deployment, platforms, content formats, end users, and monetization models shaping adoption paths

Segmentation reveals that demand patterns differ sharply depending on what users read, where they read, and why they read. When viewed through the lens of component, solutions that unify content rendering with robust annotation, search, and organization are increasingly favored over single-purpose viewers, yet services remain pivotal for institutions that need implementation support, migration, and training to drive actual adoption. This is especially true where change management is required to standardize reading workflows across departments or grade levels.Looking at deployment, cloud-based approaches continue to align with the need for rapid updates, cross-device continuity, and analytics, while on-premise and hybrid models retain importance for regulated environments that require strict data residency, bespoke integrations, or controlled network access. The most competitive providers are narrowing the trade-off by offering configurable architectures, strong identity integration, and encryption controls that satisfy governance demands without undermining usability.

Across platform type, web-based readers are gaining strategic value because they reduce device dependency and simplify administration, particularly in mixed-device settings. At the same time, mobile applications remain critical for commuter learning, fieldwork, and emerging markets where smartphones are the primary computing device. Desktop experiences continue to matter for deep work, research-heavy reading, and enterprise knowledge workflows where multi-window productivity and advanced input methods are common.

Content type segmentation shows that e-books and digital textbooks drive structured learning scenarios, while PDFs and document-based reading remain foundational in enterprises and government due to entrenched document workflows. Academic journals and research articles create demand for citation handling, reference linking, and library authentication, whereas web articles and news formats elevate needs for distraction reduction, read-later queues, and consistent typography. Audiobook and read-aloud capabilities increasingly serve both accessibility and multitasking use cases, blurring the line between reading and listening.

End-user segmentation further clarifies adoption drivers. K-12 institutions prioritize classroom management, accessibility, and aligned curriculum content; higher education places more weight on library integrations, annotation depth, and research workflows; corporate users focus on knowledge capture, compliance, and productivity integrations; and individual consumers prioritize ease of use, personalization, and cross-device sync. Finally, pricing model segmentation underscores a shift toward flexible subscriptions and institution-wide licensing, while freemium approaches remain a powerful top-of-funnel tactic when paired with clear upgrade paths for advanced study features, collaboration, or governance.

Regional adoption is shaped by regulation, language, infrastructure, and procurement norms, demanding adaptable reading platforms with localized strength

Regional dynamics materially change both product requirements and go-to-market motion. In the Americas, demand is heavily influenced by institutional procurement, privacy expectations, and strong competition among established productivity and education ecosystems. Buyers often expect seamless single sign-on, mature admin controls, and integrations with existing learning and content platforms, and they increasingly evaluate AI features through the lens of data governance and liability.In Europe, Middle East & Africa, regulatory sensitivity and multilingual requirements rise to the forefront. European buyers frequently scrutinize data processing terms, cross-border transfers, and accessibility compliance, which elevates the value of transparent controls and regional hosting options. Across the Middle East, national digital education programs and smart government initiatives can accelerate adoption, while local language support and content partnerships become decisive differentiators. In parts of Africa, mobile-first usage and connectivity variability make offline capability, bandwidth-efficient rendering, and affordable licensing structures particularly important.

In Asia-Pacific, scale, mobile penetration, and education intensity drive a fast-evolving landscape. Markets with high digital learning adoption demand sophisticated study tooling and strong device interoperability, while rapidly expanding education and training segments emphasize affordability, local content availability, and resilient performance on mid-range devices. Additionally, the region’s linguistic diversity and input methods increase the importance of typography quality, character support, and robust search across scripts.

Across all regions, the direction is consistent: buyers want platforms that respect local constraints-whether regulatory, infrastructural, or linguistic-without fragmenting the experience. Vendors that productize regional adaptability through configurable policies, modular integrations, and localization depth are better positioned to scale globally while still winning in country-level procurement processes.

Company performance hinges on balancing user-delighting reading experiences with governance, ecosystem partnerships, and trustworthy AI feature delivery

Competitive differentiation in online reading software increasingly centers on the ability to unify user-centric reading experiences with enterprise and institutional controls. Leading companies tend to invest in rendering quality, annotation fidelity, and cross-device continuity because these elements directly determine day-to-day user satisfaction. However, the strongest momentum is often seen among providers that also treat administration, identity, and policy enforcement as first-class product capabilities.Another defining trait is ecosystem positioning. Some companies win by embedding reading into broader productivity, education, or content distribution suites, reducing friction for buyers that prefer consolidated vendor relationships. Others succeed through specialization, offering superior academic workflows, research management, or accessibility features that outperform generalist tools. In both cases, platform extensibility-via APIs, integrations, and support for common content standards-has become a key lever for sustaining relevance.

AI strategy is also separating contenders from followers. Companies that deliver assistive intelligence while maintaining transparency, user control, and content-respectful processing are building trust with institutions that have low tolerance for ambiguity. Conversely, vendors that launch opaque AI features without clear governance guardrails risk procurement slowdowns, particularly in education and regulated industries.

Finally, partnerships remain central to growth. Relationships with publishers, libraries, learning platforms, device makers, and identity providers can expand distribution and reduce adoption friction. As procurement teams increasingly evaluate total solution fit-content compatibility, privacy posture, and operational support-companies with credible partner ecosystems and well-documented compliance practices tend to secure larger, longer-term deployments.

Leaders can win by optimizing for constrained environments, making AI governance explicit, expanding interoperability, and productizing accessibility outcomes

Industry leaders should treat performance on constrained devices as a strategic priority, not an engineering afterthought. Optimizing load times, annotation responsiveness, and offline resilience can protect adoption when hardware refreshes slow or budgets tighten. In practice, this means investing in efficient rendering pipelines, intelligent caching, and content delivery strategies that reduce bandwidth and compute consumption.Next, leaders should operationalize trust in AI. That requires clear user-facing explanations of what an AI feature does, what data it uses, and how outputs should be validated. It also requires admin-level controls to enable, restrict, or scope AI by user group and content type. Building auditability-such as logs for AI-assisted actions and configurable retention policies-can accelerate approvals in institutional procurement.

Additionally, interoperability should be pursued as a growth multiplier. Standardized integrations with identity systems, learning environments, library authentication, and document repositories shorten sales cycles and reduce implementation risk. Where possible, leaders should support common formats and provide migration tooling that preserves highlights and notes, since annotation portability is increasingly a deciding factor for switching.

Leaders should also elevate accessibility from compliance to competitive advantage. Investing in robust read-aloud, keyboard navigation, contrast controls, and dyslexia-friendly modes broadens addressable audiences and improves satisfaction across all users. This is particularly impactful when accessibility features are consistent across web, mobile, and desktop experiences.

Finally, go-to-market teams should align packaging with measurable outcomes. Subscription tiers and institutional licenses should map to concrete value drivers such as advanced study workflows, collaboration, admin governance, analytics, and integration depth. Clear onboarding playbooks, educator or knowledge-worker enablement content, and customer success milestones help ensure that deployments translate into habitual use rather than shelfware.

A triangulated methodology blends stakeholder validation with product, policy, and procurement signals to map real-world adoption and requirements

The research methodology integrates primary and secondary inputs to build a structured view of how online reading software is designed, purchased, deployed, and used across sectors. The process begins by defining the product scope to include software that enables digital reading experiences, annotation, content organization, and related administrative controls, while also mapping adjacent capabilities such as analytics, accessibility tooling, and AI-assisted reading features.Secondary research focuses on public materials such as product documentation, standards and regulatory guidance, developer resources, pricing disclosures, app marketplace signals, and institutional procurement artifacts when publicly available. This establishes a baseline for feature availability, deployment options, integration claims, and compliance positioning.

Primary research emphasizes qualitative validation through stakeholder discussions across the value chain, including platform vendors, channel and implementation partners, publishers and content distributors, institutional buyers, administrators, and end users. These discussions are used to test assumptions about adoption barriers, switching costs, must-have features, and the operational realities of deployment, training, and support.

The analysis then triangulates insights across segmentation dimensions and regions to identify consistent themes and meaningful divergences. Throughout, emphasis is placed on cross-checking claims, separating roadmap intent from shipped capability, and describing market dynamics without relying on speculative sizing. The outcome is a decision-oriented narrative that highlights drivers, constraints, competitive approaches, and practical implications for strategy.

The market is converging on daily-use reading workflows that are accessible, interoperable, and governed - reshaping how buyers choose platforms

Online reading software is entering a phase where user experience innovation must be matched by institutional-grade governance and operational resilience. AI-assisted features are raising expectations for speed and comprehension support, yet they also intensify scrutiny around privacy, reliability, and transparency. Meanwhile, accessibility and interoperability are no longer differentiators reserved for specialized buyers; they are becoming table stakes across education, enterprise, and public-sector use cases.As macro factors such as device costs, infrastructure economics, and policy constraints introduce uncertainty, buyers are gravitating toward solutions that minimize dependency risks and maximize flexibility. This elevates the value of web-first delivery, hybrid deployment options, strong identity and integration frameworks, and content portability that protects user annotations and learning artifacts.

The competitive landscape will favor companies that can deliver three outcomes at once: a superior reading workflow that users choose daily, governance capabilities that administrators can defend, and ecosystem fit that reduces friction with content providers and existing systems. Organizations that align their product strategy and procurement criteria to these realities will be better equipped to scale digital reading experiences sustainably.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Online Reading Software Market

Companies Mentioned

The key companies profiled in this Online Reading Software market report include:- Amazon.com, Inc.

- Apple Inc.

- Barnes & Noble, Inc.

- Bookmate Ltd.

- Google LLC

- Hoopla Digital, LLC

- OverDrive, Inc.

- Rakuten, Inc.

- Scribd, Inc.

- Wattpad Corp.

- WEBTOON Entertainment Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | January 2026 |

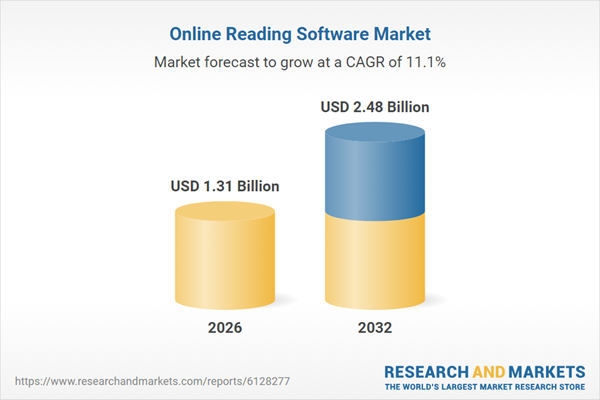

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.31 Billion |

| Forecasted Market Value ( USD | $ 2.48 Billion |

| Compound Annual Growth Rate | 11.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |