Speak directly to the analyst to clarify any post sales queries you may have.

Understanding the Emergence and Significance of Desktop Robots as a Catalyst for Innovation in Industrial Education and Healthcare Environments

As organizations and institutions increasingly pursue automation and advanced capabilities at a compact scale, desktop robots have emerged as a pivotal asset for innovation. These miniature yet sophisticated systems combine cutting-edge hardware, software algorithms, and artificial intelligence frameworks to deliver modular solutions in fields ranging from product prototyping to specialized training. By integrating robotics directly onto workbenches, education laboratories, and healthcare settings, stakeholders are unlocking unprecedented precision, flexibility, and cost efficiency.The evolution of desktop robots reflects parallel advances in sensors, actuators, and control software. Rather than relegating complex tasks to large-scale industrial facilities, teams can now conduct developmental testing, collaborative experimentation, and remote demonstrations in confined spaces. This transformative capacity underscores the growing role of desktop robots in accelerating time to insight, enhancing user engagement, and democratizing access to advanced automation.

Looking forward, the intersection of enhanced processing power, intuitive programming environments, and emerging machine learning capabilities promises to elevate desktop robots from specialized tools to mainstream assets. In navigating this trajectory, decision makers must cultivate a nuanced understanding of product ecosystems, integration pathways, and evolving user requirements.

How Evolving Technological Breakthroughs and Shifting Stakeholder Needs Are Remolding the Desktop Robotics Landscape

In recent years, a confluence of technological breakthroughs and shifting stakeholder expectations has transformed the desktop robotics landscape. Advances in computer vision, deep learning architectures, and intuitive programming interfaces have converged to deliver unprecedented levels of autonomy and versatility at the bench scale. Where early desktop robots demanded extensive manual calibration, modern variants leverage onboard intelligence to self-optimize navigation, object recognition, and collaborative motions.Simultaneously, end users across educational institutions, research organizations, and enterprise development teams are redefining applications. What began as demonstration platforms for engineering curricula now enable remote telepresence experiences, complex product assembly simulations, and precision-driven rehabilitation protocols. The rise of hybrid learning modalities, heightened demand for real-time data analytics, and growing emphasis on contactless operations have further accelerated adoption.

Consequently, the market now features an ecosystem of specialized modules, standardized control software, and service offerings that simplify deployment and maintenance. As the lines between industrial automation and consumer robotics blur, vendors must adapt to increasingly discerning requirements for interoperability, security, and user-centric design. This broader shift underscores a maturation of the desktop robotics domain from experimental niche to strategic enabler.

Examining the Complex Ripple Effects of New Tariffs on Desktop Robotics Supply Chains and Cost Structures

The imposition of new tariffs on robotics components and subassemblies has introduced a complex layer of cost pressure and supply chain reconfiguration for desktop robotics manufacturers and end users. Industries that once relied on seamless cross-border flows of precision sensors, control boards, and mechatronic modules now confront higher duty burdens, extended lead times, and the imperative to diversify sourcing strategies.As a result, many original equipment manufacturers have responded by revisiting contract terms with component suppliers, exploring alternate procurement hubs in low-tariff jurisdictions, and recalibrating bills of materials to prioritize domestically produced alternatives. Firms with preexisting in-house design capabilities have accelerated internal development of key subsystems to mitigate exposure. Meanwhile, integration partners and service providers have begun adapting price models and maintenance agreements to reflect shifting cost bases.

Despite these challenges, forward-looking organizations view the tariff-driven environment as a catalyst for supply chain resilience. By fostering closer collaboration with regional partners, investing in modular architectures amenable to local component swaps, and streamlining certification processes, stakeholders can uphold product quality while managing total landed costs. In this context, strategic agility and localization have emerged as critical differentiators for companies vying to maintain market leadership under the evolving regulatory regime.

Unpacking Layered Insights Across Product Type, Application, Technology, Component, and End User Dimensions

The desktop robotics market can be understood through multiple lenses. From a product type standpoint, systems fall into autonomous platforms, collaborative units, and telepresence solutions, with each segment further refined by subcategories such as AI-driven navigation and dual-arm collaboration. Conversely, application-driven differentiation ranges from corporate training environments and higher education laboratories to game robotics, social robots, medication dispensing modules, and prototype validation rigs.Technological segmentation illuminates the divide between AI-based and vision-based systems, with subsegments in deep learning, machine vision, and three-dimensional sensing capabilities. Component-level analysis underscores hardware elements like controllers, end effectors, manipulators, power systems, and sensor arrays, as well as software stacks encompassing simulation tools, control interfaces, and programming APIs, complemented by integration, maintenance, and training services.

Considering end users, the market spans large enterprises such as automotive and electronics manufacturers, research institutions that include private labs and universities, and small and medium enterprises encompassing boutique educational entities, clinics, and startups. This layered segmentation highlights where design complexity, service requirements, and capital expenditure profiles diverge, guiding stakeholders in tailoring offerings to precise customer needs.

How Regional Innovation, Regulatory Landscapes, and Sector Priorities Drive Divergent Desktop Robotics Trends

Regional dynamics shape both demand patterns and development strategies in the desktop robotics space. In the Americas, innovation hubs in North America spearhead advanced research and commercialization efforts, while Latin American markets show growing interest in educational and healthcare automation solutions. Customer priorities often center on integration ease, post-sales service, and compatibility with existing industrial ecosystems.Meanwhile, the Europe, Middle East & Africa region exhibits a strong regulatory emphasis on safety standards and data privacy, encouraging vendors to engineer solutions that comply with stringent certification frameworks. Market growth here is fueled by initiatives to modernize academic curricula and incorporate robotics into public sector research programs.

Across Asia-Pacific, rapid industrialization and rising R&D investment underpin a proliferation of desktop robotics deployments in both corporate and academic environments. Local manufacturers are achieving scale by aligning product roadmaps with government-driven automation agendas, while service providers emphasize localized training and maintenance support to bolster user confidence and operational uptime.

Examining How Strategic Alliances and Cross-Domain Expertise Are Shaping the Competitive Desktop Robotics Ecosystem

Prominent stakeholders are defining the competitive contours of the desktop robotics market through differentiated strategies. Established industrial automation companies have extended their portfolios to include bench-scale robots, leveraging existing distribution channels and integration expertise to accelerate adoption. Concurrently, specialized newcomers focus on modular, open-source platforms that appeal to academic and startup communities seeking customization and rapid prototyping capabilities.Strategic partnerships between hardware innovators and AI software developers are emerging as a hallmark of this sector. Alliances that combine robust mechatronic design with advanced machine learning frameworks facilitate rapid deployment of out-of-the-box solutions, appealing to organizations prioritizing minimal implementation friction. Furthermore, service-focused enterprises are carving out niches by offering subscription-based maintenance and training programs alongside product sales.

Competitive differentiation increasingly hinges on end-to-end ecosystems that seamlessly integrate hardware, software, and support. Companies excelling in this domain are those that provide flexible financing options, robust developer communities, and global service networks. As a result, collaboration between incumbents and agile startups is becoming a defining feature of the market’s evolution.

Adopting Strategic Partnerships, Modular Architectures, and Community Engagement to Pioneering Leadership

Industry leaders seeking to capitalize on desktop robotics momentum should embark on several targeted initiatives. First, building strategic partnerships with component suppliers in diverse geographies will mitigate tariff exposure and enhance supply chain resilience. Next, investing in modular platform architectures can streamline customization efforts and reduce time to deployment for end users.In parallel, organizations must cultivate robust developer and user communities by offering accessible programming tools, comprehensive documentation, and tiered support plans. This approach not only accelerates adoption but also generates valuable user feedback loops, informing iterative product enhancements. Companies should also prioritize the alignment of their roadmaps with evolving regulatory standards to secure early certifications and cultivate trust in safety-critical applications.

Lastly, deploying dedicated training programs for integration partners and end users will differentiate service offerings and foster long-term customer loyalty. By combining these actions with agile internal processes for rapid prototyping and field validation, industry leaders can navigate the shifting landscape with confidence and drive sustained growth.

Detailing a Robust Research Framework Combining Expert Interviews, Technical Analysis, and Data Triangulation

Our research methodology integrates a rigorous blend of primary and secondary data collection to ensure comprehensive market insights. Primary research comprises in-depth interviews with industry executives, system integrators, academic researchers, and end users, yielding qualitative perspectives on adoption drivers, operational challenges, and feature priorities.Secondary research involves consolidation of technical whitepapers, patent filings, regulatory documentation, and corporate disclosures. This is complemented by analysis of academic publications, industry consortium reports, and conference proceedings to capture emerging trends in AI, sensor technology, and human-robot interaction.

Data triangulation validates findings by cross-referencing stakeholder inputs with observed market behaviors and documented performance benchmarks. Our approach ensures that conclusions are grounded in factual evidence and reflect the most current technological and regulatory developments. Through iterative reviews and expert panel consultations, the methodology upholds a high standard of accuracy and relevance for decision makers.

Synthesizing Technological, Regulatory, and Customer-Centric Dynamics to Chart a Path Forward in Desktop Robotics

Navigating the complexities of the desktop robotics market requires a holistic understanding of technological evolution, regulatory influences, and customer-centric segments. As tariffs reshape supply chains and regional priorities influence innovation trajectories, stakeholders must adopt flexible strategies that emphasize modular design, local collaboration, and robust support ecosystems.Through strategic partnerships, diligent supply chain planning, and community-driven development initiatives, organizations can overcome cost pressures and accelerate adoption. The interplay of advanced AI capabilities, precise vision systems, and intuitive software interfaces positions desktop robots as a transformative tool across education, healthcare, research, and enterprise innovation.

Ultimately, success hinges on the ability to align product roadmaps with market needs, secure regulatory approval, and deliver exceptional post-sales experiences. By internalizing these insights and acting with agility, industry participants will be well positioned to lead in a domain that promises to redefine how we interact with automation at the bench scale.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Robot Type

- Articulated Robots

- Cartesian Robots

- Collaborative Desktop Robots (Cobots)

- Component

- Hardware

- Controllers

- End Effectors

- Manipulators

- Power Systems

- Sensors

- Services

- Integration

- Maintenance

- Training

- Software

- Control Software

- Programming Interfaces

- Simulation Software

- Hardware

- Payload

- 5-10 Kg

- Above 10 Kg

- Below 5 Kg

- Application

- Assembly

- Dispensing

- Entertainment

- Inspection

- Material Handling

- Packaging

- Research & Education

- Soldering & Welding

- End-Use Industry

- Academic & Research Institutions

- Aerospace & Defense

- Automotive

- Consumer Goods

- Electronics & Semiconductors

- Food & Beverage

- Pharmaceuticals & Healthcare

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Hugging Face, Inc.

- LivingAI

- AB Controls, Inc

- Adtech (Shenzhen) Technology Co., Ltd.

- Bless This Stuff

- Digital Dream Labs, INC

- Dobot

- Elephant Robotics

- Energize Lab

- Fancort Industries, Inc

- IADIY Technology

- Iwashita Engineering, Inc.

- Izumi International, Inc.

- JANOME Corporation

- JBC Soldering S.L.

- KEYI TECHNOLOGY INC

- MangDang

- Miko Mini

- Orbital Mekatronik Systems Pvt. Ltd.

- Pinnacle Automations

- Rotrics

- TM Robotics

- Toyo Robotics

- Zhejiang Neoden Technology Co.,Ltd

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Desktop Robots Market report include:- Hugging Face, Inc.

- LivingAI

- AB Controls, Inc

- Adtech (Shenzhen) Technology Co., Ltd.

- Bless This Stuff

- Digital Dream Labs, INC

- Dobot

- Elephant Robotics

- Energize Lab

- Fancort Industries, Inc

- IADIY Technology

- Iwashita Engineering, Inc.

- Izumi International, Inc.

- JANOME Corporation

- JBC Soldering S.L.

- KEYI TECHNOLOGY INC

- MangDang

- Miko Mini

- Orbital Mekatronik Systems Pvt. Ltd.

- Pinnacle Automations

- Rotrics

- TM Robotics

- Toyo Robotics

- Zhejiang Neoden Technology Co.,Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | October 2025 |

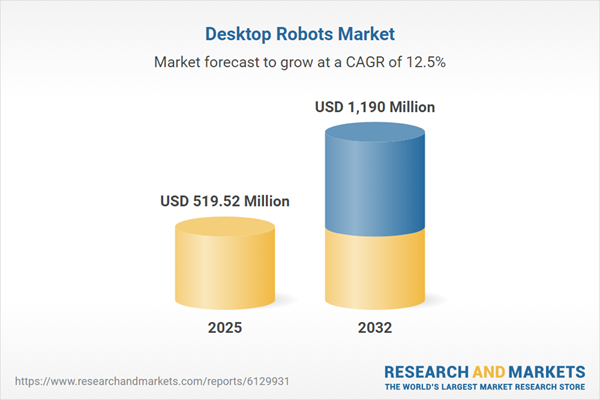

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 519.52 Million |

| Forecasted Market Value ( USD | $ 1190 Million |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |