Speak directly to the analyst to clarify any post sales queries you may have.

Understanding the Critical Role of Disposable Bite Blocks in Modern Medical and Dental Procedures and Their Influence on Patient Safety and Clinical Efficiency

Disposable bite blocks have emerged as indispensable tools across a range of clinical settings, from routine dental procedures to advanced endoscopic and anesthesia applications. Designed to maintain jaw position, protect teeth, and facilitate unobstructed access for instruments, these single-use devices contribute significantly to patient safety, clinician efficiency, and infection control protocols. Their growing adoption reflects an industry-wide shift toward disposable, sterile accessories that minimize cross-contamination risks and streamline operational workflows.In recent years, advancements in materials science have enabled manufacturers to offer foam-based, polyvinyl chloride, rubber, and silicone variants that balance comfort, flexibility, and durability. Meanwhile, evolving procedural requirements and heightened regulatory scrutiny have encouraged providers to reassess their device preferences, leading to broader integration of specialized bite blocks in both adult and pediatric care. As clinical teams strive to optimize patient outcomes, the role of a well-designed disposable bite block has become ever more pronounced.

This executive summary presents a synthesized analysis of the critical forces shaping the disposable bite block landscape. By examining transformative market shifts, the impact of United States tariffs effective in 2025, key segmentation and regional perspectives, competitive dynamics, and actionable recommendations, we aim to equip decision-makers with the comprehensive intelligence necessary to navigate emerging challenges and capitalize on strategic opportunities.

Exploring Technological Advances, Evolving Clinical Protocols, and Innovative Material Developments Reshaping the Future of Disposable Bite Block Applications

Recent years have witnessed a profound transformation in how disposable bite blocks are designed, manufactured, and utilized. Advances in polymer and elastomer technologies have enabled the creation of softer, more anatomically conforming silicone and foam-based variants that reduce tissue stress and enhance patient comfort. Simultaneously, digital dentistry and endoscopy platforms have placed new demands on device precision, spurring collaboration between device suppliers and instrument manufacturers to ensure seamless integration.Moreover, heightened attention to environmental sustainability has prompted the development of recyclable and bioresorbable alternatives, challenging traditional single-use paradigms and encouraging supply chain optimization. Regulatory bodies have also introduced more stringent validation and traceability requirements, compelling companies to invest heavily in quality systems and documentation. As a result, the competitive landscape is shifting from pure cost-driven models toward differentiation based on product performance, material innovation, and comprehensive compliance support.

Taken together, these technological advances, evolving clinical protocols, and sustainability considerations are reshaping the future trajectory of disposable bite block applications. Stakeholders who anticipate these trends and align their strategies accordingly will secure a leading position in a market that prizes both innovation and reliability.

Analyzing the Ramifications of 2025 United States Tariff Measures on Import Costs, Supply Chain Disruptions, and Strategic Sourcing for Disposable Bite Blocks

The implementation of new United States tariff measures in 2025 has introduced additional complexity into the global supply chain for disposable bite blocks. Tariffs on key imported polymers and elastomers have increased input costs for manufacturers that rely heavily on overseas sourcing, leading to pricing pressures and contract renegotiations. Suppliers have responded by diversifying their procurement strategies, turning to alternative regional partners in emerging markets to mitigate the impact of heightened duties.In addition, the tariff-induced cost shifts have accelerated the adoption of nearshoring strategies, with production capacities being established in North American facilities to ensure supply continuity and reduce lead times. These strategic relocations have required significant capital investment, but they also present opportunities for greater control over quality assurance and regulatory compliance. Meanwhile, some original equipment manufacturers have entered collaborative agreements with domestic tooling and extrusion specialists to localize key manufacturing steps.

As a result of these adjustments, end users are observing a recalibration of pricing structures across contract cycles, coupled with improved responsiveness and logistics flexibility. Looking ahead, organizations that proactively reengineer their cost models and invest in supply chain transparency will be better positioned to absorb trade policy fluctuations and maintain competitive pricing without compromising product performance or availability.

Unveiling Critical Insights Across Material Type, Age Group, Application, End User, and Distribution Channel That Shape Demand for Disposable Bite Blocks

Material selection plays a pivotal role in defining product performance and clinician preference. Foam-based constructions deliver soft cushioning and conformability, making them ideal for longer procedures, while polyvinyl chloride variants offer cost-efficiency and dimensional stability. Rubber bite blocks balance flexibility with durability in reusable environments, and silicone products provide superior biocompatibility and ease of sterilization, catering to both high-volume dental clinics and specialized anesthesia settings.Age segmentation further refines product development and marketing approaches. Adult solutions often emphasize adjustable sizing and enhanced bite resistance, meeting the demands of general anesthesia and extensive oral surgery. In contrast, pediatric bite blocks prioritize gentle materials and smaller form factors to accommodate the unique anatomical and behavioral considerations of younger patients. Manufacturers tailoring their portfolios along these lines can capture both broader and niche clinical segments.

Applications such as dental procedures, endoscopy and bronchoscopy, general anesthesia, and veterinary use each impose distinct functional and regulatory requirements. Dental teams seek precise instrument alignment and soft tissue protection, while endoscopy and bronchoscopy devices require compatibility with flexible scopes and channel adapters. In anesthesia contexts, bite blocks must integrate seamlessly into airway circuits, and veterinary practitioners demand robust, animal-safe materials that withstand rigorous cleaning protocols.

End users ranging from ambulatory surgical centers to emergency care units apply bite blocks under different throughput and sterilization standards, driving variation in packaging formats and device configurations. Distribution channels likewise influence purchase behavior, as online platforms accelerate direct procurement for bulk healthcare providers, whereas offline distributors maintain critical relationships with smaller clinics and rural hospitals. Recognizing how each of these segmentation dimensions converges enables companies to deliver targeted solutions that align with specific clinical workflows and procurement models.

Examining Regional Variations in Demand, Regulatory Frameworks, and Distribution Strategies across Americas, Europe Middle East & Africa, and Asia-Pacific Markets

In the Americas, healthcare providers emphasize rapid turnaround times and cost containment, prompting suppliers to establish local production hubs that minimize lead times and reduce logistics overhead. Regulatory authorities across North and South America have also harmonized device classifications, streamlining approval pathways for novel bite block designs that incorporate advanced polymers and antimicrobial coatings.The Europe, Middle East and Africa region presents a diverse regulatory landscape, where compliance with the European Medical Devices Regulation and local health authority requirements can vary significantly. Companies operating within EMEA often tailor their offerings to meet distinct clinical standards, such as enhanced biocompatibility testing in the European Union and adherence to import regulations in Middle Eastern nations. Additionally, environmental directives have spurred the adoption of recyclable packaging solutions to meet regional sustainability targets.

Asia-Pacific markets exhibit dynamic growth driven by expanding dental care infrastructure, rising medical tourism, and government investments in hospital modernization. In nations such as China, India and Australia, rising per capita healthcare expenditure has elevated demand for disposable consumables, including bite blocks. Meanwhile, the proliferation of online procurement platforms has expedited access to innovative devices, enabling smaller clinics to source specialized solutions that were previously unavailable locally.

Highlighting Strategic Initiatives, Competitive Positioning, and Innovation Pipelines of Leading Manufacturers in the Disposable Bite Block Industry

Leading manufacturers have adopted a spectrum of growth strategies to solidify their market presence. Several companies have expanded their portfolios through targeted acquisitions of specialty polymer suppliers, integrating advanced material capabilities to differentiate their product lines. Others have entered into co-development partnerships with endoscopy and anesthesia device innovators to ensure seamless compatibility and joint branding opportunities.Innovation pipelines now emphasize antimicrobial surface treatments, integrated sensor technologies for procedural monitoring, and bioresorbable materials that align with circular economy principles. To support these initiatives, top firms are investing in dedicated research centers and clinical trial collaborations, gathering user feedback through real-world evidence studies. Additionally, strategic alliances with regional distributors are strengthening market coverage in underserved areas, while digital engagement platforms facilitate direct product education for clinicians.

Competitive positioning is further enhanced by robust quality management systems that meet international standards such as ISO 13485, coupled with transparent labeling and traceability features. By focusing on both product innovation and operational excellence, these key players are setting new benchmarks for performance, reliability and customer support in the disposable bite block arena.

Proposing Strategic Actions for Industry Leaders to Enhance Operational Agility, Strengthen Supply Chain, and Drive Sustainable Growth in Bite Block Markets

Industry leaders can drive value by diversifying raw material sourcing and establishing multi-regional manufacturing footprints to offset trade policy volatility. By setting up dual-sourcing agreements for critical polymers and exploring partnerships with local extrusion specialists, firms can maintain price stability and foster supply chain resilience.It is essential to invest in product development that addresses emerging clinician needs, such as antimicrobial and bioresorbable materials. Entrepreneurs should collaborate with academic research institutions and clinical centers to validate novel formulations, leveraging data-driven clinical studies to support regulatory submissions and marketing claims.

Furthermore, companies should optimize commercialization strategies by aligning distribution channel investments with end user purchasing behavior. Leveraging digital platforms for direct sales can enhance accessibility in high-volume hospital systems, while personal outreach through established distributor networks remains crucial for smaller practices and veterinary clinics.

Finally, fostering continuous engagement with regulatory authorities and sustainability bodies will streamline approval cycles and future-proof offerings against tightening environmental mandates. By integrating these strategic actions, organizations will build operational agility and secure a competitive edge in the evolving disposable bite block sector.

Detailing Qualitative and Quantitative Research Techniques, Data Validation Processes, and Analytical Frameworks Supporting the Disposable Bite Block Study

The research underpinning this report combines primary and secondary data collection methods to ensure comprehensive coverage and validation. Primary research involved structured interviews with clinicians, procurement specialists and regulatory experts, supplemented by surveys that captured real-world usage patterns and unmet needs. These firsthand insights informed the identification of critical performance attributes and procurement drivers.Secondary research included a thorough review of regulatory filings, clinical guidelines and materials science publications to map the evolution of device standards and material innovations. Data validation processes employed cross-comparison of company disclosures, trade statistics and published device registries to confirm the accuracy of technology adoption trends. Analytical frameworks such as SWOT and value chain analysis provided a structured approach to evaluating competitive dynamics and supply chain vulnerabilities.

To maintain methodological rigor, all quantitative inputs were subjected to sanity checks and sensitivity analyses, ensuring that key findings remain robust across multiple scenarios. Expert consultations with market strategists and clinical advisors further enhanced the reliability of interpretations. This multi-layered approach delivers a balanced, evidence-based perspective on the forces shaping the disposable bite block landscape.

Summarizing Core Insights, Strategic Imperatives, and Emerging Opportunities Defining the Future Trajectory of the Disposable Bite Block Sector

Throughout this analysis, we have highlighted the pivotal role of material advancements, supply chain adaptations and regulatory engagement in driving the disposable bite block market forward. Strategic imperatives such as localized production, diversified sourcing and product innovation emerge as critical for maintaining competitive positioning in the face of tariff pressures and evolving clinical standards.Emerging opportunities lie at the intersection of sustainability and digital integration, where bioresorbable materials and smart sensor-enabled devices can redefine clinician workflows and patient experiences. Organizations that adopt a proactive stance-anticipating regulatory shifts, leveraging partnerships for research and streamlining distribution-will unlock the greatest value.

As the healthcare landscape continues to prioritize safety, efficiency and environmental stewardship, the disposable bite block sector stands poised for transformative growth. Stakeholders equipped with actionable intelligence and a clear strategic roadmap will lead the way in shaping the next generation of disposable procedural accessories.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Material Type

- Foam-Based

- Polyvinyl Chloride

- Rubber

- Silicone

- Age Group

- Adult

- Pediatric

- Application

- Dental Procedures

- Endoscopy & Bronchoscopy

- General Anesthesia

- Oral Surgery

- Veterinary Use

- End User

- Ambulatory Surgical Centers

- Dental Clinics

- Emergency Care Units

- Hospitals

- Veterinary Clinics

- Distribution Channel

- Offline

- Online

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Ambu A/S

- Avanos Medical, Inc.

- B&B Medical Technologies

- Boston Scientific Corporation

- Carestream Dental LLC

- Citec Group Oy Ab

- CIVCO Medical Solutions

- ConMed Corporation

- Cook Medical LLC

- Dentsply Sirona Inc.

- GC Corporation

- Henry Schein, Inc.

- Jiangsu Grit Medical Technology Co., Ltd.

- Kerr Corporation

- Medorah Meditek Pvt. Ltd.

- Olympus Corporation

- Septodont Holding

- Skycare Dental

- Teleflex Incorporated

- Ultradent Products, Inc.

- Zhejiang Gongdong Medical Technology Co., Ltd.

- Zhuji Pengtian Medical Instrument Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Disposable Bite Block Market report include:- Ambu A/S

- Avanos Medical, Inc.

- B&B Medical Technologies

- Boston Scientific Corporation

- Carestream Dental LLC

- Citec Group Oy Ab

- CIVCO Medical Solutions

- ConMed Corporation

- Cook Medical LLC

- Dentsply Sirona Inc.

- GC Corporation

- Henry Schein, Inc.

- Jiangsu Grit Medical Technology Co., Ltd.

- Kerr Corporation

- Medorah Meditek Pvt. Ltd.

- Olympus Corporation

- Septodont Holding

- Skycare Dental

- Teleflex Incorporated

- Ultradent Products, Inc.

- Zhejiang Gongdong Medical Technology Co., Ltd.

- Zhuji Pengtian Medical Instrument Co., Ltd.

Table Information

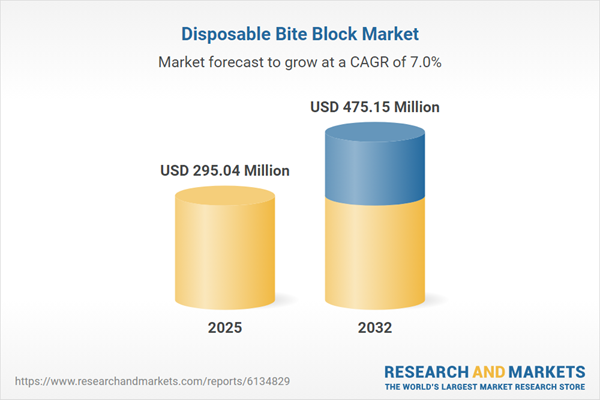

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 295.04 Million |

| Forecasted Market Value ( USD | $ 475.15 Million |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |