Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Foundation for an In-Depth Analysis of Oral Care Market Evolution Influences Strategic Directions and Technological Developments

The executive summary embarks on a journey to illuminate the multifaceted evolution of the oral care industry by examining technological advances, consumer expectations, and shifting competitive dynamics. In recent years, innovations ranging from smart toothbrush integrations to natural ingredient formulations have redefined the benchmarks of preventive and therapeutic oral hygiene. Consequently, stakeholders across the value chain, from raw material suppliers to retail distributors, are recalibrating their strategies to align with the heightened emphasis on personalized care and holistic wellness.As consumer awareness about the interplay between oral health and overall well-being continues to expand, demand for differentiated products and services has surged. Moreover, digital transformation initiatives have streamlined procurement, engagement, and adherence, reinforcing the importance of omnichannel presence. This introductory section lays the groundwork for a deeper exploration of transformative shifts, regulatory headwinds, and segmentation insights that collectively shape the roadmap for innovation, investment, and competitive differentiation in the oral care arena.

Unveiling the Pivotal Technological Regulatory and Consumer-Driven Transformations Redefining Oral Care Excellence

The oral care landscape is experiencing profound transformations driven by a convergence of scientific breakthroughs, consumer empowerment, and regulatory recalibration. At the forefront, the rapid adoption of connected oral health devices and artificial intelligence-enabled diagnostics has ushered in a new era of preventive dentistry, enabling real-time feedback on brushing techniques and adherence. Meanwhile, regulatory authorities are increasingly scrutinizing ingredient safety, spurring companies to validate claims through robust clinical evidence and transparent data disclosures.In parallel, heightened consumer interest in sustainability and clean-label products has propelled the growth of biodegradable toothbrush materials and naturally derived active compounds, fostering competitive differentiation. Furthermore, retailers and online platforms are investing heavily in customer education tools and subscription-based replenishment models, reinforcing brand loyalty and purchase frequency. As industry players navigate these transformative currents, strategic agility and collaborative ecosystems will be paramount to capturing emerging value pools and securing long-term growth trajectories

Examining How 2025 United States Tariffs on Oral Care Imports Have Driven Supply Chain Resilience Innovation and Pricing Evolution

In 2025, the cumulative impact of United States tariffs on imported oral care goods has reverberated across supplier networks, pricing structures, and sourcing strategies. Manufacturers reliant on raw materials such as specialized polymers and active ingredient precursors from overseas have faced increased cost pressures. As a result, procurement teams have been compelled to diversify supplier portfolios, negotiate long-term contracts with domestic partners, and explore alternative ingredient chemistries that are less susceptible to tariff escalation.Concurrently, branded producers have adjusted pricing strategies to mitigate margin compression, introducing tiered product offerings and value packs to maintain affordability for end consumers. At the same time, distributors and retailers have recalibrated inventory management protocols to anticipate potential disruptions while sustaining service levels. The interplay of these factors underscores the necessity for stakeholders to adopt dynamic scenario planning and to invest in supply chain resilience measures that can absorb regulatory shocks without eroding brand equity or consumer trust

Deep Dive into the Multidimensional Segmentation Landscape Spanning Products Age Groups Formulations Applications and Distribution Channels

A granular examination of the oral care market reveals distinctive growth trajectories across product categories, demographics, formulation philosophies, usage occasions, and sales channels. In the product realm, traditional manual toothbrushes contend with electric variants that offer smart features and enhanced plaque removal, while toothpaste formulations range from fluoride-based prevention blends to herbal, sensitivity relief, and whitening specialties. Consumers spanning teenagers to adults and geriatric cohorts demonstrate varied preferences influenced by lifestyle, oral health needs, and purchasing power.Ingredient philosophies bifurcate into conventional chemistries backed by decades of dental research and natural extracts that cater to eco-conscious segments seeking gentle yet efficacious solutions. Usage occasions further diversify the portfolio, addressing daily hygiene routines, anti-cavity maintenance, post-surgery recovery protocols, and specialized orthodontic or denture care regimens. Meanwhile, distribution channels split between traditional offline storefronts-including pharmacies, convenience outlets, specialty boutiques, and supermarket formats-and digital touchpoints via brand-owned portals and global e-commerce platforms. This multidimensional segmentation landscape demands that market participants tailor value propositions, marketing messages, and channel strategies to resonate with discrete consumer cohorts and purchase contexts

Highlighting Contrasting Growth Drivers Consumer Preferences and Strategic Priorities across Americas EMEA and Asia-Pacific Regions

Regional dynamics in the oral care sector underscore divergent growth drivers and market behaviors across the Americas, Europe Middle East & Africa, and Asia-Pacific territories. In the Americas, a mature healthcare infrastructure and widespread insurance frameworks have underpin robust demand for premium electric toothbrushes and clinically validated toothpaste blends. As a result, leading brands leverage comprehensive clinical studies and digital engagement platforms to reinforce trust and capture share.Conversely, in Europe Middle East & Africa, regulatory harmonization efforts and rising per capita incomes have catalyzed interest in natural ingredient portfolios and sustainable packaging innovations. At the same time, localized distribution models and multi-brand retailer partnerships amplify accessibility across urban and emerging suburban markets. In Asia-Pacific, rapid urbanization and expanding middle-class demographics fuel a dual focus on value-driven daily hygiene products and technologically advanced oral care devices. Consequently, market incumbents often adopt hybrid go-to-market strategies that blend mass-market penetration with targeted premium offerings to address variegated consumer needs

Unraveling the Competitive Fabric Defined by Global Leaders Niche Innovators and Collaborative Ecosystems Reinventing Oral Care

The competitive arena of the oral care market is characterized by the strategic interplay of global conglomerates, specialized healthcare firms, and emerging disruptors. Established multinationals continue to invest in R&D to enhance active ingredient efficacy, digital connectivity features, and sustainable packaging solutions. On the other hand, niche players leverage agile innovation cycles to introduce novel natural formulations, subscription-based distribution models, and direct-to-consumer outreach channels that resonate with digitally native audiences.Collaboration between universities, technology incubators, and dental associations has accelerated product development pipelines, enabling faster translation of scientific discoveries into market-ready offerings. At the same time, strategic partnerships with e-commerce giants and omnichannel retailers have expanded market reach, particularly in regions with fragmented traditional retail infrastructures. This competitive mosaic underscores the imperative for companies to balance scale-driven investments with nimble market responsiveness to capitalize on emerging wellness trends and regulatory incentives

Empowering Oral Care Stakeholders with Strategic Pathways for Supply Chain Resilience Consumer Engagement and Collaborative Innovation

Industry leaders can fortify their market positions by embracing several strategic imperatives. Firstly, investing in modular manufacturing capabilities and nearshoring partnerships will buffer against future tariff fluctuations and supply chain disruptions. Furthermore, integrating data analytics platforms to capture real-time consumer usage patterns and feedback loops will inform iterative product refinements and personalized marketing initiatives.In parallel, forging cross-sector alliances with dental professionals, digital health startups, and sustainability advocates can amplify credibility and accelerate time-to-market for breakthrough solutions. Companies should also prioritize the development of flexible channel strategies that balance the breadth of offline retail coverage with the precision of online segmentation models. By implementing these approaches with disciplined execution and a focus on end-to-end customer experience, industry leaders can cultivate resilience, drive innovation, and unlock new avenues for profitable growth

Detailed Explanation of the Mixed-Methods Research Design Combining Primary Interviews Secondary Analysis and Scenario Planning

This research leverages a robust mixed-methods framework integrating both qualitative assessments and quantitative validations. Primary research included in-depth interviews with industry executives, dental professionals, and supply chain specialists to capture firsthand insights on emerging challenges and innovation vectors. Simultaneously, a comprehensive review of regulatory filings, clinical studies, and patent disclosures provided a structural foundation for understanding evolving compliance landscapes and technological frontiers.Secondary research involved aggregating publicly available information from trade associations, financial reports, and academic publications to contextualize macroeconomic influences and regional market nuances. Data triangulation techniques were employed to cross-verify findings and ensure consistency across sources. In addition, scenario planning workshops with subject matter experts facilitated the exploration of alternative trajectories for tariff developments, consumer behavior shifts, and technological advancements. This methodological rigor underpins the credibility and actionable value of the insights presented throughout the report

Synthesizing Technological Regulatory and Consumer Insights to Define the Strategic Imperatives Driving Oral Care Market Success

The converging insights from technological innovation, shifting regulatory frameworks, and consumer-driven segmentation highlight both opportunities and challenges for stakeholders in the oral care market. Adoption of smart oral health devices, coupled with a growing preference for natural formulations, signals a departure from one-size-fits-all solutions toward more personalized offerings. At the same time, the ripple effects of tariff adjustments underscore the importance of supply chain flexibility and strategic sourcing.Regional disparities in consumer expectations and distribution dynamics further emphasize the need for tailored market entry strategies and adaptive partnership models. Ultimately, organizations that blend rigorous R&D investments with agile go-to-market capabilities will be best positioned to navigate the complexities of this dynamic landscape. These conclusions set the stage for informed decision-making and strategic investment planning in the evolving realm of oral care excellence

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Dental Floss & Tape

- Interdental Brushes

- Mouthwash/Rinse

- Tongue Scrapers

- Toothbrushes

- Electric Toothbrushes

- Manual Toothbrushes

- Toothpaste

- Fluoride Toothpaste

- Herbal/natural Toothpaste

- Sensitivity Toothpaste

- Whitening Toothpaste

- Age Group

- Adults

- Geriatric

- Teenagers

- Ingredient Type

- Conventional

- Natural

- Application

- Anti-cavity

- Breath Freshening

- Daily Hygiene

- Gum Disease Treatment

- Orthodontic/denture care

- Post-surgery Care

- Sensitivity Relief

- Whitening

- Distribution Channel

- Offline

- Convenience Stores

- Pharmacies Drugstores

- Specialty Stores

- Supermarkets/Hypermarkets

- Online

- Brand Websites

- Ecommerce Platforms

- Offline

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- 3M Company

- Church & Dwight Co., Inc.

- Colgate-Palmolive Company

- Coswell S.p.A.

- Curaden AG

- Dabur India Limited

- Dentaid S.L.

- Dr. Fresh LLC

- GC Corporation

- GlaxoSmithKline plc

- Hager & Werken GmbH & Co. KG

- Hawley & Hazel Chemical Company Limited

- Henkel AG & Co. KGaA

- Jason Natural Products, Inc.

- Johnson & Johnson Consumer Inc.

- Lion Corporation

- Procter & Gamble Company

- Splat Global LLC

- Sunstar Suisse S.A.

- The Himalaya Drug Company

- Unilever PLC

- Young Innovations, Inc.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Oral Care market report include:- 3M Company

- Church & Dwight Co., Inc.

- Colgate-Palmolive Company

- Coswell S.p.A.

- Curaden AG

- Dabur India Limited

- Dentaid S.L.

- Dr. Fresh LLC

- GC Corporation

- GlaxoSmithKline plc

- Hager & Werken GmbH & Co. KG

- Hawley & Hazel Chemical Company Limited

- Henkel AG & Co. KGaA

- Jason Natural Products, Inc.

- Johnson & Johnson Consumer Inc.

- Lion Corporation

- Procter & Gamble Company

- Splat Global LLC

- Sunstar Suisse S.A.

- The Himalaya Drug Company

- Unilever PLC

- Young Innovations, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | November 2025 |

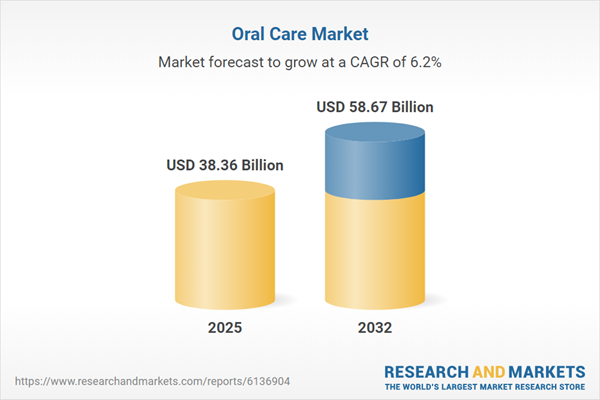

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 38.36 Billion |

| Forecasted Market Value ( USD | $ 58.67 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |