Speak directly to the analyst to clarify any post sales queries you may have.

Unlocking the Potential of the Mattress in a Box Market Through Comprehensive Insight Into Consumer Preferences and Innovative Distribution Strategies

Introduction to the Mattress in a Box Phenomenon and Its Industry Significance

The mattress in a box concept has revolutionized the traditional sleep products industry by offering a convenient, direct-to-consumer delivery model that aligns with modern shoppers' demand for speed and simplicity. By compressing and rolling high-quality mattresses into compact cartons, brands have been able to disrupt long-standing retail channels while achieving significant reductions in logistics costs. This evolution has empowered consumers to shop online with confidence, spurred by generous trial periods and transparent return policies that mitigate purchase anxiety.As consumer expectations shift towards seamless e-commerce experiences, companies have increasingly invested in digital platforms, advanced customer support, and data-driven personalization. Emerging innovations such as bed-in-a-box subscription models, augmented reality sizing tools, and AI-powered sleep analysis are further enhancing the value proposition. Consequently, industry stakeholders must remain vigilant of these developments while adapting their strategies to maintain competitive relevance.

This executive summary offers an in-depth exploration of the transformative trends shaping the mattress in a box landscape. It delves into the effects of recent tariff measures, uncovers critical segmentation and regional insights, highlights the strategic positioning of key market players, and outlines actionable recommendations for industry leaders. Finally, the research methodology is detailed to ensure transparency and rigor, concluding with a clear call to action for stakeholders seeking comprehensive, decision-ready analysis.

Examining the Rapid Evolution of Consumer Behavior Technology Integration and Competitive Dynamics Shaping the Mattress in a Box Sector

Examining the Forces Driving Rapid Industry Transformation and the Emergence of New Competitive Frontiers

Consumer behavior has shifted dramatically in recent years as digital adoption accelerates and personalization becomes the norm. Mattress brands are responding by integrating advanced materials, proprietary foam blends, and hybrid coil systems designed to cater to a broad spectrum of sleep preferences. Alongside product innovation, omnichannel strategies have emerged as a key battleground: seamless integration between digital storefronts and physical pop-up showrooms is enabling companies to showcase products while retaining the flexibility of online operations.Furthermore, sustainability has gained prominence as a distinguishing factor. The use of eco-friendly foams, recyclable packaging, and carbon-neutral shipping solutions resonates strongly with younger demographics. Brands that can authentically demonstrate environmental stewardship through transparent supply chain practices and third-party certifications are achieving heightened brand loyalty.

Finally, strategic partnerships with logistics providers, interior design influencers, and hospitality chains are reshaping distribution paradigms. These alliances not only extend market reach but also create unique touchpoints for product trials, driving consumer trust. As the market continues to mature, firms that can adeptly blend cutting-edge technology with compelling brand narratives will define the next era of mattress in a box competition.

Understanding the Far-Reaching Consequences of the 2025 United States Tariff Measures on Raw Materials Manufacturing and Cross Border Logistics in Mattress Sector

Understanding the Cumulative Impact of 2025 United States Tariff Measures on Costs Sourcing and Supply Chain Resilience

In 2025, the United States implemented a series of tariff measures targeting critical raw materials and components within the mattress value chain, including specialized foams, steel for coil systems, and ancillary packaging materials. These levies have introduced additional cost pressures at multiple stages of production, compelling manufacturers to reevaluate their supplier networks and negotiate longer-term agreements to stabilize input expenses.As a result, firms are increasingly diversifying their sourcing strategies to include alternative regional suppliers, leveraging trade zones with preferential tariffs, and investing in domestic manufacturing capabilities. This trend towards near-shoring has not only mitigated exposure to sudden policy shifts but also offered shorter lead times and enhanced quality control. Nonetheless, the transition requires substantial capital outlay, placing a premium on efficient production planning and logistics optimization.

In turn, transportation costs have been affected by the imposition of duties on imported metal frames and adhesives. Companies are collaborating with carriers to implement route consolidation, cross-docking, and multi-modal shipping solutions that counterbalance these added expenses. Looking ahead, sustained dialogue between industry associations and regulatory bodies will be essential to advocate for incremental adjustments that balance economic objectives with sectoral competitiveness.

Revealing Strategic Segmentation Insights Highlighting Diverse Consumer Needs Across Product Types Mattress Sizes End Use and Distribution Channels

Revealing Key Segmentation Insights Highlighting Consumer Preferences Across Diverse Product Types Sizes End Uses and Distribution Pathways

The mattress in a box market can be dissected through a multi-layered segmentation framework that illuminates evolving consumer priorities. Based on product type, mattress offerings range from hybrid constructions featuring coil support and conforming foams to traditional innerspring systems and memory foam models optimized for pressure relief and motion isolation. Each category caters to distinct comfort and performance expectations, with hybrids appealing to individuals seeking a balance of responsiveness and cushioning, innersprings favored for bounce and breathability, and memory foams chosen for their contouring properties.When viewed through the lens of size, preferences span from compact twin and twin XL dimensions to queen, full/double, and king configurations. Smaller formats are prevalent in urban dwellings and guest rooms, whereas queen and king sizes dominate primary bedrooms. The extra length of twin XL models has found a niche in university accommodations and hospitality suites that prioritize single-occupant comfort.

End-use segmentation reveals divergent purchasing rationales. Residential consumers focus on at-home comfort and extended trial periods; commercial buyers in sectors such as airlines, hospitality, hotels & resorts emphasize durability, streamlined logistics, and bulk procurement; healthcare facilities require specialized hygienic standards and pressure-management features. Distribution channels further differentiate market pathways, with online platforms driving direct sales through user-friendly e-commerce interfaces, while offline outlets-ranging from furniture showrooms to dedicated mattress and specialty stores-offer tangible product experiences and immediate fulfillment.

Illuminating Regional Dynamics in the Mattress in a Box Market Emphasizing Shifts in Consumption Patterns and Growth Drivers Across Key Geographies

Illuminating Regional Dynamics and Growth Drivers Across Key Global Mattress in a Box Markets

Geographic analysis uncovers pronounced variations in consumer adoption rates, regulatory environments, and logistical infrastructures. Within the Americas, mature e-commerce ecosystems and well-established last-mile networks support robust uptake of direct-to-consumer mattress models. In North America, premiumization drives interest in innovative materials and extended warranties, while in Latin America, expanding middle-class demographics are propelling interest in value-oriented hybrid and memory foam offerings.Across Europe, Middle East & Africa, diverse regulatory standards around fire safety and material certifications necessitate localized compliance efforts, particularly in the European Union's stringent REACH framework. Western Europe's high penetration of online retail is counterbalanced by strong traditional retail presences in Southern and Eastern Europe. In the Middle East, luxury hospitality partnerships are fueling demand for customized solutions, whereas in parts of Africa, infrastructural challenges and fragmented supply chains require strategic collaborations to unlock market potential.

The Asia-Pacific region presents a dual narrative: in developed markets such as Japan and Australia, consumers demand eco-friendly materials and premium hybrid designs, while in emerging economies like India and Southeast Asia, increasing internet penetration and mobile-first shoppers are creating fertile ground for digital mattress startups. Across all territories, regional logistics hubs and localized manufacturing facilities are critical to mitigating tariff impacts and ensuring consistent service levels.

Highlighting Competitive Dynamics and Strategic Positioning of Leading Global Mattress in a Box Suppliers Including Innovation Partnerships and Market Approaches

Highlighting Competitive Landscapes and Strategic Positioning Among Leading Mattress in a Box Suppliers

Market leaders have pursued a spectrum of differentiation strategies to solidify their footholds. Several pioneering brands have continually refreshed product portfolios with patent-pending foam formulations and intelligent temperature-regulating technologies, enhancing sleep quality metrics and reinforcing brand credibility. Others have forged partnerships with established brick-and-mortar retailers to create hybrid retail models that combine the convenience of direct delivery with in-store product trials.Vertical integration has emerged as another lever for competitive advantage, enabling certain manufacturers to control foam production, spring assembly, and packaging in-house. This approach has yielded tighter quality control, streamlined fulfillment, and improved margin stability. Meanwhile, emerging disruptors have carved out niches by offering subscription programs and mattress recycling services that resonate with environmentally conscious consumers.

Strategic alliances with logistics providers have been instrumental in scaling last-mile capabilities, while tie-ups with hospitality chains and co-working space operators have opened B2B channels. In addition, a growing number of entrants are leveraging immersive digital experiences-such as virtual sleep consultations and augmented reality room visualizers-to elevate the purchase journey and reduce return rates. Together, these initiatives underline the multifaceted efforts companies are undertaking to navigate a fast-evolving competitive landscape.

Empowering Industry Leaders with Actionable Strategies to Enhance Supply Chain Agility Optimize Consumer Engagement and Drive Sustainable Growth in Mattress Innovation

Empowering Industry Leaders with Actionable Recommendations to Strengthen Resilience Elevate Customer Engagement and Drive Sustainable Innovation

Leaders should continue to prioritize supply chain diversification by forging relationships with regional raw material suppliers and exploring near-shore production models. This strategy not only hedges against tariff volatility but also shortens lead times, enabling rapid response to shifting consumer demand and seasonal peaks. Concurrently, investing in digital fulfillment capabilities-such as automated warehouses and real-time inventory tracking-can further enhance operational agility.On the consumer front, brands must deepen personalization through data analytics that power AI-driven product recommendations and tailored trial experiences. Enhancing post-purchase engagement via subscription sleep-care programs and loyalty platforms can foster recurring revenue streams and increase customer lifetime value. At the same time, integrating eco-friendly materials and carbon-neutral shipping solutions will resonate with sustainability-oriented demographics, offering a compelling point of differentiation.

Finally, collaboration with technology providers-ranging from smart sensor manufacturers to augmented reality developers-can unlock new frontiers in product innovation and online shopping experiences. By adopting a holistic approach that balances cost efficiency, customer intimacy, and environmental stewardship, industry leaders will be well-positioned to capitalize on emerging opportunities and secure long-term growth.

Outlining a Robust Research Methodology Combining Qualitative Insights Quantitative Analysis and Field Expertise to Ensure Rigor Transparency and Actionable Findings

Outlining a Rigorous Research Methodology Integrating Qualitative Interviews Quantitative Data and Field Verification to Ensure Analytical Integrity

This study was conducted through a blended research approach designed to deliver robust, multilayered insights. Primary research included in-depth interviews with senior executives across manufacturing, distribution, and retail segments, complemented by surveys of end-users to capture evolving preferences and purchase drivers. These firsthand perspectives were instrumental in contextualizing secondary research findings.Secondary research sources encompassed industry journals, trade association reports, and publicly accessible corporate filings. Each data point underwent a multi-stage validation process, involving cross-referencing with proprietary databases, comparative analysis of historical trends, and consultation with subject-matter experts. This triangulation ensures that conclusions drawn are both reliable and actionable.

Finally, field verification was carried out through logistical site visits, mystery shopping exercises, and hands-on product trials. These activities provided empirical observations on packaging effectiveness, delivery performance, and in-store consumer interactions. Collectively, this rigorous methodological framework underpins the study's credibility and offers stakeholders a clear line of sight into the data integrity underpinning all insights.

Drawing Comprehensive Conclusions on Industry Trends Consumer Preferences and Strategic Imperatives That Will Shape the Future Trajectory of the Mattress in a Box Landscape

Drawing Holistic Conclusions on Emerging Trends Consumer Demands and Strategic Imperatives for Sustained Success

The mattress in a box sector stands at a pivotal juncture, shaped by digital disruption, evolving consumer expectations, and regulatory dynamics. The imperative to deliver seamless e-commerce experiences has catalyzed investments in advanced materials, immersive online tools, and agile fulfillment networks. Meanwhile, sustainability considerations are elevating the role of eco-friendly production and packaging as core brand differentiators.Tariff measures introduced in 2025 have intensified the focus on supply chain resilience, prompting near-shoring initiatives and diversified sourcing strategies. Alongside these adjustments, competitive intensity remains high, with leading players leveraging vertical integration, strategic partnerships, and data-driven personalization to fortify market positions. Segmentation analysis underscores the importance of tailoring offerings by product type, size, end-use, and distribution channel to meet distinct consumer and commercial requirements.

Regional dynamics reveal that while mature markets continue to demand premium innovations, emerging economies are ripe for digital first entrants. Companies that can balance cost efficiency, environmental stewardship, and customer intimacy will be best equipped to navigate this landscape. By synthesizing these insights into cohesive strategies, stakeholders can make informed decisions to capitalize on growth opportunities and secure long-term success.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Hybrid Mattresses

- Innerspring Mattresses

- Memory Foam Mattresses

- Size

- Full/Double Mattress

- King Mattress

- Queen Mattress

- Twin Mattress

- Twin XL Mattress

- End-Use

- Commercial

- Airlines

- Hospitality

- Hotels & Resorts

- Healthcare

- Residential

- Commercial

- Distribution Channel

- Offline

- Furniture Stores

- Mattress Stores

- Specialty Stores

- Online

- Offline

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Amerisleep

- Avocado Mattress, LLC.

- Brooklyn Bedding, LLC

- Casper Sleep Inc.

- Ecosa Group Pty. Ltd.

- Emma Sleep GmbH

- GhostBed

- Koala AU Operations Pty Ltd

- Layla Sleep

- "Purple Innovation, Inc. "

- Resident Home, LLC.

- Serta Simmons Bedding, LLC

- Sleep Number Corporation

- SLEEPYCAT

- Tempur-Pedic North America, LLC.

- Vaya Sleep, LLC

- Zinus, Inc.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Mattress in A Box market report include:- Amerisleep

- Avocado Mattress, LLC.

- Brooklyn Bedding, LLC

- Casper Sleep Inc.

- Ecosa Group Pty. Ltd.

- Emma Sleep GmbH

- GhostBed

- Koala AU Operations Pty Ltd

- Layla Sleep

- Purple Innovation, Inc.

- Resident Home, LLC.

- Serta Simmons Bedding, LLC

- Sleep Number Corporation

- SLEEPYCAT

- Tempur-Pedic North America, LLC.

- Vaya Sleep, LLC

- Zinus, Inc.

Table Information

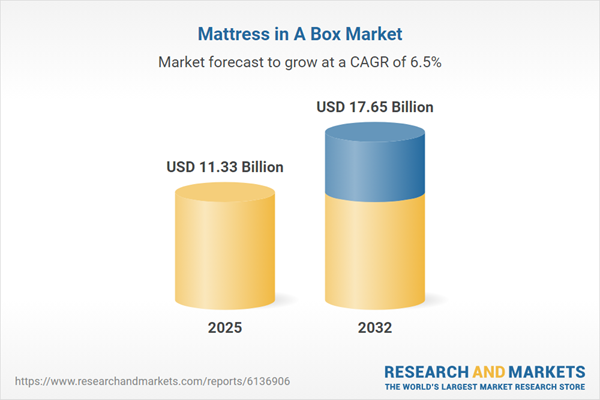

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 11.33 Billion |

| Forecasted Market Value ( USD | $ 17.65 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |