Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the foundational pillars and emerging dynamics transforming the paintless dent repair service market landscape for foresight and market advantage

Paintless dent repair, often abbreviated PDR, has emerged as an innovative approach to vehicle damage restoration that preserves original paint finishes by meticulously manipulating metal panels without the need for fill or repainting. This method leverages specialized rod and bar techniques to restore vehicle surfaces to their factory specifications while minimizing material waste and labor-intensive processes. Over recent years, the industry has witnessed a transition from conventional body shop operations to mobile and on-demand service frameworks that emphasize flexibility and rapid response to customer needs.Consequently, environmental considerations and cost efficiency have become significant drivers shaping market dynamics. PDR technology aligns with sustainability goals by reducing the usage of chemicals, paints, and body fillers, thereby curbing volatile organic compound emissions. Simultaneously, advancements in tools such as dent lifters, specialized hammers, and precision adhesives have elevated technician capabilities, fostering higher productivity and service quality. Moreover, the integration of digital inspection systems and seamless scheduling platforms underscores the sector's evolution toward data-driven operations.

This executive summary distills critical insights into the transformative forces redefining the PDR market, encompassing segment-driven behaviors, tariff impacts, regional variations, and the competitive landscape. It outlines strategic imperatives for stakeholders, actionable recommendations for industry leaders, and the rigorous methodology underpinning these findings. In doing so, it equips decision-makers with a robust analytical framework to capitalize on emerging opportunities within the paintless dent repair ecosystem.

Uncovering the pivotal technological and operational shifts redefining the paintless dent repair service ecosystem and reshaping competitive paradigms

Recent years have witnessed unprecedented technological innovations that are redefining paintless dent repair processes. Advanced high-resolution imaging and digital scanning platforms now enable precise damage assessments that inform optimal tool application and technique selection. Technicians are increasingly leveraging ultra-lightweight alloys and 3D-printed fixtures to access complex panel geometries while preserving structural integrity. Simultaneously, developments in dent lifter tool ergonomics and glue-pull systems have enhanced maneuverability and reduced the risk of secondary surface distortion.Operational paradigms are also undergoing transformation as providers expand from traditional in-shop workflows to versatile mobile service models. On-demand and scheduled mobile fleets empower technicians to deliver on-site repairs at customer locations, thereby reducing transit times and bolstering service convenience. Furthermore, integrated workforce management software facilitates resource allocation, workload balancing, and real-time progress tracking, ensuring alignment with customer expectations and regulatory standards. As a result, service turnaround is accelerating while overhead costs are becoming more transparent and manageable.

In tandem with these shifts, the sector is forging stronger partnerships with insurance stakeholders and fleet operators to streamline claims handling and cost recovery processes. Collaborative data-sharing platforms are emerging to validate repair quality, optimize pricing structures, and reinforce trust across the value chain. Moreover, immersive training simulations powered by augmented reality are scaling technician skill development, reducing onboarding times and ensuring consistent repair quality across diverse service environments. Collectively, these transformative shifts underscore a market in flux, driven by ingenuity and a relentless pursuit of efficiency.

Analyzing evolving trade policies and tariff implications on supply chain resilience and cost structures within the paintless dent repair service domain

Amid shifting global trade dynamics, United States tariff adjustments scheduled through 2025 are exerting pronounced effects on the paintless dent repair supply chain. Key raw materials such as aluminum alloys and steel sheets, along with specialized tool imports, are subject to levy escalations designed to protect domestic manufacturing. As a result, procurement teams are navigating increased complexity in sourcing arrangements, facing extended lead times and tighter inventory buffers to mitigate potential shortages. These policy changes are compounded by reciprocal duties imposed by trading partners, prompting stakeholders to reassess cross-border logistics strategies.Consequently, the cumulative tariff burden is influencing cost structures across PDR operations. Material and component price inflation is cascading into retail pricing models, challenging service providers to balance competitive affordability with margin preservation. In response, many enterprises have initiated collaborative frameworks with domestic tool manufacturers to localize production and reduce dependency on international shipments. Likewise, alliances with customs brokerage firms have improved visibility into compliance requirements, minimizing disruption related to classification disputes and retrospective liability assessments.

Looking ahead, strategic resilience will hinge on diversified sourcing and agile supply chain orchestration. Leveraging nearshoring opportunities and establishing buffer inventories in key regional hubs are proving effective in smoothing cost volatility. Furthermore, adoption of dynamic pricing platforms enables real-time cost pass-through and demand-based adjustments, sustaining profitability under fluctuating tariff regimes. Collectively, these adaptations serve to fortify the paintless dent repair sector against ongoing geopolitical uncertainties and reinforce its capacity to deliver value-driven solutions through 2025 and beyond.

Illuminating critical segmentation dimensions and nuanced market behavior patterns shaping strategic positioning in the paintless dent repair service landscape

Segmentation analysis reveals that in-shop and mobile service formats are foundational to market differentiation. In-shop facilities continue to cater to high-volume collision centers with established infrastructure and specialized equipment, while mobile offerings subdivide into on-demand rapid response units and scheduled visits that prioritize convenience and minimal vehicle downtime. This bifurcation underscores a broader shift toward customer-centric engagement models, enabling service providers to tailor operational capacities to distinct time-sensitivity and location-based requirements.Additionally, vehicle-type segmentation delineates passenger cars from commercial fleets, with commercial operations further divided into heavy-duty trucks and light-duty vehicles. This stratification aligns repair protocols and tool allocations to varying panel materials, thickness profiles, and operational cycles. A comprehensive ecosystem of dent lifter tools, removal hammers and knockdown instruments, precision rods, specialized repair adhesives, and modular tool kits supports these diverse use cases. Consequently, technicians can deploy technique-specific equipment calibrated for tasks ranging from nuanced crease restoration to extensive panel reshaping.

Moreover, technique-based differentiation encompasses blending approaches, cold rolling or tapping down processes, glue-pulling procedures, and lever or push-rod manipulations. Application-based segments span major collision repairs-classified into heavy, medium, and light incidents-as well as precision crease removal, hail damage mitigation, and minor dent abatement. End-user categories include fleet operators seeking rapid turnaround, individual consumers focused on cost-effective convenience, and insurance entities emphasizing standardized quality and claim efficiency. Distribution channels integrate independent workshops renowned for flexibility, insurance-sponsored service centers that ensure seamless claims integration, and original equipment manufacturer dealerships prioritizing warranty alignment and brand consistency. Together, these segmentation insights illuminate pathways for targeted growth and differentiated service offerings within the paintless dent repair domain.

Revealing regional performance nuances and key demand drivers shaping market evolution in the Americas, Europe Middle East and Africa, and Asia Pacific zones

Across the Americas, the paintless dent repair landscape is characterized by mature service networks and high consumer awareness. In North America, robust partnerships between repair providers and insurance carriers have streamlined claims processing, driving consistent demand for PDR solutions. Meanwhile, Latin American markets are witnessing gradual uptake as end users increasingly value cost efficiency and environmentally friendly repair methods. The presence of extensive vehicle fleets in both commercial and passenger segments further bolsters regional growth, enabling service operators to capitalize on economies of scale and cross-border supply chain synergies.In Europe, Middle East and Africa, regulatory drivers and sustainability mandates are catalyzing the adoption of PDR technologies. European nations with stringent emissions standards are incentivizing reduced solvent usage and minimized repaint cycles, prompting workshops to integrate advanced dent removal tools and digital inspection platforms. In Middle Eastern markets, the proliferation of luxury vehicle ownership necessitates premium repair services that preserve cosmetic integrity. Simultaneously, select African markets are emerging as high-potential arenas, fueled by rising urbanization, expanding automotive fleets, and an increasing emphasis on maintenance over replacement.

The Asia Pacific region presents a dynamic blend of established and frontier markets. Developed economies in East Asia showcase sophisticated PDR operations backed by cutting-edge tool innovation and structured training programs. Southeast Asian nations are rapidly adopting mobile service models to address infrastructure constraints and urban traffic challenges. Within Australia and New Zealand, a strong aftermarket ecosystem and collaborative industry associations support continuous refinement of techniques and quality standards. Collectively, these regional nuances underscore the importance of localized strategies and adaptive service models to harness growth opportunities across diverse geographies.

Examining competitive strategies, innovation trajectories, and investment priorities of leading paintless dent repair service providers driving industry evolution

Leading entities within the paintless dent repair domain are distinguished by their robust investment in research and development, enabling the introduction of next-generation tools and process innovations. These frontrunners have established integrated solution portfolios that encompass end-to-end service offerings-from advanced inspection technologies to proprietary adhesive formulations-thereby elevating repair precision and efficiency. In parallel, selected global tool manufacturers are forging strategic alliances with workshop networks to co-create tailored tool kits that address evolving panel materials and intricate dent geometries.Regional specialists are also carving out competitive niches by emphasizing localized service excellence and deep market understanding. In markets where mobile repairs are gaining traction, trailblazers have developed agile fleet management systems that optimize technician routing, minimize response times, and enhance customer satisfaction. Conversely, in high-volume collision hubs, top-tier players have augmented traditional in-shop capabilities with scalable production models, ensuring standardized quality even under peak demand conditions. Across both models, continuous upskilling initiatives and certification programs are reinforcing brand credibility and guaranteeing consistent workmanship standards.

Furthermore, a growing cohort of technology-driven entrants is disrupting conventional value chains by integrating digital platforms for virtual damage assessment, remote consultation, and dynamic pricing. These innovators are leveraging data analytics to predict service demand, personalize customer interactions, and streamline inventory management. Collectively, these company-level insights highlight a competitive ecosystem propelled by a balance of operational agility, toolset innovation, and data-centric service delivery.

Strategic imperatives and practical guidelines for industry leaders to seize emerging opportunities and boost competitive standing in paintless dent repair

To thrive in the evolving paintless dent repair environment, industry leaders should prioritize the expansion of mobile service capabilities, harnessing on-demand and scheduled delivery models to meet shifting customer expectations for convenience and rapid turnaround. Establishing agile fleet structures complemented by advanced dispatch algorithms will optimize resource allocation and minimize idle time. Parallelly, investing in digital inspection tools-such as high-resolution imaging, cloud-based damage assessment software, and augmented reality training modules-will enhance diagnostic accuracy and accelerate technician proficiency.Moreover, forging strategic alliances with insurance carriers and fleet operators can streamline claims workflows and foster transparent pricing mechanisms. Collaborative platforms that integrate repair documentation, real-time progress tracking, and automated approval processes will not only improve operational efficiency but also reinforce stakeholder trust. Simultaneously, sourcing diversification strategies are critical to mitigate tariff-induced supply chain disruptions. Partnering with domestic tool producers and nearshoring component assembly can safeguard input availability and stabilize cost structures amid shifting trade policies.

Sustainability should also feature prominently within strategic plans. Adopting low-emission adhesives, recyclable tool materials, and solvent-free cleaning agents will align service offerings with environmental mandates and enhance brand differentiation. Additionally, developing comprehensive workforce training programs-encompassing hands-on workshops, virtual simulations, and certification pathways-will ensure consistent service quality and foster talent retention. By embedding these actionable imperatives into their operational roadmap, market participants can unlock new revenue streams, fortify competitive positioning, and secure long-term growth in paintless dent repair.

Detailing the rigorous research framework, data sources, and analytical protocols underpinning comprehensive insights into the paintless dent repair service market

To construct a robust analytical foundation, this study employed a multifaceted research framework combining primary and secondary data acquisition. Primary research consisted of in-depth interviews and surveys with executive management teams, operations personnel, and technical experts spanning service providers, tool manufacturers, and insurance stakeholders. These engagements yielded qualitative insights into emerging operational practices, technology adoption rates, and strategic priorities.Secondary research involved a thorough review of corporate publications, regulatory filings, industry conference proceedings, and technical journals. This approach facilitated triangulation of data points related to tool and technique innovations, service delivery models, and regional market trends. Trade association reports and governmental trade databases provided additional context on tariff changes, compliance requirements, and supply chain shifts.

Analytical protocols integrated both qualitative and quantitative methodologies. Thematic analysis was applied to interview transcripts to extract recurring patterns, while scenario analysis evaluated the potential trajectories of trade policy impacts. Cross-sectional segmentation models were developed to interpret service type, vehicle classifications, tool categories, and end-user behaviors. Geospatial analysis further illuminated regional performance differentials. Rigorous validation steps, including peer review by independent subject-matter experts and consistency checks across multiple data sources, ensured the reliability and credibility of the findings presented herein.

Summarizing key takeaways and strategic implications to empower decision-makers with actionable foresight in the paintless dent repair service ecosystem

In synthesizing these comprehensive insights, it becomes evident that the paintless dent repair landscape is undergoing significant transformation driven by technological innovation, operational agility, and shifting trade policies. The integration of digital inspection platforms and advanced toolsets is enhancing service precision, while the proliferation of mobile service models is redefining customer engagement and accessibility. Concurrently, tariff adjustments through 2025 are reshaping supply chain dynamics, compelling stakeholders to adopt diversified sourcing and nearshoring strategies.Segmentation analysis underscores the importance of tailored approaches that align with service type, vehicle category, and application-specific requirements. Regional variations highlight the need for localized strategies, whether by leveraging established insurance partnerships in the Americas, adhering to stringent sustainability mandates in Europe Middle East and Africa, or capitalizing on rapid service adoption in Asia Pacific. Competitive intensity is characterized by a balance of established global players, nimble regional specialists, and technology disruptors, each contributing to a dynamic ecosystem.

By embracing the actionable recommendations outlined-ranging from fleet expansion and digitalization to supply chain resilience and sustainability initiatives-industry participants can position themselves to capture emerging opportunities and navigate future uncertainties. Ultimately, stakeholders equipped with these evidence-based perspectives are better poised to drive value creation and sustain growth within the evolving paintless dent repair market.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Service Type

- In Shop

- Mobile

- On Demand

- Scheduled

- Vehicle Type

- Commercial Vehicle

- Heavy Commercial Vehicle

- Light Commercial Vehicle

- Passenger Vehicle

- Commercial Vehicle

- Technique Used

- Blending Technique

- Cold Rolling / Tapping Down

- Glue Pulling

- Lever/Push Rod Technique

- Application

- Collision Repair

- Heavy Collision

- Light Collision

- Medium Collision

- Crease Removal

- Hail Damage

- Minor Dent Removal

- Collision Repair

- End User

- Fleet Operators

- Individual Consumers

- Insurance Companies

- Distribution Channel

- Independent Workshop

- Insurance Sponsored Service Centers

- Oem Dealership

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Dent Wizard International, Inc.

- AutoDent LLC

- BumperDoc

- Colors on Parade Mobile Body Shop, LLC

- Dent Masters International, Inc by Brightpoint Auto Body Repair

- Dentbusters, Inc.

- DentPro Corporation

- DENTTECHLLC

- Dillon Hail Repair

- Ding King Auto Body, Inc.

- Elimidents, LLC

- Express PDR, LLC

- fixxadent

- Hail Butlers LLC

- MAGIC DENTS

- Mondofix Inc

- Pop-A-Dent, LLC

- Premier Paintless Dent Repair, LLC

- ProDent LLC

- Speedy Dent Repair Ltd

- The Auto Clinique LLC

- Titan Hail Repair LLC

- Titan Paintless Dent Repair, LLC

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Paintless Dent Repair Service market report include:- Dent Wizard International, Inc.

- AutoDent LLC

- BumperDoc

- Colors on Parade Mobile Body Shop, LLC

- Dent Masters International, Inc by Brightpoint Auto Body Repair

- Dentbusters, Inc.

- DentPro Corporation

- DENTTECHLLC

- Dillon Hail Repair

- Ding King Auto Body, Inc.

- Elimidents, LLC

- Express PDR, LLC

- fixxadent

- Hail Butlers LLC

- MAGIC DENTS

- Mondofix Inc

- Pop-A-Dent, LLC

- Premier Paintless Dent Repair, LLC

- ProDent LLC

- Speedy Dent Repair Ltd

- The Auto Clinique LLC

- Titan Hail Repair LLC

- Titan Paintless Dent Repair, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | November 2025 |

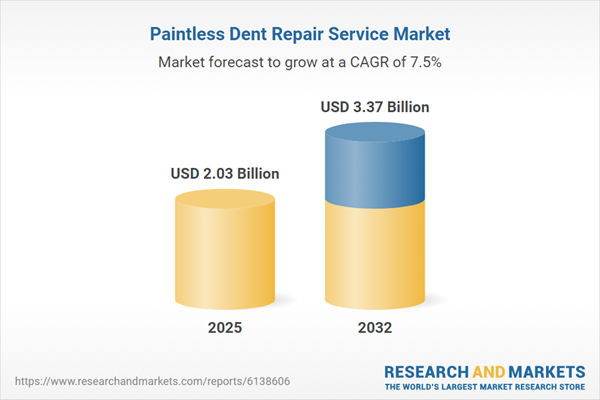

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 2.03 Billion |

| Forecasted Market Value ( USD | $ 3.37 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |