Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Stage for an In-Depth Examination of the Tableware Rental Service Industry's Evolving Dynamics, Emerging Trends, and Strategic Imperatives

In an era defined by dynamic event landscapes and shifting consumer expectations, the tableware rental service sector has emerged as a pivotal enabler of seamless event execution and elevated hospitality experiences. Organizations ranging from boutique event planners to global hospitality chains now recognize the critical importance of sourcing high-quality table settings that align with the tone and scale of each occasion. This report opens with an exploration of the market's foundational pillars, examining how service excellence, operational efficiency, and aesthetic innovation converge to drive demand for rental offerings across diverse end users.With rising sustainability concerns and cost optimization imperatives at the forefront of corporate and consumer agendas, rental services have transcended their traditional role to become strategic partners in event planning. Rather than focusing solely on one-time purchases, stakeholders appreciate the environmental benefits of reusable assets and the financial flexibility afforded by rental models. As a result, providers are investing in sophisticated inventory management systems, customized design services, and integrated logistics capabilities. This introduction sets the stage for a comprehensive analysis of market forces, regulatory shifts, and emerging opportunities that collectively define the current and future trajectory of the tableware rental service industry.

Analyzing Revolutionary Market Forces Redefining Operational Models Customer Experiences and Sustainability Practices Within Tableware Rental Services

Recent years have witnessed transformative shifts reshaping the competitive landscape of tableware rental services. One of the most profound changes stems from the integration of digital platforms and data-driven decision making. Technology adoption has accelerated, enabling providers to streamline order processing, automate inventory tracking, and offer virtual visualization tools that allow clients to design table settings with unprecedented precision. Consequently, the customer journey has evolved from impersonal catalog browsing to immersive online experiences, effectively raising the bar for service expectations.Concurrently, the rise of sustainability as a core value has reoriented procurement strategies and vendor selection criteria. Clients now demand transparency regarding material sourcing, waste management protocols, and carbon footprint mitigation. This shift has prompted service providers to optimize laundering processes, embrace energy-efficient warehousing solutions, and offer reusable alternatives that align with circular economy principles. Moreover, evolving demographic preferences, including a growing appetite for customization and experiential differentiation, have spurred providers to diversify product portfolios and develop thematic collections that cater to niche event formats. Through these combined forces, the industry is undergoing a profound redefinition of its value proposition and operational blueprint.

Unpacking the Ripple Effects of 2025 United States Tariff Measures on Procurement Expenditures Supply Chain Resilience and Competitive Positioning

With the implementation of the 2025 United States tariffs, tableware rental providers have encountered a multifaceted impact on cost structures and supply chain resilience. Tariffs imposed on imported ceramics, glass, and stainless steel have directly influenced procurement expenses, compelling providers to reassess vendor relationships and material sourcing strategies. As import duties have risen, many suppliers have faced the imperative of diversifying their manufacturing base or negotiating long-term contracts to mitigate price volatility, ensuring continuity of service for end users.This realignment has also highlighted the importance of domestic production capabilities and regional supply hubs. Firms with localized warehousing and distribution networks have experienced enhanced agility, successfully absorbing incremental costs while maintaining competitive pricing models. Conversely, providers reliant on single-source imports have navigated operational dilemmas, balancing the imperative to preserve service standards against the need to sustain profit margins. Furthermore, the tariff environment has stimulated innovation in alternative materials, prompting exploratory collaborations with textile manufacturers and eco-friendly composite producers. In sum, the 2025 tariffs have served as a catalyst for strategic adaptation, driving industry players toward more robust, diversified, and cost-efficient supply chain architectures.

Deconstructing Multi-Dimensional Segmentation Elements Illustrating Product Type Materials and Customer Profiles That Shape Rental Service Demand

Understanding the varied drivers of demand requires a nuanced appreciation of product type segmentation, material composition, and customer classification. The product spectrum spans foundational categories such as cutlery, glassware, linens, plates, and serveware, each carrying its own design and functional considerations. Within cutlery, offerings differentiate themselves through forks, knives, and spoons crafted for diverse dining contexts, while glassware encompasses specialized formats including champagne flutes, tumblers, and wine glasses that cater to beverage pairing narratives. Linens, in turn, range from chair covers to napkins and tablecloths, each fabric choice influencing both aesthetics and laundering regimes. Plates encompass dessert, dinner, and salad varieties, reflecting event themes and menu sequencing, whereas serveware options such as bowls and trays facilitate buffet and plated service modalities.Material composition adds another layer of refinement, with ceramic, glass, plastic, and stainless steel choices shaping durability profiles, cleaning protocols, and sustainability footprints. Ceramic components deliver a premium tactile impression but require more intensive handling, while glass offerings combine elegance with careful breakage management. Plastic alternatives provide lightweight, cost-effective solutions that support high-volume events, and stainless steel stands out for its resilience and sanitization efficiency. Meanwhile, the spectrum of customer types spans institutional and individual segments, with business clients including event planners, hotels, and restaurants seeking tailored service agreements and volume discounts, while individual consumers prioritize flexibility and aesthetic customization for private gatherings. This three-dimensional segmentation matrix offers providers a strategic framework to align product development and marketing initiatives with specific client needs.

Examining Diverse Regional Market Characteristics Influenced by Economic Trends Regulatory Environments and Cultural Celebratory Practices Across Americas EMEA and Asia-Pacific

Regional market dynamics reveal distinct growth trajectories shaped by economic vitality, cultural preferences, and regulatory landscapes. In the Americas, the affinity for large-scale corporate events, festivals, and high-profile celebrations drives demand for premium tableware collections and end-to-end rental solutions. Providers operating in North and South America leverage advanced logistics networks and regional manufacturing partnerships to optimize lead times and cost efficiency, while strategic distribution centers facilitate rapid deployment across diversified markets.Europe, Middle East & Africa embodies a mosaic of regulatory frameworks and consumer behaviors. The emphasis on sustainability in Western European nations has accelerated adoption of low-waste laundering technologies and circular rental models. In the Middle East, luxury hospitality projects and destination weddings command bespoke tableware designs, prompting service providers to collaborate with local artisans and design studios. African markets, although nascent in formalized rental practices, present significant untapped potential as urbanization accelerates and hospitality standards evolve.

In the Asia-Pacific region, a combination of burgeoning middle-class spending and rising experiential event formats fuels expansion. Countries such as China, India, and Australia exhibit strong appetite for themed celebrations and corporate gatherings, driving providers to scale their inventories quickly while ensuring consistent quality controls. Cross-border trade agreements and logistical corridors within this region further enhance supply chain fluidity, enabling faster replenishment cycles and lower transit costs. Collectively, these regional distinctions underscore the imperative for providers to tailor service offerings and operational strategies in alignment with localized market conditions.

Profiling Market Leaders That Leverage Technology, Vertical Integration, and Design Collaborations to Establish Competitive Moorings and Accelerate Growth Trajectories

Leading service providers have differentiated themselves through investments in technology, strategic partnerships, and brand-building initiatives. Classic Party Rentals has earned recognition for its comprehensive online configurator that enables clients to visualize table settings in situ, enhancing the decision-making process. BBJ Linen has distinguished itself through a vertically integrated model that spans manufacturing, distribution, and in-house laundering, delivering consistent quality and rapid turnaround times at scale. CORT Events has prioritized geographic expansion, establishing regional distribution hubs that reduce lead times and support multinational client engagements.Tri-Star Tabletop has focused on product innovation, collaborating with designers to introduce limited-edition collections that resonate with high-end event planners and hospitality chains. A2Z Event Rental & Sales has adopted a hybrid sales model, blending rental and purchase options to cater to both one-off events and permanent installations. These organizations share a common emphasis on digital enablement, deploying inventory management systems that leverage real-time data analytics to optimize stock utilization and minimize asset downtime. Their strategic playbooks illustrate how targeted investments in technology and service capabilities can enhance customer loyalty, drive margin expansion, and secure long-term industry leadership.

Developing Actionable Strategic Pathways That Integrate Digital Excellence Sustainability Initiatives Design Differentiation and Targeted Expansion to Secure Market Leadership

To thrive amid escalating competitive pressures and evolving customer expectations, industry leaders must pursue a multifaceted strategic agenda. First, providers should deepen investments in digital platforms that unify client-facing interfaces with back-end inventory management and logistics coordination. By harnessing real-time data streams, organizations can achieve precision in asset allocation, reduce idle inventory, and anticipate maintenance requirements. This proactive approach not only enhances service reliability but also strengthens client trust in the provider's operational rigor.Second, cultivating sustainable practices represents both a responsibility and a growth enabler. Adopting closed-loop laundering systems, integrating eco-friendly materials, and tracking carbon footprints at the enterprise level will resonate with environmentally conscious clients. In parallel, partnerships with emerging suppliers of recycled or bio-based materials can diversify the product portfolio while reinforcing corporate social responsibility commitments. Third, differentiation through bespoke design services and thematic offerings can capture niche market segments. Collaborations with local artisans, interior designers, and cultural consultants will enable providers to curate exclusive collections that align with client narratives. Finally, geographic expansion should be pursued judiciously, focusing on markets where regulatory alignment and infrastructure maturity support operational scalability. Through joint ventures, strategic alliances, or targeted acquisitions, organizations can unlock new revenue streams while maintaining service quality standards.

Elaborating a Comprehensive Research Protocol Incorporating Primary Interviews, Quantitative Surveys, Secondary Analysis, and Multi-Method Quality Assurance Measures

This research study was built upon a robust methodological framework combining primary and secondary data sources to ensure comprehensive coverage and analytical rigor. Primary research involved in-depth interviews with key decision makers across event planning firms, hospitality operators, and rental service providers. These qualitative engagements yielded nuanced insights into operational challenges, service preferences, and emerging trend signals. Supplementary phone and virtual surveys with end users provided quantifiable perspectives on satisfaction levels, feature priorities, and willingness to pay for premium offerings.Secondary research encompassed a systematic review of industry publications, regulatory filings, and corporate reports to validate market developments, tariff impacts, and technological advancements. Data triangulation was achieved by cross-referencing findings from multiple sources and reconciling any discrepancies through follow-up inquiries. The analytical framework employed a blend of SWOT analysis, Porter's Five Forces, and PESTEL assessment to evaluate competitive dynamics, regulatory influences, and macroeconomic factors. Rigorous data validation protocols ensured integrity of the final insights, and all proprietary datasets underwent a multi-tier quality check before incorporation into the final report deliverables.

Summarizing Strategic Insights on Digital Integration, Sustainability Commitments, and Adaptive Supply Chain Strategies That Define Future Success in Tableware Rentals

The insights distilled in this report underscore the intricate interplay between technological advancement, sustainability imperatives, and evolving customer expectations in the tableware rental service market. Providers that align their digital infrastructure with real-time operational analytics, prioritized eco-friendly practices, and thematic design offerings will be best positioned to capture high-value segments. Moreover, strategic agility in response to tariff-induced supply chain disruptions and regional market variances will differentiate resilient organizations from those constrained by cost pressures.As the industry continues its trajectory toward a circular, digitally enabled ethos, stakeholders must remain vigilant to emerging materials, new consumption models, and shifting regulatory landscapes. The future growth path will favor incumbents and challengers alike who invest in integrative solutions spanning end-to-end service delivery, from procurement to post-event logistics. This conclusion affirms the imperative for continuous innovation as firms seek to solidify their competitive moorings and meet the heightened demands of a global client base.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Cutlery

- Forks

- Knives

- Spoons

- Glassware

- Champagne Flutes

- Tumblers

- Wine Glasses

- Linens

- Chair Covers

- Napkins

- Tablecloths

- Plates

- Dessert Plates

- Dinner Plates

- Salad Plates

- Serveware

- Bowls

- Trays

- Cutlery

- Material

- Ceramic

- Glass

- Plastic

- Stainless Steel

- Customer Type

- B2B

- Event Planners

- Hotels

- Restaurants

- B2C

- B2B

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Event Source JBK Group, Inc.

- Maison Margaux Ltd

- Abbey Party Rents

- Arena Group

- A to Z Event Rentals

- ATLAS EVENT RENTAL

- Beyond Elegance

- Brass Line Hirer

- Bright Event Rentals

- Butler Rents

- Grand Event Rentals

- Heirloom Events

- Party Pro Rents

- Party.Rent Franchise GmbH

- PEAK Event Services

- Pedersens Rentals

- Primary Event Rentals

- PROP Premium Decoration Rentals

- Raphael's Party Rentals

- Signature Event Rentals

- Spoon + Salt

- Stuart Event Rentals

- Swift + Company

- TableMade

- The Bartan Company

- The Hostess Haven

- The Sophisticated Touch

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Tableware Rental Service market report include:- Event Source JBK Group, Inc.

- Maison Margaux Ltd

- Abbey Party Rents

- Arena Group

- A to Z Event Rentals

- ATLAS EVENT RENTAL

- Beyond Elegance

- Brass Line Hirer

- Bright Event Rentals

- Butler Rents

- Grand Event Rentals

- Heirloom Events

- Party Pro Rents

- Party.Rent Franchise GmbH

- PEAK Event Services

- Pedersens Rentals

- Primary Event Rentals

- PROP Premium Decoration Rentals

- Raphael's Party Rentals

- Signature Event Rentals

- Spoon + Salt

- Stuart Event Rentals

- Swift + Company

- TableMade

- The Bartan Company

- The Hostess Haven

- The Sophisticated Touch

Table Information

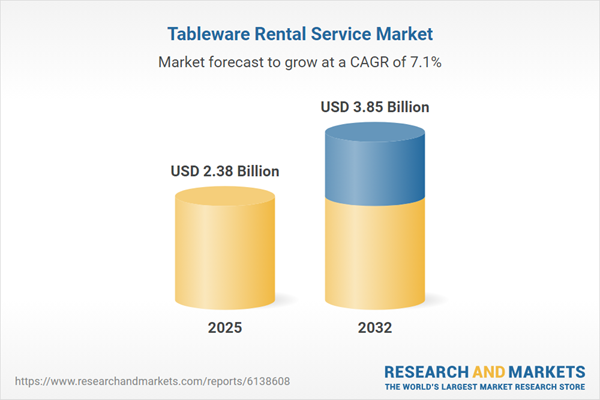

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 2.38 Billion |

| Forecasted Market Value ( USD | $ 3.85 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |