Speak directly to the analyst to clarify any post sales queries you may have.

The industrial HVAC market is undergoing swift transformation, driven by demands for energy efficiency, environmental compliance, and operational resilience. Senior leaders require actionable insights to align investments and navigate the sector's evolving landscape.

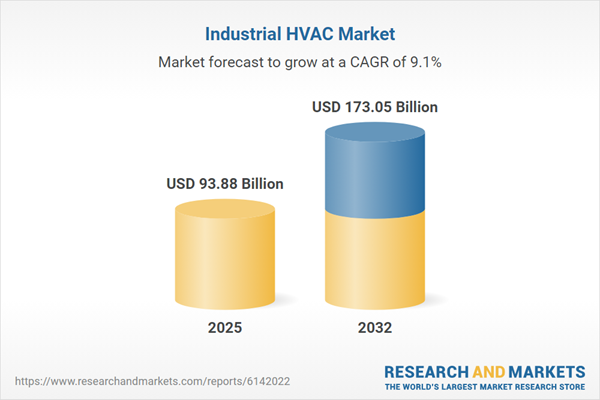

Market Snapshot: Industrial HVAC Market Size and Growth

The industrial HVAC market grew from USD 86.42 billion in 2024 to USD 93.88 billion in 2025. It is projected to maintain a robust trajectory at a CAGR of 9.06%, reaching USD 173.05 billion by 2032. This momentum reflects heightened attention to sustainability, stricter regulations, and operational demands across manufacturing, infrastructure, and data-intensive industries.

Comprehensive Scope & Segmentation of the Industrial HVAC Market

This report delivers an extensive breakdown across the entire industrial HVAC landscape, enabling granular analysis and tailored strategies:

- System Types: Cooling equipment (air conditioning, chillers: air-cooled, evaporative, water-cooled, cooling towers), heating equipment (boilers, furnaces, heat pumps), and ventilation equipment (air filters, air handling units, air purifiers, dehumidifiers, humidifiers, ventilation fans).

- Components: Hardware (compressors, condensers, evaporators, fans), services (installation, maintenance), and software (analytics and optimization, building automation systems).

- Fuel Types: Electric, gas, and oil-powered systems suited to varying regulatory and operational needs.

- Control Technologies: Automated HVAC systems and manual control solutions to accommodate digital and legacy operations.

- Capacities: Airflow, cooling, and heating capacities tailored for diverse industrial settings, supporting a range of process requirements.

- Applications: Air quality and contamination control, process climate control, and thermal management for specialized industrial contexts, including server cooling and hazardous airflow management.

- Deployment Types: New installations and retrofit solutions to support both greenfield projects and upgrades.

- End-Use Industries: Aerospace, automotive, chemicals, data centers, food & beverage, marine, metals, oil & gas, pharmaceuticals, plastics, power generation, semiconductors, textiles, warehousing, and logistics.

- Regions Covered: Americas (United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru), Europe (including UK, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland), Middle East (UAE, Saudi Arabia, Qatar, Turkey, Israel), Africa (South Africa, Nigeria, Egypt, Kenya), Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan).

- Leading Companies Analyzed: Includes AAON, Alfa Laval, Carrier, Daikin, Danfoss, Emerson, Hitachi, Honeywell, Johnson Controls, Lennox, LG Electronics, Midea Group, Mitsubishi Electric, Panasonic, Rheem, Bosch, Samsung, Trane Technologies, and more.

Key Takeaways and Strategic Insights

- Digitalization is rapidly redefining system monitoring, with IoT-enabled controls and digital twins supporting predictive maintenance and optimized facility management.

- Stringent regulatory frameworks are accelerating adoption of low-GWP refrigerants, catalyzing R&D in sustainable chemistry and leak containment solutions.

- Modular and scalable HVAC solutions provide flexibility for both retrofits and capacity expansions, supporting fast-changing industrial needs.

- Collaboration between equipment manufacturers, software providers, and energy service firms advances integrated solutions, enabling bundled performance guarantees and smarter capital deployment.

- Industry-wide sustainability imperatives—driven by investor and customer expectations—are repositioning environmental transparency as a core business requirement rather than a compliance task.

- Regional differentiation remains vital, with regulatory climates in Europe, digital integration in Asia-Pacific, and supply chain strategies in the Americas shaping demand patterns and investment priorities.

Tariff Impact on Supply Chains and Procurement Strategies

Recent tariff adjustments in the United States are increasing import costs for essential HVAC components, prompting procurement teams to reassess sourcing models. These changes are influencing budgets, extending project timelines, and prompting manufacturers and installers to consider domestic production or multi-region sourcing to protect against trade-related volatility. Successful organizations are adopting inventory buffering, dual sourcing, and proactive engagement with customs professionals to maintain project flow and cost predictability.

Methodology & Data Sources

Our methodology integrates primary consultations with senior executives and technical specialists in diverse geographies, alongside rigorous secondary analysis of industry reports, technical journals, and regulatory filings. Scenario modeling and data triangulation enhance the reliability and context of findings, supporting confident decision-making for industrial HVAC stakeholders.

Why This Report Matters to Senior Decision-Makers

- Delivers clear intelligence to guide investments in compliant, sustainable, and future-ready HVAC systems.

- Enables procurement, operations, and executive teams to anticipate shifts in technology, supply chain risks, and regulatory drivers with data-backed foresight.

- Facilitates tailored strategy development by aligning market segmentation, technology trends, and regional demand signals for optimal positioning.

Conclusion

This report equips leaders with a comprehensive understanding of the industrial HVAC market, supporting informed strategies amidst regulatory, technological, and operational complexity. Harness these insights to drive resilient, efficient, and sustainable business growth.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Industrial HVAC market report include:- AAON, Inc.

- Alfa Laval AB

- BELIMO Holding AG

- Carrier Global Corporation

- CSW Industrials, Inc.

- Daikin Industries, Ltd.

- Danfoss A/S

- Emerson Electric Co.

- Hitachi, Ltd.

- Honeywell International Inc.

- Ingersoll Rand Inc.

- Johnson Controls International plc

- Lennox International Inc.

- LG Electronics Inc.

- Midea Group Co., Ltd.

- Mitsubishi Electric Corporation

- Panasonic Holdings Corporation

- Rheem Manufacturing Company

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Shield Air Solutions, Inc.

- Specific Systems, LLC

- SPX Technologies

- Taikisha Ltd.

- Trane Technologies plc

- Watts Water Technologies, Inc.

- WHESCO Group, Inc.

- SIROCO HVAC INDIA PVT LTD

- Tate Engineering, Inc.

- Blue Star Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 93.88 Billion |

| Forecasted Market Value ( USD | $ 173.05 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |