Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Core Drivers Shaping the Future of Commercial Kitchen Flooring Solutions Across Materials, Applications, and Innovation

In today’s fast-paced commercial environments, the flooring beneath every cook station and prep counter is more than just a surface-it defines operational efficiency, safety, and hygiene standards. Increasingly stringent sanitation protocols intersect with heightened expectations for durability, demanding solutions that resist spills, stains, and wear while maintaining a cleanable surface. Facility managers and foodservice operators face the challenge of balancing cost considerations with performance requirements, all within the confines of tight installation windows and evolving regulatory mandates.Innovation in material science has given rise to a diverse array of flooring options tailored to specific operational demands. From the emergence of high-performance resins that cure rapidly under ultraviolet light to advanced tile compositions that integrate antimicrobial properties, the spectrum of choices continues to expand. Meanwhile, budgets remain under scrutiny, compelling decision makers to evaluate total lifecycle costs rather than just upfront expenses.

This executive summary distills the critical drivers shaping the commercial kitchen flooring segment, examining transformative shifts in design and technology, the ramifications of trade policy changes, and nuanced segmentation structures by material, end user, distribution channel, and installation type. Subsequent sections provide regional perspectives, competitive analysis, and strategic recommendations rooted in rigorous research methodologies. The goal is to equip stakeholders with a clear, authoritative roadmap for navigating a market in flux and unlocking sustainable value.

Unprecedented Transformations in Commercial Kitchen Flooring Driven by Innovation, Hygiene Imperatives, and Sustainable Design Demands

The commercial kitchen flooring landscape is undergoing a profound transformation as hygiene imperatives and performance benchmarks converge to redefine product expectations. Advanced resinous coatings featuring antimicrobial additives and seamless epoxy systems have gained traction, offering operators the ability to meet rigorous sanitation requirements while minimizing joints that harbor contaminants. Simultaneously, tile manufacturers are innovating with low-porosity ceramics and high-density porcelain variants that resist moisture ingress and chemical exposure, extending service life and reducing maintenance cycles.Sustainability considerations now permeate the design and procurement processes, driving adoption of recycled rubber composites and bio-based vinyl compounds that reduce environmental footprints. Manufacturers are integrating post-consumer materials into rubber formulations and deploying phthalate-free plasticizers in vinyl production to comply with emerging green building standards. As a result, long-term cost savings from energy-efficient cleaning protocols and extended replacement intervals are becoming key selling points.

Digitalization also plays a growing role, with Building Information Modeling integration streamlining material selection, specification, and installation planning. Customizable patterns and modular flooring systems enable rapid reconfiguration of kitchen layouts, enhancing operational agility in dynamic foodservice environments. Taken together, these shifts illustrate a market that is simultaneously embracing technological innovation, environmental stewardship, and data-driven design to meet the exacting demands of modern commercial kitchens.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Supply Chains, Material Costs, and Pricing Structures in Commercial Kitchen Flooring

The implementation of new United States tariffs scheduled for 2025 has introduced a complex set of variables affecting supply chains, procurement strategies, and end-user pricing in the commercial kitchen flooring sector. Tariffs levied on key imported raw materials, including specialized resins, ceramic tile components, and vinyl polymers, have driven manufacturers to reassess sourcing strategies and explore alternative suppliers in tariff-exempt regions. This recalibration has, in some cases, lengthened lead times and introduced variability in material specifications.In response, several domestic producers have accelerated investments in local manufacturing capacity, aiming to insulate their operations from international trade fluctuations. While these initiatives help stabilize supply and manage cost inflation, they also require significant capital expenditures and extended ramp-up periods. End users are balancing the benefits of reduced exposure to import duties against potential price increases stemming from higher domestic production costs.

Moreover, the tariff environment has incentivized consolidation of purchase volumes to maximize negotiating leverage with suppliers, alongside the adoption of total cost analysis models that account for duty rates, freight expenses, and potential mitigation strategies such as bonded warehousing. As stakeholders navigate a landscape marked by ongoing tariff volatility, proactive risk management and strategic supplier partnerships have emerged as critical enablers of cost containment and operational resilience.

Revealing Critical Market Segmentation Insights Spanning Material Types, End Users, Distribution Channels, and Installation Variants

Material diversity in the commercial kitchen flooring market extends from the traditional robustness of ceramic tile-offered in both non-porcelain and porcelain variants-to advanced polymer systems. Epoxy solutions distinguish themselves through mortar-based formulations for high-impact areas and self-leveling resins that ensure seamless finishes. Rubber surfaces achieve resilience through calendered sheets ideal for continuous runs and molded components suited for matting applications. Vinyl products span heterogeneous constructions for general-purpose use, homogeneous formulations for uniform performance, and luxury vinyl tile designed to mimic natural substrates while delivering enhanced durability.End-user requirements further stratify demand across healthcare facilities, where clinics demand hygienic surfaces amenable to frequent disinfecting and hospitals prioritize slip resistance in emergency wings. In the hospitality sector, boutique properties seek bespoke aesthetic expressions, budget hotels focus on cost-effective installations with quick turnaround times, and luxury hotels emphasize premium finishes that complement upscale décor. Restaurant segments range from full-service establishments requiring large-scale, wear-resistant flooring to institutional catering venues where functionality and rapid maintenance are paramount, and quick-service outlets that prioritize fast installation and replacement cycles.

Distribution channels reflect a balance between direct sales channels offering custom project support, national and regional distributors who manage broad product portfolios, and retailers operating both offline showrooms and online platforms to serve smaller-scale buyers. Installation methodologies divide into new installations that integrate flooring into construction workflows and replacement installations that demand minimal downtime and precise removal of existing materials. This layered segmentation provides stakeholders with a clear framework for targeting product development, marketing, and service offerings.

Key Regional Dynamics Shaping Adoption and Investment Trends Across the Americas, Europe Middle East and Africa, and Asia-Pacific Markets

Within the Americas, demand is propelled by high-volume quick-service restaurant chains and expanding healthcare infrastructure projects. Regulatory compliance with North American sanitation standards drives rapid adoption of seamless resinous floors in commercial kitchens, while Latin American markets show growing interest in cost-effective ceramic and vinyl options to support a burgeoning urban hospitality sector.In Europe, Middle East and Africa, stringent EU regulations on indoor air quality and chemical emissions have prompted widespread use of low-VOC and phthalate-free vinyl flooring, as well as enhanced epoxy systems in high-volume kitchen environments. Gulf countries are investing extensively in large-scale hospitality developments, generating demand for premium porcelain tiles and innovative antimicrobial surfaces to meet luxury and hygiene expectations.

Asia-Pacific exhibits the fastest growth trajectory, fueled by rising disposable incomes, expansion of international hotel brands, and government initiatives to upgrade healthcare facilities. Local manufacturers in Southeast Asia are producing rubber and vinyl composites to capitalize on lower production costs, while major metropolitan centers in East Asia leverage advanced ceramic extrusion technologies and robotics-assisted installation techniques to optimize project timelines and ensure consistent quality.

Analyzing the Strategies, Innovations, and Competitive Positioning of Leading Stakeholders in the Commercial Kitchen Flooring Sector

Leading participants are differentiating through integrated solutions that combine material innovation with value-added services. Some manufacturers have expanded their portfolios to include turnkey flooring systems, offering advisory services on specification, subfloor preparation, and maintenance training. Others have pursued strategic partnerships with coating technology firms to co-develop hybrid surfaces that deliver both seamless resilience and decorative flexibility.Competitive positioning is also influenced by mergers and acquisitions aimed at strengthening geographic reach and product breadth. Regional distributors have aligned with global production platforms to offer just-in-time delivery models, while boutique suppliers focus on niche segments such as biodegradable vinyl and ultra-high-performance ceramics. Cross-industry collaborations with hygiene technology providers have yielded surfaces treated with long-lasting antimicrobial agents, reinforcing safety credentials in healthcare and foodservice environments.

Investment in digital tools-ranging from augmented reality visualization for layout planning to online configurators enabling rapid specification-has become a hallmark of market leaders. By enhancing the customer experience and streamlining project workflows, these capabilities not only support higher conversion rates but also foster long-term client relationships grounded in reliability and technical expertise.

Actionable Strategic Recommendations to Enhance Market Resilience, Drive Innovation, and Optimize Growth in the Commercial Kitchen Flooring Industry

Industry leaders should prioritize end-to-end solutions that address hygiene, durability, and design requirements in an integrated manner. Investing in research and development of novel resin blends or tile coatings with enhanced antimicrobial and stain-resistant properties will differentiate offerings in a crowded market. Furthermore, establishing flexible manufacturing processes that accommodate small-batch customization alongside high-volume production can capture demand across diverse end-user segments.To mitigate supply chain risks associated with tariff fluctuations, organizations should diversify sourcing by qualifying secondary suppliers in multiple trade zones and leveraging bonded warehousing to smooth cost impacts. Implementing advanced analytics to forecast material requirements and monitor cost drivers will enable more precise procurement planning. Similarly, building robust partnerships with installation contractors and offering value-added services such as maintenance training can strengthen market position and drive recurring revenue streams.

Finally, embracing digital engagement tools-from virtual showrooms that allow clients to experience flooring options in simulated kitchen environments to data-driven specification platforms that optimize material selection-will enhance customer satisfaction and accelerate decision cycles. By combining technical excellence with responsive service models, industry leaders can secure lasting competitive advantage in the evolving commercial kitchen flooring landscape.

Comprehensive Research Methodology Leveraging Primary Interviews, Secondary Sources, and Data Triangulation to Ensure Analytical Rigor

The insights presented in this executive summary are based on a multi-layered research framework combining primary and secondary data collection, expert consultations, and rigorous analytical techniques. Primary research included in-depth interviews with industry executives, end-user facility managers, distribution channel leaders, and installation specialists to capture perspectives on performance requirements, emerging trends, and purchasing criteria.Secondary research drew upon publicly available technical papers, regulatory databases, corporate filings, and industry association reports to establish a contextual baseline of material innovations, market drivers, and trade policy developments. Trade flow analyses were conducted using customs databases to quantify shifts in import and export patterns, while case studies of recent major installations provided practical insights into project timelines, cost components, and installation best practices.

All data points were triangulated through cross-functional reviews to validate findings and reconcile discrepancies. Quantitative outputs were supplemented by qualitative assessments to ensure a holistic understanding of market dynamics. This methodological rigor underpins the reliability of the segmentation analysis, regional insights, competitive benchmarking, and strategic recommendations detailed herein.

Conclusive Insights Highlighting Market Evolution, Strategic Priorities, and the Path Forward for Commercial Kitchen Flooring Stakeholders

The commercial kitchen flooring sector stands at the intersection of operational performance, design aesthetics, and regulatory compliance. Rapid advancements in material technologies-ranging from seamless antimicrobial epoxy systems to sustainable vinyl composites-are enabling facility operators to meet stringent hygiene protocols while maintaining visual appeal and ease of maintenance. Concurrently, tariff shifts and supply chain realignments underscore the importance of agile sourcing strategies and proactive cost management.Segmentation by material, end user, distribution channel, and installation type provides a clear roadmap for targeting market opportunities, while regional dynamics highlight differentiated priorities across the Americas, Europe Middle East and Africa, and Asia-Pacific. Competitive landscapes are reshaping through strategic alliances, digital engagement tools, and value-added service models that extend beyond mere product delivery to encompass advisory and maintenance support.

Going forward, industry leaders who invest in innovation, diversify supply chain footprints, and leverage digital platforms will be best positioned to capitalize on emerging trends. By aligning product development with end-user expectations and regulatory trajectories, stakeholders can navigate uncertainty, drive sustainable growth, and secure a resilient foothold in the ever-evolving commercial kitchen flooring landscape.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Type

- Hard Flooring

- Ceramic Tile

- Laminate

- Stone

- Vinyl

- Wood

- Soft Flooring

- Area Rugs

- Carpet Tiles

- Hard Flooring

- Flooring Material

- Natural Materials

- Synthetic Materials

- Installation Method

- Floating Installation

- Click-Lock

- Loose Lay

- Glue-Down Installation

- Floating Installation

- End Use Industry

- Food & Beverage Processing Plants

- Beverage Manufacturing

- Dairy Processing

- Meat Processing

- Hotels & Resorts

- Boutique Hotels

- Full Service Hotels

- Resorts

- Institutional Kitchens

- Hospitals

- Schools

- Restaurants & Cafeterias

- Food & Beverage Processing Plants

- Installation Type

- New Construction

- Renovation

- Distribution Channel

- Offline

- Online

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- MAPEI S.p.A.

- LATICRETE International, Inc.

- AHF, LLC

- American Biltrite

- Beaulieu International Group N.V

- Bolon AB

- Ceramiche Refin S.p.A.

- Congoleum

- Floormonk

- Florim USA, Inc.

- Forbo Holding Ltd

- Gerflor SAS

- Karndean Designflooring

- Kronospan

- LX Hausys, Ltd.

- Mannington Mills, Inc.

- Mohawk Industries, Inc.

- Pamesa Cerámica

- RMG Polyvinyl India Limited

- Roca Group

- RPM International Inc.

- Shaw Industries Group, Inc.

- Sika AG

- Tarkett Group

- TOLI Corporation

- Welspun Group

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Commercial Kitchen Flooring market report include:- MAPEI S.p.A.

- LATICRETE International, Inc.

- AHF, LLC

- American Biltrite

- Beaulieu International Group N.V

- Bolon AB

- Ceramiche Refin S.p.A.

- Congoleum

- Floormonk

- Florim USA, Inc.

- Forbo Holding Ltd

- Gerflor SAS

- Karndean Designflooring

- Kronospan

- LX Hausys, Ltd.

- Mannington Mills, Inc.

- Mohawk Industries, Inc.

- Pamesa Cerámica

- RMG Polyvinyl India Limited

- Roca Group

- RPM International Inc.

- Shaw Industries Group, Inc.

- Sika AG

- Tarkett Group

- TOLI Corporation

- Welspun Group

Table Information

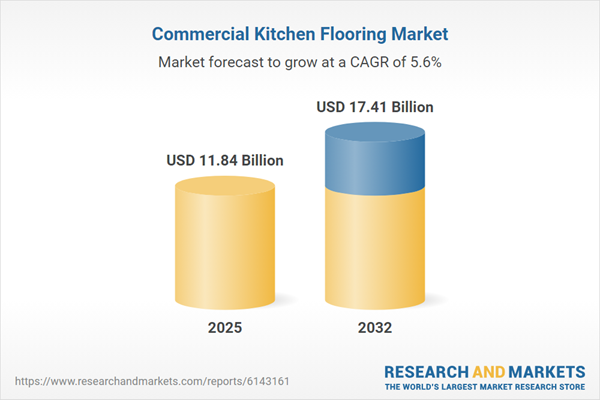

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 11.84 Billion |

| Forecasted Market Value ( USD | $ 17.41 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |