Speak directly to the analyst to clarify any post sales queries you may have.

A focused introduction to how material innovation, service integration, and procurement priorities are redefining operational resilience and supplier selection in the wear parts market

The crusher wear parts sector underpins critical segments of global heavy industry, from mining and aggregates to construction and metallurgical processing. Beyond the simple exchange of replacement components, this market embodies complex interactions among material science, equipment design, and aftermarket service models that directly influence plant uptime and total cost of ownership. As producers and operators pursue higher throughput and lower lifecycle costs, wear parts selection and supply continuity have become strategic levers rather than routine procurement tasks.Importantly, the competitive landscape has shifted: manufacturers are integrating advanced metallurgy and surface treatments, while service providers bundle condition monitoring, predictive maintenance, and rapid logistics to deliver differentiated value. Simultaneously, buyers are balancing the trade-offs between OEM-specified parts and aftermarket alternatives, evaluating performance, warranty implications, and lead-time risk. Consequently, procurement teams and engineering leaders must align around clear metrics for abrasion resistance, impact toughness, install complexity, and compatibility across crusher types.

This introduction frames the broader analysis by spotlighting the operational, technical, and commercial drivers that determine wear part selection and supplier relationships. It sets the stage for subsequent sections which explore transformative shifts, tariff consequences, segmentation intelligence, regional profiles, competitor dynamics, actionable recommendations, and the research approach that underlies these insights.

Transformative supply chain, materials, digital maintenance and sustainability shifts that are redefining how wear parts are specified, sourced, and serviced across industrial users

Several transformative shifts are actively reshaping how organizations source, specify, and manage crusher wear parts, producing new strategic priorities across the value chain. First, material science advances have elevated expectations for component longevity; metallurgical optimization and composite overlays are extending run life while altering refurbishment cycles. As a result, engineering teams now consider total life performance curves rather than simple upfront cost comparisons when qualifying suppliers.Concurrently, digitalization is enabling more proactive maintenance regimes. Remote condition monitoring, vibration analytics, and wear-mapping tools allow operators to plan part exchanges with greater precision, reducing unplanned downtime and inventory carrying costs. This trend has also encouraged suppliers to offer performance-based service contracts, linking replacement cadence and technical support to measurable uptime outcomes.

Another critical shift is the move toward localized manufacturing and strategic inventory placement. In response to geopolitical uncertainty and logistics volatility, firms are shortening supply chains through regional stocking hubs and closer supplier partnerships. Finally, sustainability imperatives are influencing specification decisions; recyclability of steel and lower-emission manufacturing processes now form part of buyer evaluations. Together, these drivers are transforming the competitive playing field and elevating the role of integrated supplier solutions over transactional sales.

Analysis of how the 2025 United States tariff adjustments have prompted sourcing diversification, nearshoring, and procurement recalibration in the wear parts ecosystem

The sequence of tariff measures implemented by the United States in 2025 has produced multi-dimensional effects across procurement, supplier relations, and manufacturing strategy for organizations using crusher wear parts. One notable consequence has been an immediate recalibration of sourcing strategies: buyers increased scrutiny of cross-border vendor exposure, preferring suppliers with resilient logistics, regional manufacturing capacity, or flexible production footprints that can mitigate incremental duties and transit cost volatility.Procurement cycles have lengthened as organizations introduced more rigorous total-cost assessments that account for tariff pass-through, customs handling, and potential delays. These assessments encouraged a shift toward diversified supplier portfolios, where dual-sourcing or multi-origin supply chains reduce the risk of concentrated tariff impact. In parallel, suppliers responded by re-evaluating their upstream inputs; raw material sourcing decisions were adjusted to manage exposure to duty-sensitive imports, prompting renegotiation of long-term contracts and a renewed focus on vertical integration where feasible.

Additionally, tariffs amplified incentives for nearshoring and regional manufacturing investment, particularly for high-wear components where lead times drive operational risk. While some manufacturers absorbed incremental costs to maintain competitive pricing, others repositioned product lines and service offerings to preserve margins, emphasizing refurbishment programs and aftermarket services that can be delivered domestically. Ultimately, the cumulative tariff environment in 2025 underscored the advantage of supply-chain visibility, flexible sourcing, and supplier collaboration in preserving uptime and stabilizing procurement costs.

Comprehensive segmentation insights into components, crusher types, wear materials, end-user needs, and sales channel dynamics that inform targeted product and service strategies

A nuanced segmentation perspective reveals differentiated demands and performance expectations across components, crusher types, wear materials, end users, and sales channels. Component-level distinctions matter because blow bars, cone liners, hammers, jaw plates, and mantles each face unique wear mechanics and replacement rhythms; blow bars and hammers require impact-resistant grades, while cone liners and mantles prioritize compressive abrasion resistance, shaping supplier specialization and inventory policies.Crusher type further conditions specification: cone crushers and gyratory machines impose continuous compressive loads and benefit from high-toughness wear parts, whereas impact crushers-both horizontal and vertical configurations-necessitate materials engineered to resist fragmentation and high-velocity particle collisions; jaw crushers demand components that tolerate cyclic loading and localized spalling. Thus, equipment architecture informs material selection and maintenance intervals, influencing aftermarket demand patterns.

Material choices-ceramics, polymers, steel, and tungsten carbide-introduce trade-offs among hardness, toughness, cost, and reparability. For example, ceramics can offer superior abrasion resistance in finely milled streams but may lack impact toughness for feed with tramp metal, while tungsten carbide provides exceptional wear life where repairability is limited. End-user contexts also shape priorities: the chemical industry and oil & gas sectors often emphasize corrosion resistance and contamination control, construction and metallurgy prioritize robust throughput, and mining operations-across both coal mining and metal mining-demand extreme durability and predictable replacement cycles. Finally, the sales channel dynamic between aftermarket and OEM supply influences service expectations; aftermarket channels compete on lead time and value engineering, while OEM channels often emphasize fit, warranties, and integrated lifecycle support. Collectively, these segmentation dimensions provide granular insight for aligning product development, inventory strategy, and customer engagement.

Regional operating nuances and strategic go-to-market considerations across the Americas, Europe Middle East & Africa, and Asia-Pacific that shape supply footprint and aftermarket support

Regional dynamics exert significant influence on operational priorities, supplier selection, and investment decisions across the wear parts market, with distinct drivers apparent in the Americas, Europe, Middle East & Africa, and Asia-Pacific regions. In the Americas, infrastructure investment cycles and a mature mining sector create consistent aftermarket demand, while the emphasis on reducing downtime favors suppliers with responsive logistics and refurbishment capabilities. North American operators frequently prioritize compatibility with legacy equipment and rapid parts availability to avoid costly production interruptions.Within Europe, Middle East & Africa, regulatory pressures and environmental standards drive interest in more sustainable manufacturing processes and traceable supply chains. This region also exhibits significant heterogeneity in demand structures, with advanced metallurgical operations in some markets and bulk commodity extraction in others, necessitating adaptive product portfolios and flexible service models. In the Asia-Pacific, a combination of rapid industrial expansion, heavy construction activity, and large-scale mining projects fuels high-volume wear part consumption, but price sensitivity and intense local competition push suppliers to balance cost, performance, and local production footprint.

Across all regions, the interplay between regional logistics, tariff regimes, and local content expectations shapes where manufacturers choose to locate production and stocking points. As a result, successful suppliers design regional go-to-market strategies that combine localized inventory, technical support, and collaboration with end users to optimize component life, reduce lead times, and tailor value propositions to distinct regional operating conditions.

Key company-level insights into how technology investment, service integration, and supply-chain adaptability are creating competitive advantage in the wear parts sector

Competitive dynamics among leading suppliers center on technical differentiation, integrated service offerings, and the ability to manage complex supply chains. Market leaders invest in metallurgical R&D and coating technologies to improve component wear life while also expanding service portfolios that include on-site inspections, condition monitoring, and rapid exchange programs. These capabilities create stickiness with large industrial customers that prioritize predictable performance and streamlined maintenance workflows.Smaller and specialized suppliers, meanwhile, compete by offering niche materials expertise, rapid customization for legacy equipment, or highly localized support that reduces downtime risk. Partnerships between component manufacturers and service providers are increasingly common, allowing companies to bundle parts with inspection, refurbishment, and logistics to present a single accountable solution. Additionally, some manufacturers are enhancing digital customer interfaces to simplify ordering, track part usage, and provide maintenance guidance that aligns component life with operational schedules.

Pricing discipline and warranty structures are differentiating factors as well; firms that can demonstrate superior total lifecycle performance command stronger long-term relationships, while those emphasizing lower upfront costs often contend with higher churn. Overall, competitive advantage derives from a combination of proven material performance, transparent service delivery, and the ability to adapt supply models in response to regional and tariff-driven pressures.

Practical, high-impact recommendations for manufacturers and buyers to enhance resilience, extend component life, and translate technical differentiation into market advantage

Leaders in the wear parts ecosystem should pursue a set of targeted, actionable strategies to protect margins, increase uptime, and strengthen customer relationships. First, prioritize investments in materials engineering and surface treatments that demonstrably extend component life under the specific load and feed conditions encountered by your customers, and translate those improvements into clear service-level commitments.Second, develop regional manufacturing or stocking nodes that reduce exposure to tariff swings and logistics disruptions while offering rapid replenishment. Integrate digital tools for condition monitoring and wear prediction to move customers from reactive to planned maintenance regimes; these tools not only reduce downtime but also create opportunities for performance-based contracts that align incentives.

Third, expand aftermarket service capabilities-inspection, refurbishment, and rapid exchange-so that the supplier becomes an indispensable partner in operational continuity. Tie warranty and pricing structures to measured lifecycle outcomes to differentiate offerings and justify premium positioning. Finally, foster collaborative supplier relationships upstream for raw materials to secure quality inputs and negotiate flexibility in supply agreements. By combining technical differentiation with supply-chain resilience and customer-centric services, industry leaders can convert disruption into competitive advantage.

A transparent, triangulated research methodology combining stakeholder interviews, technical material reviews, and supply-chain analysis to produce actionable industry insights

The research methodology underpinning this analysis combines qualitative and quantitative inquiry to ensure robust, actionable findings. Primary research included structured interviews and workshops with procurement leaders, plant engineers, aftermarket service managers, and supplier executives to capture firsthand perspectives on wear mechanisms, lead-time sensitivities, and procurement decision criteria. These interactions were supplemented by technical reviews of material performance literature and manufacturer technical specifications to ground insights in proven engineering principles.Secondary research involved cross-referencing trade publications, customs and tariff filings, and logistics performance indicators to understand macro-level supply-chain pressures and regional operating differences. The methodology emphasized triangulation: insights from interviews were validated against material science data and logistics patterns to reduce bias and identify convergent themes. Scenario analysis explored supply disruption, tariff adjustments, and equipment mix shifts to illustrate plausible operational impacts and mitigation strategies. Throughout, the approach prioritized transparency in assumptions and clarity in the linkage between observed trends and recommended actions so stakeholders can confidently incorporate findings into procurement and engineering plans.

Concluding synthesis of strategic implications showing how materials, service models, and regional supply choices combine to drive uptime and operational efficiency in wear parts management

In closing, the wear parts environment for crushers is a strategically important and evolving domain where material innovation, supply-chain agility, and service integration collectively determine operating performance and cost efficiency. Across component types and crusher architectures, the emphasis is shifting from transactional replacement toward outcome-based maintenance, driven by digital monitoring capabilities and heightened expectations around uptime. Tariff developments and regional dynamics have reinforced the value of diversified sourcing, localized inventory strategies, and supplier partnerships capable of delivering rapid response.Decision-makers should therefore treat wear parts strategy as a multi-dimensional exercise: optimize specifications to align with actual feed and load conditions, invest in predictive maintenance to smooth replacement cycles, and design supply footprints that balance cost with operational risk. Suppliers that combine proven materials, strong aftermarket services, and flexible regional operations will be best positioned to capture durable customer relationships. Ultimately, applying these insights will enable operators to reduce unplanned downtime, stabilise operating costs, and enhance long-term asset productivity.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Wear Part Category

- Cone Crusher Parts

- Bowl Liners

- Mantles

- Torch Rings

- Gyratory Crusher Parts

- Concaves

- Mantles

- Spider Caps

- Impact Crusher Parts

- Apron Liners

- Blow Bars

- Impact Plates

- Side Liners

- Jaw Crusher Parts

- Cheek Plates

- Jaw Plates

- Toggle Components

- Wedges

- VSI Crusher Parts

- Anvils

- Distributor Plates

- Rotor Tips

- Tip Holders

- Cone Crusher Parts

- Crusher Type

- Cone Crusher

- Gyratory Crusher

- Impact Crusher

- Horizontal

- Vertical

- Jaw Crusher

- Wear Part Material

- Ceramics

- Manganese Steel

- Polymers

- Tungsten Carbide

- Manufacturing Process

- Additive Manufacturing

- Direct Energy Deposition

- Casting

- Investment Casting

- Lost Foam Casting

- Sand Casting

- Fabrication & Hardfacing

- Chromium Carbide Overlay

- PTA Hardfacing

- Tungsten Carbide Overlay

- Forging

- Heat Treatment

- Quenching & Tempering

- Solution Treatment

- Additive Manufacturing

- Application

- Aggregates

- Crushed Stone

- Quarrying

- Sand & Gravel

- Cement

- Mining

- Metal Mining

- Copper

- Gold

- Iron Ore

- Nickel

- Non-Metal Mining

- Coal

- Limestone

- Phosphate

- Potash

- Metal Mining

- Recycling

- Asphalt

- Concrete

- Construction & Demolition Waste

- Slag

- Aggregates

- Sales Channel

- Aftermarket

- OEM (Original Equipment Manufacturer)

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Sandvik AB

- Magotteaux International S.A.

- Aceros y Suministros S.A.

- Astec Industries, Inc.

- Amsted Global Solutions

- Bradken Limited

- Bruce Engineering Ltd

- CMS Cepcor Limited

- Crusher Parts International Pty Ltd

- Eagle Crusher Company Inc.

- Egnatia Foundry

- FLSmidth & Co. A/S

- Luoyang zhili new materials co.,ltd

- Mays Machinery Co., Ltd.

- Metso Outotec Corporation

- Minyu Machinery Corp.

- Nanjing Qiming Machinery Co.;Ltd

- Quarry Manufacturing & Supplies Ltd

- Rubble Master GmbH

- Shanvim Wear Parts Co., Ltd.

- Stahlwerke Bochum GmbH

- Superior Industries, Inc.

- Terex Corporation

- The Weir Group plc

- thyssenkrupp AG

- Electro Metalurgica SA

- Nanjing Manganese Manufacturing Co.; LTD.

- Melco India Pvt. Ltd.

- Rocktech Engineers

- Columbia Steel Cast Products LLC.

- Shri Ram Castech Pvt. Ltd.

- Jalpadevi Engineering Pvt Ltd

- Me Elecmetal International Inc.

- H-E Parts International LLC

- Chengdu GUBT Industry Co., Ltd.

- Foothills Steel Foundry Ltd.

- Tasek Iron and Steel Foundry Sdn Bhd

- Optimum Crush

- Unified Screening and Crushing

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Crusher Wear Parts market report include:- Sandvik AB

- Magotteaux International S.A.

- Aceros y Suministros S.A.

- Astec Industries, Inc.

- Amsted Global Solutions

- Bradken Limited

- Bruce Engineering Ltd

- CMS Cepcor Limited

- Crusher Parts International Pty Ltd

- Eagle Crusher Company Inc.

- Egnatia Foundry

- FLSmidth & Co. A/S

- Luoyang zhili new materials co.,ltd

- Mays Machinery Co., Ltd.

- Metso Outotec Corporation

- Minyu Machinery Corp.

- Nanjing Qiming Machinery Co.;Ltd

- Quarry Manufacturing & Supplies Ltd

- Rubble Master GmbH

- Shanvim Wear Parts Co., Ltd.

- Stahlwerke Bochum GmbH

- Superior Industries, Inc.

- Terex Corporation

- The Weir Group plc

- thyssenkrupp AG

- Electro Metalurgica SA

- Nanjing Manganese Manufacturing Co.; LTD.

- Melco India Pvt. Ltd.

- Rocktech Engineers

- Columbia Steel Cast Products LLC.

- Shri Ram Castech Pvt. Ltd.

- Jalpadevi Engineering Pvt Ltd

- Me Elecmetal International Inc.

- H-E Parts International LLC

- Chengdu GUBT Industry Co., Ltd.

- Foothills Steel Foundry Ltd.

- Tasek Iron and Steel Foundry Sdn Bhd

- Optimum Crush

- Unified Screening and Crushing

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

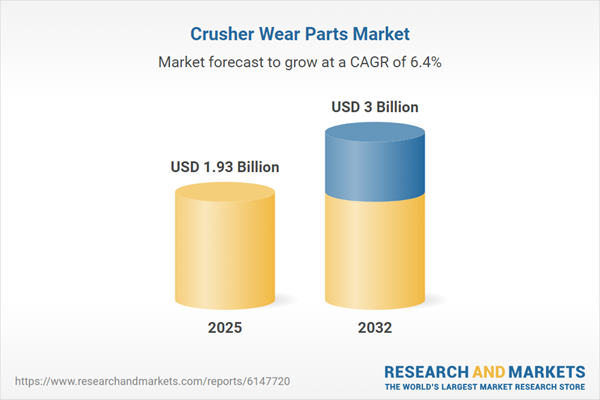

| Estimated Market Value ( USD | $ 1.93 Billion |

| Forecasted Market Value ( USD | $ 3 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 40 |