Speak directly to the analyst to clarify any post sales queries you may have.

Pioneering Sustainable Connectivity with Eco Material Cables to Drive the Next Generation of Green Infrastructure and Environmental Stewardship

The accelerating demand for sustainable infrastructure solutions is reshaping the global cables industry. As stakeholders across public utilities, telecommunications, energy, construction, and automotive sectors prioritize environmental stewardship, eco material cables are emerging as a strategic imperative rather than a niche alternative. These cables, designed with bio-based polymers, halogen-free compounds, low smoke zero halogen materials, and recyclable formulations, address stringent regulatory mandates and evolving corporate sustainability commitments. Accordingly, industry participants are compelled to balance performance, safety, and environmental impact to meet both end-user requirements and global decarbonization goals.Against this backdrop, innovative material science breakthroughs have unlocked new pathways for reducing carbon footprints across the cable life cycle. From the selection of raw polymers and insulating agents to manufacturing processes optimized for lower emissions, the eco material cable landscape is undergoing a profound transformation. Moreover, cross-industry collaborations and supply chain realignments are catalyzing widespread adoption by streamlining material sourcing and enhancing cost efficiencies. As a result, market leaders are poised to harness these developments to differentiate their offerings and secure long-term competitive advantage.

Navigating Disruptive Innovations and Regulatory Momentum That Are Rapidly Transforming the Global Eco Material Cable Landscape in the Digital Age

Global policy momentum and technological innovation are converging to redefine cable system engineering. On one front, government agencies across regions are tightening regulations on hazardous substances, waste management, and product carbon intensity, thereby accelerating the phase-out of legacy PVC-based and high-smoke formulations. Concurrently, standards bodies are introducing certification frameworks that reward bio-content, recyclability, and low emission profiles. These regulatory shifts are prompting manufacturers to invest heavily in research and development, forging partnerships with material suppliers to co-create next-generation insulating compounds and jacketing materials that deliver both fire safety and environmental compliance.In tandem with regulatory imperatives, rapid advances in polymer chemistry and additive manufacturing techniques are fueling disruptive product launches. Cross-linked polyethylene remains a backbone for high-voltage applications, yet emerging alternatives such as polylactic acid offer compelling end-of-life recycling pathways without sacrificing performance. Likewise, halogen-free and low smoke zero halogen solutions are gaining traction across critical infrastructure projects where fire suppression and occupant safety are paramount. As artificial intelligence and digital twins become integral to cable design, predictive modeling is optimizing material usage and energy consumption in production lines, thereby reinforcing sustainable best practices throughout the value chain.

Assessing the Far-reaching Effects of United States Tariff Adjustments on Eco Material Cable Supply Chains and Cost Dynamics in 2025

The introduction of revised import duties by the United States in early 2025 has introduced both challenges and opportunities for supply chain architects and procurement leaders. Heightened tariffs on cable assemblies and raw polymer imports have increased landed costs, prompting end-users to reexamine sourcing strategies and inventory policies. At the same time, domestic producers have experienced a moderation in competitive pressure, enabling greater investment in capacity expansions and capital upgrades aimed at enhancing production efficiency and reducing operational carbon output.Consequently, multinational corporations are adopting a dual-track approach that balances cost mitigation with long-term resilience. In the short term, many have diversified supplier portfolios by qualifying regional sources in the Americas to circumvent tariff exposure, while in parallel negotiating long-term offtake agreements to secure stable pricing. Over the medium horizon, strategic insights suggest that partnerships with raw material innovators can offset incremental duties through material substitutions that lower overall input spend. By applying scenario planning and dynamic cost-modeling tools, stakeholders are fortifying their supply networks against future policy volatility and sustaining momentum toward environmental targets.

Unveiling Critical Market Segmentation Insights That Illuminate Diverse Product, Material, Voltage, Installation, End User, and Distribution Perspectives

A nuanced understanding of market segmentation uncovers diverse growth trajectories driven by distinct product portfolios. Eco material cables designed with bio-based formulations are finding favor in commercial and residential construction projects, whereas halogen-free and low smoke zero halogen variants are prioritized in mission-critical environments such as healthcare and data centers. Recyclable cable solutions, by contrast, are gaining prominence among consumer electronics and automotive wiring applications that mandate circularity credentials.Material type segmentation further refines competitive positioning. Cross-linked polyethylene maintains strong demand for medium and high voltage transmission, while paper-insulated cables hold heritage appeal in specialized industrial installations. Polylactic acid and other biopolymers are carving out niches in low voltage distribution networks, and thermoplastic elastomers are emerging as versatile sheathing alternatives for dynamic environments. Polyvinyl chloride remains ubiquitous but faces sustained pressure from eco-conscious stakeholders, making it imperative for manufacturers to articulate sustainability roadmaps.

Voltage rating delineation reveals that high voltage deployments are influenced by grid modernization initiatives, medium voltage applications align with urban electrification efforts, and low voltage variants support the proliferation of electric vehicle infrastructure and smart home ecosystems. Installation characteristics also shape product requirements: indoor wiring demands flexibility and flame retardance, outdoor runs require UV stability and moisture resistance, submarine cables necessitate robust pressure tolerance, and underground conduits call for exceptional mechanical strength.

End user industry segmentation highlights cross-cutting patterns of adoption and innovation. Automotive applications split between traditional wiring harnesses and fast-charging network cabling, reflecting the shift toward electrified transport. Building and construction divides into commercial, infrastructure, and residential sub-segments, each with distinct regulatory, performance, and budgetary imperatives. Energy and utilities focus on grid resiliency and renewable integration, while IT and telecommunications prioritize data throughput and minimal signal attenuation. Meanwhile, healthcare environments demand ultra-low smoke and biocompatible components. Finally, distribution channels are bifurcated into offline frameworks dominated by established channel partners and online platforms that expedite niche product procurement and rapid customization requests.

Exploring Regional Opportunities and Challenges for Eco Material Cable Adoption across the Americas, EMEA, and Asia-Pacific Zones

Regional dynamics play a pivotal role in shaping the trajectory of eco material cable adoption. In the Americas, legislative initiatives such as state-level decarbonization mandates and federal infrastructure investment packages are catalyzing demand for bio-content and recyclable cable solutions. North American utilities are renewing transmission corridors, while automotive OEMs are accelerating electrification roadmaps, thereby driving requirement for advanced insulating and jacketing materials.Across Europe, the Middle East, and Africa, escalating sustainability targets and the Green Deal framework are directing capital toward halogen-free and low emission cable systems. Western Europe’s rigorous chemical directives and building codes reinforce stringent compliance standards, whereas the Gulf Cooperation Council region is witnessing robust investment in renewable energy corridors and smart city expansions. In Africa, electrification initiatives and off-grid power projects are generating demand for durable, low maintenance cable installations.

Asia-Pacific stands at the forefront of manufacturing scale and technological adoption. Rapid urbanization, expansive telecom network rollouts, and government-led renewable energy schemes in China, India, and Southeast Asia underpin significant volume demand. Simultaneously, rising environmental awareness and tightening safety standards are encouraging domestic producers to upgrade facilities and adopt eco-material formulations. This confluence of scale, regulation, and innovation positions the region as both a supply hub and a critical consumer market for sustainable cable technologies.

Profiling Leading Innovators and Strategic Collaborators Shaping the Eco Material Cable Industry’s Technological and Commercial Evolution

Industry incumbents and emerging challengers are forging distinctive pathways to capture value in the eco material cable ecosystem. Leading global cable manufacturers have scaled capacity for halogen-free and low smoke zero halogen offerings while integrating advanced recycling capabilities within their operations. By contrast, specialized biopolymer enterprises are collaborating with tier-one cable producers to pilot bio-based insulating compounds on high-voltage platforms.Several market leaders are deploying digitalization and Industry 4.0 principles to optimize material utilization and reduce waste. Through real-time process monitoring and automated quality control, they are achieving consistent product performance and accelerating time-to-market for new eco cable lines. Strategic partnerships with research universities and national laboratories are unlocking proprietary formulations that blend cross-linked polyethylene with sustainable additives, improving dielectric strength and thermal stability.

In parallel, mid-sized regional players are leveraging agile manufacturing footprints to serve niche verticals, such as EV charging infrastructure and submarine power transmission. Their emphasis on customized color coding, rapid prototyping, and local regulatory compliance has fostered strong customer loyalty. Collectively, these leaders are committing capital expenditure toward pilot plants for polylactic acid and thermoplastic elastomer jackets, signaling long-term shifts toward circular product models and closed-loop recycling frameworks.

Implementing Precision Strategies and Sustainable Practices to Propel Leadership and Resilience in the Eco Material Cable Market

To thrive amid accelerating sustainability demands, industry leaders must adopt a multi-pronged strategy rooted in collaboration, innovation, and market intelligence. Establishing joint ventures with raw material suppliers will secure preferential access to advanced biopolymers and halogen-free compounds, enabling cost-effective scale-up of eco cable production. Concurrently, forging alliances with research institutions will expedite development of novel formulations that exceed current performance benchmarks and lifecycle expectations.Operational excellence should be pursued through digital transformation initiatives that integrate predictive maintenance, process optimization, and supply chain visibility. By harnessing data analytics to forecast material consumption and identify inefficiencies, manufacturers can minimize waste and reduce carbon emissions per kilometer of cable produced. In addition, implementing circular economy principles-such as take-back programs and closed-loop recycling partnerships-will strengthen brand credibility and meet escalating sustainability mandates from key end users.

Market penetration can be strengthened by tailoring product portfolios to industry-specific requirements. For example, offering plug-and-play modules for EV charging networks or pre-terminated assemblies for data center deployments will accelerate decision-maker adoption. Lastly, engaging proactively with regulatory bodies to help shape forthcoming standards will ensure that new eco material cable solutions align with evolving compliance criteria and open avenues for strategic differentiation.

Detailing the Rigorous Multi-Stage Research Methodology Ensuring Reliability, Validity, and Depth of Analysis for Eco Material Cable Insights

This analysis rests on a robust, multi-stage methodology designed to ensure comprehensive coverage and rigorous validation. Initially, secondary research was conducted by reviewing academic journals, patent filings, technical standards, and regulatory frameworks to establish a foundational understanding of eco material cable technologies and market drivers. Trade publications and conference proceedings provided real-time insights into emerging innovations and commercial launches.Primary research comprised in-depth interviews with equipment manufacturers, raw material suppliers, end-user procurement executives, and industry experts to capture nuanced perspectives on strategic priorities and investment plans. These qualitative inputs were triangulated with quantitative data points gleaned from supply chain mapping exercises and production cost assessments. Furthermore, expert panels were convened to challenge key assumptions and validate the interpretation of market signals.

Finally, an iterative analytical framework was applied to synthesize findings, refine segmentation schemas, and construct forward-looking scenarios. This approach ensures that the resulting insights are both strategically actionable and grounded in empirical evidence, equipping decision-makers with a reliable compass for navigating the evolving eco material cable landscape.

Synthesizing Core Findings and Forward-Looking Perspectives to Summarize the Implications of Eco Material Cable Market Dynamics

The transition toward eco material cables represents a convergence of environmental imperatives, technological progress, and shifting market dynamics. Key takeaways include the critical role of regulatory frameworks in accelerating the adoption of halogen-free and low emission formulations, the strategic impact of tariff adjustments on supply chain configurations, and the importance of granular segmentation to tailor offerings across product type, material chemistry, voltage rating, installation context, end-user vertical, and distribution channels.Regionally, North America’s policy incentives, EMEA’s stringent standards, and Asia-Pacific’s manufacturing scale each exhibit unique enablers and barriers that demand localized go-to-market strategies. Leading companies are already distinguishing themselves through digitalization, strategic partnerships, and circular economy initiatives. As the competitive terrain intensifies, actionable recommendations suggest prioritizing R&D alliances, enhancing supply chain agility, and segmenting offerings to capture niche applications such as EV charging infrastructure and high-resiliency submarine cabling.

Looking ahead, stakeholders who align their strategic roadmaps with evolving sustainability criteria and harness emerging material innovations will be best positioned to capture long-term value. By integrating these insights into investment decisions and product development pipelines, industry participants can navigate uncertainties and drive the mass adoption of eco material cables across global infrastructure projects.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Bio-based Cables

- Halogen-Free Cables

- Low Smoke Zero Halogen (LSZH) Cables

- Recyclable Cables

- Material Type

- Cross-linked Polyethylene (XLPE)

- Paper-Insulated Cables

- Polyethylene (PE)

- Polylactic Acid (PLA)

- Polyvinyl Chloride (PVC)

- Thermoplastic Elastomers (TPE)

- Voltage Rating

- High Voltage

- Low Voltage

- Medium Voltage

- Installation

- Indoor

- Outdoor

- Submarine

- Underground

- End User Industry

- Automotive

- Automotive Wiring

- EV Charging Infrastructure

- Building & Construction

- Commercial

- Infrastructure

- Residential

- Consumer Electronics

- Energy & Utilities

- Healthcare

- IT & Telecommunication

- Automotive

- Distribution Channel

- Offline

- Online

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Prysmian S.p.A.

- Nexans S.A.

- LS Cable & System Ltd.

- Sumitomo Electric Industries, Ltd.

- Hengtong Group Co., Ltd.

- Southwire Company, LLC

- Furukawa Electric Co., Ltd.

- Jiangsu Zhongtian Technology Co., Ltd.

- KEI Industries Limited

- NKT A/S

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Eco Material Cables Market report include:- Prysmian S.p.A.

- Nexans S.A.

- LS Cable & System Ltd.

- Sumitomo Electric Industries, Ltd.

- Hengtong Group Co., Ltd.

- Southwire Company, LLC

- Furukawa Electric Co., Ltd.

- Jiangsu Zhongtian Technology Co., Ltd.

- KEI Industries Limited

- NKT A/S

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | October 2025 |

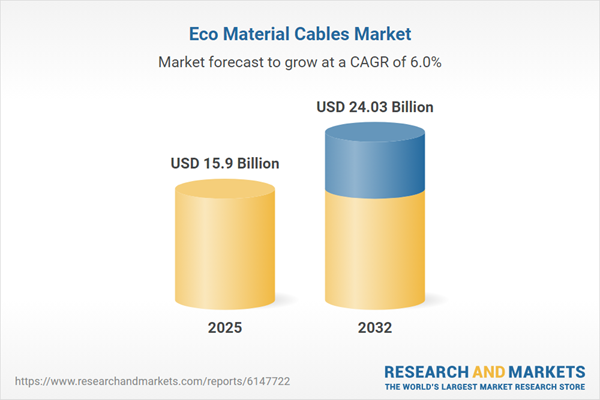

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 15.9 Billion |

| Forecasted Market Value ( USD | $ 24.03 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |