Speak directly to the analyst to clarify any post sales queries you may have.

Exploring Strategic Significance and Emergent Trends Driving Innovation and Demand in the Deployable Camp Kitchen Market Ecosystem

The deployable camp kitchen market is experiencing a convergence of dynamic consumer demand, technological innovation, and evolving operational requirements. Modern stakeholders are increasingly seeking solutions that offer rapid deployment, ease of use, and multifunctional capabilities across diverse environments. Recent emphasis on outdoor recreation, emergency preparedness, and defense logistics has driven the need for camp kitchen systems that deliver both performance and reliability under challenging field conditions. Consequently, manufacturers are investing in lightweight materials, modular configurations, and energy-efficient designs to meet stringent portability and environmental standards.As the market continues to mature, a shift toward integrated digital features such as IoT-enabled temperature control and predictive maintenance is reshaping product offerings. This transformation is further supported by partnerships between equipment suppliers and service providers to deliver turnkey solutions for governmental agencies, professional caterers, and individual adventurers. In addition, collaborative engagements with outdoor event organizers and humanitarian relief non-governmental organizations are expanding the operational scope of these systems beyond traditional use cases. In parallel, heightened focus on sustainability has led to the adoption of solar-powered and multi-fuel alternatives, reflecting broader industry efforts to minimize carbon footprints. By examining the interplay of these forces, this summary sets the stage for a deeper exploration of transformative trends, tariff impacts, segmentation insights, and strategic recommendations that will influence the future trajectory of deployable camp kitchen solutions.

Unveiling Paradigm Shifts Transforming Customer Expectations and Operational Models in Deployable Camp Kitchen Design and Delivery

The deployable camp kitchen industry is undergoing paradigm shifts influenced by rapid technological advances and evolving customer expectations. Manufacturers are increasingly integrating modular components that allow field teams to customize cooking configurations on demand. Concurrently, digital interfaces equipped with remote monitoring capabilities are enabling real-time oversight of fuel consumption, temperature regulation, and hygiene compliance. These advances are reshaping procurement strategies as end users prioritize solutions that reduce operational downtime and streamline logistical workflows.Meanwhile, distribution channels are transforming as online platforms gain prominence alongside traditional brick-and-mortar outlets. Direct-to-consumer e-commerce initiatives and manufacturer-operated digital portals are facilitating broader market access and accelerated product adoption. In addition, collaborative engagements with outdoor event organizers and humanitarian relief non-governmental organizations are expanding the operational scope of these systems beyond traditional use cases. Furthermore, a growing emphasis on sustainable fuel types has catalyzed research into solar-powered modules and biofuel-compatible cooktops. This environmental consciousness is complemented by a surge in premium offerings that provide enhanced durability, ergonomic design, and advanced insulation. By embracing these transformative shifts, industry participants can position themselves to meet the complex demands of governmental agencies, military operations, and professional catering services while driving superior performance across recreational and emergency response applications.

Assessing the Comprehensive Consequences of United States Tariff Policies on Supply Chain Dynamics and Cost Structures for Deployable Camp Kitchens

The implementation of new United States tariffs in 2025 has introduced significant cost pressures across the deployable camp kitchen supply chain. Import duties on steel, aluminum, and specialized components have increased production expenses, prompting manufacturers to reassess procurement strategies. Upstream effects are evident in raw material sourcing, where domestic suppliers face elevated demand as global alternative markets become less price-competitive. These shifts are cascading toward end users, resulting in recalibrated pricing structures and extended lead times for critical equipment.In response, industry participants are diversifying supplier portfolios to include regional partners capable of offering favorable trade agreements and shorter transit routes. Companies that previously relied heavily on single-country sourcing are now exploring multi-regional contracts to mitigate tariff exposure and ensure continuity of supply. Additionally, some manufacturers are leveraging bonded warehouses and duty deferral programs to offset immediate cash flow impacts while maintaining flexibility in inventory management.

Despite these adjustments, rising material costs and administrative compliance expenses continue to challenge margins. This environment underscores the importance of operational agility and proactive tariff monitoring. By investing in tariff engineering analysis and engaging with trade advisory services, stakeholders can identify applicable exemptions and optimize product configurations. Ultimately, building a resilient supply chain foundation will be critical for sustaining competitive positioning and delivering reliable deployable camp kitchen solutions under evolving trade policy conditions.

Deriving Critical Segmentation Insights to Illuminate Product Preferences Distribution Channels End User and Application Drivers in the Camp Kitchen Market

Detailed segmentation analysis brings clarity to divergent performance across product architectures. Compact camp kitchen configurations have become favored for minimalistic expedition requirements, while folding kitchen systems satisfy the space-conscious preferences of individual adventurers. Modular camp kitchens are increasingly adopted by large-scale operations such as government feeding programs and professional catering events, reflecting demand for scalable layouts. Portable cooking stations remain the go-to solution for military field deployments due to their durability and rapid deployment capabilities.The distribution landscape is marked by a dual channel strategy that leverages established trade networks and digital commerce platforms. Offline outlets such as independent retail shops and specialty outdoor stores continue to drive in-person engagement through experiential demonstrations. Mass merchandisers contribute value-focused alternatives, whereas e-commerce portals and direct-from-manufacturer digital storefronts accelerate reach, offering expedited fulfillment and personalized customer journeys that cater to emerging remote and underserved markets.

Further segmentation by end user, application, fuel type, and price reveals intersecting trends. Military units and emergency response teams prioritize multi-fuel systems in premium price brackets to ensure reliability under austere conditions. Recreational campers and individual consumers show strong uptake of propane-powered mid-range models, balancing performance and affordability. Solar-powered and wood-based units are gaining traction among eco-oriented users seeking off-grid sustainability. Economy segment options are also witnessing stable demand as entry-level solutions for light recreational use.

Revealing Regional Market Dynamics Influencing Growth Opportunities and Strategic Priorities across Americas EMEA and Asia Pacific Camp Kitchen Sectors

The Americas region remains a pivotal market for deployable camp kitchen systems, driven by robust outdoor recreation industries and substantial government procurement contracts. In North America, established infrastructure and accessibility to advanced manufacturing capabilities support rapid adoption of modular solutions tailored for emergency response teams and professional catering services. Latin American markets are witnessing gradual uptake as economic development accelerates interest in reliable portable cooking systems for both community events and disaster relief operations.Europe, Middle East, and Africa present a mosaic of market dynamics shaped by regulatory frameworks and diverse end-user requirements. Western European nations lead in sustainability adoption, favoring solar-powered and low-emission multi-fuel units for off-grid expeditions. In contrast, Middle Eastern governments and military organizations prioritize high-capacity, durable systems capable of withstanding extreme temperature conditions. African markets are emerging as areas of growth potential where humanitarian agencies deploy portable kitchens for large-scale relief initiatives and community feeding programs.

The Asia-Pacific landscape exhibits rapid market expansion supported by rising disposable incomes and expanding adventure tourism sectors. Southeast Asian countries are adopting compact and folding kitchen configurations for island-hopping tours and remote hospitality ventures, while Australasian end users demonstrate a preference for premium-grade systems that combine sleek design with rugged performance. Simultaneously, East Asian manufacturers are innovating around cost-effective solutions that can be scaled across both domestic and export markets, reinforcing the region's influence on global supply chains.

Highlighting Competitive Movements Strategic Alliances Product Innovations and Market Positioning of Leading Deployable Camp Kitchen Manufacturers

Industry leaders in the deployable camp kitchen arena are actively leveraging innovation and strategic collaborations to strengthen their market positions. One prominent manufacturer has differentiated itself through the introduction of modular platforms that can be rapidly reconfigured to support varying scale requirements, thereby addressing both small unit deployments and large-scale feeding operations. Another competitor has focused on developing integrated digital management systems, enabling remote monitoring and predictive maintenance capabilities that reduce operational downtime and optimize fuel consumption. Companies pursuing sustainability agendas have expanded their portfolios to include solar-powered and biofuel-compatible units, reflecting a broader commitment to environmental stewardship.Strategic alliances are also reshaping competitive dynamics as equipment suppliers partner with logistics providers and service organizations to deliver comprehensive field kitchen solutions. Several firms have established joint ventures with local distributors in key regions to enhance after-sales support and respond to region-specific needs. In addition, a number of manufacturers are investing in advanced materials research to produce lighter and more robust cooking stations without compromising durability. Through targeted acquisitions and cross-industry partnerships, these companies are expanding their reach into new application areas such as disaster relief and mobile hospitality. Overall, this constellation of strategic maneuvers underscores the importance of continuous product development and ecosystem integration in maintaining leadership within the deployable camp kitchen market.

Formulating Actionable Strategic Recommendations to Enhance Supply Chain Resilience and Drive Sustainable Growth in the Deployable Camp Kitchen Industry

To navigate the evolving deployable camp kitchen landscape, industry leaders should prioritize diversification of supply chain partnerships and invest in multi-regional sourcing strategies to mitigate the impact of trade policy fluctuations. Embracing tariff engineering practices will help identify optimal product configurations and applicable duty exemptions, thereby preserving cost competitiveness. Concurrently, incorporating advanced monitoring systems and IoT-enabled solutions can enhance operational transparency, enabling real-time performance tracking and proactive maintenance scheduling.Manufacturers should also accelerate the development of modular and lightweight designs to address the increasing demand for rapid deployment in emergency response and military operations. Integrating sustainable energy options, including solar-powered modules and biofuel-compatible cooktops, will align product offerings with global decarbonization goals and appeal to environmentally conscious end users. Furthermore, strengthening omnichannel capabilities by forging partnerships with e-commerce platforms and specialized retail networks will expand market reach and improve customer engagement through targeted digital marketing initiatives.

Finally, cultivating strategic alliances with logistics providers and service organizations can extend value-added support services, such as field installation training and maintenance contracts. By adopting a holistic ecosystem mindset, companies can deliver comprehensive turnkey solutions that drive customer loyalty and unlock new revenue streams. Collectively, these strategic actions will fortify resilience, foster innovation, and position market participants for sustainable growth in the deployable camp kitchen sector.

Detailing Rigorous Research Methodology Approaches Employed to Ensure Data Accuracy and Comprehensive Insights in the Deployable Camp Kitchen Study

This study employs a rigorous mixed-method research methodology designed to deliver reliable and comprehensive insights into the deployable camp kitchen market. Primary research involved in-depth interviews with key industry stakeholders, including design engineers, procurement officers, and end-user representatives from government agencies, military units, humanitarian organizations, and outdoor event planners. These conversations provided firsthand perspectives on evolving operational requirements, product performance expectations, and emerging procurement strategies. Qualitative insights gathered through these interviews were complemented by structured surveys conducted with a broader sample of professional caterers and individual adventurers to capture usage patterns and satisfaction drivers.Secondary research efforts focused on consolidating information from publicly available sources such as technical white papers, industry standards, regulatory filings, and patent databases. Market intelligence was further enriched through analysis of trade association reports and insights from logistics and materials specialists. Data points were triangulated across multiple sources to ensure consistency and validity, with particular attention given to regional variations in adoption patterns and supply chain dynamics. The research framework also incorporated scenario planning exercises to explore potential market responses to policy changes and technological disruptions. Throughout the process, stringent quality checks and peer reviews were applied to all data inputs and analytical outputs. This methodological approach underpins the credibility of the findings and supports informed decision-making for stakeholders seeking to navigate the complexities of the deployable camp kitchen sector.

Concluding Key Takeaways Emphasizing Market Dynamics Strategic Imperatives and Future Directions for Stakeholders in Deployable Camp Kitchen Sector

This executive summary has illuminated the key forces shaping the deployable camp kitchen market, including technological innovations, shifting distribution paradigms, and the ramifications of evolving trade policies. Through granular segmentation analysis, we have highlighted divergent growth patterns across product types, distribution channels, end-user categories, and fuel and price configurations. Geographic insights underscored how regional variations in infrastructure, regulatory environments, and customer preferences are influencing strategic market decisions.The study's exploration of competitive positioning revealed that industry leaders are leveraging modular design, digital integration, and sustainability-driven solutions to differentiate their offerings and capture new application segments. Moreover, actionable recommendations were proposed to fortify supply chain resilience, accelerate product innovation, and enhance omnichannel market engagement. A rigorous research methodology, encompassing both primary and secondary data collection, provided a robust foundation for these insights and underscored the credibility of the findings.

As stakeholders consider next steps, the convergence of digital, environmental, and geopolitical dynamics will continue to redefine value propositions and competitive landscapes. Organizations that proactively adapt to these currents by embracing supply chain diversification, strategic alliances, and customer-centric product development will be best positioned for sustainable success. This holistic perspective offers a roadmap for decision-makers seeking to capitalize on emerging opportunities and navigate potential challenges in this dynamic sector.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Compact Camp Kitchen

- Containerized Kitchens

- Folding Kitchen Systems

- Modular Camp Kitchen

- Fuel Type

- Diesel-Fired

- Gas-Powered

- Solar-Powered

- Mobility

- Fixed

- Portable

- Material

- Aluminum-Based

- Stainless Steel

- End User

- Commercial Outdoor Operations

- Mining & Exploration Camps

- Oil & Gas Field Operations

- Emergency & Disaster Relief Agencies

- Event Management & Festival Catering

- Humanitarian Organizations & NGOs

- Military & Defense Forces

- Recreational Users

- Individual Campers

- Outdoor Adventure Tour Operators

- Commercial Outdoor Operations

- Distribution Channel

- Offline Channels

- Online Channels

- Company Website

- eCommerce Website

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- AMG Group

- Backcountry.com, LLC

- Blue Diamond Products Ltd T/A Outdoor Revolution

- Cabela's L.L.C

- Camco Manufacturing, LLC

- Cascade Designs Inc.

- Dometic Group AB

- GCI Outdoor, Inc.

- Leisureshopdirect Ltd

- Logan Outdoor Products, LLC

- Mountain Summit Gear

- OLPRO Ltd.

- SylvanSport, LLC

- The Coleman Company, Inc.

- VEVOR

- Weatherhaven Global Resources Ltd.

- Zempire Camping

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Deployable Camp Kitchen Market report include:- AMG Group

- Backcountry.com, LLC

- Blue Diamond Products Ltd T/A Outdoor Revolution

- Cabela's L.L.C

- Camco Manufacturing, LLC

- Cascade Designs Inc.

- Dometic Group AB

- GCI Outdoor, Inc.

- Leisureshopdirect Ltd

- Logan Outdoor Products, LLC

- Mountain Summit Gear

- OLPRO Ltd.

- SylvanSport, LLC

- The Coleman Company, Inc.

- VEVOR

- Weatherhaven Global Resources Ltd.

- Zempire Camping

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | November 2025 |

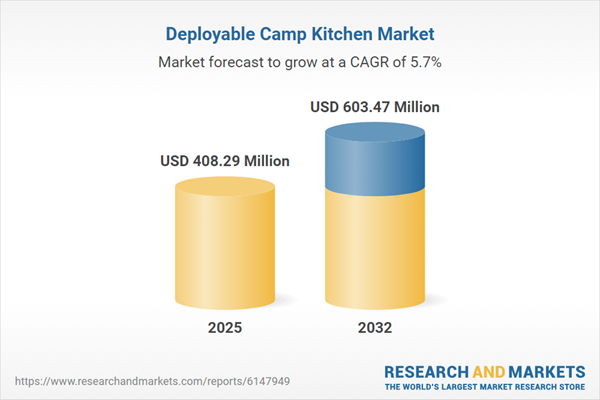

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 408.29 Million |

| Forecasted Market Value ( USD | $ 603.47 Million |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |