Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Rise of Pet Companion Robotics as a Transformative Force in Consumer Behavior and Emotional Well-Being Across Global Demographics

Pet companion robotics have emerged at the nexus of advanced artificial intelligence, nuanced sensor technologies, and shifting consumer expectations. As households seek emotionally intelligent companions that can adapt to individualized routines, robotics developers are pioneering devices capable of nuanced interactions that emulate the warmth of living pets while providing unprecedented consistency and safety.Furthermore, demographic trends such as aging populations and the rise of remote and hybrid work models have fueled demand for interactive robotic companions that address loneliness and cognitive engagement. These solutions transcend mere novelty by offering programmable behaviors, health monitoring, and multimodal communication channels, thereby redefining the role of robotics in personal well-being.

In parallel, sustainability considerations and ethical design principles are gaining prominence among both manufacturers and end users. As regulatory frameworks evolve and ecological footprints become a focal point, the interplay between material innovation, power efficiency, and lifecycle management will define competitive differentiation in this space.

This executive summary delves into the critical forces shaping the pet companion robotics sector, examines recent policy adjustments impacting supply chains, and explores how granular segmentation and regional distinctions inform strategic decision-making. Actionable recommendations and a transparent methodological overview ensure that stakeholders can navigate this rapidly evolving landscape with confidence.

How Evolving Technologies and Shifting Social Dynamics Are Redefining the Roles and Expectations Placed on Pet Companion Robots Worldwide

Breakneck advances in machine learning algorithms and sensor miniaturization have accelerated the integration of emotionally responsive behaviors into companion robots. Cutting-edge natural language processing models now enable fluid vocal interactions, while high-fidelity tactile sensors allow devices to detect and adapt to human touch with remarkable accuracy. Meanwhile, the convergence of edge computing and cloud-based analytics underpins real-time decision making, enabling robots to learn preferences and routines without compromising data privacy.Simultaneously, shifting social dynamics are reshaping the contours of pet ownership. Urbanization, dual-income households, and increasing residence mobility have constrained the feasibility of traditional pet care, prompting a search for low-maintenance yet engaging alternatives. These lifestyle changes have elevated consumer expectations for on-demand companionship, driving developers to craft modular platforms with customizable personalities, interactive learning modules, and seamless connectivity to household ecosystems.

Furthermore, the growing emphasis on mental health and well-being has underscored the therapeutic potential of companion robotics. Research collaborations between robotics firms and healthcare institutions have yielded devices that support stress reduction, cognitive therapy, and social skills development, broadening the appeal of these products beyond mere entertainment. In essence, the intersection of technological prowess and evolving social needs is forging a new paradigm in which pet companion robots serve as multifunctional assets that bridge the gap between utility and emotional fulfillment.

Examining the Multi-Dimensional Effects of the 2025 United States Tariff Adjustments on Supply Chains, Pricing Strategies, and Industry Partnerships

The implementation of revised tariff structures by United States authorities in 2025 has introduced a complex set of variables into the global pet companion robotics supply chain. Components such as high-precision actuators, advanced imaging sensors, and specialized circuit boards now face increased import duties, prompting manufacturers to reevaluate cost distribution and procurement strategies. The resultant increase in landed costs has spurred a renewed focus on supplier diversification and nearshoring initiatives.Manufacturers are responding by forging strategic partnerships with domestic component producers and exploring alternative manufacturing hubs in regions that maintain preferential trade agreements. This shift is fostering greater regional self-sufficiency, but it also requires accelerated development of local expertise and infrastructure. Meanwhile, original equipment manufacturers are negotiating volume-based incentives and collaborative R&D agreements to mitigate the tariff burden and preserve margin stability.

Moreover, the tariff-induced reassessment of logistics networks has catalyzed investments in supply chain resilience. Industry leaders are integrating advanced demand-forecasting tools, blockchain-enabled provenance tracking, and just-in-time inventory management to minimize exposure to cost volatility. In tandem, efforts to optimize product architectures for modularity and component interchangeability are reducing the impact of trade policy fluctuations. As a result, the market is witnessing a maturation of end-to-end operational frameworks designed to withstand geopolitical headwinds and ensure uninterrupted delivery of pet companion robotics to diverse end users.

Consequently, stakeholders are prioritizing transparency and collaboration across the ecosystem. Industry consortia and trade associations are convening to influence policy dialogues and advocate for balanced trade regulations that support innovation. Through these collective efforts, the sector aims to achieve a sustainable equilibrium that aligns competitive economics with continued technological advancement.

Unraveling the Critical Segmentation Dynamics That Drive Product Innovation, Consumer Accessibility, and Competitive Differentiation in Companion Robotics

An in-depth examination of product type reveals distinct performance and design considerations across aerial drones, legged platforms, stationary installations, and wheeled units. Aerial variants leverage advanced stabilization mechanisms and compact form factors to deliver interactive aerial displays, while legged robots offer agile gait dynamics that replicate organic movements. Stationary systems function as ambient companions with embedded environmental sensors, and wheeled models emphasize portability and spatial efficiency in domestic environments. These differences inform both end-user experience and maintenance protocols.Turning to pricing tiers, the economy segment is characterized by entry-level models with essential interaction capabilities and streamlined feature sets, appealing to budget-conscious consumers seeking basic companionship functions. Mid-range offerings integrate enhanced tactile feedback, richer behavioral libraries, and limited cloud connectivity, catering to households that prioritize versatility without premium costs. Premium solutions distinguish themselves through advanced onboard AI modules, extended battery life, and customizable skins or form updates, attracting enthusiasts and commercial establishments aiming to demonstrate technological leadership.

Power source considerations further differentiate product lines. Battery-powered units remain the most ubiquitous due to their portability and ease of recharging, while hybrid models combine battery reserves with auxiliary solar panels to extend operational durations in outdoor settings. Emerging solar-powered prototypes showcase potential for energy autonomy, particularly in research and education applications where uninterrupted uptime is valued.

Connectivity profiles shape interaction modalities. Standalone devices operate independently, leveraging onboard processing, whereas IoT-enabled systems integrate seamlessly into home networks via Bluetooth, cellular, or Wi-Fi protocols. Bluetooth-enabled configurations support direct device pairing, cellular-enabled variants ensure remote access across geographies, and Wi-Fi-enabled products facilitate high-bandwidth transmissions for firmware updates and multimedia features.

End-user categories span individual consumers who prioritize personalization and emotional rapport, and commercial establishments that deploy robots for themed environments, customer engagement, or therapeutic programs. Applications range from assistance and monitoring in elder care to entertainment and education in family settings, from healthcare and therapy in clinical contexts to research and development testbeds, as well as security and surveillance deployments. Distribution channels encompass offline networks-including hypermarkets and supermarkets, retail stores, and specialty outlets-and online avenues such as direct sales and e-commerce platforms that broaden accessibility and streamline procurement.

Comparative Regional Observations Highlighting Consumer Adoption Patterns, Regulatory Influences, and Infrastructure Variations Across Major Global Markets

Analysis of the Americas highlights a dynamic landscape driven by high household pet ownership and strong consumer spending power. North American markets illustrate robust demand for advanced companion robotics with emphasis on seamless integration into smart homes. Latin American regions showcase a rising interest in cost-effective models, reflecting a preference for economy and mid-range segments, though infrastructure variability influences power source choices. Regional technology parks and university-industry collaborations in Brazil and Mexico are fostering localized R&D programs that reinforce manufacturing capabilities and drive user awareness initiatives.Within Europe, Middle East & Africa, the market is shaped by stringent regulatory frameworks governing data privacy and product safety. European Union directives on electronic waste and energy efficiency have prompted manufacturers to prioritize modular design for easier recycling and to adopt hybrid or solar-enhanced power sources. In the Middle East, affluent consumer segments are gravitating toward premium offerings that emphasize luxurious form factors and immersive AI-driven interactions. African markets are in an incubation stage, with pilot projects in urban centers focusing on educational and security applications, supported by international aid programs and private-sector partnerships.

The Asia-Pacific region stands out for its diverse consumer profiles and rapid technological innovation. Japan and South Korea have established themselves as early adopters of legged and aerial companion robots, leveraging domestic robotics expertise and strong home appliance integration. China's expansive manufacturing infrastructure and government incentives for AI research have accelerated the rollout of cost-competitive battery-powered and IoT-enabled solutions. Meanwhile, Southeast Asia exhibits a growing middle-class appetite for entertainment and education applications, with online distribution channels gaining prominence due to digital retail penetration. Collectively, these regional nuances underscore the importance of tailoring product roadmaps and go-to-market strategies to localized consumer behaviors, regulatory environments, and infrastructural frameworks.

Profiling Leading Industry Players to Illuminate Their Strategic Approaches, Technological Innovations, and Competitive Differentiators in Robotics

Leading technology and electronics conglomerates are investing heavily in robotics divisions to carve out sustainable positions in the companion robotics arena. These firms leverage their established R&D infrastructures and global supply networks to accelerate feature rollouts and maintain rigorous quality control standards. Strategic partnerships between robotics startups and established automotive or aerospace suppliers are also prevalent, enabling the adaptation of high-precision motion control systems and durable materials for consumer-grade devices.Companies specializing in artificial intelligence are differentiating through proprietary emotion-detection algorithms, which enhance the ability of companion robots to recognize subtle human cues and deliver contextually appropriate responses. Meanwhile, several market entrants are capitalizing on modular hardware platforms that allow rapid customization of aesthetic components, sensor arrays, and power modules to meet diverse end-user requirements. This modular approach not only streamlines the manufacturing process but also supports aftermarket upgrades and serviceability.

In addition, forward-thinking organizations are establishing dedicated innovation labs that blend robotics engineers with behavioral psychologists, ensuring that product design aligns with both technical feasibility and human emotional needs. Cross-industry collaborations with pet care companies, healthcare providers, and educational institutions are further enriching the product roadmap, introducing features tailored to specific verticals such as cognitive therapy, classroom engagement, and themed entertainment experiences. Collectively, these competitive dynamics underscore a shift toward ecosystem-driven strategies that prioritize long-term user engagement and platform extensibility.

Strategic Imperatives for Industry Leaders to Ignite Innovation, Enhance Resilience, and Cultivate Sustainable Growth in the Pet Companion Robotics Ecosystem

Industry leaders should prioritize the development of interoperable platforms that support seamless integration with existing smart home and healthcare ecosystems. By adopting open communication protocols and robust security frameworks, manufacturers can foster greater consumer trust and streamline cross-device interactions. In addition, embedding modular hardware architectures that facilitate incremental upgrades will extend product lifecycles and reduce total cost of ownership for end users.It is equally important to invest in ethical AI practices, including transparent data handling and bias mitigation processes. Implementing user-centric privacy controls and clear consent mechanisms can differentiate offerings in markets where data sovereignty and regulatory compliance are critical. Furthermore, companies should explore localized production partnerships to mitigate exposure to international trade fluctuations and to capitalize on regional manufacturing incentives.

To enhance market penetration, industry participants must cultivate strategic alliances with pet care specialists, healthcare institutions, and entertainment brands. Co-creative design workshops and joint pilot programs can validate new applications and accelerate time to market. Lastly, establishing comprehensive after-sales support infrastructures-encompassing remote diagnostics, software maintenance, and community-based training resources-will drive higher customer satisfaction and foster brand loyalty in a competitive landscape.

Overview of the Robust Methodological Framework Guaranteeing Analytical Rigor, Data Integrity, and Sectoral Relevance in the Market Research Process

The research process was structured around a blended methodology combining rigorous secondary research with targeted primary engagements. Initially, public domain resources, industry white papers, and regulatory filings were systematically reviewed to establish baseline insights into technological trends, policy developments, and consumer behavior patterns. These findings informed the design of in-depth interviews with robotics engineers, software architects, supply chain experts, and end-user champions to capture firsthand perspectives.Subsequently, a series of qualitative workshops and expert panel discussions were convened, leveraging domain specialists from academic institutions, healthcare providers, and consumer technology forums. These collaborative sessions were instrumental in validating preliminary hypotheses, refining segmentation frameworks, and uncovering emergent use cases. Quantitative validity was ensured through the triangulation of interview data against market databases and proprietary intelligence repositories.

Data integrity was further reinforced by employing cross-functional analyst reviews, where interdisciplinary teams assessed the consistency, plausibility, and relevance of all inputs. Analytical models were stress-tested across varied scenarios to evaluate sensitivity to external shocks, such as tariff changes or supply disruptions. Throughout the process, ethical research guidelines governed participant confidentiality, consent protocols, and data anonymization, ensuring that all insights adhere to the highest standards of academic and industry compliance.

Conclusive Reflections Emphasizing Future Trajectories, Strategic Opportunities, and Essential Considerations for the Pet Companion Robotics Landscape

As demonstrated throughout this summary, pet companion robotics are poised to redefine personal engagement, therapeutic interventions, and interactive entertainment across diverse markets. The confluence of advanced AI, sensor integration, and modular design underscores a shift toward devices that are not merely functional but emotionally resonant. Regulatory and trade policy adjustments in 2025 have catalyzed supply chain optimization and regional diversification, further accelerating industry maturation.Granular segmentation analysis reveals that product form factors, pricing strategies, power sources, connectivity options, and end-user applications each contribute uniquely to product differentiation and user satisfaction. Regional insights illuminate how varying consumer preferences, regulatory frameworks, and infrastructure maturity necessitate tailored value propositions. Competitive landscapes are evolving toward ecosystem-driven business models, with collaborations that bridge robotics technology and specialized sector expertise.

In light of these developments, stakeholders equipped with actionable recommendations and a transparent methodological foundation will be best positioned to navigate a landscape characterized by rapid innovation and evolving consumer expectations. Ultimately, embracing interoperability, ethical AI, and strategic partnerships will unlock the full potential of pet companion robotics, ensuring sustainable growth and enhanced human well-being.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Aerial

- Legged

- Stationary

- Wheeled

- Price

- Economy

- Mid Range

- Premium

- Power Source

- Battery Powered

- Hybrid

- Solar Powered

- Connectivity

- IoT Enabled

- Bluetooth Enabled

- Cellular Enabled

- Wi-Fi Enabled

- Standalone

- IoT Enabled

- End User

- Commercial Establishment

- Individual Consumer

- Application

- Assistance And Monitoring

- Entertainment And Education

- Healthcare And Therapy

- Research And Development

- Security And Surveillance

- Distribution Channel

- Offline

- Hypermarkets And Supermarkets

- Retail Stores

- Specialty Stores

- Online

- Direct Sales

- E-Commerce Platforms

- Offline

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- AGELESS INNOVATION

- Anki, Inc. by Digital Dream Labs

- ANYbotics AG

- Elephant Robotics

- Enabot

- Liberator Ltd

- Ogmen Robotics Inc

- Petoi Corporation

- SciTech Patent Art Services Ltd.

- Shenzhen Unitree Robotics Co., Ltd.

- Sony Group Corporation

- Spin Master Corp.

- Tombot, Inc.

- WowWee Group Limited by Optimal Group, Inc.

- Xiaomi Corp

- Ziff Davis

- Samsung Electronics Co Ltd.

- Kolony Robotic inc.

- GULIGULI

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Pet Companion Robot Market report include:- AGELESS INNOVATION

- Anki, Inc. by Digital Dream Labs

- ANYbotics AG

- Elephant Robotics

- Enabot

- Liberator Ltd

- Ogmen Robotics Inc

- Petoi Corporation

- SciTech Patent Art Services Ltd.

- Shenzhen Unitree Robotics Co., Ltd.

- Sony Group Corporation

- Spin Master Corp.

- Tombot, Inc.

- WowWee Group Limited by Optimal Group, Inc.

- Xiaomi Corp

- Ziff Davis

- Samsung Electronics Co Ltd.

- Kolony Robotic inc.

- GULIGULI

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2025 |

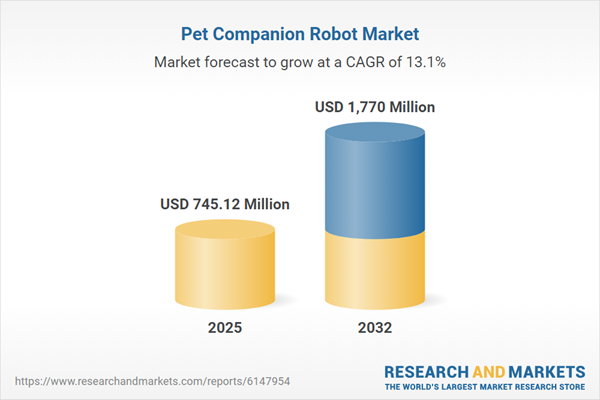

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 745.12 Million |

| Forecasted Market Value ( USD | $ 1770 Million |

| Compound Annual Growth Rate | 13.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |