Speak directly to the analyst to clarify any post sales queries you may have.

An incisive overview that outlines foundational technologies, operational drivers, and integration imperatives shaping modern integrated battlefield management systems

The rapid convergence of sensors, communications, and data analytics is reshaping how armed forces conceive command and control, requiring integrated battlefield management systems that deliver decision advantage under complex operational conditions. This introduction frames the ecosystem by highlighting how advances in hardware, software, and services are combining to create interoperable, resilient, and scalable solutions for contemporary conflict environments. It outlines the scope of technological building blocks, the operational demands driving acquisition decisions, and the strategic implications for defense planners and system integrators.Against this backdrop, emerging expectations around persistent connectivity, multi-domain awareness, and secure information exchange are redefining procurement prerequisites. Hardware elements such as communications equipment, displays, navigation and positioning devices, processors, and sensors must interface seamlessly with command and control software, communication management suites, and data fusion platforms. Meanwhile, services comprising maintenance and support, system integration, and training and simulation are increasingly treated as integral components of solution delivery rather than optional aftercare. Taken together, these dynamics create a complex procurement landscape that rewards modularity, standards alignment, and lifecycle-oriented contracting. This introduction sets the stage for deeper analysis by clarifying foundational concepts and by aligning technical considerations with operational outcomes that matter to decision-makers.

A comprehensive examination of technological, doctrinal, and procurement shifts that are redefining interoperability, resilience, and fielding speed in battlefield management

The landscape for integrated battlefield management is undergoing transformative shifts driven by technological maturation, doctrinal evolution, and escalating demands for multi-domain interoperability. Advances in artificial intelligence and machine learning have migrated from experimental projects into operational data fusion platforms that prioritize real-time analytic outputs and automated decision aids. At the same time, communications architectures are moving toward heterogeneous, resilient fabrics that can sustain connectivity across contested and degraded environments, which changes how systems are architected and validated.Doctrinal shifts toward distributed operations and contested logistics increase the value placed on low-latency situational awareness and decentralized command nodes. This evolution elevates the importance of integrating airborne, ground, naval, and space platforms into coherent information-sharing constructs. Concurrently, lifecycle delivery models are shifting; procurement authorities increasingly demand that software and platform upgrades be supported by robust maintenance, system integration services, and simulation-driven training. These collective shifts compel vendors to design systems with open interfaces, modular hardware components, and cloud-capable or on-premise deployment models that can be reconfigured to meet evolving operational concepts. Consequently, industry participants must reorient investment and partnership strategies to emphasize agility, secure interoperability, and rapid fielding cycles.

An analytical assessment of how United States tariff policy changes in 2025 reshaped global supplier networks, procurement risk posture, and supply chain resilience strategies

Policy changes and trade measures introduced by the United States in 2025 have materially influenced supplier networks, sourcing strategies, and program risk assessments for integrated battlefield management systems. Tariff adjustments and updated export controls have prompted defense primes and subsystem suppliers to re-evaluate supply chain routes, leading to near-term decisions to diversify component sources and to increase in-region manufacturing where feasible. These adjustments have had ripple effects across procurement timelines, supplier contractual terms, and certification pathways due to changes in lead times and component availability.As stakeholders reacted to tariff-induced shifts, procurement officers placed renewed emphasis on supply chain transparency and supplier traceability, requiring more rigorous vendor due diligence and enhanced compliance mechanisms. Vendors responded by expanding their authorized supplier lists, qualifying alternate parts, and in some cases, accelerating localization strategies to mitigate exposure to cost volatility. At the program level, acquisition teams balanced the need for technical capability against the operational risks associated with single-source dependencies. This period also saw intensified cooperation between system integrators and component manufacturers to create more resilient bill-of-material configurations and to support contingency sourcing plans that align with defense readiness objectives.

Deep segmentation insights that connect component architectures, platform constraints, deployment choices, operational applications, and end-user priorities to commercial strategy

Segmentation-driven analysis reveals nuanced demand characteristics across components, platforms, deployment modes, applications, and end users that shape strategic product roadmaps and go-to-market approaches. Based on component, the ecosystem spans hardware, services, and software and platforms; hardware encompasses communications equipment, displays, navigation and positioning devices, processors, and sensors, while services include maintenance and support, system integration, and training and simulation, and software and platforms cover command and control software, communication management software, and data fusion and analytics platforms. These component-level distinctions influence lifecycle support models and aftermarket revenue potential, prompting vendors to bundle hardware with persistent services and iterative software upgrades.Based on platform type, solutions must adapt to the distinct environmental, performance, and certification requirements of airborne, ground, naval, and space domains, each demanding tailored ruggedization, latency profiles, and interoperability testing. Based on deployment mode, offerings range across cloud and on-premise approaches, with on-premise options further differentiated between centralized operations centers and field installations; this dichotomy affects data sovereignty considerations, latency tolerance, and sustainment strategies. Based on application, the primary mission sets include communications, electronic warfare, reconnaissance, and surveillance, each imposing unique sensor fusion and processing demands. Finally, based on end user, requirements diverge among air force, army, navy, and special forces communities, which prioritize different mixes of mobility, endurance, stealth, and interoperability. Taken together, these segmentation layers inform product roadmaps, certification priorities, and channel strategies, enabling vendors to align technical investments with the operational profiles of target customers.

A strategic regional analysis that maps procurement preferences, interoperability demands, and industrial policy implications across three pivotal global theaters

Regional dynamics exert a pronounced influence on procurement preferences, technology adoption timelines, and partnership architectures. In the Americas, defense programs tend to emphasize rapid integration of advanced data fusion capabilities, strong requirements for interoperability with legacy national systems, and a preference for hybrid deployment models that blend cloud-enabled analytics with secure on-premise controls. These priorities favor suppliers who can demonstrate proven integration experience and who maintain robust domestic or allied supply chains.In Europe, Middle East & Africa, procurement decisions reflect a mix of modernization drives, interoperability projects tied to multinational coalitions, and growing investments in resilient communications and electronic warfare capabilities. Regional programs increasingly favor modular systems that can be tailored to coalition interoperability standards and that support phased capability insertion. In the Asia-Pacific region, accelerating force modernization and distributed operational concepts elevate demand for persistent surveillance, airborne and naval sensor integration, and low-latency command and control. Vendors operating in the Asia-Pacific must account for a diverse set of industrial policies, local partner expectations, and the imperative to offer flexible deployment modes that accommodate both centralized command centers and forward-deployed field installations. Across all regions, the ability to demonstrate supply chain resilience, security accreditation, and adaptable sustainment models remains a decisive factor in program selection.

A competitive landscape assessment that highlights incumbent strengths, specialist agility, and partnership dynamics shaping capability delivery and sustainment outcomes

The competitive landscape is characterized by a mix of legacy primes, specialized systems integrators, and innovative software and analytics firms that together deliver end-to-end battlefield management capabilities. Legacy defense contractors bring deep systems engineering experience, established trust relationships with procurement authorities, and extensive integration track records that help manage large-scale modernization programs. These incumbents often emphasize full-system delivery, rigorous certification workflows, and enduring sustainment contracts.Specialized integrators and software-centric firms contribute agility, rapid iteration cycles, and advanced analytics capabilities that accelerate deployment of modern command and control features. They frequently partner with hardware manufacturers to combine robust sensor suites and communications equipment with sophisticated data fusion and command software. Meanwhile, pure-play service providers focus on maintenance, training, and simulation offerings that enhance operational readiness and reduce lifecycle risk. Collectively, these cohorts create an ecosystem where strategic partnerships, M&A activity, and alliance networks determine competitive positioning. For program managers and procurement teams, vendor selection increasingly considers not only technical fit but also ecosystem depth, partnership flexibility, and the ability to deliver continuous capability enhancements through modular upgrades.

Practical strategic actions that industry leaders should implement to enhance modularity, supply chain resilience, and sustained operational support for defense programs

Industry leaders must adopt proactive strategies to capitalize on shifting operational demands while mitigating supply chain and regulatory risks. First, prioritize modular open architectures that enable rapid integration of new sensors, communication modalities, and analytics engines; this reduces lock-in and accelerates capability refresh cycles. Next, invest in dual-mode deployment capabilities so that offerings can support both cloud-enabled analytics for strategic centers and hardened on-premise solutions for forward-deployed nodes, thereby satisfying diverse sovereignty and latency requirements.Additionally, establish resilient supplier ecosystems through multi-sourcing, qualified alternate parts lists, and regional manufacturing partnerships to reduce lead-time and tariff exposure. Strengthen lifecycle revenue streams by bundling maintenance, system integration, and immersive training and simulation as part of contract proposals, ensuring sustained operational performance and stronger customer relationships. Finally, align product roadmaps with end-user mission sets by co-developing solutions with air force, army, navy, and special forces stakeholders to validate real-world utility and to accelerate operational acceptance. Executing on these recommendations enables organizations to deliver differentiated capability while managing program risk and strengthening long-term customer ties.

A transparent multi-method research methodology combining primary stakeholder interviews, technical synthesis, and scenario-driven risk assessment for decision-grade insights

This research leverages a multi-method approach that integrates primary stakeholder interviews, technical literature review, and structured analysis of procurement practices to build a robust understanding of the integrated battlefield management ecosystem. Primary insights derive from discussions with procurement officials, program managers, system integrators, and subject-matter experts across hardware, software, and services domains, ensuring that operational priorities and technical constraints inform interpretation. Secondary inputs include open-source technical documentation, standards specifications, and defense acquisition policy statements that provide context for certification and interoperability requirements.Analytical methods include comparative capability mapping, supplier ecosystem profiling, and scenario-based risk assessment to evaluate supply chain resilience and program-level exposure to policy shifts such as tariff changes. Where appropriate, qualitative findings are triangulated across multiple sources to enhance reliability. The methodology emphasizes transparency in source attribution, careful handling of proprietary information, and a pragmatic synthesis that aligns technical detail with strategic decision-making needs. This approach supports defensible conclusions about capability gaps, acquisition sensitivities, and high-impact intervention points for stakeholders.

A concise synthesis that highlights the decisive interplay of technological integration, sustainment practices, and supply chain resilience for lasting operational advantage

Integrated battlefield management systems are at an inflection point where technology integration, operational doctrine, and supply chain realities converge to redefine capability delivery and sustainment. The accumulated evidence shows that success will favor organizations that can demonstrate modular architectures, resilient sourcing strategies, and the ability to deliver persistent training and maintenance as integral parts of solution packages. Technological progress in data fusion, communications resilience, and edge compute creates tangible operational advantages, but these advantages only translate into fielded capability when matched with robust lifecycle support and rigorous interoperability testing.Looking ahead, procurement and program decisions will increasingly weigh not only performance metrics but also supply chain risk, regulatory compliance, and the pace at which upgrades can be fielded without disrupting readiness. Consequently, stakeholders should prioritize partnerships that offer both technical depth and operational delivery confidence. In sum, the most competitive offerings will be those that balance cutting-edge analytics and sensor capabilities with proven integration, sustainment, and supply chain resilience.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Component

- Hardware

- Communication Equipments

- Radios

- Satellite Communication Terminals

- Displays

- Navigation & Positioning Devices

- GPS Receivers

- Inertial Navigation Systems (INS)

- Processors

- Sensors & Cameras

- Camera Sensors

- Electro-Optical (EO) Cameras

- Infrared Sensors

- Night Vision Cameras

- Thermal Cameras

- Communication Equipments

- Services

- Maintenance & Support

- System Integration

- Training & Simulation

- Software & Platforms

- Command & Control Software

- Communication Management Software

- Data Fusion & Analytics Platforms

- Situational Awareness Software

- Hardware

- Platform Type

- Airborne Platforms

- Aircraft

- Helicopters

- Unmanned Aerial Vehicles (UAVs)

- Ground Platforms

- Armored Vehicles

- Headquarters & Command Centers

- Soldier Systems

- Naval Platforms

- Submarines

- Warships

- Airborne Platforms

- Deployment Mode

- Cloud

- On Premise

- Centralized Operations Centers

- Field Installations

- Installation Type

- New Installation

- Upgradation

- Application

- Combat Simulation & Training

- Command & Control (C2)

- Communication & Networking

- Electronic Warfare

- Reconnaissance

- Surveillance

- End User

- Air Force

- Army

- Navy

- Special Forces

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- BAE Systems plc

- Singapore Technologies Engineering Ltd

- Airbus SE

- Aselsan A.S.

- CACI International Inc.

- Curtiss-Wright Corporation

- Elbit Systems Ltd.

- General Dynamics Corporation

- Hexagon AB

- Honeywell International Inc.

- Indra Sistemas S.A.

- Israel Aerospace Industries Ltd.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Leonardo S.p.A

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Rolta India Limited

- Saab AB

- Safran S.A.

- Systematic A/S

- Thales S.A.

- The Boeing Company

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Integrated Battlefield Management System Market report include:- BAE Systems plc

- Singapore Technologies Engineering Ltd

- Airbus SE

- Aselsan A.S.

- CACI International Inc.

- Curtiss-Wright Corporation

- Elbit Systems Ltd.

- General Dynamics Corporation

- Hexagon AB

- Honeywell International Inc.

- Indra Sistemas S.A.

- Israel Aerospace Industries Ltd.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Leonardo S.p.A

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Rolta India Limited

- Saab AB

- Safran S.A.

- Systematic A/S

- Thales S.A.

- The Boeing Company

Table Information

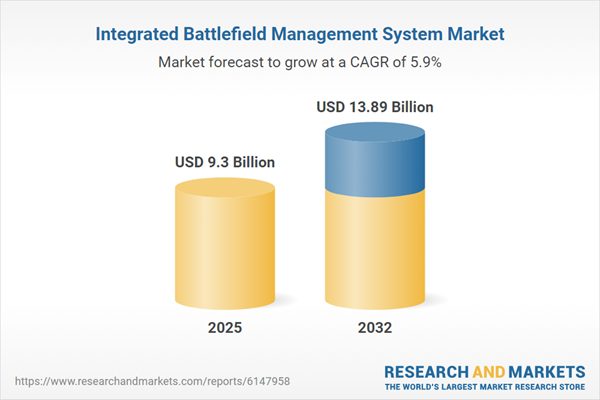

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 9.3 Billion |

| Forecasted Market Value ( USD | $ 13.89 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |