Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive Overview of the Envelope Making Machine Industry Highlighting Core Dynamics and Emerging Themes Shaping the Global Market Environment

Envelope making machines have served as a foundational pillar in the evolution of business communications and commercial packaging workflows. Emerging from simple manual assemblies, these systems have progressively integrated advanced mechanical designs and digital controls to meet the expanding demands of corporate mailing departments, transactional communications enterprises, and high-volume logistics providers. As the global economy accelerates the pace of trade and regulatory compliance intensifies, organizations across diverse verticals are seeking automated solutions that can ensure consistent throughput, precision alignment, and cost-effective operation.In recent years, the convergence of mechatronics, sensor technologies, and software-driven process management has redefined expectations for productivity and quality assurance. Manufacturers have responded by incorporating modular architectures and scalable platforms, enabling rapid adaptation to fluctuating order volumes, varied envelope formats, and stringent data security requirements. Consequently, equipment longevity and ease of maintenance have become pivotal selection criteria, prompting original equipment manufacturers and end-users to forge new collaborative models focused on lifecycle services and predictive diagnostics.

Against this backdrop, the subsequent sections of this executive summary illuminate the critical shifts shaping the envelope making machine industry. From transformative technology trends to regulatory impacts and strategic segmentation insights, the following analysis offers decision-makers a comprehensive orientation to inform investment priorities, operational enhancements, and long-term growth strategies.

Rapid Technological Innovations and Evolving Operational Protocols Reshaping Production Workflows and Driving Continuous Improvement Across the Envelope Making Machinery Segment

The envelope making machine landscape is undergoing a profound transformation driven by disruptive technological advancements and evolving customer expectations. Automation has migrated from standalone conveyors to fully integrated production cells orchestrated by real-time process management software. In conjunction with this shift, the adoption of machine-to-machine communication standards has facilitated seamless data exchange across the manufacturing floor, enabling greater visibility and agile batch changeover capabilities.Moreover, the growing emphasis on sustainability has catalyzed innovation in energy-efficient drive systems, reduced material waste, and eco-friendly adhesive applications. Manufacturers are now embedding sensor networks throughout their equipment to optimize resource utilization and support circular economy initiatives. Parallel to these developments, the integration of artificial intelligence for pattern recognition and predictive maintenance is mitigating downtime and enhancing yield consistency.

Furthermore, end-users' demand for customization has compelled original equipment manufacturers to introduce configurable modules that accommodate an expanding variety of envelope types, from specialized security formats to bespoke window configurations. Consequently, strategic partnerships between machine builders, materials suppliers, and software providers are redefining value creation, signaling a move toward more service-oriented business models. As these transformative shifts continue to accelerate, stakeholders across the value chain must remain vigilant and responsive to maintain competitive advantage.

Consolidated Effects of New Tariff Measures on Supply Chains Raw Material Sourcing and Competitive Positioning Within the United States Envelope Production Sector

The introduction of new tariff measures in 2025 has exerted multifaceted pressures on the envelope making machine industry, particularly with respect to raw material procurement, component sourcing, and overall supply chain resiliency. Steel and aluminum levies have elevated the cost foundations for critical machine frames and mechanical assemblies, prompting equipment manufacturers to reevaluate vendor agreements and explore alternative alloys and composite materials. At the same time, electronic and control system components sourced from overseas have faced incremental duties, compelling original equipment manufacturers to localize key subassembly production or adjust their supply networks.Consequently, these cumulative impacts have sparked negotiations for long-term contracts with domestic suppliers, as well as investments in in-house fabrication capabilities to buffer against import fluctuations. End-users have been affected by this shift, witnessing extended lead times and variable commissioning schedules for newly ordered equipment. However, this scenario has also generated impetus for closer collaboration between machine builders and clients on inventory management and just-in-time delivery frameworks.

In parallel, some manufacturers have mitigated cost pressures through redesign initiatives aimed at reducing raw material intensity, optimizing machine footprints, and standardizing modular interfaces. These strategic adjustments underscore the industry's capacity to adapt to external policy environments while preserving performance standards and service delivery commitments.

Deep Dive into Market Structure Revealing How Machine Type Automation Level Capacity Envelope Format End-User and Distribution Channel Drive Diverse Industry Dynamics

An in-depth analysis of the envelope making machine industry reveals distinct market dynamics driven by equipment type, automation sophistication, processing capacity, envelope format variety, end-user requirements, and distribution pathways. Machines engineered for precise addressing functions coexist alongside sealing systems optimized for high-speed lamination and window patching platforms tailored to intricate insert placements. Each category commands unique engineering expertise and service frameworks, reflecting the spectrum of operational tasks performed across mailrooms and packaging lines.Furthermore, the level of automation directly influences capital investment decisions and labor deployment models. Fully automatic solutions deliver end-to-end processing with minimal human intervention, while semi-automatic and manual systems cater to lower throughput environments where flexible batch sizes or specialized handling procedures prevail. Capacity considerations further distinguish these machines, with high-volume configurations designed to meet the demands of central distribution hubs, and medium-to-low capacity offerings enabling agile performance in niche or regional operations.

Envelope format diversity also plays a pivotal role in shaping equipment specifications, from airmail and booklet envelopes requiring strict weight and size controls to elaborate contour flap and window envelope productions necessitating precise registration and material handling. Meanwhile, end-user sectors such as banking, corporate offices, e-commerce logistics, educational institutions, government agencies, healthcare and pharmaceutical concerns, packaging firms, and postal services all impose distinct performance and compliance attributes. Finally, the choice between offline channel procurement or online direct engagement influences lead times, after-sales support structures, and pricing strategies. Together, these segmentation dimensions provide a nuanced framework for understanding competitive positioning and value creation across the industry.

Regional Performance Patterns and Strategic Variations Across the Americas Europe Middle East Africa and Asia Pacific Environments Informing Growth Trajectories

Geographic regions exhibit differentiated growth trajectories and adoption patterns in the envelope making machine sector, reflecting local market demands, regulatory contexts, and infrastructure maturity. In the Americas, a robust blend of corporate mail centers, logistics hubs, and financial institutions has sustained high demand for advanced sealing and addressing equipment. Investments in mail processing modernization programs and postal service upgrades have further reinforced the region's leadership in machine deployments.In Europe, the Middle East, and Africa, regulatory emphasis on data privacy and environmental sustainability has accelerated the adoption of energy-efficient systems and secure sealing technologies. This region's diverse economic landscape has spurred tiered market entry strategies, with established manufacturers targeting mature Western markets while cultivating nascent opportunities within emerging economies.

Across the Asia-Pacific region, rapid e-commerce expansion, coupled with industrial policy incentives for domestic manufacturing, has driven significant procurement of modular and high-throughput machines. Strategic partnerships between local assemblers and global technology providers have enhanced service networks, reducing total cost of ownership and enabling quicker response times. As digital transformation initiatives continue to proliferate, each regional cluster presents unique imperatives for tailored product roadmaps, support infrastructures, and strategic alliances.

Critical Examination of Leading Manufacturers Operational Strategies RD Investments and Collaborative Ventures Defining Competitive Edges in the Envelope Machinery Market

Leading industry participants have been executing multifaceted strategies to strengthen their competitive moats and capture differentiated value. Flagship manufacturers have prioritized R&D initiatives aimed at developing intelligent control systems, advanced human-machine interfaces, and adaptive tooling platforms. These investments have yielded next-generation solutions capable of real-time defect detection and automated batch changeovers, enhancing throughput and reducing waste across complex operational scenarios.In parallel, several companies have expanded their global footprints through targeted mergers, acquisitions, and joint ventures, securing complementary technologies and localized service capabilities. These collaborative moves have provided expanded aftermarket networks and assured spare parts availability-critical considerations for end-users with continuous production requirements. Moreover, leading players have been offering subscription-based maintenance programs and remote diagnostics services, shifting the value proposition toward outcome-oriented engagements rather than pure equipment sales.

Furthermore, some organizations are differentiating themselves through sustainability commitments, integrating recyclable polymer modules and low-energy pneumatic systems to align with corporate social responsibility goals. By forging ecosystem partnerships with material innovators and software providers, they are establishing holistic offerings that address the full lifecycle needs of modern envelope production lines.

Strategic Imperatives and Tactical Approaches Guiding Industry Leaders to Enhance Operational Efficiency Market Penetration and Innovation in Envelope Fabrication Technologies

Industry leaders should prioritize the integration of intelligent automation solutions to maintain responsiveness and drive operational excellence. By deploying sensor-embedded modules and cloud-enabled monitoring platforms, organizations can shift from reactive maintenance to predictive servicing, significantly reducing unplanned downtime and optimizing asset utilization. Collaborative engagements with control system vendors can further accelerate the deployment of adaptive machine learning algorithms that fine-tune process parameters in real time.Additionally, companies are advised to diversify supply networks and explore strategic localization of key subassemblies. This approach not only mitigates tariff-related cost volatility but also strengthens resilience against geopolitical disruptions. Simultaneously, investing in modular design principles will allow rapid reconfiguration for emerging envelope formats and evolving end-user specifications.

From a commercial perspective, expanding outcome-based service models-such as performance guarantees and pay-per-use arrangements-can create stickier customer relationships and unlock new revenue streams. Finally, embedding sustainability benchmarks into product development roadmaps will resonate with environmentally conscious clients and support long-term regulatory compliance, fostering brand loyalty and competitive differentiation.

Robust Multistage Research Framework Employing Qualitative Interviews Primary Surveys and Secondary Data Synthesis to Deliver Comprehensive Market Insights

This research employs a rigorous, multistage methodology combining qualitative and quantitative data collection to ensure comprehensive market insights. Primary research included in-depth interviews with senior executives from original equipment manufacturers, major end-users, and key distribution partners. These discussions provided firsthand perspectives on technological trajectories, procurement criteria, and service expectations.Complementing this, secondary research involved systematic reviews of industry publications, patent filings, technical white papers, and regulatory documents to contextualize competitive and regulatory landscapes. Data triangulation techniques were applied to verify consistency across sources, ensuring that conclusions are grounded in reliable evidence. In addition, regional market assessments drew upon government statistics and trade association databases to capture nuanced macroeconomic and policy drivers.

Finally, expert validation workshops were conducted with subject-matter specialists to refine analytical models, test hypothesis scenarios, and confirm strategic recommendations. This robust approach guarantees that the findings presented in this report reflect the latest dynamics and actionable intelligence required for informed decision-making.

Synthesis of Strategic Observations Underscoring Core Industry Transformations and Highlighting Key Imperatives for Stakeholders in the Envelope Making Machinery Sector

The envelope making machine industry is at a critical juncture, shaped by rapid technological innovation, evolving regulatory frameworks, and shifting customer expectations. Intelligent automation and data-driven process optimization have become indispensable tools for maintaining competitive parity and reducing total cost of ownership. At the same time, external policy influences have necessitated supply chain recalibrations and design optimizations, underscoring the importance of agility and strategic foresight.Moreover, segmentation analysis highlights the necessity for tailored solutions across machine types, automation levels, capacity requirements, envelope formats, end-user applications, and distribution channels. Regional insights further illustrate that localized approaches are essential to navigate varying market maturities and sustainability mandates. Leading companies have demonstrated that a combination of R&D leadership, collaborative partnerships, and service-based business models can drive sustained value creation.

As stakeholders contemplate future priorities, they must embrace a holistic perspective that integrates technological enablement, supply chain resilience, and customer-centric engagement. By doing so, organizations can harness the full promise of next-generation envelope making machines and secure long-term growth in a dynamic global landscape.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Types

- Envelope Addressing Machines

- Envelope Sealing Machines

- Window Patching Machines

- Automation Level

- Fully Automatic Machines

- Manual Envelope Machines

- Semi-Automatic Machines

- Capacity

- High Volume

- Low Volume

- Medium Volume

- Envelope Type

- Airmail Envelope

- Booklet Envelope

- Catalog Envelope

- Contour Flap Envelope

- Manila Envelope

- Square Envelope

- Window Envelope

- End-User

- Banking & Financial Institutions

- Corporate Offices

- eCommerce & Logistics

- Educational Institutions

- Government

- Healthcare & Pharmaceuticals

- Packaging Industry

- Postal & Courier Services

- Distribution Channel

- Offline

- Online

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Barry-Wehmiller Group Inc.

- APR Solutions S.r.l.

- Fidia Macchine Grafiche Srl

- DELTA TECHNIQUE

- DSY Packaging Machinery Co.,Ltd.

- Fuji Paper Bag Machine Works Co., Ltd.

- Jay Engineering

- Koten Machinery Industry Co., Ltd.

- MOHINDRA MECHANICAL WORKS

- Nanjing ZONO

- Ruian Fangda Envelope Making Machine

- Ruian Haoxing Machinery

- Shanghai Printyoung Inteational Industry

- Sunhope Packaging Machinery (Zhenjiang) Co., Ltd.

- Tech Master Engineering

- Wenzhou Kingsun Machinery Industrial

- Wity Machinery

- WUXI VOKEDA TECHNOLOGY CO., LTD.

- YG Paper Machinery

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Envelope Making Machine Market report include:- Barry-Wehmiller Group Inc.

- APR Solutions S.r.l.

- Fidia Macchine Grafiche Srl

- DELTA TECHNIQUE

- DSY Packaging Machinery Co.,Ltd.

- Fuji Paper Bag Machine Works Co., Ltd.

- Jay Engineering

- Koten Machinery Industry Co., Ltd.

- MOHINDRA MECHANICAL WORKS

- Nanjing ZONO

- Ruian Fangda Envelope Making Machine

- Ruian Haoxing Machinery

- Shanghai Printyoung Inteational Industry

- Sunhope Packaging Machinery (Zhenjiang) Co., Ltd.

- Tech Master Engineering

- Wenzhou Kingsun Machinery Industrial

- Wity Machinery

- WUXI VOKEDA TECHNOLOGY CO., LTD.

- YG Paper Machinery

Table Information

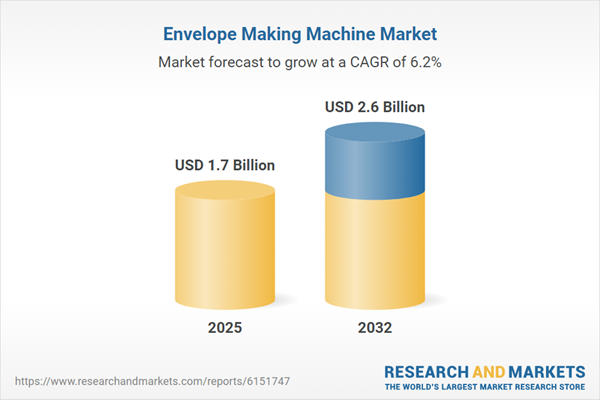

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 2.6 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |