Speak directly to the analyst to clarify any post sales queries you may have.

Establishing the Panorama of Transparent Conductive Oxide Coated Glass Market Evolution and Core Opportunities in a Converging Technological Era

Transparent conductive oxide coated glass has emerged as a cornerstone material in modern industries seeking to balance optical clarity with electrical conductivity. As global demand for smarter infrastructure converges with energy efficiency imperatives, the role of transparent conductive oxide coatings has become more pronounced than ever. Architectural glass facades are integrating advanced coatings to reduce heating and cooling loads while maintaining aesthetic transparency. In parallel, the automotive sector is embracing coatings that deliver robust performance under harsh environmental conditions, particularly for electric vehicle window defogging systems and in cabin displays. Transitioning into consumer electronics, high resolution monitors and smartphones are leveraging these coatings to sustain touchscreen responsiveness and extended display lifespans. Simultaneously, the solar energy industry is deploying TCO coated substrates to enhance electrode performance in photovoltaic modules and to optimize light absorption and current collection. This convergence of application drivers underscores a market at the intersection of technological innovation and sustainability mandates. With material scientists refining aluminum-doped zinc oxide, antimony tin oxide, fluorine-doped tin oxide, and indium tin oxide formulations, coating providers are pushing the boundaries of conductivity and transparency. These advances are unfolding against a backdrop of evolving regulatory standards, shifting trade policies, and dynamic end user requirements. Accordingly, this executive summary synthesizes critical dynamics and emerging opportunities, offering industry leaders a structured lens through which to navigate the complex landscape of transparent conductive oxide coated glass.As the competitive intensity escalates and supply chain agility becomes paramount, understanding the interplay between raw material sourcing, coating process technologies, and regional demand patterns is essential. This summary distills primary insights, highlights strategic inflection points, and delivers actionable recommendations to empower decision makers in capturing value from next generation transparent conductive oxide coated glass solutions

Identifying the Disruptive Forces and Transformational Trends Reshaping the Transparent Conductive Oxide Coated Glass Landscape Across Multiple Sectors

Recent years have witnessed a fundamental reorientation of the transparent conductive oxide coated glass market driven by converging sustainability objectives and rapid technological evolution. Policymakers worldwide are imposing stricter energy efficiency standards on building envelopes, accelerating the adoption of coatings that simultaneously deliver solar control functions and electrical conductivity. At the same time, the proliferation of smart cities has spurred demand for dynamic glazing solutions capable of integrating sensors and responsive controls, creating new opportunities for multifunctional TCO coatings. In the automotive domain, the transition towards electric mobility has heralded a wave of innovation in defogging and heating systems where low power consumption and fast thermal response are critical. Display applications have similarly advanced, as device manufacturers push for thinner form factors and enhanced touch performance, prompting coating developers to refine thin film deposition techniques. Meanwhile, solar energy applications are benefiting from improved electrode transparency and lower resistivity, driving higher module efficiency and reduced balance of system costs.Technological breakthroughs in atomic layer deposition, chemical vapor deposition, physical vapor deposition, spray pyrolysis, and sputtering have recalibrated production capabilities, enabling more uniform coatings with precise thickness control. These process innovations are complemented by material science breakthroughs that tailor band gap and carrier mobility characteristics to meet specific end use requirements. Moreover, the growing adoption of digital twins and predictive maintenance frameworks is transforming how coating performance is monitored throughout the glass lifecycle, boosting reliability and lowering long term operational expenses. As these transformative shifts converge, market participants are redefining competitive strategies, forging cross industry collaborations and reevaluating value chain configurations to harness the next wave of growth in the transparent conductive oxide coated glass arena.

Together, these forces are shaping a market landscape where differentiation hinges on the ability to deliver integrated solutions that address thermal management, light transmission, and electrical performance in unison. To capitalize on this shift, stakeholders must align R&D roadmaps with evolving end user expectations, streamline supply chain resilience, and proactively engage in policy dialogues to influence regulatory frameworks conducive to broader TCO coated glass adoption

Assessing the Compound Effects of United States Tariff Adjustments in 2025 on Global Transparent Conductive Oxide Coated Glass Trade and Logistics

Over the course of 2025, the introduction of revised tariff structures by the United States government has reverberated throughout the transparent conductive oxide coated glass market, triggering a cascade of adjustments across global supply chains. By increasing import duties on coated glass assemblies and select raw materials, these measures have elevated landed costs for domestic fabricators, compelling them to reassess sourcing strategies and collaborate more closely with local suppliers. The heightened tariff environment has also incentivized manufacturers to explore nearshoring options, as proximity to end markets offers buffer against duty fluctuations and reduces the complexity of international logistics. Consequently, production footprints are gradually shifting, with some firms expanding capacities in the Americas to mitigate exposure to punitive trade levies while others are forging cross border partnerships to leverage tariff free zones.Simultaneously, the tariff revisions have stimulated dialogue at multilateral trade forums, prompting stakeholders to advocate for standardization of customs classifications for transparent conductive coated products. This push aims to reduce ambiguity in duty assessments and foster a more predictable regulatory landscape. On the demand side, end users are experiencing modest price adjustments, which are being absorbed unevenly across application segments. In high growth areas such as electric vehicle glazing and consumer electronics, manufacturers are implementing value engineering initiatives to offset cost increases without compromising performance benchmarks. Meanwhile, solar module assemblers are negotiating long term supply agreements to secure stable pricing and ensure uninterrupted access to critical electrode substrates.

As these cumulative impacts unfold, market participants are adapting procurement policies and diversifying supply basins. Forward looking organizations are investing in coating process innovations to reduce dependency on imported precursors and to achieve greater material efficiency. This strategic recalibration underscores the importance of agility in navigating tariff induced headwinds and positions those who proactively respond to these regulatory shifts to emerge as leaders in the evolving transparent conductive oxide coated glass ecosystem

Delving into Material Coating Technological and Application Driven Segmentation Dynamics That Define Growth Pathways in the TCO Coated Glass Market

Examining the transparent conductive oxide coated glass market through the lens of material type reveals distinct performance profiles and cost paradigms. Aluminum doped zinc oxide coatings, for example, exhibit balanced conductivity and low production expense, making them well suited for applications where moderate electrical performance suffices. Antimony tin oxide variants deliver exceptional thermal stability, positioning them as a preferred choice in high temperature environments. Fluorine doped tin oxide strikes a balance between optical transparency and electrical resilience, while indium tin oxide remains the industry benchmark for high mobility and minimal resistivity, albeit at a higher raw material cost. Coating type plays an equally critical role; double sided coatings enable bidirectional conductivity and support advanced functionalities such as dual simplified electrode architectures, whereas single sided coatings optimize material usage for cost sensitive deployments.The choice of deposition technology influences not only film uniformity but also scalability and throughput. Atomic layer deposition offers unparalleled thickness control at the atomic scale, which is pivotal for emerging microelectronic displays. Chemical vapor deposition delivers high quality films over large areas, meeting the needs of photovoltaic glass substrates. Physical vapor deposition remains a versatile technique, balancing deposition speed with adaptability across different glass thickness ranges, whether less than 0.75 millimeters or greater than 1.5 millimeters. Spray pyrolysis and sputtering provide cost effective pathways for mass production, particularly when aligned with offline and online distribution channel strategies that cater to traditional fabrication workshops as well as direct digital commerce platforms.

Application segmentation underscores the diverse end use scenarios driving market dynamics. In the architectural domain, coatings are being deployed across commercial buildings, industrial facilities, and residential structures to achieve energy optimization and aesthetic integration. Automotive applications encompass a wide spectrum from commercial vehicles to passenger cars, including the rapid adoption in electric vehicles where defogging and heating requirements are paramount. Display usage spans laptops, monitors, smartphones, and televisions, each demanding precise touch sensitivity and display clarity. Finally, solar panel applications in commercial settings, residential rooftops, and utility scale installations are leveraging coating enhancements to boost module efficiency and reliability. These segmentation insights illuminate where innovation and tailored value propositions can fuel sustainable growth in the transparent conductive oxide coated glass market.

Comparative Regional Examination of Demand Drivers and Infrastructure Maturation Impacting Transparent Conductive Oxide Coated Glass Adoption Worldwide

In the Americas, particularly within North America, transparent conductive oxide coated glass adoption is being propelled by robust investments in green building initiatives and a fast expanding electric vehicle market. Demand from commercial and residential construction projects is supported by incentive programs targeting energy efficient building materials. Meanwhile, South American markets, though at a nascent stage, are demonstrating growing interest in display and solar applications as infrastructure development accelerates. The regional supply chain is characterized by a mix of vertically integrated manufacturers and specialized coating service providers, fostering competitive pricing and localized innovation. As regulatory frameworks evolve to reward low carbon footprint materials, market participants in the Americas are seizing the opportunity to scale up production capacities and to cultivate strategic partnerships with local glass fabricators.Across Europe, the Middle East, and Africa, stringent environmental standards and ambitious sustainability targets are reshaping market demand. In Europe, energy performance requirements for building envelopes have elevated the use of advanced TCO coatings in both new construction and retrofit projects. The Middle East is witnessing an uptick in high end architectural glazing installations that combine solar control with dynamic shading functionalities. In Africa, although adoption remains limited by infrastructural challenges, pilot projects in public sector installations are showcasing the potential of transparent conductive oxide glass in energy efficient applications. The diverse regulatory landscapes within EMEA are stimulating innovation, as companies tailor material formulations and coating processes to satisfy region specific performance and compliance criteria.

Asia-Pacific stands out as a hotspot of growth, driven by rapid urbanization, large scale solar deployments, and a burgeoning consumer electronics industry. China and India are investing heavily in smart city infrastructure, creating demand for sensor enabled glazing and electrochromic integration that leverage conductive oxide coatings. Southeast Asian markets are benefiting from spillover effects in solar panel manufacturing and display production, with local coating facilities expanding to meet export driven demand. Japan and Korea continue to lead in high precision thin film deposition technologies, reinforcing their positions as hubs for advanced display and semiconductor related applications. Collectively, these regional dynamics underscore the necessity for a tailored go to market approach that aligns product portfolios with localized drivers and regulatory imperatives.

Profiling Leading Manufacturers and Innovators Shaping the Competitive Landscape of Transparent Conductive Oxide Coated Glass Through Strategic Alliances and R&D

Leading players in the transparent conductive oxide coated glass market are engaging in multifaceted strategies to reinforce their competitive positions. Established glass manufacturers have intensified investments in research and development to integrate coating capabilities directly within their production lines, thereby reducing lead times and enhancing product consistency. Strategic collaborations between raw material suppliers and technology providers are yielding proprietary coating formulations that promise lower resistivity and enhanced durability. Concurrently, specialized technology companies are forging alliances to expand their geographic footprint and to access new application verticals such as wearable electronics and building integrated photovoltaics.Innovation pipelines are being fueled by acquisitions of niche asset makers and by partnerships with academic institutions focused on material sciences. These initiatives are aimed at accelerating the commercialization of next generation transparent conductive oxide films with tailored band gap properties and tunable conductivity profiles. Meanwhile, some firms are exploring modular coating equipment solutions to cater to small batch production runs, enabling customized designs for high end architectural and automotive use cases. Service providers offering coating as a service are leveraging digital platforms to streamline order processing and to deliver rapid prototyping capabilities to display and solar module manufacturers.

Financially, leading companies are leveraging their scale to negotiate favorable terms for indium and fluorine precursors, thereby mitigating input cost volatility. At the same time, they are diversifying portfolios to include lower cost alternatives such as aluminum doped zinc oxide, to capture a broader range of price sensitive applications. This multi pronged approach is allowing market incumbents to sustain margins while exploring new revenue streams in emerging markets. Collectively, these competitive maneuvers are shaping a market where technological prowess, supply chain agility, and customer centricity will determine long term leadership in the transparent conductive oxide coated glass industry.

Strategic Imperatives and Actionable Paths for Market Leaders to Harness Technological Advancements and Navigate Regulatory and Supply Chain Complexities

To thrive in the rapidly evolving transparent conductive oxide coated glass market, industry leaders should prioritize the convergence of material innovation and application specific design. Companies are advised to invest in cross functional research teams that bridge coating process development with end user requirements, thereby expediting time to market for groundbreaking formulations. In parallel, forging strategic partnerships with architectural design firms and automotive OEMs can ensure alignment between evolving functional imperatives and coating specifications. This collaborative approach will foster co innovation that drives differentiation and enhances customer engagement.Supply chain resilience must be reinforced through diversified sourcing strategies. Leaders should evaluate the feasibility of establishing regional manufacturing hubs, particularly in high growth Asia Pacific and Americas regions, to mitigate tariff exposures and logistical uncertainties. Implementing predictive analytics for raw material inventory management can further reduce operational disruptions and optimize working capital. Additionally, integrating sustainability targets into procurement policies will resonate with regulatory mandates and end user preferences for low carbon footprint solutions.

From a market development perspective, companies should deploy targeted digital marketing initiatives to educate stakeholders on the performance advantages of advanced transparent conductive oxide coatings, thereby expanding awareness and accelerating adoption in underserved segments. Establishing demonstration projects in smart buildings and EV charging infrastructure can provide tangible proof points of coating efficacy and unlock new volume opportunities. Finally, continuous professional development programs for sales and technical teams will ensure that customer interactions are underpinned by deep technical knowledge and consultative service excellence, reinforcing long term partnerships and fostering brand loyalty.

Unveiling the Research Blueprint Integrating Primary Insights Secondary Sources and Analytical Frameworks Underpinning the Transparent Conductive Oxide Coated Glass Study

Designed to deliver comprehensive and actionable insights, the research methodology employed a dual pronged approach combining primary interviews with industry stakeholders and extensive secondary research. Primary engagements included detailed discussions with coating technology developers, glass fabricators, material suppliers, and end user equipment manufacturers. These interviews yielded qualitative perspectives on emerging application requirements, process optimization challenges, and evolving regulatory considerations. The secondary research component drew upon publicly available technical papers, industry conference proceedings, regulatory filings, and company disclosures to validate and complement the primary findings.Data triangulation was achieved by cross referencing information across multiple independent sources, ensuring robustness and consistency in the analysis. Market dynamics were evaluated through a combination of trend mapping and scenario based modeling, which accounted for potential shifts in trade policies, raw material availability, and technological breakthroughs. Segmentation analyses were conducted by systematically categorizing the market according to material type, coating configuration, deposition technology, substrate thickness, distribution channel, and application domain. Regional assessments incorporated macroeconomic indicators, infrastructure development plans, and policy frameworks to gauge local demand drivers and adoption barriers.

Analytical frameworks such as Porter's Five Forces and SWOT analysis were applied to structure the competitive landscape evaluation, while value chain mapping provided clarity on upstream raw material flows and downstream distribution pathways. Quality assurance protocols, including peer reviews by subject matter experts and data consistency checks, were implemented throughout the research process. This rigorous methodology underpins the credibility of the insights presented, equipping decision makers with a solid foundation for strategic planning and investment.

Synthesizing Critical Findings and Strategic Takeaways to Empower Decision Makers with Clarity on Next Generation Transparent Conductive Oxide Coated Glass Opportunities

In summary, the transparent conductive oxide coated glass market stands at a pivotal juncture as technological advances, sustainability mandates, and shifting trade policies collectively drive a new era of material innovation and application expansion. The interplay between deposition technologies and tailored material formulations will continue to shape performance benchmarks across architectural, automotive, display, and solar energy segments. Concurrently, regional dynamics in the Americas, EMEA, and Asia Pacific will determine the speed of market penetration and the configuration of global supply chains.Industry participants that effectively navigate tariff induced headwinds and regulatory complexities while maintaining agility in coating process development are poised to capture disproportionate value. Strategic emphasis on collaborative partnerships, supply chain diversification, and targeted go to market execution will be key enablers of long term success. Furthermore, integrating sustainability imperatives into R&D roadmaps and procurement strategies will align with evolving end user preferences and policy frameworks.

This executive summary has distilled critical insights and highlighted actionable recommendations to support informed decision making. By embracing an integrated approach that spans material innovation, application specific design, and strategic market engagement, stakeholders can position themselves at the forefront of the next phase of growth in the transparent conductive oxide coated glass sector.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Material Type

- Aluminum-Doped Zinc Oxide (AZO)

- Antimony Tin Oxide (ATO)

- Fluorine-Doped Tin Oxide (FTO)

- Indium Tin Oxide (ITO)

- Coating Type

- Double Sided

- Single Sided

- Coating Technology

- Atomic Layer Deposition (ALD)

- Chemical Vapor Deposition (CVD)

- Physical Vapor Deposition (PVD)

- Spray Pyrolysis

- Sputtering

- Glass Thickness

- 0.75-1.5 mm

- Greater Than 1.5 mm

- Less Than 0.75 mm

- Distribution Channel

- Offline

- Online

- Application

- Architectural

- Commercial Buildings

- Industrial Facilities

- Residential Buildings

- Automotive

- Commercial Vehicles

- Electric Vehicles

- Passenger Cars

- Display

- Laptops

- Monitors

- Smartphones

- Televisions

- Solar Panel

- Commercial

- Residential

- Utility Scale

- Architectural

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Acree Technologies Incorporated

- AGC Inc.

- Arkema S.A.

- Changzhou Almaden Co., Ltd.

- Compagnie de Saint-Gobain S.A.

- Jinjing (Group) Co., Ltd.

- Luoyang North Glass Technology Co., Ltd.

- Nippon Sheet Glass Co., Ltd.

- Qingdao Vatti Glass Co., Ltd.

- Schott AG

- Solaronix SA

- SYP Glass Group Co.,Ltd.

- Vritra Technologies

- Xinyi Glass Holdings Limited

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this TCO Coated Glass Market report include:- Acree Technologies Incorporated

- AGC Inc.

- Arkema S.A.

- Changzhou Almaden Co., Ltd.

- Compagnie de Saint-Gobain S.A.

- Jinjing (Group) Co., Ltd.

- Luoyang North Glass Technology Co., Ltd.

- Nippon Sheet Glass Co., Ltd.

- Qingdao Vatti Glass Co., Ltd.

- Schott AG

- Solaronix SA

- SYP Glass Group Co.,Ltd.

- Vritra Technologies

- Xinyi Glass Holdings Limited

Table Information

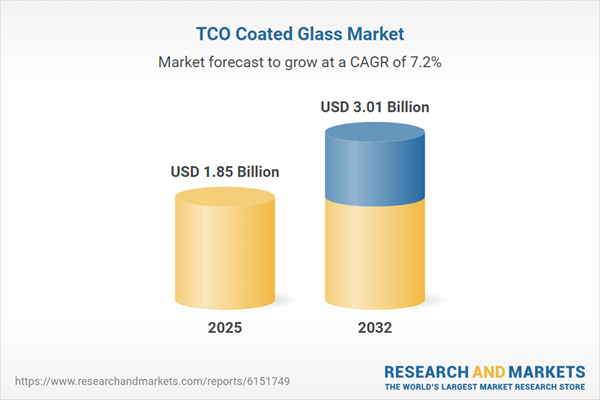

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.85 Billion |

| Forecasted Market Value ( USD | $ 3.01 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |