Speak directly to the analyst to clarify any post sales queries you may have.

Navigating the Critical Role of Foam Packaging Solutions in Ensuring Integrity and Efficiency Throughout the Cold Chain Process Worldwide

Effective cold chain management is indispensable for preserving the quality and safety of temperature-sensitive goods throughout complex supply networks. Foam packaging solutions serve as the critical barrier against thermal fluctuations, mechanical shock, and moisture intrusion, ensuring that pharmaceuticals, perishable foods, and specialty electronics arrive in optimal condition. By harnessing advanced polymer science and precision manufacturing techniques, companies can achieve superior product protection while addressing evolving customer expectations.As global supply chains become more interconnected and regulatory scrutiny intensifies, the reliability of cold chain packaging takes on heightened importance. Foam coolers and boxes, foam inserts, panels, and rolls collectively form a multilayered system that adapts to diverse transit, storage, and handling conditions. Stakeholders ranging from raw-material suppliers to last-mile logistics providers must therefore align around innovative design principles and operational protocols to mitigate risk.

In parallel, sustainability considerations are driving a transition toward recyclable and bio-based foam compositions. Emerging formulations aim to reduce environmental impact without compromising insulating performance, signaling a shift in strategic priorities for many market participants. Looking forward, organizations that balance cost-efficiency, regulatory compliance, and ecological stewardship will be best positioned to lead in the dynamic cold chain foam packaging landscape.

Uncovering Paradigm-Shifting Innovations and Operational Disruptions Redefining the Cold Chain Foam Packaging Industry across Diverse Market Segments

Recent years have witnessed a convergence of forces reshaping cold chain foam packaging. Sustainability imperatives now demand materials that can deliver performance while reducing environmental impact. At the same time, evolving regulatory frameworks have elevated the requirements for thermal protection, especially for biologics and temperature-sensitive pharmaceuticals. In response, manufacturers are scaling investments in novel polymer blends and reformulating traditional foams to achieve thinner profiles with equivalent insulating properties. Consequently, the cost per unit of temperature maintenance has begun to decline, enabling broader adoption across emerging markets.Digital transformation initiatives are also signaling transformative change. The integration of IoT-enabled temperature and humidity sensors directly into foam panels is enabling real-time visibility along transit routes. Data analytics platforms aggregate sensor outputs to proactively identify potential breach events before spoilage occurs. This predictive approach is enhancing service levels for cold chain logistics providers while fostering closer collaboration with shippers and end users. As interoperability standards mature, these smart packaging solutions are expected to become an industry baseline.

Simultaneously, collaborations between raw-material suppliers, packaging designers, and logistics operators are accelerating the shift toward circular economy models. Post-use foam recycling trials are being piloted in several regions, addressing end-of-life concerns. Likewise, joint ventures are emerging to repurpose processed foam into secondary products, further extending material lifecycle value. Taken together, these transformative shifts are redefining the landscape of foam-based cold chain packaging, positioning it at the intersection of performance, data-driven decision-making, and sustainability.

Analyzing the Comprehensive Consequences of Newly Instituted Tariffs on Cold Chain Foam Packaging Imports into the United States from 2025 and Beyond

The introduction of new trade tariffs on imported cold chain foam packaging materials in 2025 is poised to reverberate throughout the entire supply ecosystem. Suppliers now face increased cost pressures that are likely to be passed downstream, impacting contract negotiations with packaging distributors and logistics providers. As a result, many shippers are evaluating nearshoring alternatives or dual-sourcing strategies to mitigate the risk of price volatility and protect service levels.At the same time, tariff-driven cost escalation is fueling investment in domestic manufacturing capabilities. Several major producers have already announced capacity expansions, spurred by incentives to localize production of key foam formulations. These developments are expected to reduce lead times and transportation expenses, improving the agility of cold chain operations. Nevertheless, the initial transition entails capital outlays and potential disruption as new facilities come online and workforce training programs are implemented.

Importers are also reexamining their product portfolios to prioritize high-value applications where rigorous thermal performance justifies higher packaging expenses. In sectors like pharmaceuticals and specialty electronics, where product integrity is paramount, buyers may absorb modest cost increases in exchange for enhanced reliability and compliance support. Over the longer term, collaborative efforts between industry associations and policymakers may yield exemptions or adjusted tariff schedules to preserve critical supply chains, but in the interim, stakeholders must navigate a more granular cost-management environment.

Deriving Segmentation Insights Across Product Types Material Compositions Functions Applications and Distribution Channels to Drive Strategic Decisions

A nuanced understanding of segmentation dynamics can empower targeted strategies. Based on product type, each solution category-from foam coolers and boxes to foam inserts, panels, and wraps and rolls-exhibits unique attributes in insulation performance, structural integrity, and handling efficiency. Organizations seeking high-strength protective liners may prioritize foam inserts and panels, while logistics partners focused on volume optimization may leverage lightweight foam wraps and rolls.Material composition serves as another critical axis of differentiation. Polyethylene-based and polypropylene-based foams offer cost-effective thermal control for routine applications, whereas polystyrene-based foams deliver superior low-temperature resistance ideal for deep-freeze supply chains. Meanwhile, polyurethane-based formulations provide enhanced compressive strength and can be tailored for specific shock-absorption requirements. By aligning material selection with end-use conditions, stakeholders can optimize both performance and budgetary constraints.

Functional segmentation reveals that humidity control features, advanced insulation properties, shock absorption capabilities, and temperature regulation mechanisms each address distinct operational challenges. Temperature-sensitive biologics, for instance, may necessitate integrated temperature regulation modules, whereas perishable foods benefit from high-efficiency insulation and humidity buffers.

In application contexts, agriculture, chemicals, food and beverage-including bakery and confectionery, frozen and perishable foods, and ready-to-eat meals-pharmaceuticals and biotechnology such as blood and blood products, clinical trial materials, diagnostic specimens, and vaccines, as well as specialty electronics, all exploit foam packaging to preserve quality. Finally, distribution channels split between offline networks and online platforms, with eCommerce storefronts and manufacturer websites playing an increasingly prominent role in direct-to-customer fulfillment.

Examining Regional Dynamics Shaping Demand Patterns Operational Challenges and Growth Levers in Cold Chain Foam Packaging across Americas EMEA and Asia Pacific

Regional market nuances are shaping the adoption of cold chain foam packaging in distinct ways. In the Americas, robust pharmaceutical manufacturing hubs and expansive refrigerated logistics networks in North America drive demand for high-performance foam coolers and sensor-integrated solutions. Conversely, Latin American producers are increasingly focused on cost-effective polyethylene-based materials to safeguard agricultural exports under variable transit conditions.Within Europe, the Middle East, and Africa, stringent regulatory standards for vaccine distribution and food safety are compelling stakeholders to invest in advanced polystyrene- and polyurethane-based foams. Growth in emerging EMEA markets is supported by public-private partnerships aimed at upgrading cold storage infrastructure, while established markets are prioritizing sustainability and circular economy pilots to recover and recycle end-of-life foam materials.

In the Asia-Pacific region, rapid expansion of eCommerce and rising consumer demand for fresh and frozen foods are generating opportunities for lightweight foam wraps and modular panel systems. Manufacturers in APAC are also exploring bio-based foam chemistries to address environmental concerns linked to single-use plastics. Strategic alliances between regional packaging innovators and global logistics providers are accelerating the deployment of next-generation solutions designed to balance cost efficiency with regulatory compliance.

Profiling Leading Players Pioneering Innovations and Strategic Collaborations Driving the Evolution of Cold Chain Foam Packaging Solutions Globally

Major players in the foam packaging space are spearheading innovation through strategic investments and collaborative ventures. BASF Corporation has enhanced its polymer R&D capabilities to formulate bio-based foam blends, while Sealed Air Corporation is advancing sensor-embedded insulation systems that interface with cloud-based monitoring platforms. Sonoco Products Company has focused on scaling production of thermoformed foam coolers tailored for high-volume vaccine distribution, reflecting growing public health imperatives.At the same time, Pregis has expanded its global footprint through acquisitions that complement its portfolio of recyclable polyethylene-based wraps, and FoamPartner has entered joint development agreements with logistics providers to pilot closed-loop recycling programs. These initiatives underscore a trend toward end-to-end solution delivery, blending material science expertise with digital analytics and service-level guarantees.

Additionally, emerging regional specialists in Asia Pacific are investing in automated foam fabrication technologies, seeking to reduce production lead times and meet surging demand from eCommerce and perishable food sectors. Collaboration among upstream resin suppliers, packaging converters, and downstream shippers continues to refine the balance between cost, performance, and sustainability, setting a precedent for integrated supply chain partnerships worldwide.

Implementing Strategic Recommendations to Enhance Resilience Adaptability and Sustainability in Cold Chain Foam Packaging Operations Amid Evolving Market Forces

Industry leaders should prioritize material innovation by directing R&D resources toward recyclable and bio-based foam chemistries that align with long-term sustainability mandates. Establishing cross-functional teams to evaluate raw material substitutions and material life-cycle impacts will yield both environmental and competitive benefits. Equally important is the integration of IoT sensors and data analytics into foam packaging systems, which can transform reactive quality control into predictive risk management.To mitigate cost volatility arising from trade policy changes, organizations are advised to diversify their supplier portfolios and explore nearshore sourcing options. Cultivating relationships with regional converters and distributors can reduce lead times and enhance supply chain resilience. At the same time, implementing modular packaging designs that accommodate multiple product types will improve operational flexibility and reduce inventory carrying costs.

Finally, engaging with industry consortia and regulatory bodies to shape standards around foam recyclability and sensor interoperability will ensure that tomorrow's innovations conform to emerging global norms. By adopting these strategic actions, businesses can not only navigate current market disruptions but also lay the groundwork for sustainable, data-driven growth in the cold chain foam packaging sector.

Detailing Rigorous Research Methodology for Systematic Data Collection Analysis and Validation Underpinning Cold Chain Foam Packaging Market Intelligence

This analysis is grounded in a rigorous research methodology combining secondary data review with primary stakeholder engagement. Initial insights were derived from technical articles, regulatory documents, and patent filings to establish a foundational understanding of material formulations and performance parameters. These findings were then enriched through in-depth interviews with packaging engineers, supply chain directors, and R&D leaders.Quantitative data collection involved mapping production capacities, raw material supply chains, and regional distribution networks to identify critical nodes of value creation. Survey data and transaction records were triangulated to validate cost structures and logistics performance benchmarks. Qualitative assessments of emerging sustainability initiatives and digital integration projects were corroborated with case studies and pilot program reports.

Throughout the process, each hypothesis was subjected to validation cycles involving cross-functional experts and peer reviews to ensure accuracy and relevance. The result is a cohesive framework that captures both macro-level market dynamics and granular segmentation insights, providing decision-makers with robust evidence to support strategic planning and operational enhancements.

Synthesizing Key Conclusions and Strategic Imperatives to Navigate the Future Landscape of Cold Chain Foam Packaging Solutions with Confidence

In conclusion, foam packaging solutions remain at the forefront of cold chain innovation, addressing critical needs in thermal protection, mechanical resilience, and regulatory compliance. The landscape is being reshaped by sustainability mandates, digitization imperatives, and evolving trade policies, prompting stakeholders to reconsider material choices, supply chain configurations, and technological partnerships.Key segmentation insights highlight the importance of aligning product types and material compositions with specific functional requirements, whether temperature regulation, shock absorption, or humidity control. Regional outlooks reveal differentiated growth drivers across the Americas, EMEA, and Asia-Pacific, each presenting unique challenges and opportunities.

Looking ahead, companies that embrace integrated strategies-combining advanced foam chemistries, IoT-enabled visibility, and circular economy initiatives-will secure lasting competitive advantage. By leveraging the actionable recommendations and validated research framework presented herein, decision-makers can confidently navigate complexity and chart a clear path toward resilient, high-performance cold chain operations.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Foam Coolers & Boxes

- Foam Inserts

- Foam Panels

- Foam Wraps & Rolls

- Material Composition

- Polyethylene-Based

- Polypropylene-Based

- Polystyrene-Based

- Polyurethane-Based

- Function

- Humidity Control

- Insulation

- Shock Absorption

- Temperature Regulation

- Application

- Agriculture

- Chemicals

- Food & Beverage

- Bakery & Confectionery

- Frozen Foods

- Perishable Foods

- Ready-to-eat Meals

- Pharmaceuticals & Biotechnology

- Blood & Blood Products

- Clinical Trial Materials

- Diagnostic Specimens

- Vaccines

- Specialty Electronics

- Distribution Channel

- Offline

- Online

- eCommerce Platforms

- Manufacturer Websites

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Alleguard

- Berry Global Inc.

- Cellofoam North America Inc.

- Cold Chain Technologies

- Cruz Foam.

- Cryopak.

- EFP, LLC.

- Ernest Packaging Solutions

- Hanchett Paper Company.

- Insulated Products Corporation.

- Katzke Packaging Co.

- Kingspan Aerobord Ltd.

- Peli BioThermal LLC

- Pregis LLC.

- Sealed Air Corporation

- Sofrigam Group

- Sonoco Products Company

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Cold Chain Foam Packaging Solution Market report include:- Alleguard

- Berry Global Inc.

- Cellofoam North America Inc.

- Cold Chain Technologies

- Cruz Foam.

- Cryopak.

- EFP, LLC.

- Ernest Packaging Solutions

- Hanchett Paper Company.

- Insulated Products Corporation.

- Katzke Packaging Co.

- Kingspan Aerobord Ltd.

- Peli BioThermal LLC

- Pregis LLC.

- Sealed Air Corporation

- Sofrigam Group

- Sonoco Products Company

Table Information

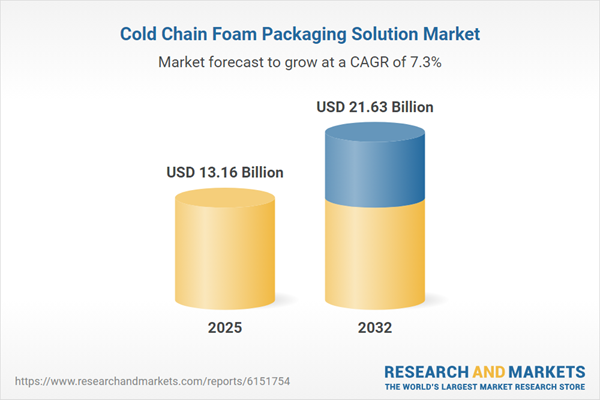

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 13.16 Billion |

| Forecasted Market Value ( USD | $ 21.63 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |