Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive Overview of the Latest Developments and Core Principles Driving the Evolution of 96 Well Plate Utilization in Modern Laboratory Research

96 well plates have emerged as cornerstone instruments within biomedical laboratories, enabling streamlined sample processing and enhancing data reliability. Their fixed grid of eighty-eight wells arranged in eight rows and twelve columns facilitates uniform throughput for assays ranging from enzymatic reactions to high-content imaging. This standardized geometry is central to harmonizing protocols across different research environments and equipment platforms, thus enabling reproducible experimental outcomes.Recent advancements have transcended basic plate formats by integrating features such as low-binding surfaces, optical clarity enhancements, and compatibility with robotics. Such innovations have reduced sample loss and improved signal detection thresholds, directly addressing challenges encountered in proteomics, genomics, and cell-based assays. Moreover, the evolution of plate materials has responded to demands for increased chemical resistance and thermal stability, broadening the range of experimental conditions that can be reliably executed.

As laboratories pursue greater efficiency, the synergy between plate design and automation systems becomes increasingly vital. The interplay of hardware capabilities and consumable formats dictates the performance of sophisticated workflows such as automated liquid handling, high-throughput screening, and multiplexed biomarker analysis. This introduction establishes the foundational context for exploring current industry dynamics and technological trajectories that are shaping the future of 96 well plate utilization.

In-Depth Analysis of the Transformative Technological Shifts and Emerging Trends Reshaping the Competitive Landscape of the 96 Well Plate Sector

Innovation cycles within the 96 well plate domain have accelerated under the influence of several transformative shifts. The integration of robotics and liquid handling platforms has established a new paradigm in high-throughput experimentation, enabling parallel processing of thousands of samples with unprecedented precision. As a result, researchers can compress timelines for drug discovery pipelines and diagnostic assay development while maintaining rigorous quality controls.Concurrently, advancements in materials science have yielded next-generation polymers and coatings that minimize sample adsorption and enhance optical clarity. These enhancements support more sensitive detection methods, including fluorescence-based and luminescence assays, broadening the scope of biological targets that can be accurately quantified. In parallel, the push towards miniaturization has driven design refinements in well geometry, supporting reduced reagent volumes and enabling cost-effective screening protocols.

Furthermore, the digital transformation of laboratories is reshaping how data are captured, analyzed, and shared. Connectivity between instruments, cloud-based data repositories, and machine learning-driven analytics now inform decision-making in real time, fostering adaptive experimental workflows. Moreover, environmental sustainability has become a key consideration, prompting developers to explore biodegradable and recyclable materials. These sustainability efforts align with broader institutional goals to reduce plastic waste and comply with evolving regulatory frameworks, positioning the sector for continued growth and differentiation.

Thorough Examination of the Cumulative Consequences of Newly Implemented United States Tariffs on Import and Export Dynamics within the 96 Well Plate Industry in 2025

In 2025, the United States introduced a series of tariffs affecting imports of laboratory consumables, including those classified under plastic and polymer product codes relevant to multiwell plates. These adjustments have led to notable changes in landed cost structures and prompted organizations to reassess their procurement strategies.Tariff increases on polycarbonate and polypropylene imports have had pronounced cost implications for manufacturers reliant on foreign feedstock. Consequently, some suppliers have accelerated domestic production expansions or sought alternative supply chains in regions offering more favorable tariff treatments. In parallel, end users with established global sourcing networks have diversified vendor portfolios to mitigate exposure to single-source dependencies.

The interplay between tariff policy and logistic networks has also underscored the importance of inventory planning. Companies are now evaluating safety stock levels more rigorously and exploring just-in-time replenishment models to balance working capital constraints against the risk of supply interruptions. As a result, supplier relationships and contractual terms have evolved to incorporate tariff mitigation clauses and shared risk arrangements.

Moreover, the complexity of tariff classifications and periodic policy updates has underscored the value of real-time trade analytics and tariff engine tools. By integrating these capabilities, procurement and finance teams can model scenario-based cost adjustments swiftly, enhancing agility in response to evolving regulatory landscapes. In this context, strategic collaboration between procurement, legal, and regulatory affairs functions is emerging as a best practice to ensure seamless adaptation to ongoing tariff developments.

Looking ahead, these trade policy dynamics will remain a critical influence on pricing strategies and market access. Organizations that proactively engage with cross-border compliance frameworks and optimize their supply chain architectures will be best positioned to navigate the sustained impact of these tariff measures.

Insightful Breakdown of Market Dynamics Through Well Shape Material Composition Sterility Levels Application Areas and End User Profiles Driving Growth

Analysis of plating geometries reveals that the prevalence of flat bottom configurations remains dominant due to their compatibility with imaging and optical detection systems. However, the specialized benefits of round bottom designs for cell aggregation studies and U shape wells for enhanced reagent mixing are gaining traction. Additionally, the high surface-to-volume ratio of V shape wells has found favor for rapid pelleting applications, illustrating how design nuances inform functional selection.Material choices also play a pivotal role in performance optimization. Polycarbonate variants offer high mechanical strength and thermal stability, making them suitable for applications requiring elevated temperatures or repeated handling. Polypropylene alternatives provide excellent chemical resistance for protocols involving organic solvents, while polystyrene remains a cost-effective solution with superior optical clarity, particularly in fluorescence- and luminescence-based assays.

Sterility requirements further segment product preferences. Non-sterile formats are frequently utilized for fundamental research protocols where contamination risk is minimal, whereas sterile offerings are indispensable for cell culture work and clinical diagnostic workflows. This distinction underscores the importance of manufacturing environments and sterilization processes in meeting user specifications.

Application diversity drives additional differentiation. Sentiments around cell culture platforms underscore the need for low-binding surfaces, while drug screening assays prioritize throughput and consistency. Enzyme-linked immunosorbent assays rely on precise surface chemistries, and PCR amplification workflows demand plates compatible with rapid thermal cycling. These application-driven imperatives subsequently inform end user purchasing decisions.

End users span academic research institutes focused on foundational discovery, biotechnology companies accelerating translational programs, hospitals and diagnostic laboratories delivering patient-centric testing, and pharmaceutical companies orchestrating complex discovery pipelines. Collectively, these segments shape demand patterns and guide ongoing product enhancements.

Regional Performance Highlights Detailing How the Americas Europe Middle East and Africa and Asia-Pacific Zones Are Propelling Innovations and Adoption Rates

North American research facilities continue to drive demand through sustained investments in life science infrastructure and automated workflows. The Americas benefit from a strong network of contract research organizations and a vibrant biotechnology ecosystem, where collaborations between startups and established institutions accelerate adoption of advanced plate formats and integrated platforms.In the Europe Middle East and Africa region, regulatory harmonization frameworks and public research funding have fueled cross-border collaborations. Academic consortia and national research programs emphasize standardization of experimental protocols, prompting suppliers to tailor product portfolios that meet diverse regulatory requirements. Sustainability initiatives have also gained momentum, influencing material selections and waste management practices across multiple jurisdictions.

The Asia-Pacific zone has exhibited robust growth driven by expanding pharmaceutical research hubs, increasing government support for biotech innovation, and a growing base of academic institutions. Local manufacturing capabilities are expanding to serve domestic demand, while partnerships with international OEMs facilitate technology transfer. As a result, the region is emerging as both a significant consumer and producer of cutting-edge plate formats.

Regional dynamics are further shaped by infrastructure development, talent availability, and policy incentives. Stakeholders operating across these zones must navigate varying trade regulations, operational cost structures, and cultural considerations to optimize their regional footprint and harness emerging opportunities.

Strategic Overview of Leading Industry Players' Initiatives Research and Development Efforts and Competitive Approaches Shaping the Global 96 Well Plate Ecosystem

Thermo Fisher Scientific has intensified its focus on advanced material formulations and integrated solutions that combine multiwell plates with automated systems. Their investments in workflow optimization underscore a commitment to reducing hands-on time and improving assay consistency for customers in pharmaceutical and clinical diagnostics.Corning Incorporated continues to differentiate through proprietary surface treatments that enhance binding capacities for protein and nucleic acid assays. Their collaborations with academic laboratories and industrial partners facilitate rapid prototyping of customized solutions, ensuring alignment with evolving research needs.

Greiner Bio-One has expanded its sterile plate offerings to encompass a range of polymer types suited for cell culture and molecular biology applications. By leveraging modular design platforms, they cater to laboratories seeking both standard formats and bespoke configurations.

Eppendorf AG has integrated digital monitoring features into their consumable portfolio, enabling real-time tracking of usage patterns and environmental conditions. This connectivity layer supports data-driven decision-making and predictive maintenance within automated laboratory ecosystems.

Other notable players have pursued strategic partnerships and licensing agreements to broaden their geographic presence and reach specialized market niches. Collectively, these initiatives highlight how competition is driving both incremental and radical innovations, ultimately benefiting end users through enhanced performance and broader access to emerging technologies.

Actionable Strategies and Best Practices for Industry Leaders to Optimize Operational Efficiency and Foster Sustainable Growth in the Evolving 96 Well Plate Market

Leaders should invest in cross-functional teams that harmonize procurement, technical operations, and quality assurance to streamline product development lifecycles. By implementing stage-gate processes, organizations can evaluate performance metrics at each milestone and address potential roadblocks before scaling manufacturing outputs.Engaging with academic and industrial research consortia can accelerate technology validation and de-risk emerging innovations. Collaborative pilot studies enable rapid feedback loops, ensuring that novel plate designs and material compositions align with end user requirements and regulatory standards.

Supply chain resilience can be enhanced by diversifying raw material suppliers and establishing strategic buffer inventories in key regions. Incorporating advanced analytics tools to monitor supplier performance and tariff implications will help maintain consistent throughput and cost transparency.

To foster sustainable growth, companies should explore eco-friendly materials and closed-loop recycling initiatives. Transparent reporting on environmental impact and adoption of green manufacturing certifications can differentiate offerings and appeal to institutions prioritizing corporate social responsibility.

Finally, integrating digital platforms for order management, usage analytics, and customer feedback forms a continuous improvement cycle. This holistic approach ensures that operational efficiencies are aligned with evolving laboratory practices and that long-term strategic objectives remain responsive to market demands.

Robust Research Framework Detailing Data Collection Methodologies Analytical Procedures and Validation Techniques Utilized to Ensure Comprehensive Market Insights

Primary research for this analysis included in-depth interviews with industry executives, laboratory end users, and technical experts. These interviews provided firsthand perspectives on emerging challenges, workflow preferences, and the impact of trade policies. Interview schedules were structured to cover supply chain considerations, material performance, and automation integration.Secondary research encompassed review of scientific journals, patent filings, regulatory guidelines, and publicly available company disclosures. Data from industry associations and trade publications were triangulated with proprietary databases to validate trends related to material innovation and regional adoption patterns.

Quantitative data were analyzed using statistical methods to identify correlations between product attributes and application performance. Scenario analysis was conducted to assess the effects of tariff changes and regional policy shifts, while sensitivity tests evaluated the robustness of observed relationships under varying assumptions.

Validation techniques included cross-referencing interview insights with documented case studies and peer-reviewed research findings. An expert advisory panel provided critical review of preliminary outputs, ensuring that conclusions reflected practical realities and adhered to rigorous methodological standards.

Concise Synthesis of Key Findings Leading to Strategic Implications and Forward-Looking Perspectives Highlighting Essential Takeaways from the 96 Well Plate Market Analysis

The analysis underscores how innovation in plate design, material science, and automation is redefining laboratory workflows. Stakeholders who align product development with end user needs for sensitivity, throughput, and sustainability stand to gain competitive advantage.Trade policy shifts, particularly the recent United States tariff adjustments, have cemented the importance of agile supply chain strategies. Organizations that proactively model cost impacts and cultivate diverse sourcing arrangements will maintain operational continuity amidst policy volatility.

Regional dynamics reveal that growth is being driven by targeted investments in research infrastructure across the Americas, Europe Middle East and Africa, and Asia-Pacific. Tailoring market entry and commercialization strategies to each region's regulatory and institutional landscape is essential for success.

The strategic initiatives adopted by leading companies illustrate the value of collaboration, digital integration, and eco-friendly practices. By synthesizing these approaches into cohesive roadmaps, companies can accelerate product innovation and meet evolving laboratory demands.

Collectively, these findings offer a roadmap for stakeholders to navigate a complex and rapidly evolving ecosystem, fostering decision-making grounded in empirical insights and operational best practices.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Well Shape

- Flat Bottom

- Round Bottom

- U Shape

- V Shape

- Material

- Polycarbonate

- Polypropylene

- Polystyrene

- Sterility

- Non-Sterile

- Sterile

- Application

- Cell Culture

- Drug Screening

- ELISA

- PCR Amplification

- End User

- Academic Research Institutes

- Biotechnology Companies

- Hospitals & Diagnostic Labs

- Pharmaceutical Companies

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Agilent Technologies

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- Bio‑Rad Laboratories Inc.

- BioAssay Systems Inc.

- Corning Incorporated

- Merck KGaA

- Eppendorf AG

- Greiner Bio-One International GmbH

- Hamilton Company

- Thermo Fisher Scientific Inc.

- Guangzhou Jet Bio-Filtration Co., Ltd.

- PerkinElmer Inc.

- Sanplatec Corporation

- Sarstedt AG & Co.

- SPL Life Sciences Co., Ltd.

- TPP Techno Plastic Products AG

- VWR International, LLC

- Alpha Laboratories Ltd

- BioSpace, Inc.

- Berthold Technologies GmbH & Co.KG

- Wuxi NEST Biotechnology Co.,Ltd

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this 96 Well Plate Market report include:- Agilent Technologies

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- Bio‑Rad Laboratories Inc.

- BioAssay Systems Inc.

- Corning Incorporated

- Merck KGaA

- Eppendorf AG

- Greiner Bio-One International GmbH

- Hamilton Company

- Thermo Fisher Scientific Inc.

- Guangzhou Jet Bio-Filtration Co., Ltd.

- PerkinElmer Inc.

- Sanplatec Corporation

- Sarstedt AG & Co.

- SPL Life Sciences Co., Ltd.

- TPP Techno Plastic Products AG

- VWR International, LLC

- Alpha Laboratories Ltd

- BioSpace, Inc.

- Berthold Technologies GmbH & Co.KG

- Wuxi NEST Biotechnology Co.,Ltd

Table Information

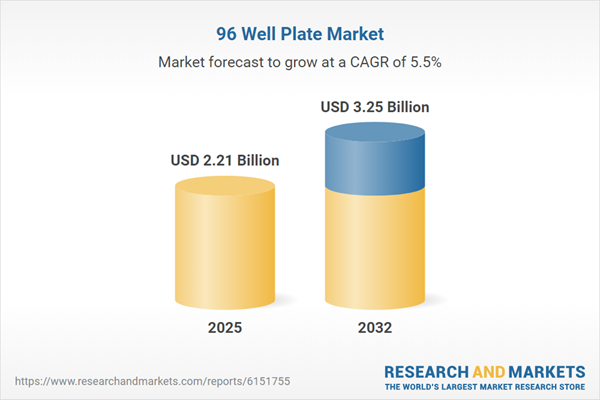

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 2.21 Billion |

| Forecasted Market Value ( USD | $ 3.25 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |

![IVD Labware Market by Product [Plastic, Glass], Type, Application, End User - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/12894/12894573_60px_jpg/ivd_labware_market.jpg)