Speak directly to the analyst to clarify any post sales queries you may have.

Pioneering The Transformation Of Global Logistics With Electric Vertical Takeoff And Landing Cargo Solutions Delivering Unprecedented Speed And Flexibility

The dawn of electric vertical takeoff and landing cargo vehicles heralds a paradigm shift in global logistics. These advanced platforms marry vertical lift capabilities with electric propulsion, opening new corridors for rapid, cost-effective freight movement. By circumventing traditional airport dependence and ground congestion, eVTOL cargo systems enable door-to-door connectivity in environments ranging from sprawling urban centers to remote rural outposts.As urbanization accelerates and supply chains strain under rising consumer expectations, the agility and sustainability of eVTOL cargo transport become indispensable. This executive summary introduces key themes shaping the future of aerial freight delivery, including regulatory evolution, technological breakthroughs, and strategic stakeholder alliances. It establishes a foundation for understanding how eVTOL solutions can redefine operational efficiency, environmental impact, and competitive advantage.

Unveiling The Transformative Shift In Supply Chain Dynamics As Electric Vertical Takeoff And Landing Vehicles Disrupt Emergency Relief Humanitarian Aid

Industry dynamics are shifting as electric vertical takeoff and landing platforms gain traction across critical delivery sectors. In emergency response scenarios, disaster relief teams leverage vertical lift to transport life-saving medical supplies and equipment into areas rendered inaccessible by natural calamities. Similarly, organizations orchestrating humanitarian aid deploy these nimble vehicles for timely distribution of food aid and medical consumables to displaced populations.Simultaneously, industrial operations are reimagining material flows, with construction projects receiving building supplies and manufacturing facilities sourcing component parts via aerial corridors. As e-commerce penetration intensifies, the last-mile logistics segment witnesses a revolution in parcel handoffs, food delivery services, and retail stock replenishment. This transformative nexus of use cases underscores eVTOL cargo's versatility in shrinking lead times, trimming carbon footprints, and fostering resilient supply chains.

Analyzing The Comprehensive Effects Of Newly Implemented United States Tariffs On Electric Vertical Takeoff And Landing Cargo Transport Ecosystem

The introduction of new United States tariffs in 2025 targeting key components of electric vertical takeoff and landing systems has generated notable ripple effects throughout the supply chain. Increased duties on airframe materials and battery cell imports have compelled manufacturers to reassess sourcing strategies and negotiate localized production agreements. Component suppliers are exploring tariff mitigation measures, while original equipment manufacturers (OEMs) evaluate the viability of in-country assembly hubs to offset heightened costs.This tariff landscape has also influenced pricing structures across service providers and end users, prompting a heightened focus on operational efficiency and total cost of ownership. Stakeholders are accelerating engagements with policymakers to advocate for adjusted duty classifications that reflect the environmental benefits of eVTOL technology. In parallel, research and development priorities are evolving to identify alternative materials and domestic manufacturing partnerships, ensuring that the momentum of aerial cargo innovation remains undeterred despite shifting trade regulations.

Exploring A Comprehensive Segmentation Analysis Across Application Vehicle Type End User Payload Capacity Propulsion Range Autonomy Environment And Service Mode

A multilayered segmentation approach reveals nuanced performance differentials among eVTOL cargo offerings. In terms of application, vertical lift aircraft have proven indispensable for disaster relief and medical missions, while food aid and medical supply runs highlight their critical role in humanitarian operations. Industrial transport scenarios demonstrate robust utilization in the delivery of construction materials and specialized manufacturing components, and last-mile operations are increasingly characterized by tailored e-commerce dispatches, rapid food delivery, and strategic retail restocking.Evaluating vehicle type uncovers distinct trade-offs between fixed wing designs that optimize endurance and multirotor models offering exceptional hover stability. Hybrid tilt-rotor and tilt-wing variants bridge these capabilities, delivering extended range without sacrificing precision. End user industries span major online marketplaces, government defense and emergency services, healthcare networks including hospitals and pharmacies, and logistics providers from third-party to fourth-party integrators. Payload capacities range from sub-five kilogram medical drone sorties to heavy lifts exceeding one hundred kilograms, each aligned with electric, hybrid electric, or hydrogen fuel cell propulsion. Range classifications from short to long reveal varying mission profiles, and autonomy levels from remotely piloted to fully autonomous corridors are reshaping operational protocols. Furthermore, rural and dense urban environments present divergent infrastructure requirements, while dedicated, scheduled, and on-demand service paradigms drive customizable delivery experiences.

Unraveling The Distinct Regional Market Dynamics And Growth Drivers Spanning The Americas Europe Middle East Africa And Asia Pacific Landscape

Regional dynamics illustrate how geographic imperatives shape adoption pathways for eVTOL cargo solutions. In the Americas, strong research consortiums and forward-looking regulatory bodies are enabling proof-of-concept corridors, while major logistics carriers collaborate on pilot deployments to address urban congestion. Europe, the Middle East, and Africa showcase a tapestry of regulatory frameworks that emphasize airspace integration and sustainable fuel usage, with defense agencies and humanitarian organizations testing aerial cargo models for rapid response scenarios.The Asia-Pacific region is emerging as a hotbed for manufacturing scale-ups, owing to robust component supply chains and burgeoning urban populations demanding faster delivery cycles. Cross-border corridors are under evaluation to connect densely populated megacities, and partnerships between public infrastructure authorities and private innovators are accelerating the rollout of vertiport networks. These regional distinctions inform tailored engagement strategies and investment priorities that align with local policy objectives and logistical ecosystems.

Illuminating The Competitive Landscape Through Analysis Of Leading Electric Vertical Takeoff And Landing Cargo Delivery Industry Stakeholders And Innovations

Leading stakeholders are forging the competitive contours of the eVTOL cargo delivery landscape. Industry pioneers are forming consortiums to standardize battery safety protocols and establish common charging infrastructures. Start-up manufacturers are collaborating with established aerospace contractors to leverage supply chain expertise, while technology firms are integrating advanced avionics and autonomy systems to ensure reliable performance in complex environments.Strategic partnerships underpin many commercialization roadmaps, as pilot programs with logistics service providers validate use cases and refine operational frameworks. Companies focusing on vertical lift aircraft design are engaging in joint ventures to scale production volumes, and alliances with energy suppliers are securing commitments for clean propulsion sources. This confluence of innovation, collaboration, and resource pooling underscores a competitive ecosystem driven by cross-sector synergies and aligned with decarbonization goals.

Strategic Actionable Recommendations To Empower Industry Leaders To Capitalize On Emerging Trends Operational Efficiencies And Regulatory Evolutions

Industry leaders should accelerate investments in modular vertiport infrastructure that accommodates diverse payload requirements and charging modalities. Engaging with regulatory authorities to establish clear certification pathways and operational standards will reduce time-to-market and cultivate stakeholder confidence. Collaborative pilot programs with humanitarian and emergency response agencies can generate valuable performance data, bolstering credibility and informing service design.Organizations must also prioritize supply chain resilience by diversifying component sources and exploring domestic manufacturing partnerships. Integrating advanced autonomy features can streamline labor costs and enhance safety protocols, while hydrogen fuel cell research may unlock extended range capabilities for heavy-lift missions. By aligning these initiatives with sustainability metrics and transparent performance reporting, industry players will position themselves at the forefront of a rapidly maturing market.

Detailing The Rigorous Multi-Source Research Methodology Employed To Analyze Electric Vertical Takeoff And Landing Cargo Delivery Market Data With Precision

This analysis synthesizes insights derived from a rigorous, multi-source research methodology. Primary interviews with aerospace executives, logistics providers, and regulatory officials provided firsthand perspectives on operational challenges and adoption drivers. These qualitative findings were triangulated with secondary research encompassing scientific journals, patent registries, and airspace policy documents to validate technological and regulatory trends.Data modeling exercises incorporated real-world performance metrics, while scenario analyses explored tariff impacts, infrastructure roll-out timelines, and service mode adoption rates. Continuous editorial review and expert validation ensured factual accuracy and coherence across thematic areas, resulting in an integrated view of the eVTOL cargo delivery ecosystem that balances strategic foresight with actionable intelligence.

Driving Home A Compelling Conclusion On The Critical Strategic Imperatives And Sustainable Trajectory Of Electric Vertical Takeoff And Landing Cargo Delivery

Electric vertical takeoff and landing cargo solutions represent a watershed innovation poised to redefine global freight dynamics. The confluence of evolving regulatory frameworks, emergent propulsion technologies, and a diverse application landscape underscores the strategic imperative for stakeholders to adapt swiftly. Embracing modular infrastructure, fostering cross-sector collaborations, and investing in autonomy and sustainability will determine the leaders of tomorrow's aerial logistics networks.In moving forward, decision-makers must balance near-term operational efficiencies with long-term ecosystem viability. By leveraging the insights presented herein, organizations can chart a deliberate course toward scalable, resilient, and environmentally responsible cargo delivery operations that will shape supply chains for decades to come.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Vehicle Type

- Fixed Wing

- Hybrid

- Tilt-Rotor

- Tilt-Wing

- Multirotor

- Octocopter

- Quadcopter

- Payload Capacity

- 50-150 kg

- Less Than 50 Kg

- More Than 150 Kg

- Range

- Long (>150 km)

- Medium (51-150 km)

- Short (≤50 km)

- Operation Environment

- Rural

- Urban

- Dense Urban

- Suburban

- Cruise Speed

- High (>200 km/h)

- Low (≤100 km/h)

- Medium (101-200 km/h)

- Application

- Last-Mile Delivery

- Warehouse-to-Warehouse Transport

- End Use

- Agriculture & Forestry

- Defense & Public Safety

- Humanitarian Aid & Disaster Relief

- Tactical Resupply

- Food & Grocery

- Grocery Replenishment

- Restaurant Delivery

- Industrial Logistics

- Manufacturing MRO Parts

- Mining

- Oil & Gas / Offshore

- Maritime / Port Logistics

- Ship-to-Ship

- Ship-to-Shore

- Medical Logistics

- Cold Chain

- Emergency Response

- Routine Supply

- Parcel Delivery

- E-Commerce

- Postal

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- AIR VEV LTD

- FedEx Corporation

- Beta Technologies, Inc.

- EHang Holdings Limited

- Elroy Air, Inc.

- Jaunt Air Mobility, Inc.

- Sabrewing Aircraft Company, Inc.

- Vertical Aerospace

- Volocopter GmbH

- Beta Technologies, Inc.

- Volocopter GmbH

- EHang Holdings Limited

- Elroy Air, Inc.

- Sabrewing Aircraft Company, Inc.

- Jaunt Air Mobility, Inc.

- Vertical Aerospace

- United Parcel Service of America, Inc.

- DB Schenker by DSV

- DHL Group

- Skyports Drone Services

- Anduril Industries UK

- AutoFlight

- MightyFly

- Pipistrel

- UrbanLink Air Mobility

- Traverse Aero Corporation

- Archer Aviation Inc.

- FlyingBasket

- CycloTech GmbH

- Yamato Holdings Co., Ltd

- Wingcopter

- LYTE Aviation

- MGI Engineering

- Zipline International Inc.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this eVTOL Cargo Delivery market report include:- AIR VEV LTD

- FedEx Corporation

- Beta Technologies, Inc.

- EHang Holdings Limited

- Elroy Air, Inc.

- Jaunt Air Mobility, Inc.

- Sabrewing Aircraft Company, Inc.

- Vertical Aerospace

- Volocopter GmbH

- Beta Technologies, Inc.

- Volocopter GmbH

- EHang Holdings Limited

- Elroy Air, Inc.

- Sabrewing Aircraft Company, Inc.

- Jaunt Air Mobility, Inc.

- Vertical Aerospace

- United Parcel Service of America, Inc.

- DB Schenker by DSV

- DHL Group

- Skyports Drone Services

- Anduril Industries UK

- AutoFlight

- MightyFly

- Pipistrel

- UrbanLink Air Mobility

- Traverse Aero Corporation

- Archer Aviation Inc.

- FlyingBasket

- CycloTech GmbH

- Yamato Holdings Co., Ltd

- Wingcopter

- LYTE Aviation

- MGI Engineering

- Zipline International Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | November 2025 |

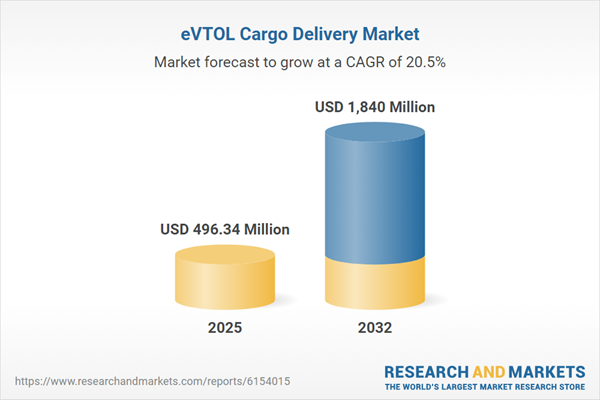

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 496.34 Million |

| Forecasted Market Value ( USD | $ 1840 Million |

| Compound Annual Growth Rate | 20.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 35 |