The increasing decentralization of clinical trials in the U.S. is a major driver for the demand for equipment and ancillary solutions. Traditional centralized trials are being replaced or supplemented by hybrid and fully decentralized models, which require extensive logistical coordination and specialized equipment deployment at participants’ homes or local sites. This shift has created a need for direct-to-patient (DTP) supply chains, mobile health kits, connected medical devices, and home-use diagnostics that must be compliant with FDA standards. For instance, the rise of remote ECG monitors, wearable biosensors, and digital spirometers has necessitated ancillary providers capable of managing device calibration, patient training, and data integration remotely. The logistical complexity of supporting multiple remote sites and participants requires real-time tracking, automated resupply systems, and robust reverse logistics - all of which are fueling investments into ancillary solution providers offering end-to-end support tailored for decentralized trials.

The surge in precision medicine and complex therapeutic areas such as oncology, neurology, and gene therapy trials is also propelling the growth of the clinical trial equipment & ancillary solutions industry in the U.S. These trials often demand highly specific equipment like infusion pumps for cellular therapies, customized specimen collection kits, and temperature-controlled drug delivery devices. Ancillary providers are expected to handle specialized packaging, pre-conditioning of equipment, and maintenance protocols to preserve the integrity of temperature- and time-sensitive supplies. The increase in protocol complexity - including biomarker assessments, digital endpoints, and longitudinal sampling - has made the standardization and scalability of ancillary services critical. In response, vendors are integrating cloud-based inventory management, automated labeling, and compliance-tracking tools to streamline processes and meet the heightened demands of sponsors and CROs. This alignment with advanced therapeutic trials is expanding the market beyond basic logistics into high-value clinical trial support infrastructure.

U.S. Clinical Trial Equipment & Ancillary Solutions Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, the analyst has segmented the U.S. clinical trial equipment & ancillary solutions market report based on type, and phase:Type Outlook (Revenue, USD Million, 2021 - 2033)

- Sourcing

- Procurement

- Equipment

- Ancillaries

- Rental

- Equipment

- Ancillaries

- Supply/Logistics

- Transportation

- Packaging

- Others

- Service

- Calibrations

- Equipment servicing

- Others

- Others

Phase Outlook (Revenue, USD Million, 2021 - 2033)

- Phase I

- Phase II

- Phase III

- Phase IV

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- Ancillare, LP

- Imperial CRS, Inc.

- Woodley Equipment Company Ltd.

- Thermo Fisher Scientific, Inc.

- Parexel International (MA) Corporation

- Emsere (formerly MediCapital Rent)

- Quipment SAS

- IRM

- Marken (UPS-United Parcel Service)

- Myonex

- Yourway

Table Information

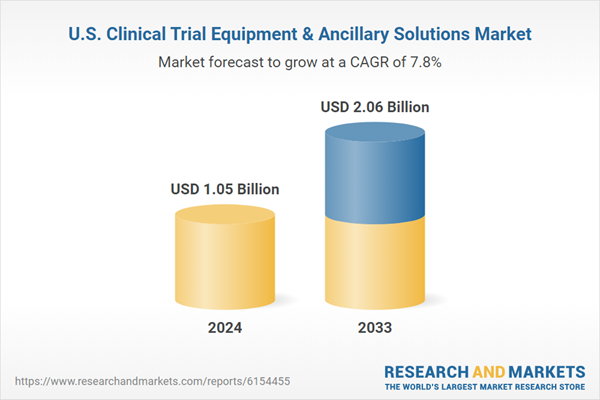

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | July 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.05 Billion |

| Forecasted Market Value ( USD | $ 2.06 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |