In the U.S. companion animal diagnostics space, innovation is rapidly accelerating by combining advanced technologies and integrative research models. Leading experts in veterinary diagnostics emphasize that artificial intelligence (AI) plays an increasingly central role in transforming everything from bloodwork and urinalysis to imaging platforms and medical record systems.

AI powered analyzers such as Zoetis’s Vetscan OptiCell and Imagyst enable faster, more accurate identification of blood cell abnormalities and pathological changes during routine clinic workflows. These systems reduce variability and lighten the workload on veterinary staff while delivering real time support for diagnostic decisions. In imaging, machine learning models trained on millions of x ray and ultrasound images can detect subtle patterns in canine and feline scans, offering near-human-expert diagnostic performance and much quicker turnaround times. AI integration into record keeping, scheduling, SOAP note automation, and trend analysis tools is also streamlining practice management, improving consistency, and freeing veterinarians to focus on patient care and client communication.

At the same time, One Health research initiatives, such as the May 2025 collaboration between Texas A&M and the University of Georgia on Chagas disease in dogs, are reshaping diagnostic priorities by tackling zoonotic infections within a combined animal/human health frame. Backed by over USD 4 million in recent funding, these researchers are developing sensitive diagnostic panels (DNA based and serologic biomarkers), staging protocols, and modified therapeutic regimens to manage Trypanosoma cruzi infection in canine cohorts at high risk in southern U.S. settings. By monitoring privately owned pets and working dogs, researchers are gathering clinical and ecological data to capture disease progression, cardiac impact, and exposure routes, feeding directly into improved diagnostics and early intervention strategies. The One Health approach ensures that advances in canine diagnostics and treatment protocols can directly inform human health applications in endemic regions.

Other converging trends fueling growth in companion diagnostics include the increasing complexity of pet care (pet aging, comorbidities), workforce constraints in the veterinary sector, and rising demand for rapid and trustworthy diagnostic results. With connectivity and telemedicine tools, clinics can leverage cloud based AI platforms, remote interpretation services, and decision support systems to make smarter clinical choices more efficiently.

To conclude, these developments, like AI enabled diagnostic technologies delivering heightened speed and accuracy, combined with integrative One Health research collaborations, are propelling the companion animal diagnostics industry forward. They enable veterinarians to detect disease earlier, personalize treatment protocols, optimize clinic operations, and align animal health efforts with broader public health goals. Innovations such as hematology analyzers, imaging AI, and disease diagnostic pipelines exemplify how science, clinical practice, and cross disciplinary collaboration drive a new era of precision veterinary medicine in the U.S.

U.S. Companion Animal Infectious Disease Diagnostics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, the analyst has segmented the U.S. companion animal infectious disease diagnostics market report based on animal type, product, technology, Infection type, and end use:Product Outlook (Revenue, USD Million, 2021 - 2033)

- Consumables, Reagents & Kits

- Equipment & Instruments

Technology Outlook (Revenue, USD Million, 2021 - 2033)

- Immunodiagnostics

- Lateral Flow Assays

- ELISA Test

- Others

- Molecular Diagnostic

- Polymerase Chain Reaction (PCR) Tests

- Microarrays

- Others

- Others

Animal Type Outlook (Revenue, USD Million, 2021 - 2033)

- Canine

- Feline

- Equine

- Others

Infection Type Outlook (Revenue, USD Million, 2021 - 2033)

- Bacterial

- Viral

- Parasitic

- Others

End Use Outlook (Revenue, USD Million, 2021 - 2033)

- Veterinary Hospitals and Clinics

- Veterinary Reference Laboratories

- Others

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- IDEXX Laboratories Inc.

- Zoetis Services LLC.

- Thermo Fisher Scientific, Inc

- Virbac

- bioMérieux SA

- IDvet

- Neogen Corporation

- Agrolabo S.p.A.

- Bio-Rad Laboratories, Inc

- Antech Diagnostics, Inc.

Table Information

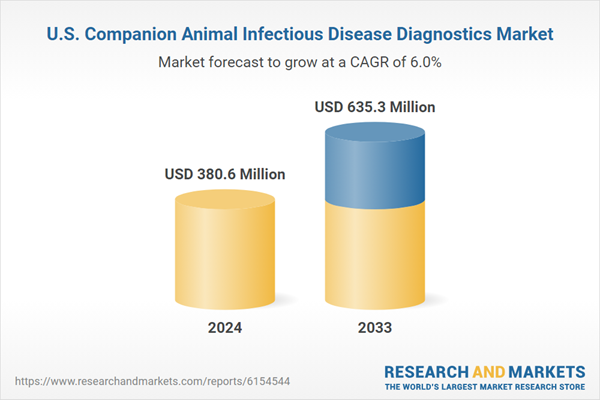

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | July 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 380.6 Million |

| Forecasted Market Value ( USD | $ 635.3 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |