Besides, most of the biopharmaceutical and pharmaceutical companies are turning to CROs and CDMOs to leverage advanced technologies such as artificial intelligence, bioinformatics, and high-throughput screening. In addition, the rising number of small and virtual biotech companies, which often lack robust internal capabilities, further accelerates the trend toward outsourcing.

Moreover, shifting trends towards personalized medicine and adaptable development frameworks enhances the demand for outsourced discovery services. Globalization, the need for quicker time-to-IND submissions, and the emergence of new therapeutic areas are continuously driving outsourcing as a key strategy for growth.

In addition, the emergence of personalized medicine is driving the need for adaptable, small-batch production within the U.S. drug discovery outsourcing sector. As treatments become increasingly targeted, particularly in areas like oncology, rare diseases, and gene therapy, traditional mass production methods are shifting towards customized drug development strategies, which are expected to drive the market growth over the estimated time period.

Contract research organizations (CROs) and contract development and research organizations (CDROs) utilize a modular infrastructure, flexible workflows, and quick assay development are becoming vital partners. Outsourcing provides biopharma companies with the ability to navigate variability in drug design, patient stratification, and biomarker-driven studies, which in turn enhances their agility, cost-effectiveness, and speed in bringing precision therapies to market.

Furthermore, the growing integration of artificial intelligence (AI) and machine learning (ML) in drug discovery is transforming the process of identifying, optimizing, and validating compounds. AI streamlines target identification, assesses drug-likeness, and models molecular interactions, leading to significant reductions in early-stage R&D timelines and expenses. Besides, ML algorithms sift through extensive datasets ranging from omics data to clinical outcomes to reveal innovative insights and minimize risks in candidate selection.

In addition, biopharma companies in the U.S. are increasingly incorporating AI-driven solutions into their workflows or collaborating with AI-focused contract research organizations (CROs) to boost productivity, accelerate the path to Investigational New Drug (IND) applications, and enhance success rates in the development of treatments for complex and rare diseases. For instance, in July 2024, Exscientia plc mentioned Amazon Web Services expansion to use the AI & ML services of cloud providers to power the company’s platform for end-to-end drug discovery and automation. Such factors are expected to drive the estimated time period.

U.S. Drug Discovery Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, the analyst has segmented the U.S. drug discovery outsourcing market report based on workflow, drug, service, therapeutics area, end use, and country.Workflow Outlook (Revenue, USD Million, 2021 - 2033)

- Target Identification & Screening

- Target Validation & Functional Informatics

- Lead Identification & Candidate Optimization

- Preclinical Development

- Others

Drug Outlook (Revenue, USD Million, 2021 - 2033)

- Small Molecules

- Large Molecules

Service Outlook (Revenue, USD Million, 2021 - 2033)

- Chemistry Services

- Biology Services

Therapeutics Area Outlook (Revenue, USD Million, 2021 - 2033)

- Respiratory system

- Pain and Anesthesia

- Oncology

- Ophthalmology

- Hematology

- Cardiovascular

- Endocrine

- Gastrointestinal

- Immunomodulation

- Anti-infective

- Central Nervous System

- Dermatology

- Genitourinary System

End Use Outlook (Revenue, USD Million, 2021 - 2033)

- Pharmaceutical & Biotechnology companies

- Academic Institutes

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Albany Molecular Research Inc.

- EVOTEC

- Laboratory Corporation of America Holdings

- GenScript

- Pharmaceutical Product Development, LLC

- Charles River Laboratories

- WuXi AppTec

- Merck & Co., Inc.

- Thermo Fisher Scientific Inc.

- Dalton Pharma Services

- Oncodesign

- Jubilant Biosys

- DiscoverX Corp.

- QIAGEN

- Eurofins SE

- Syngene International Limited

- Dr. Reddy Laboratories Ltd.

- Pharmaron Beijing Co., Ltd.

- TCG Lifesciences Pvt Ltd.

- Domainex Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | July 2025 |

| Forecast Period | 2024 - 2033 |

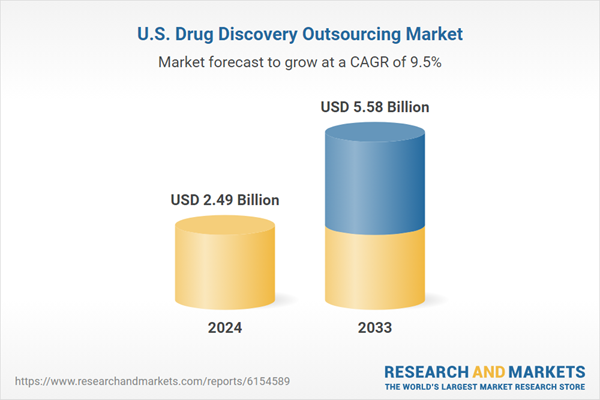

| Estimated Market Value ( USD | $ 2.49 Billion |

| Forecasted Market Value ( USD | $ 5.58 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 20 |