Rising disposable incomes and health-conscious consumer behavior further boost demand. Companies are increasingly investing in sustainable sourcing to meet market needs. For instance, in May 2023, BGG World (BGG) and its subsidiary, Algae Health Sciences (AHS), announced the completion of a significant expansion of their state-of-the-art, 100% glass tube photobioreactor microalgae farm. This marks the second major expansion in the last two years and has doubled the capacity of BGG’s flagship AstaZine Natural Astaxanthin line.

Natural astaxanthin is preferred over synthetic versions due to consumer demand for clean-label products free from chemical residues, with the aquaculture sector, especially salmon farming, serving as a key growth driver by using astaxanthin to enhance fish pigmentation and health. Innovations like microencapsulation, adopted by a leading nutraceutical brand, improve product stability and bioavailability, and expand uses in functional foods and cosmetics.

In May 2025, the study by Y. Zhang et al. demonstrated an effective method for astaxanthin production using flocculated H. pluvialis cultivated as biofilms in a tri-layer tray photobioreactor. This approach improved biomass harvesting efficiency and enhanced astaxanthin yield, offering a promising commercial-scale production technique. Developing advancements, such as advanced extraction methods and sustainable closed-system microalgae cultivation, improve yield efficiency and lessen environmental impact. New delivery formats, including water-dispersible powders for drinks, cater to changing consumer preferences.

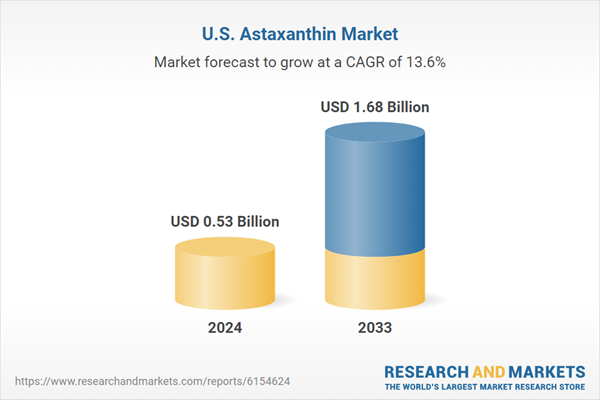

Despite challenges from the high production costs of natural astaxanthin, technological progress is expected to lower costs over time. Strategic partnerships between raw material suppliers and manufacturers to streamline supply chains boost efficiency, while regulatory support for natural ingredients ensures compliance with FDA standards. The rising trend toward plant-based and eco-friendly products will likely increase adoption in the nutraceutical and cosmetic sectors, with projections indicating steady market growth through 2033.

U.S. Astaxanthin Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, the analyst has segmented the U.S. astaxanthin market report based on source, product, and application:Source Outlook (Revenue, USD Million, 2021 - 2033)

- Natural

- Yeast

- Krill/Shrimp

- Microalgae

- Others

- Synthetic

Product Outlook (Revenue, USD Million, 2021 - 2033)

- Dried Algae Meal or Biomass

- Oil

- Softgel

- Liquid

- Others

Application Outlook (Revenue, USD Million, 2021 - 2033)

- Nutraceuticals

- Cosmetics

- Aquaculture & Animal Feed

- Food

- Functional Foods & Beverages

- Other Traditional Food Manufacturing Applications

- Others

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- DSM Nutritional Products

- BASF SE

- Fuji Chemical Industries Co., Ltd.

- BGG World (Beijing Gingko Group)

- Cyanotech Corporation

- Algatech Ltd.

- AstaReal Inc.

- Valensa International

- PIVEG, Inc.

- ENEOS Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | July 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 0.53 Billion |

| Forecasted Market Value ( USD | $ 1.68 Billion |

| Compound Annual Growth Rate | 13.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |