Speak directly to the analyst to clarify any post sales queries you may have.

Understanding the Evolving Dynamics of the Global DIY Tools Sector and Strategic Implications for Industry Leaders Seeking Growth and Innovation

The ever-evolving landscape of the DIY tools sector demands a clear understanding of changing consumer preferences, rapid technological advancements, and shifting competitive dynamics. In recent years, DIY enthusiasts have become increasingly sophisticated, seeking professional-grade tools that combine ease of use with high performance. Meanwhile, manufacturers are integrating smart connectivity features, sustainable materials, and ergonomic designs to cater to a broader audience of both hobbyists and seasoned craftsmen.This introduction lays the groundwork by examining how digital transformation, supply chain resilience, and evolving retail channels are reshaping strategic priorities for stakeholders. It highlights the importance of aligning product innovation with consumer expectations, optimizing distribution strategies across brick-and-mortar and digital platforms, and anticipating regulatory shifts that may affect trade flows. By framing these central considerations, this section establishes a holistic view of the key drivers and challenges influencing decision-makers across the DIY tools ecosystem.

Unveiling the Fundamental Transformations Redefining the Competitive Landscape of the DIY Tools Market in the Modern Era

A convergence of technological breakthroughs, sustainability imperatives, and consumer empowerment is driving fundamental shifts across the DIY tools market. Cordless power tools are now squarely in the mainstream as lithium-ion battery technology aligns with performance demands, reducing reliance on traditional combustion engines. This transition underscores a broader move toward cleaner, quieter, and more efficient equipment.Simultaneously, the integration of connectivity features and mobile applications is transforming user experiences. Enthusiasts can now track tool performance in real-time, access maintenance alerts, and engage with online communities for project inspiration. This shift is fostering deeper brand loyalty, while also generating valuable usage data that informs iterative product development cycles.

Beyond technology, sustainability has moved from niche to necessary. Manufacturers are adopting recyclable components and eco-friendly packaging, responding to consumer expectations and regulatory pressures. The result is a market that rewards innovation in materials science and circular business models. Together, these transformative shifts are redefining competitive dynamics and creating new pathways for market entrants and incumbents alike.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Supply Chains and Cost Structures within the DIY Tools Industry

The roll-out of new import duties on tool components has reshaped cost structures and sourcing strategies throughout the value chain. Tariffs imposed on key inputs such as precision blades and specialized battery cells have prompted manufacturers to reevaluate their supplier networks, driving a search for alternate production hubs in regions offering cost advantages and trade incentives. In some instances, assemblers have repatriated light manufacturing activities to North America, balancing higher labor expenses against reduced shipping duties and improved supply chain visibility.These shifts have also influenced pricing strategies across retail channels. Retailers have navigated margin pressures by renegotiating terms with vendors, embracing dynamic pricing models, and leveraging promotional campaigns to manage inventory levels. For consumers, the net effect has been a recalibration of perceived value, with increased emphasis on durability and total cost of ownership.

Furthermore, the tariff landscape has catalyzed innovation in material sourcing and design efficiency. Manufacturers are exploring alternative alloys and advanced composites that deliver comparable performance at lower input costs. This response highlights the sector’s resilience and adaptive capacity in the face of trade policy upheaval.

Delineating Critical Segmentation Perspectives to Illuminate Product, Power Source, Application, End User, and Distribution Channel Trends

A nuanced exploration of product categories reveals that battery-powered drills, circular saws, and precision blades are at the forefront of demand, while traditional hand tools continue to benefit from their simplicity and reliability. Examining the role of power sources, it becomes clear that electric tools are driving premium segment growth as end users prioritize efficiency and convenience, even as manual tools hold steady in regions where affordability and ruggedness are paramount.Application-based segmentation sheds light on diverse usage scenarios ranging from gardening and woodworking to automotive maintenance and metal fabrication. Each application group is characterized by unique performance requirements and purchasing behaviors, compelling manufacturers to tailor feature sets accordingly. End user insights indicate that commercial customers often demand high-durability models and comprehensive service support, industrial purchasers value bulk procurement and long-term warranties, and residential DIYers seek user-friendly designs and brand accessibility.

The evolution of distribution channels underscores a migration toward digital platforms, with e-commerce sites and manufacturer websites gaining traction alongside traditional hardware outlets. This hybrid landscape requires manufacturers to balance omnichannel strategies, ensuring consistent branding and seamless customer experiences across both offline retail stores and online portals.

Illuminating Key Regional Trends and Growth Trajectories Across the Americas, Europe Middle East Africa, and Asia-Pacific Markets

Across the Americas, robust consumer spending on home improvement and a mature retail network underpin strong demand for both professional-grade and entry-level DIY tools. Shifts toward urbanization and smaller living spaces are spurring interest in compact, multifunctional equipment designed to maximize limited work areas. Furthermore, proximity to manufacturing centers and regional trade agreements facilitate efficient distribution and competitive pricing.In Europe, the Middle East, and Africa, diverse economic conditions and regulatory frameworks shape varied adoption patterns. Western European markets favor eco-friendly and digitally integrated tools, reflecting stringent environmental policies and high consumer awareness. In the Middle East, infrastructure development projects are boosting demand for heavy-duty power tools, while select African markets are emerging as hotspots for affordable manual and battery-powered equipment, driven by growing DIY communities and improving retail accessibility.

The Asia-Pacific region stands out for its rapid urban expansion and rising disposable incomes. Local manufacturing capabilities are complemented by government incentives for domestic production, yielding a proliferation of both international brands and regional players. This dynamic environment is propelling innovation in cost-effective, entry-level tool offerings tailored to first-time homeowners and small business operators.

Highlighting Strategic Profiles and Competitive Strategies of Leading Global Players Shaping the Future of the DIY Tools Ecosystem

A handful of established multinational corporations continue to dominate the landscape, leveraging extensive R&D investments and global supply chains to maintain product leadership. These industry titans are increasingly collaborating with technology partners to embed advanced sensors, connectivity modules, and data analytics capabilities within their offerings. At the same time, nimble mid-tier companies are carving out specialized niches by focusing on sustainability, bespoke customization, and direct-to-consumer engagement.Strategic alliances and joint ventures have emerged as a preferred route to accelerate market entry, particularly in emerging economies where local expertise and regulatory familiarity are critical. Meanwhile, private capital inflows are fueling acquisitions of specialized technology firms, enabling traditional manufacturers to augment their portfolios with digital services and predictive maintenance solutions.

The competitive arena is further energized by a wave of innovative startups uniting design thinking with additive manufacturing, introducing lightweight, ergonomic tools that challenge conventional form factors. Their rapid prototyping capabilities and direct feedback loops with early adopters allow for iterative refinement at unprecedented speed.

Crafting Actionable Strategies and Best Practices to Empower Industry Leaders in Navigating Challenges and Capturing Growth Opportunities

Industry leaders should prioritize the integration of smart connectivity features that deliver real-time usage insights and preventative maintenance alerts, thereby enhancing customer loyalty and unlocking new revenue streams through subscription-based services. Emphasizing modular design and interchangeable battery systems can streamline production costs and simplify customer decision-making, while also fostering an ecosystem of complementary accessories.Sustainability must be embedded at the core of product development, from selecting recyclable materials to optimizing packaging and logistics for minimal environmental impact. Collaborating with industry consortia and standards bodies can amplify these efforts, ensuring interoperability and facilitating broader adoption of green initiatives.

To capture value in emerging markets, forging local partnerships with distributors and service providers is essential. Tailoring products and marketing approaches to align with regional preferences-such as compact designs for densely populated urban areas-will drive deeper market penetration. Finally, cultivating robust digital channels, including immersive e-commerce experiences and virtual demonstration platforms, can bridge the gap between online research and offline purchasing behavior.

Detailing Rigorous Research Methodology Integrating Primary and Secondary Approaches to Deliver Accurate Insights and Robust Analysis

This analysis is underpinned by a comprehensive research framework combining primary interviews with industry executives, engineers, and distribution partners alongside secondary analysis of regulatory filings, patent databases, and trade publications. In-depth qualitative discussions were conducted to validate emerging trends, while quantitative data sources such as customs records and procurement databases were mined to identify shifting supply chain patterns.Geopolitical and policy developments were mapped through continuous monitoring of government announcements and trade authority publications, enabling timely assessment of tariff impacts and regulatory changes. Competitive benchmarking drew on public annual reports, investor presentations, and digital platform analytics to compare product portfolios, R&D investments, and go-to-market strategies across leading players.

Rigorous data triangulation and cross-validation ensured that insights reflect a balanced perspective, blending macroeconomic contexts with granular industry signals. This methodology provides a robust foundation for actionable recommendations and forward-looking analysis aligned with executive decision-making needs.

Synthesizing Core Findings and Forward-Looking Insights to Guide Decision-Makers Toward Sustainable Success in the DIY Tools Market

In summary, the DIY tools industry is at a pivotal juncture defined by technological innovation, evolving trade policies, and dynamic end-user expectations. Cordless solutions and digital connectivity continue to drive differentiation, while sustainability considerations are reshaping product lifecycles and value propositions. Regional nuances, from urban densification in the Americas to manufacturing incentives in Asia-Pacific, highlight the importance of localized strategies and agile supply chain configurations.Competitive intensity remains high as established brands reinforce their leadership through strategic acquisitions and R&D collaborations, while emerging players capitalize on niche innovations and direct engagement with digital-native consumers. Navigating this complex landscape requires a balanced approach that blends global best practices with market-specific adaptations, underpinned by continuous monitoring of policy developments and consumer sentiment.

By synthesizing these themes, decision-makers are equipped to chart a course that leverages core strengths, anticipates disruptive forces, and seizes opportunities for sustainable growth in the evolving DIY tools market.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Accessories

- Batteries

- Bits

- Blades

- Chargers

- Garden Tools

- Garden Saws

- Lawnmowers

- Shovels

- Trimmers

- Hand Tools

- Hammers

- Pliers

- Screwdrivers

- Wrenches

- Power Tools

- Accessories

- Power Source

- Electric

- Manual

- Application

- Automotive

- Electrical

- Gardening

- Metalworking

- Woodworking

- End User

- Commercial

- Industrial

- Residential

- Distribution Channel

- Offline Retail

- Online Retail

- E-Commerce Platforms

- Manufacturer Websites

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Würth Industrie Service GmbH & Co. KG

- OBI Home and Garden GmbH

- AIMCO

- Apex Tool Group, LLC

- Asian Paints Limited

- Atlas Copco AB

- Einhell Germany AG

- Emerson Electric Co.

- Ferm International B.V.

- Festool GmbH

- Hilti AG

- Ingersoll-Rand plc

- Innovative Tools & Technologies, Inc.

- Koki Holdings Co., Ltd.

- Metabo Corporation

- Robert Bosch Power Tools GmbH

- Snap-on Incorporated

- Stanley Black & Decker, Inc.

- URYU SEISAKU, LTD.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this DIY Tools market report include:- Würth Industrie Service GmbH & Co. KG

- OBI Home and Garden GmbH

- AIMCO

- Apex Tool Group, LLC

- Asian Paints Limited

- Atlas Copco AB

- Einhell Germany AG

- Emerson Electric Co.

- Ferm International B.V.

- Festool GmbH

- Hilti AG

- Ingersoll-Rand plc

- Innovative Tools & Technologies, Inc.

- Koki Holdings Co., Ltd.

- Metabo Corporation

- Robert Bosch Power Tools GmbH

- Snap-on Incorporated

- Stanley Black & Decker, Inc.

- URYU SEISAKU, LTD.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | October 2025 |

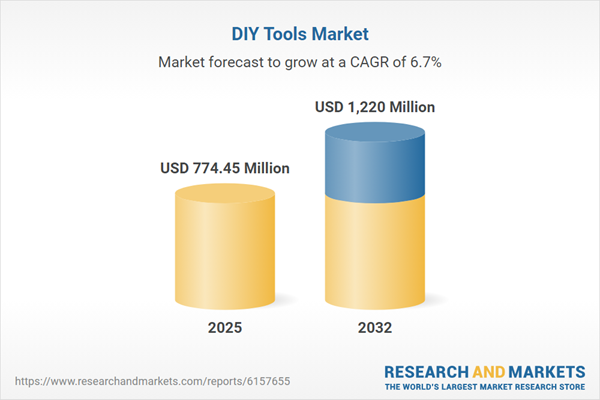

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 774.45 Million |

| Forecasted Market Value ( USD | $ 1220 Million |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |