Speak directly to the analyst to clarify any post sales queries you may have.

Unlocking the Complexities of the Coding Inks Market Landscape and Setting the Stage for Informed Strategic Planning by Industry Leaders Worldwide

The coding inks sector underpins a wide array of modern manufacturing and packaging processes. These specialized formulations are engineered to deliver precise, high-contrast marking on diverse substrates under challenging production environments. Across facilities ranging from food and beverage bottling lines to pharmaceutical labeling and high-speed electronics assembly, coding inks ensure traceability, compliance, and brand protection. The interplay between ink composition and performance demands rigorous innovation to meet evolving requirements for durability, legibility, and resistance to abrasion, solvents, and temperature variations.Applications extend beyond conventional printing on glass and metal. Paper, cardboard, and flexible films rely on formulations that adhere reliably without compromising recyclability. Similarly, the growth of plastic packaging has driven the development of inks compatible with both rigid containers and flexible laminates. The market has witnessed a gradual shift toward solvent reduction and increased use of water-based and UV-curable solutions that deliver rapid curing times and lower environmental impact without sacrificing print quality. Concurrently, advancements in drop on demand and continuous inkjet technologies have broadened the possibilities for high-resolution coding and variable data printing.

Moreover, regulatory frameworks and sustainability goals are reshaping investment priorities. Stringent mandates on volatile organic compound emissions and single-use plastic reduction are spurring formulators to explore bio-based resins and novel pigments. In this context, understanding the fundamental interplay between chemistry, process integration, and end use demands becomes a strategic imperative. Therefore, a comprehensive introduction to these core dimensions is essential for decision makers seeking to navigate an increasingly complex landscape of innovation and compliance.

Examining Pivotal Transformative Shifts Reshaping Coding Inks in Response to Digitalization, Sustainability Imperatives, and Evolving End Use Industry Demands

Transformative shifts within the coding inks landscape are converging around digitalization, sustainability imperatives, and evolving end-use industry demands. The proliferation of digital printing platforms is redefining expectations for speed, customization, and data integration. Variable data printing now enables dynamic serialization and real-time tracking across production lines, while integrated sensors and software analytics support just-in-time adjustments for ink viscosity, dispensing pressure, and drying profiles. Consequently, manufacturers are investing heavily in smart printing modules that seamlessly merge chemical formulation with digital control frameworks.Simultaneously, sustainability has emerged as a central driver of change. Initiatives to reduce volatile organic compounds and solvent waste are yielding water-based and UV-curable chemistries that maintain adhesion and color fidelity under high-speed conditions. In response to circular economy mandates, formulators are exploring bio-derived resins and pigment concentrates that simplify downstream recycling processes. As a result, procurement teams and environmental compliance officers are collaborating closely to evaluate life cycle impacts and regulatory compliance pathways.

Furthermore, shifting priorities among end-use industries-from automotive and electronics to food & beverage and pharmaceuticals-are accelerating demand for specialized coding inks. Each sector imposes distinct requirements for chemical resistance, thermal stability, and occlusion standards, prompting a deeper alignment between R&D, quality assurance, and supply chain management. Therefore, recognizing these multifaceted shifts is crucial for stakeholders aiming to sustain competitive advantage.

Understanding the Cumulative Impact of Recent United States Tariff Policies on Coding Inks Supply Chains, Cost Structures, and Competitive Dynamics in 2025

The imposition of new United States tariff policies in 2025 has introduced significant dynamics across global supply chains and cost structures for coding inks. Raw material sourcing has become more complex, as import duties on petrochemical derivatives and specialty pigments have prompted formulators to reassess supplier agreements and diversify procurement channels. In turn, this realignment has led to incremental increases in production lead times and logistical expenditures, challenging manufacturers to optimize inventory management and streamline inbound freight operations.Moreover, the cumulative impact of these tariffs is influencing competitive positioning across the value chain. Companies with vertically integrated production or established regional manufacturing hubs have been better able to mitigate pass-through costs, while those reliant on cross-border component imports face heightened pricing pressures. Consequently, strategic partnerships and regional consolidation efforts are accelerating, as stakeholders seek to balance cost containment with agility. Amidst this evolving tariff landscape, proactive collaboration between procurement, finance, and R&D functions has become indispensable to safeguard margins without compromising on performance criteria.

Unveiling Key Segmentation Insights across Substrates, Ink Types, Technologies, Applications, and End Use Industries Driving Differentiated Opportunities

Insight into substrate segmentation reveals that glass, metal, paper and cardboard, and plastic each present unique adhesion challenges and surface energy considerations. Glass and metal demand inks with enhanced solvent resistance, while paper and cardboard prioritize formulations that dry quickly without compromising porosity. Plastic substrates, ranging from polyethylene terephthalate to polypropylene films, require specialized binders to maintain print clarity and adhesion during thermal stress.When examining ink type segmentation, oil-based systems continue to deliver robust weatherability, whereas solvent-based variants provide rapid drying at high line speeds. UV-curable formulations are rapidly gaining traction for their near-instantaneous cure mechanisms and reduced energy consumption, while water-based inks are recognized for their low environmental impact and simplified cleaning protocols.

Technology segmentation further delineates market dynamics through continuous inkjet solutions that excel in high-volume coding, laser systems that offer contactless, high-precision marking, and piezo drop on demand and thermal inkjet platforms that enable fine-resolution graphics and variable data printing. Each platform imposes distinct viscosity, particle size, and rheological parameters to achieve consistent droplet formation and trajectory control.

In the realm of application segmentation, labeling and tagging encompasses pressure sensitive labels, shrink sleeves, and tags, which require inks that bond reliably under diverse substrate tensions. Packaging applications span flexible packaging solutions-such as laminates and plastic films-as well as rigid formats including glass containers, metal cans, and rigid plastic. Complementing these are publication and commercial printing uses that emphasize color gamut and resolution, alongside textile coding applications that demand wash-fastness and fabric adherence.

Finally, end use industry segmentation highlights that the automotive sector values heat-resistant and solvent-tolerant inks for interior and exterior components; electronics manufacturers require non-conductive, thermally stable formulations for circuit boards; food and beverage producers demand compliance with food safety regulations; and pharmaceutical companies insist on highly legible, tamper-evident coding for serialization and track-and-trace initiatives.

Illuminating Regional Market Dynamics and Emerging Trends in the Americas, Europe Middle East and Africa, and Asia Pacific to Guide Strategic Investments

The Americas region continues to lead in advanced manufacturing adoption, leveraging established chemical production hubs and mature distribution networks. North American formulators benefit from proximity to raw material suppliers and a robust domestic consumer base, fostering innovation in water-based and UV-curable systems. Furthermore, Latin American markets are showing incremental growth as regulations on packaging waste and food safety converge with rising consumer expectations for brand transparency.Meanwhile, Europe, Middle East and Africa (EMEA) is characterized by stringent environmental and safety standards that drive rapid adoption of low-VOC and bio-based ink technologies. Regulatory bodies enforce rigorous testing protocols for chemical composition, which accelerates commercialization of sustainable formulations. Additionally, the expansion of pharmaceutical and cosmetics manufacturing facilities in this region has heightened demand for high-precision coding solutions that comply with serialization and anti-counterfeiting requirements.

Asia-Pacific remains the fastest-growing region, propelled by a surge in e-commerce, food and beverage production, and consumer electronics manufacturing. Investments in high-speed printing lines and smart factory integration are driving uptake of automated quality control and inline data capture. Emerging markets in Southeast Asia are also creating opportunities for cost-effective water-based inks tailored to local printing infrastructures. As such, regional manufacturing strategies are shifting toward localized formulation centers to reduce lead times and respond to diverse regulatory frameworks.

Highlighting Leading Coding Inks Manufacturers and Innovative Competitor Strategies Shaping Market Positioning and R D Priorities Across the Value Chain

Leading companies in the coding inks sector are centering their competitive strategies on formulation innovation and supply chain resilience. Several global manufacturers have expanded R&D facilities dedicated to next-generation chemistries that offer enhanced adhesion, rapid cure times, and lower environmental footprints. Partnerships with academic institutions and specialized ingredient suppliers have accelerated discovery of novel polymeric binders and pigment dispersions.Moreover, strategic mergers and acquisitions have reshaped competitive dynamics. Key players are acquiring niche ink producers to integrate complementary technologies and broaden geographic coverage. These transactions enable accelerated market entry for advanced UV-curable and water-based solutions, while optimizing scale efficiencies in procurement and manufacturing.

In parallel, forward-looking manufacturers are harnessing digital tools to enhance service offerings. Predictive maintenance platforms, real-time process analytics, and remote diagnostics have become standard value-added services, fostering deeper customer engagement and upsell opportunities. Consequently, market leaders are distinguished not only by their chemical expertise but also by their ability to deliver integrated hardware-software ecosystems that streamline production and elevate quality assurance.

Crafting Actionable Recommendations for Industry Leaders to Navigate Regulatory Challenges, Drive Operational Efficiency, and Foster Sustainable Growth

Industry leaders must proactively address regulatory challenges by embedding compliance into early-stage formulation development. Engaging with regulatory agencies and participating in standardization committees ensures that emerging restrictions on volatile organic compounds and single-use plastics are anticipated rather than reacted to. In this way, new ink systems can be designed in alignment with future requirements, minimizing reformulation costs and market entry delays.Additionally, optimizing operational efficiency is essential for maintaining margin resilience amid tariff pressures and fluctuating raw material costs. Companies should leverage advanced process control algorithms and inline measurement tools to reduce waste, improve yield, and shorten changeover cycles. Establishing cross-functional teams that span R&D, production, and procurement can further accelerate continuous improvement initiatives and risk mitigation protocols.

Finally, fostering sustainable growth requires investment in circular economy principles and end-of-life considerations. Collaborating with packaging manufacturers and waste management partners to develop recyclable ink-substrate combinations can unlock new value chains and reinforce brand sustainability commitments. By prioritizing closed-loop practices and transparent reporting, stakeholders can enhance stakeholder trust and secure long-term market advantage.

Detailing a Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Validation Processes to Ensure Credible Insights

The research methodology underpinning this analysis integrates primary interviews with senior executives, technical experts, and regulatory specialists to capture firsthand perspectives on market drivers and constraints. These qualitative engagements provide nuanced understanding of evolving formulation priorities, technology adoption patterns, and supply chain dynamics.In parallel, secondary data analysis draws upon peer-reviewed journals, industry case studies, patent databases, and proprietary databases to validate emerging trends and benchmark performance metrics. This comprehensive review ensures that chemical innovation trajectories and competitive benchmarks are informed by the latest available data while mitigating reliance on any single information source.

Finally, a rigorous validation process synthesizes findings through triangulation techniques, reconciling insights from multiple stakeholders and cross-referencing conflicting data points. Analytical frameworks such as Porter’s Five Forces and PESTEL analysis are employed to structure strategic assessments, while sensitivity analyses gauge the robustness of observed trends under varying operational scenarios.

Concluding Observations Emphasizing Strategic Imperatives, Innovation Trajectories, and Collaborative Opportunities for the Future of Coding Inks Industry

As the coding inks industry continues to evolve, the convergence of digital printing platforms, sustainable chemistries, and complex regulatory environments underscores the need for integrated strategies. Manufacturers that align formulation innovation with smart production technologies will be well positioned to address diverse end-use requirements and rapidly shifting market conditions.Innovation trajectories are increasingly defined by cross-sector collaboration, where ingredient suppliers, equipment vendors, and end users co-develop solutions that optimize performance while minimizing environmental impact. Consequently, open innovation models and co-laboratory initiatives have gained traction as mechanisms to accelerate product development and reduce time-to-market.

Looking forward, collaborative opportunities extend beyond traditional partnerships. Alliances with waste management firms, recyclers, and digital platform providers will shape the next wave of growth by enabling circular ink-substrate ecosystems and data-driven service offerings. In this context, stakeholders who embrace a holistic, ecosystem-oriented mindset will emerge as the frontrunners in a dynamic and increasingly competitive landscape.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Substrate

- Glass

- Metal

- Paper & Cardboard

- Plastic

- Ink Type

- Oil Based

- Solvent Based

- UV Curable

- Water Based

- Technology

- Continuous Inkjet

- Laser

- Piezo Drop On Demand

- Thermal Inkjet

- Application

- Labeling & Tagging

- Packaging

- Flexible Packaging

- Rigid Packaging

- Publication & Commercial Printing

- Textile Coding

- End Use Industry

- Automotive

- Electronics

- Food & Beverage

- Pharmaceuticals

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- DIC CORPORATION

- Flint Group

- artience Co., Ltd.

- Siegwerk Druckfarben AG & Co. KGaA

- hubergroup Deutschland GmbH

- SAKATA INX CORPORATION

- TOKYO PRINTING INK MFG. CO., LTD.

- T&K TOKA CORPORATION

- Korea Newspaper Ink Co., Ltd.

- Hitachi Industrial Equipment & Solutions America, LLC

- FUJIFILM Speciality Ink Systems Limited

- Huizhou Xingxin Coating Chemical Co., Ltd.

- Dainichiseika Color & Chemicals Mfg.Co.,Ltd.

- Wikoff Color Corporation

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Coding Inks market report include:- DIC CORPORATION

- Flint Group

- artience Co., Ltd.

- Siegwerk Druckfarben AG & Co. KGaA

- hubergroup Deutschland GmbH

- SAKATA INX CORPORATION

- TOKYO PRINTING INK MFG. CO., LTD.

- T&K TOKA CORPORATION

- Korea Newspaper Ink Co., Ltd.

- Hitachi Industrial Equipment & Solutions America, LLC

- FUJIFILM Speciality Ink Systems Limited

- Huizhou Xingxin Coating Chemical Co., Ltd.

- Dainichiseika Color & Chemicals Mfg.Co.,Ltd.

- Wikoff Color Corporation

Table Information

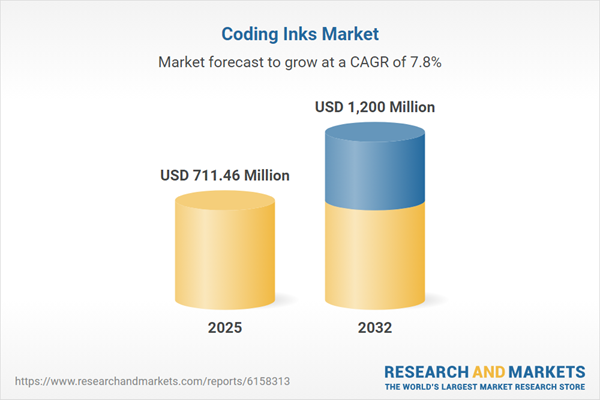

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 711.46 Million |

| Forecasted Market Value ( USD | $ 1200 Million |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |