Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the Dynamic Evolution and Emerging Opportunities Shaping the Heating Bags Market Landscape and Driving Strategic Growth

The heating bags market has swiftly evolved from a niche commodity to an essential solution across multiple sectors, driven by technological innovations and shifting consumer expectations. Advances in materials science have enabled the development of more efficient and longer lasting heat sources, while design enhancements have improved usability and safety. As end users seek convenient, on-demand warmth for applications ranging from outdoor recreation and food service to medical therapy, the industry has responded with product variants tailored to specific performance requirements. Concurrently, heightened awareness of sustainability and environmental impact has spurred investments in eco-friendly formulations and recyclable packaging, reshaping procurement criteria for both B2B and B2C buyers.Moving beyond simple warming devices, modern heating bags now integrate smart temperature controls and ergonomic features that cater to comfort and precision. These capabilities have broadened market appeal, propelling adoption in clinical rehabilitation and industrial maintenance contexts where consistent thermal delivery is paramount. The convergence of design thinking, material innovation, and user-centric functionality marks a transformative phase for the sector. As regulatory frameworks evolve to address safety and environmental standards, manufacturers are aligning product roadmaps to maintain compliance and foster market trust. This confluence of factors underscores the strategic imperative for stakeholders to stay abreast of technological breakthroughs and emerging consumer needs in order to capitalize on growth opportunities.

Navigating the Intersection of Digital Innovation Regulatory Evolution and Sustainability Trends Redefining the Heating Bags Industry

The heating bags industry is being redefined by several pivotal forces that are reshaping traditional paradigms. First, the increasing integration of digital technologies has enabled remotely adjustable temperature settings and real-time performance tracking, elevating product differentiation and customer satisfaction. IoT connectivity and app-driven controls are no longer futuristic concepts but rapidly becoming mainstream, spurring manufacturers to invest in embedded sensors and firmware development.Simultaneously, environmental stewardship and circular economy principles are guiding material selection and end-of-life considerations. Biodegradable additives and post-consumer recycling programs are rising in importance as regulators and consumers demand greener alternatives. This shift has encouraged cross-industry collaborations with chemical suppliers and waste management firms to establish closed-loop supply models.

Moreover, evolving health and safety regulations, particularly in medical and food service sectors, have accelerated the adoption of standardized testing protocols and certification schemes. In response, industry leaders are strengthening quality assurance processes and pursuing voluntary benchmarks that exceed baseline compliance, thereby bolstering brand reputation and market access. These transformative shifts underscore the necessity for agile strategies that align product innovation, sustainability objectives, and regulatory adherence to capture emerging market potential.

Assessing the 2025 United States Tariff Adjustments and Their Far-Reaching Implications on Cost Structures Supply Chains and Competitive Dynamics

The introduction of new United States tariffs scheduled for 2025 is set to exert notable pressure on import-dependent segments of the heating bags market. Tariff escalations on key inputs, particularly battery components and specialized plastic films, will likely increase landed costs for electric and reusable product lines. Manufacturers reliant on cross-border supply chains are already evaluating cost mitigation strategies such as nearshoring and alternative sourcing from tariff-exempt countries. These adjustments are expected to realign global procurement networks and may prompt shifts toward domestic production capabilities.As cost structures adjust, pricing strategies will come under scrutiny. While some suppliers may absorb incremental duties to preserve market share, others may recalibrate profit margins or introduce tiered pricing models that differentiate between premium feature sets and standard offerings. In turn, downstream distributors and retailers will need to reassess promotional tactics and contract terms to maintain competitive positioning without eroding profitability.

Furthermore, the tariff landscape is likely to catalyze innovation in material substitution and process optimization. Producers may accelerate the exploration of lower-duty materials or pursue technical collaborations to develop novel composites that replicate existing performance at reduced cost. Such adaptive measures will be critical in minimizing disruption and sustaining growth trajectories amid evolving trade policies.

Uncovering Detailed Insights into Product Type Material Composition Usage Duration and Packaging Strategies Driving Targeted Consumer Engagement

Insight into market segmentation reveals a nuanced tapestry of product differentiation and consumer preferences. The market is structured around distinct product types, wherein chemical heating bags-encompassing iron powder based and magnesium iron based formulations-coexist with electric variants powered by batteries, plug-in sources, and rechargeable systems, alongside microwaveable options that leverage convenience. This diversity is mirrored in the disposable versus reusable paradigm, which delineates short-term, single-use packages from sustainable iterations designed for repeated applications.Material composition further stratifies offerings into air activated, gel, phase change material, and water activated categories, each delivering targeted thermal profiles. Customers select longer lasting solutions or rapid-onset heat based on desired duration brackets spanning short intervals under four hours to extended exposure beyond eight hours. Temperature thresholds also inform decision-making, with users opting for high-heat options exceeding 65°C, moderate settings between 45°C and 65°C, or gentler warmth up to 45°C according to application requirements.

Packaging strategies play a pivotal role in market access and consumer engagement. Bulk boxes and retail boxes accommodate professional or commercial volume demands, whereas single pouches and multi-pack arrangements cater to individual or family usage scenarios. End-use segmentation underscores this diversity: food and beverage warming and specialized medical treatments for menstrual cramps or pain relief share shelf space with home comfort solutions and robust industrial and construction applications. Distribution channels span traditional storefronts like retail pharmacies and supermarkets to direct-to-consumer platforms and broad eCommerce marketplaces, illustrating the intricate ecosystem that stakeholders must navigate.

Examining Regional Adoption Patterns and Regulatory Influences Shaping the Heating Bags Industry Across Americas EMEA and Asia-Pacific Markets

Regional dynamics shape the heating bags market in distinctive ways, driven by socioeconomic, regulatory, and cultural factors. In the Americas, robust demand stems from widespread adoption in outdoor recreation, professional food service, and healthcare sectors. Consumers value portability and reliability in colder climates, prompting manufacturers to emphasize rugged design and extended duration models. This region also benefits from well-established logistics networks and stable regulatory frameworks that facilitate rapid product rollout.The Europe, Middle East and Africa region is characterized by stringent environmental regulations and growing consumer preference for sustainable solutions. Manufacturers operating here are increasingly pressured to comply with rigorous packaging directives and chemical safety standards. At the same time, the hospitality and industrial maintenance segments offer fertile ground for growth, as urbanization and infrastructure development drive higher consumption of temperature management products.

Asia-Pacific stands out as a dynamic growth engine, propelled by expanding manufacturing capabilities and rising disposable incomes. Emerging economies within the region are witnessing accelerated uptake of both chemical and electric heating bags for home use and medical therapy. The presence of large-scale chemical producers and electronics suppliers has fostered cost-effective production, enabling manufacturers to compete on price while advancing innovation in smart heating features and eco-friendly materials.

Exploring Strategic R&D Alliances Portfolio Diversification and Supply Chain Optimization Strategies of Leading Heating Bags Manufacturers

Market leaders in the heating bags industry are distinguishing themselves through targeted investment in research and development, strategic partnerships, and portfolio diversification. Established chemical formulators are leveraging their core competencies to launch advanced iron powder blends with enhanced heat retention and reduced activation times. Concurrently, electronics manufacturers are intensifying efforts to integrate rechargeable lithium-ion batteries and microcontroller-based temperature regulation into reusable electric models.Collaborative ventures are emerging as a preferred pathway for new product introductions, as firms seek to combine material science expertise with digital control capabilities. Joint development agreements and licensing partnerships are enabling faster time to market and shared risk in R&D. On the distribution front, leading players are deepening ties with major retail chains while expanding direct-to-consumer channels through proprietary eCommerce platforms.

In response to shifting regulatory landscapes, many companies are streamlining supply chains by forging closer relationships with vetted raw material suppliers and contract manufacturers. This consolidation not only enhances quality assurance but also improves responsiveness to tariff changes and evolving compliance requirements. These coordinated strategies underscore a broader industry trend toward agility, innovation, and integrated value chain management.

Prioritizing Sustainable Material Innovation Resilient Supply Networks and Smart Technology Integration to Maintain Competitive Leadership

To thrive in a rapidly evolving environment, industry leaders should prioritize the development of sustainable, next-generation materials that minimize environmental impact while ensuring consistent thermal performance. Collaborating with chemical suppliers and academic institutions will accelerate breakthroughs in biodegradable activators and recyclable packaging solutions. At the same time, investing in smart heating controls-such as IoT-enabled sensors and adaptive algorithms-can unlock premium pricing tiers and foster customer loyalty.Supply chain resilience must be bolstered through nearshoring strategies, diversified sourcing, and strategic inventory management to mitigate risks associated with fluctuating tariffs and geopolitical uncertainties. Companies should explore partnerships with regional manufacturing hubs to shorten lead times and reduce exposure to trade policy shifts. On the go-to-market front, leveraging omnichannel distribution by integrating traditional retail partnerships with enhanced direct and indirect eCommerce capabilities will capture broader audience segments.

Finally, maintaining compliance with evolving health, safety, and environmental regulations requires ongoing investment in quality assurance protocols and third-party certifications. Establishing cross-functional teams dedicated to regulatory monitoring and adaptive product development will ensure timely alignment with new standards, strengthening brand reputation and market access.

Employing a Multi-Phase Triangulated Methodology Featuring In-Depth Interviews Surveys and Comprehensive Secondary Research for Unmatched Market Clarity

The research approach combines qualitative and quantitative methodologies to produce a robust and unbiased perspective of the heating bags market. An extensive secondary research phase involved the review of industry publications, regulatory documents, patent filings, and technical whitepapers to establish foundational context and identify key trends. This desk research informed the subsequent primary research design, which comprised in-depth interviews with manufacturers, distributors, industry experts, and end-users across multiple regions.Quantitative data collection leveraged structured surveys targeting purchasing managers, procurement specialists, and product developers to capture pricing dynamics, procurement criteria, and adoption drivers. Data triangulation techniques were applied to reconcile insights from secondary and primary sources, ensuring consistency across diverse inputs. Supply chain analysis was conducted through material flow mapping and cost-component breakdowns, allowing for granular understanding of tariff impacts and logistical considerations.

Finally, market segmentation and regional analysis were validated via cross-referencing sales data, import-export statistics, and expert panel reviews. This rigorous multi-step methodology underpins the credibility of findings and supports actionable recommendations for stakeholders seeking to navigate the evolving heating bags landscape.

Synthesizing Innovation Sustainability and Strategic Agility as Imperatives for Sustainable Expansion in the Heating Bags Sector

The heating bags market is at a strategic inflection point, driven by rapid innovation in material science, digital integration, and shifting consumer preferences toward sustainability. As regulatory frameworks tighten and trade policies evolve, stakeholders must remain agile and forward-looking to capitalize on emerging opportunities. The segmentation insights underscore the importance of tailored product strategies that address varied performance and duration requirements, while regional analyses highlight the necessity of localized approaches in diverse markets.Manufacturers that embrace cross-industry collaborations, invest in eco-friendly formulations, and optimize supply chains will be best positioned to mitigate risks associated with tariff fluctuations and regulatory changes. Concurrently, integrating smart temperature control technologies and omnichannel distribution capabilities can unlock new revenue streams and enhance customer loyalty. By synthesizing robust research methodologies with strategic foresight, organizations can navigate the complexity of this market and achieve sustainable growth.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Chemical

- Iron Powder Based

- Magnesium Iron Based

- Electric

- Battery Powered

- Plug In

- Rechargeable

- Microwaveable

- Chemical

- Category

- Disposable

- Reusable

- Material Type

- Air Activated

- Gel

- Phase Change Material

- Water Activated

- Heating Duration

- Long (Over 8h)

- Medium (4-8h)

- Short (Under 4h)

- Temperature Level

- High (Over 65°C)

- Low (Up To 45°C)

- Medium (45-65°C)

- Packaging

- Box

- Bulk Box

- Retail Box

- Pouch

- Multi Pack

- Single Pack

- Box

- Application

- Food & Beverage

- Beverage Warming

- Food Warming

- Home Use

- Industrial & Construction

- Medical

- Menstrual Cramps

- Pain Relief

- Food & Beverage

- Distribution Channel

- Offline

- Retail Pharmacies

- Supermarkets & Hypermarkets

- Online

- Company Websites

- eCommerce Platforms

- Offline

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- 3M Company

- Pure Enrichment by Bear Down Brands, LLC

- Carex Health Brands

- Cardinal Health, Inc.

- 4RComfort LLC

- Beurer GmbH

- Caresmith

- BodyMed, LLC

- Chilly Pads, Inc.

- Conair Corporation

- Drive DeVilbiss Healthcare, LLC

- Kaz, Inc.

- Life Wear Cara, Inc.

- Medline Industries Inc.

- Nature Creation LLC

- Newell Brands Inc.

- Sunny Bay, Inc.

- ThermaCare by Bridges Consumer Healthcare, LLC

- Thermalon, LLC

- Thermopad GmbH

- UTK Technology Inc.

- Walgreen Co.

- Warmies USA, LLC.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Heating Bags market report include:- 3M Company

- Pure Enrichment by Bear Down Brands, LLC

- Carex Health Brands

- Cardinal Health, Inc.

- 4RComfort LLC

- Beurer GmbH

- Caresmith

- BodyMed, LLC

- Chilly Pads, Inc.

- Conair Corporation

- Drive DeVilbiss Healthcare, LLC

- Kaz, Inc.

- Life Wear Cara, Inc.

- Medline Industries Inc.

- Nature Creation LLC

- Newell Brands Inc.

- Sunny Bay, Inc.

- ThermaCare by Bridges Consumer Healthcare, LLC

- Thermalon, LLC

- Thermopad GmbH

- UTK Technology Inc.

- Walgreen Co.

- Warmies USA, LLC.

Table Information

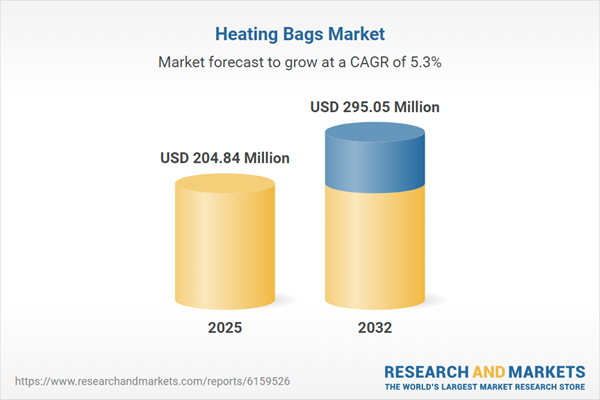

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 204.84 Million |

| Forecasted Market Value ( USD | $ 295.05 Million |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |