Speak directly to the analyst to clarify any post sales queries you may have.

Introducing the Critical Role of Advanced Nuclear Medicine Software Solutions in Modern Healthcare Diagnostics and Therapeutic Decision-Making

Advancements in nuclear medicine software have redefined the capabilities of modern diagnostic and therapeutic workflows. By harnessing sophisticated image processing algorithms and integrating seamlessly with imaging hardware, these platforms underpin critical decisions in oncology, cardiology, neurology, and beyond. Over the past decade, the convergence of high-resolution imaging modalities with intelligent software has accelerated the transition from manual interpretation to data-driven insights, empowering clinicians to identify pathophysiological processes with greater precision. As healthcare systems face mounting pressure to improve patient outcomes while containing costs, these solutions deliver streamlined analysis pipelines, automated quantification, and real-time reporting that enhance operational efficiency.Moreover, the introduction of clinical decision support functionalities and customizable reporting frameworks has fostered multidisciplinary collaboration across radiology, nuclear medicine, and molecular imaging departments. Consequently, organizations are establishing centers of excellence that leverage centralized data repositories and advanced analytics to drive continuous improvement. As regulatory bodies emphasize evidence-based practice and value-based care, the strategic importance of nuclear medicine software grows in parallel. In the following sections, readers will gain comprehensive insights into how technological innovations and market dynamics intersect to inform strategic decision-making

Unveiling the Key Technological Innovations and Workflow Optimizations Reshaping the Nuclear Medicine Software Landscape for Enhanced Clinical Outcomes

Over recent years, nuclear medicine software has undergone a profound transformation driven by artificial intelligence, machine learning, and advanced visualization techniques. These innovations have elevated diagnostic accuracy by automating the detection of radiotracer uptake patterns and quantifying physiological parameters with unprecedented granularity. Consequently, clinical teams can now leverage predictive analytics to forecast disease progression, optimize patient selection for targeted therapies, and enhance personalized treatment planning.Furthermore, the shift toward cloud-native architectures and the adoption of interoperable data standards have unlocked new possibilities for remote consultations and collaborative research. Standardized communication frameworks enable seamless integration with hospital information systems and picture archiving systems, ensuring that critical patient data flows unhindered across institutional boundaries. As healthcare providers increasingly prioritize real-time decision support and cross-disciplinary collaboration, these workflow optimizations have become essential enablers of value-based care. Amidst these technical advancements, stakeholders must remain vigilant regarding regulatory compliance and data security to fully realize the promise of next-generation nuclear medicine software

Assessing the Compound Effects of Newly Implemented United States 2025 Tariffs on Global Supply Chains and Cost Structures in Nuclear Medicine Software

The introduction of new United States tariffs in 2025 has introduced a complex layer of cost and supply chain considerations for nuclear medicine software providers and end users alike. These measures, designed to address broader geopolitical concerns, have inadvertently increased the cost of importing specialized hardware components and proprietary software modules. As a result, procurement teams are reevaluating vendor contracts and exploring alternative sourcing strategies to mitigate the impact on capital budgets.Consequently, healthcare organizations have begun to reassess total cost of ownership models, factoring in elevated maintenance fees, extended lead times for equipment upgrades, and potential fluctuations in licensing expenses tied to international exchange rates. Beyond immediate financial pressures, the shifting tariff landscape has prompted some providers to localize certain development and support functions in domestic markets. Understanding these cumulative tariff effects is essential for forecasting operational resilience and maintaining uninterrupted access to mission-critical nuclear medicine applications

Strategic Examination of Nuclear Medicine Software Across Product Type Workflow Stage Integration Options Functionality Deployment Models and Application Areas

A detailed segmentation framework reveals nuanced adoption behavior across distinct product categories and clinical workflows. Analysis software solutions continue to dominate data interpretation tasks, while clinical decision support platforms increasingly inform therapeutic planning. Data management tools underpin the aggregation of longitudinal patient records, and imaging software advances capture high-definition scintigraphy images. Radiation therapy planning suites complement these offerings by calculating precise dosimetry parameters for targeted treatment.Equally important are the inherent integration models and feature sets that define end-user experiences. Integrated platforms offer comprehensive toolsets for seamless data exchange, whereas standalone applications deliver specialized functionality that addresses point-of-care needs. Diagnostic modules focus on disease detection and staging, while therapeutic modules guide treatment monitoring and targeting strategies.

Deployment flexibility further diversifies market dynamics as cloud-based solutions empower remote collaboration and scalable resource allocation, while on-premises deployments satisfy stringent data sovereignty and latency requirements. Application-specific software serves a broad spectrum of clinical specialties, including cardiology, infectious diseases, neurology, orthopedics, and pediatrics, with oncology solutions refined for cancer staging and monitoring, radiation therapy planning and dosimetry, therapeutic targeting, and tumor detection and diagnosis.

Finally, adoption across diagnostic imaging centers, hospitals, and research institutes underscores the critical role of nuclear medicine platforms in academic, clinical, and community-based care settings. Each end-user group leverages unique combinations of features and deployment modes to address their operational priorities

Regional Insights on Growth Drivers and Adoption Trends of Nuclear Medicine Software in Americas Europe Middle East Africa and Asia Pacific

In the Americas, progressive regulatory environments and robust capital investments have accelerated the uptake of next-generation nuclear medicine software. Leading healthcare systems are deploying artificial intelligence-augmented tools to enhance patient throughput and reduce interpretive variability. Government initiatives aimed at modernizing infrastructure have further supported the integration of cloud-native deployments that optimize resource sharing across regional health networks.Meanwhile, Europe, the Middle East, and Africa present a diverse tapestry of adoption scenarios. In Europe, stringent medical device regulations and data protection standards have propelled vendors to adopt comprehensive compliance frameworks and secure data management protocols. Cross-border collaboration on digital health initiatives is fostering innovation hubs that pilot advanced analytics use cases. Conversely, in several Middle Eastern and African markets, infrastructure constraints pose challenges to widescale software deployment, prompting hybrid solutions that blend cloud services with local hosting to maintain performance and security.

Across Asia-Pacific, a surge in state-sponsored healthcare modernization programs has catalyzed demand for scalable nuclear medicine platforms. Rapid hospital expansions in China, India, and Southeast Asia emphasize functionality that supports heavy imaging volumes and multilingual reporting. Japan’s established imaging market drives incremental advancements in precision diagnostics, while emerging economies prioritize cost-effective, turnkey solutions that accelerate clinical adoption

Profiling Leading Innovators and Strategic Partnerships That Define Competitive Dynamics in the Nuclear Medicine Software Industry

Leading vendors are distinguishing themselves through targeted investments in machine learning algorithms that automate image interpretation and predictive modeling. Partnerships between software developers and imaging hardware manufacturers have produced integrated solutions that streamline installation, calibration, and ongoing support. These alliances facilitate consistent performance across diverse clinical settings and underpin vendor differentiation strategies.Simultaneously, strategic collaborations with cloud service providers and healthcare IT integrators are expanding the reach of nuclear medicine platforms into telemedicine and remote diagnostic programs. By leveraging established cloud infrastructures, vendors can offer elastic compute resources for complex image reconstructions and host centralized repositories that support multicenter clinical trials.

Emerging consolidation trends reflect sustained merger and acquisition activity aimed at acquiring specialized capabilities-from advanced dosimetry calculation engines to AI-driven lesion detection modules. Companies that have successfully integrated acquired startups into cohesive product portfolios are gaining market traction, while those investing in robust training and certification programs are strengthening customer loyalty and retention

Essential Strategic Recommendations for Industry Leaders to Leverage Technological Advances and Navigate Regulatory Complexities in Nuclear Medicine Software

Industry leaders seeking to capitalize on evolving clinical requirements should prioritize the development of interoperable platforms that align with emerging healthcare data standards. By adopting open APIs and standardized messaging protocols, software providers can facilitate seamless data exchange with electronic health records and picture archiving systems, thereby reducing integration friction.At the same time, investing in advanced cybersecurity measures and data encryption protocols will mitigate the growing risk of ransomware attacks and data breaches. Establishing cross-functional teams that include clinical, IT, and compliance experts can accelerate implementation timelines and promote risk-aware decision-making.

Leaders should also forge strategic alliances with academic institutions and research consortia to co-develop novel algorithms and validate clinical performance. Such collaborations can expedite regulatory approvals and broaden evidence-based use cases. Finally, continuous end-user training programs and outcome monitoring mechanisms will ensure sustained adoption, maximize return on investment, and support the transition to value-based care models

Research Methodology Detailing Data Collection Approaches Analytical Frameworks and Validation Processes Underpinning the Nuclear Medicine Software Study

This analysis draws on a rigorous research methodology that combines primary and secondary sources. In-depth interviews with clinicians, medical physicists, and informaticians provided first-hand perspectives on clinical workflows, unmet needs, and adoption barriers. Structured surveys captured quantitative assessments of platform performance, integration challenges, and feature priorities.Secondary research encompassed regulatory filings, clinical practice guidelines, peer-reviewed publications, and patent databases to map technological trajectories and compliance requirements. Data was triangulated using thematic coding and trend analysis to identify consistent patterns and emerging opportunities.

Throughout the study, findings underwent validation by independent subject matter experts to ensure accuracy, relevance, and practical applicability. Periodic updates and workshops with key opinion leaders reinforced the robustness of insights and facilitated continuous refinement of strategic recommendations

Concluding Reflections on the Strategic Imperatives Technological Trajectories and Market Dynamics Shaping the Future of Nuclear Medicine Software Solutions

In closing, the nuclear medicine software landscape is characterized by rapid technological evolution, shifting regulatory frameworks, and dynamic regional adoption patterns. The integration of artificial intelligence, the rise of cloud-native deployments, and the imperative for interoperability are reshaping clinical workflows and opening new avenues for personalized diagnostics and therapy planning. At the same time, external factors such as the 2025 United States tariffs necessitate adaptive procurement strategies and localized development efforts.A granular segmentation approach highlights the diverse requirements of diagnostic imaging centers, hospitals, and research institutes, while regional insights underscore the importance of tailored go-to-market strategies across the Americas, EMEA, and Asia-Pacific. Competitive differentiation will hinge on strategic partnerships, M&A activity, and robust cybersecurity postures. Ultimately, industry leaders that embrace open standards, invest in continuous training, and cultivate cross-disciplinary collaborations will redefine the standard of care and sustain growth in this high-impact domain

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Nuclear Medicine Analysis Software

- Nuclear Medicine Clinical Decision Support Software

- Nuclear Medicine Data Management Software

- Nuclear Medicine Imaging Software

- Nuclear Medicine Radiation Therapy Software

- Workflow

- Data Management

- Data Processing

- Image Acquisition

- Reporting

- Integration

- Integrated

- Standalone

- Functionality

- Diagnostics

- Therapeutics

- Deployment Mode

- Cloud Based

- On Premises

- Application

- Cardiology

- Infectious Diseases

- Neurology

- Oncology

- Cancer Staging & Monitoring

- Radiation Therapy Planning & Dosimetry

- Therapeutic Targeting

- Tumor Detection and Diagnosis

- Orthopedics

- Pediatrics

- End User

- Diagnostic Imaging Centers

- Hospitals

- Research Institutes

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Bracco Group

- Canon Medical Systems Corporation

- Comecer S.p.A.

- Convergent Imaging Solutions

- ec² Software Solutions

- Esaote S.p.A.

- Gamma Gurus Pty Ltd

- GE Healthcare

- Hermes Medical Solutions, Inc.

- InMed Healthcare

- Koninklijke Philips N.V

- LabLogic Systems Ltd.

- Mediso Medical Imaging Systems

- MIM Software Inc.

- Mirada Medical Ltd. by Sectra AB

- Mirion Technologies Inc.

- Segami Corporation

- Siemens Healthineers AG

- Syntermed Inc.

- Winkgen Medical Systems GmbH & Co. KG

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Nuclear Medicine Software market report include:- Bracco Group

- Canon Medical Systems Corporation

- Comecer S.p.A.

- Convergent Imaging Solutions

- ec² Software Solutions

- Esaote S.p.A.

- Gamma Gurus Pty Ltd

- GE Healthcare

- Hermes Medical Solutions, Inc.

- InMed Healthcare

- Koninklijke Philips N.V

- LabLogic Systems Ltd.

- Mediso Medical Imaging Systems

- MIM Software Inc.

- Mirada Medical Ltd. by Sectra AB

- Mirion Technologies Inc.

- Segami Corporation

- Siemens Healthineers AG

- Syntermed Inc.

- Winkgen Medical Systems GmbH & Co. KG

Table Information

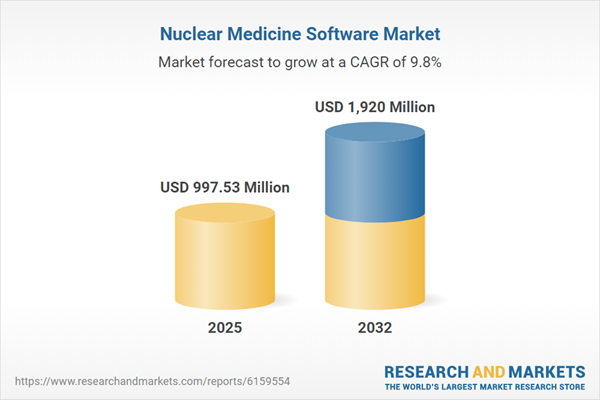

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 997.53 Million |

| Forecasted Market Value ( USD | $ 1920 Million |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |