Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the Foundational Dynamics of Pressure Sensitive Materials Driving Innovation, Adaptation, and Market Relevance Across Multiple Industries

Pressure sensitive materials represent a critical class of substrates and adhesives engineered to bond to a variety of surfaces with the application of light pressure. These materials encompass films, foils, and papers, each offering distinct mechanical, chemical, and aesthetic properties. The film category integrates advanced polymers such as polyester, polyethylene, polypropylene, and PVC, delivering robust durability and flexibility for a wide range of applications. Aluminum foil variants provide exceptional barrier performance, while glassine and kraft papers introduce complementary characteristics in printability and sustainability. Across these substrates, adhesive choices further refine functional performance, with acrylic formulas spanning solvent, UV-curable, and water-based chemistries, natural and synthetic rubbers modifying tack and cohesion, and silicone adhesives supporting extreme temperature resistance.Furthermore, technological coatings ranging from single and double coatings to patterned and transfer systems enable precision in adhesive placement, while versatile forms such as dots, sheets, labels, and tapes optimize usability across end uses. The breadth of applications in automotive, construction, consumer goods, electronics, healthcare, industrial labeling, and flexible packaging underscores the transformative potential of pressure sensitive materials. This report delves into the evolving market landscape, examining key drivers, regulatory influences, and emerging opportunities. In addition to offering segmented insights by type, adhesive chemistry, technology, form, application, and distribution channel, it illuminates regional dynamics, competitive positioning, and strategic imperatives. Ultimately, this analysis equips decision makers with a deep understanding of the forces shaping the future of pressure sensitive materials and the pathways to sustainable growth.

Unraveling the Transformative Shifts Reshaping the Pressure Sensitive Materials Landscape Through Technological Advances and Regulatory Evolution

Recent years have witnessed profound shifts in the pressure sensitive materials landscape driven by accelerating technological innovation and evolving regulatory frameworks. Digital printing techniques have matured to enable on-demand, variable data labeling directly onto films and foils, unlocking new customization opportunities for brand protection and traceability. Concurrently, the integration of pressure sensitive adhesives with flexible electronics and sensor arrays has given rise to smart labels that monitor environmental conditions, enhancing visibility across supply chains. In addition, heightened environmental scrutiny has spurred development of bio-based and recyclable substrates, prompting manufacturers to innovate with cellulose derivatives, biodegradable polymers, and solvent-free adhesive formulations.Moreover, regulatory pressure targeting volatile organic compounds and hazardous chemicals has reshaped adhesive chemistry, accelerating the adoption of UV-curable and water-based acrylic systems. These systemic shifts have influenced end-user strategies in automotive assembly, medical device manufacturing, and consumer packaging, where sustainability credentials and product performance are now intertwined. Supply chain resilience has gained prominence as companies embrace regionalized sourcing models to mitigate tariff volatility and transportation bottlenecks. Taken together, these transformative forces are redefining competitive advantages, compelling established players and emerging entrants alike to invest in advanced R&D, forge strategic partnerships, and realign product portfolios. This section explores how these shifts converge to create a more dynamic, connected, and sustainable pressure sensitive materials ecosystem.

Additionally, the convergence of digital supply chain platforms with blockchain and IoT-enabled labeling systems is strengthening end-to-end traceability, reducing waste, and delivering real-time analytics. This heightened connectivity supports sustainable practices by enabling precise material consumption tracking and circular economy initiatives.

Assessing the Far-Reaching Cumulative Impact of Proposed United States Tariffs in 2025 on Supply Chains, Cost Structures, and Industry Competitiveness

As the United States considers the implementation of additional tariffs on certain imported substrates and adhesive components in 2025, the pressure sensitive materials sector anticipates multifaceted impacts on cost structures and supply chain configurations. Manufacturers reliant on overseas sourcing of polymer films, specialty additives, and coated papers face the prospect of elevated import duties, which could erode margins or necessitate price adjustments. In response, some companies are accelerating plans to diversify procurement by qualifying domestic suppliers, establishing regional production hubs, or shifting manufacturing footprints closer to end markets.Furthermore, increased input costs may prompt downstream users in automotive assembly, electronics, and flexible packaging to reassess material specifications, balancing performance requirements against cost ceilings. Contingency strategies, such as dual sourcing agreements and long-term supply contracts, are gaining traction as risk management measures. Importantly, the tariff discourse has stimulated dialogue between industry consortia and regulatory bodies, underscoring the need for transparent dialogue on trade policy and its ripple effects on innovation and competitive positioning. In light of these dynamics, stakeholders are evaluating the potential for supply chain realignment, nearshoring of critical processes, and the acceleration of material substitution programs. This analysis provides a comprehensive view of how the proposed 2025 tariff measures may reshape sector economics, supply interdependencies, and strategic decision making within the pressure sensitive materials market.

Moreover, some manufacturers are exploring alternative materials and innovative adhesive chemistries to offset tariff-induced cost increases while maintaining performance standards. Initiatives such as multi-year supply agreements and pass-through cost models are under evaluation to preserve customer relationships and revenue stability.

Deriving Key Insights from Multifaceted Segmentation Revealing Type, Adhesive, Technology, Form, Application, and Distribution Channel Performance Dynamics

In examining the pressure sensitive materials market through the lens of type segmentation, film-based substrates emerge as the dominant category, with polyester, polyethylene, polypropylene, and PVC variants addressing diverse mechanical resilience and printability requirements. Aluminum foil constructions deliver superior barrier properties critical for pharmaceutical and high-end packaging applications. Paper substrates, including glassine and kraft paper, maintain relevance in eco-sensitive sectors where recyclability and tactile aesthetics are prioritized.Adhesive segmentation reveals distinct preferences across end uses. Acrylic formulations, encompassing solvent acrylic, UV-curable acrylic, and water-based acrylic systems, offer a balance of adhesion performance and environmental compliance. Natural rubber and synthetic rubber adhesives find favor in applications demanding rapid initial tack, while silicone chemistries, divided into one-part and two-part formulations, support high-temperature industrial processes and medical device assembly.

From a technological standpoint, single-coated, double-coated, pattern-coated, and transfer systems enable precision control over adhesive placement, optimizing material utilization and product functionality. Form-based segmentation underscores the practical diversity of the sector, with dots, labels, sheets, and tapes each fulfilling specialized application workflows from automatic labeling lines to manual assembly tasks.

Application segmentation spans automotive, construction and building, consumer goods, electrical and electronics, healthcare, industrial labeling, and packaging, reflecting the ubiquitous presence of pressure sensitive materials across vertical markets. Lastly, distribution channel analysis highlights the roles of direct sales, distributors, online platforms, and retailers in shaping market accessibility and customer engagement models. Together, these segmentation insights illuminate the complex interplay of materials, chemistries, and delivery formats driving innovation and competitive differentiation in the pressure sensitive materials landscape.

Distribution channel dynamics further influence market penetration and customer accessibility. Direct sales models foster close collaboration and bespoke solutions, while partnerships with distributors and online platforms expand geographic reach. Retailer alliances provide end-user visibility, collectively shaping how materials are marketed and delivered to diverse industrial and consumer segments.

Unearthing Critical Regional Dynamics Highlighting Growth Drivers, Adoption Patterns, and Strategic Opportunities Across Major Global Markets

Across the Americas, pressure sensitive materials benefit from a well-established manufacturing base, particularly in North America, where proximity to end-user industries such as automotive and healthcare fuels demand for high-performance substrates and adhesives. The region's advanced infrastructure and robust distribution networks enable rapid deployment of new formulations and technologies. Additionally, sustainability initiatives led by leading consumer packaged goods companies have accelerated the adoption of recyclable films and water-based adhesive systems.In Europe, the intersection of stringent environmental regulations and a strong focus on circular economy principles has driven innovation in biodegradable papers and low-VOC adhesive chemistries. Manufacturers in this market prioritize compliance with chemical directives and eco-labeling standards, positioning pressure sensitive materials as enablers of sustainable packaging and labeling solutions. Collaborative research efforts between industry associations and academic institutions are further advancing recyclable substrate development and solvent-free coating technologies.

Asia-Pacific stands out for its dynamic growth trajectory, fueled by expanding manufacturing capabilities in China, India, and Southeast Asia. Rapid industrialization and rising consumer goods production underpin demand for cost-effective films and tapes, while technological adoption in electronics assembly and logistics tracking creates avenues for smart label integration. Local players increasingly invest in capacity expansion to meet both domestic consumption and export requirements. This regional mosaic highlights how diverse market drivers shape competitive strategies and innovation pathways across the global pressure sensitive materials arena.

Illuminating the Competitive Landscape by Profiling Leading Pressure Sensitive Materials Manufacturers, Innovators, and Strategic Collaborations

Leading manufacturers in the pressure sensitive materials arena are intensifying efforts to differentiate through proprietary materials, process excellence, and strategic alliances. Global polymer producers have integrated backward into adhesive formulation, securing feedstock consistency and cost control. Specialty chemical companies are forging partnerships with converter networks to co-develop next-generation coatings that enhance adhesion under extreme environmental conditions. Meanwhile, technology start-ups focusing on digital printing and sensor-enabled label platforms are attracting investment from established players seeking to broaden their value chain reach.Mergers and acquisitions remain a prominent feature of industry consolidation, facilitating entry into adjacent markets and bolstering geographic footprints. Major players are also prioritizing capital investments in pilot plants and R&D centers to accelerate commercialization of sustainable substrates and solvent-free adhesives. Collaboration with end-use customers, such as automotive OEMs and medical device firms, enables co-creation of materials tailored to evolving regulatory and performance requirements. As these strategic moves unfold, differentiation is increasingly rooted in a combination of material science expertise, scalable manufacturing processes, and the ability to deliver integrated solutions that address complex adhesion challenges.

In parallel, emerging start-ups and academic spin-offs are introducing niche innovations, such as biodegradable adhesive chemistries and smart material prototypes, often accelerated through incubator programs and venture partnerships. These entrants challenge incumbents to continually evolve their R&D focus and explore collaborative commercialization pathways.

Formulating Actionable Recommendations for Industry Leaders to Navigate Market Disruptions, Capitalize on Growth Verticals, and Foster Sustainable Innovation

Industry leaders should prioritize the development of sustainable substrate and adhesive platforms by allocating R&D resources toward bio-based polymers, recyclable coatings, and low-VOC chemistries. By establishing cross-functional innovation teams that integrate materials science, process engineering, and sustainability experts, companies can accelerate product introductions that meet increasingly stringent regulatory and customer requirements.Supply chain diversification is critical to mitigate the risks associated with geopolitical tensions and tariff uncertainties. Executives are advised to evaluate alternative sourcing strategies, including the qualification of regional suppliers and the pursuit of strategic stockpiling agreements. Implementing digital supply chain visibility tools will further enable real-time monitoring of logistics and inventory levels, enhancing responsiveness to market disruptions.

Furthermore, investment in digital printing and smart labeling technologies can unlock new value propositions, such as dynamic packaging, anti-counterfeiting features, and embedded tracking capabilities. Partnerships with technology providers and software integrators will facilitate the rapid integration of these solutions into existing production workflows. Finally, proactive engagement with regulatory bodies and participation in industry consortia will ensure that emerging legislation supports innovation rather than impeding it. Through these targeted initiatives, businesses can strengthen competitive positioning, drive sustainable growth, and capitalize on emerging market opportunities.

Furthermore, fostering a culture of continuous learning and upskilling within R&D and operational teams will be crucial to maintaining technological leadership. Structured training programs, cross-functional workshops, and university collaborations can build the talent base necessary for pioneering next-generation materials and processes.

Detailing a Rigorous Research Methodology Combining Primary and Secondary Data Collection, Rigorous Validation, and Multidimensional Analytical Frameworks

The research methodology underpinning this analysis combines rigorous primary interviews with industry executives, material scientists, and supply chain managers alongside comprehensive secondary research from reputable technical journals, regulatory filings, and patent databases. Primary data collection involved structured interviews and surveys conducted with key stakeholders across converter facilities, adhesive formulators, and original equipment manufacturers to capture real-world challenges and innovation priorities.Secondary research encompassed the review of industry association reports, peer-reviewed publications, and trade data to validate material flow dynamics and competitive landscapes. Patent landscape analysis provided insights into emerging adhesive chemistries and substrate technologies, while regulatory document reviews clarified environmental and safety requirements influencing product development.

Data triangulation ensured the accuracy and reliability of findings by cross-referencing interview insights with documented technical specifications and market behavior indicators. Analytical techniques included segmentation mapping, opportunity sizing exercises, and scenario planning to illuminate potential pathways under varying trade policy and sustainability scenarios. Quality assurance protocols involved peer review by subject matter experts and iterative validation of key assumptions. This multifaceted approach delivers a holistic and credible perspective on the current state and future directions of the pressure sensitive materials market.

Concluding Observations Emphasizing Market Trajectories, Strategic Imperatives, and the Path Forward for Pressure Sensitive Materials Stakeholders

In conclusion, the pressure sensitive materials sector is at a pivotal juncture, driven by technological advancements, evolving regulatory imperatives, and shifting trade dynamics. The continuous innovation in substrate formulations and adhesive chemistries, coupled with the adoption of smart labeling and digital printing, is redefining the value proposition for a broad array of end markets. At the same time, proposed tariff measures and sustainability mandates are influencing supply chain strategies and product development roadmaps.Key stakeholders must navigate these multifaceted challenges by deploying sustainable materials, embracing digital transformation, and fostering resilient sourcing frameworks. Collaborative engagement with regulators, investment in advanced manufacturing capabilities, and strategic partnerships across the value chain will be vital to maintaining a competitive edge. As the market evolves, decision makers should continuously monitor emerging technologies, regulatory updates, and regional growth trends to adapt strategies proactively.

Ultimately, the successful pursuit of innovation, sustainability, and supply chain agility will determine the leaders in the next phase of pressure sensitive materials. By aligning organizational capabilities with evolving market demands, companies can secure long-term growth and deliver differentiated solutions that address the complex adhesion needs of tomorrow.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Type

- Film

- Poly Vinyl Chloride

- Polyethylene

- Polypropylene

- Foil

- Paper

- Film

- Adhesive Type

- Acrylic

- Solvent-Based Acrylic

- Water-Based Acrylic

- Rubber

- Natural Rubber

- Synthetic Rubber

- Silicone

- Acrylic

- Form

- Dot

- Label

- Sheet

- Tape

- Application

- Automotive

- Construction & Building

- Consumer Goods

- Electrical & Electronics

- Healthcare

- Packaging

- Distribution Channel

- Direct Sales

- Distributors

- Online Retail

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- 3M Company

- Amcor plc

- ACHEM Co., Ltd.

- Arkema SA

- Avery Dennison Corporation

- BASF SE

- Berry Global Inc.

- Compagnie de Saint-Gobain S.A.

- Dexerials Corporation

- Dyna-Tech Adhesives

- Eastman Chemical Company

- Evonik Industries AG

- GTG Manufacturing Sdn. Bhd.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Intertape Polymer Group, Inc.

- IPS Packaging & Automation

- Lintec Corporation

- Momentive Performance Materials Inc.

- Nitto Denko Corporation

- PPG Industries, Inc.

- SANYO CHEMICAL INDUSTRIES, LTD.

- Shurtape Technologies LLC

- Sika AG

- tesa SE by Beiersdorf AG

- The Dow Chemical Company

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Pressure Sensitive Materials market report include:- 3M Company

- Amcor plc

- ACHEM Co., Ltd.

- Arkema SA

- Avery Dennison Corporation

- BASF SE

- Berry Global Inc.

- Compagnie de Saint-Gobain S.A.

- Dexerials Corporation

- Dyna-Tech Adhesives

- Eastman Chemical Company

- Evonik Industries AG

- GTG Manufacturing Sdn. Bhd.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Intertape Polymer Group, Inc.

- IPS Packaging & Automation

- Lintec Corporation

- Momentive Performance Materials Inc.

- Nitto Denko Corporation

- PPG Industries, Inc.

- SANYO CHEMICAL INDUSTRIES, LTD.

- Shurtape Technologies LLC

- Sika AG

- tesa SE by Beiersdorf AG

- The Dow Chemical Company

Table Information

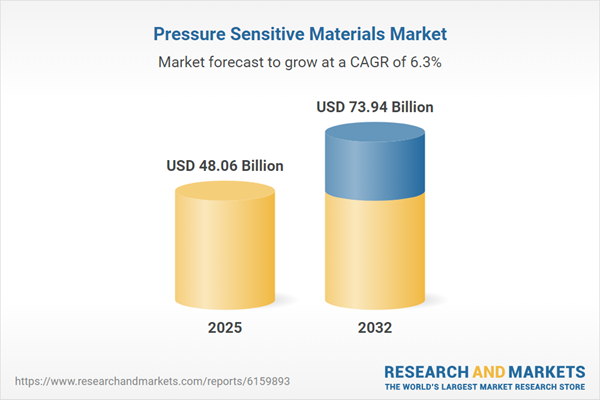

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 48.06 Billion |

| Forecasted Market Value ( USD | $ 73.94 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |