Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the Role of High-Performance Scandium Foil in Advanced Industries and Its Emerging Relevance in Next-Generation Applications

The awakening of interest in scandium foil reflects a broader pursuit of materials that deliver exceptional performance without compromising weight, conductivity, or durability. Recognized for its remarkable strength-to-weight ratio, resistance to corrosion, and compatibility with advanced manufacturing techniques, scandium foil has emerged as a focal point for sectors demanding both precision and resilience. As industries such as aerospace, defense, and electronics push the boundaries of miniaturization and efficiency, scandium foil's unique properties have begun to unlock possibilities once thought unattainable.Advancements in alloy formulation and rolling processes have accelerated the adoption of scandium foil, enabling manufacturers to tailor thicknesses and surface finishes to meet exacting specifications. Consequently, early adopters have reported significant gains in fuel efficiency, component lifespan, and overall system reliability. Transitional investments in research and development continue to refine these benefits, positioning scandium foil as a strategic asset for organizations seeking to differentiate themselves through innovation and performance enhancement.

Unveiling Transformative Shifts Reshaping Material Science and Manufacturing Dynamics for Scandium Foil Adoption Worldwide

A confluence of technological breakthroughs and shifting supply chain dynamics is redefining how scandium foil is produced, distributed, and applied across key markets. Innovations in roll bonding and precision rolling have dramatically improved yield consistency, allowing producers to achieve ultra-thin gauges while minimizing material waste. Simultaneously, automated quality inspection systems are driving tighter tolerances, ensuring that foil delivered to original equipment manufacturers aligns perfectly with stringent aerospace and electronics standards.Moreover, strategic alliances between mining companies and specialized smelters are reshaping resource availability. New refinery capacities in Scandinavia and Canada have reduced lead times, while pilot projects focusing on scandium recycling are maturing into scalable operations. As a result, manufacturers can navigate between primary production and secondary sources, bolstering resilience against supply disruptions. Together, these transformative shifts underscore a trajectory toward cost-effective, sustainable production pathways, making scandium foil a more reliable choice for performance-driven applications.

Assessing the Cumulative Impact of United States 2025 Tariff Adjustments on Scandium Foil Supply Chains and Pricing Structures

The introduction of United States tariffs on foreign-sourced scandium products scheduled for 2025 is set to recalibrate global trade flows and cost structures. By elevating duties on imported foil, policymakers aim to fortify domestic production, encouraging investments in local refining and rolling capabilities. Inevitably, manufacturers reliant on international suppliers will face increased procurement expenses, compelling many to reassess their sourcing strategies.In response to the tariff landscape, several downstream fabricators have accelerated plans to qualify alternative suppliers or pivot toward domestic partnerships. Extended lead times for tariff-exempt inventory have sharpened focus on onshore facility expansions, while engineering teams are evaluating redesigns to offset potential material cost increases. These adjustments, though initially disruptive, are fostering a more robust and self-sufficient supply chain, with long-term prospects for streamlined logistics and improved quality control. Ultimately, the tariff measures are catalyzing a shift toward more localized manufacturing ecosystems.

Revealing Key Segmentation Insights Across Product Type Thickness Configuration Application and Distribution Channels in Scandium Foil Market Landscape

A nuanced examination of scandium foil market segmentation reveals distinct preferences and performance requirements across multiple dimensions. The pure scandium foil segment continues to attract demand where maximum thermal stability and corrosion resistance are paramount, while the scandium alloy variant garners attention for its enhanced tensile properties and cost-efficiency in high-volume production runs. When considering foil thickness, ultra-thin formats below 0.1 millimeters are prized for microelectronics and sensor applications, intermediate gauges between 0.1 and 1 millimeter serve as the workhorse for precision components, and thicker selections above 1 millimeter find niche use in structural subassemblies.Format configurations further influence procurement decisions: custom-cut sections enable seamless integration into complex assemblies, roll formats streamline automated feeding on production lines, and sheet offerings provide versatility for prototyping and tool-and-die operations. Applications in aerospace and defense break down into airframe skins and engine part liners, each demanding stringent certification protocols. In electronics, LED lighting and semiconductor substrates leverage scandium's thermal conductivity and minimal coefficient of thermal expansion. The energy and power sector spans fuel cells, nuclear component liners, and high-efficiency solar panel conductors, while the medical field employs scandium foil for diagnostic imaging equipment and biocompatible implants. Finally, distribution channels bifurcate into traditional offline procurement networks that emphasize contractual volume commitments and emerging online marketplaces that cater to rapid sample acquisition and just-in-time replenishment.

Evaluating Regional Trends and Growth Drivers Spanning the Americas Europe Middle East Africa and Asia Pacific in Scandium Foil Market Landscape

Regional dynamics for scandium foil consumption exhibit pronounced variation driven by industrial focus and regulatory environments. In the Americas, a well-established defense manufacturing base and burgeoning commercial aerospace activities ensure robust demand for high-purity foil grades. Canada's mining sector expansion has complemented this growth by unlocking new sources of scandium-rich ore, fostering a tighter integration between extractive and value-added supply chains.Across Europe, the Middle East, and Africa, investment in advanced research centers and exploration concessions has stimulated interest in scandium applications for renewable energy and lightweight mobility. European manufacturers are particularly active in developing next-generation fuel cell membranes, with partnerships spanning from academic institutions to automotive OEMs. Meanwhile, African resource developments are beginning to feed refined scandium intermediates into established rolling mills in Western Europe.

In Asia-Pacific, China maintains a dominant position in upstream processing, refining significant volumes of scandium concentrate and directing foil toward consumer electronics and solar module producers. Japan's legacy specialization in precision metallurgy continues to drive innovations in foil thickness control, and South Korea's electronics conglomerates remain key off-takers for semiconductor substrate variants. Together, these regional trends portray a mosaic of specialized ecosystems that collectively underpin the global scandium foil market.

Highlighting Competitive Strategies and Innovations from Leading Scandium Foil Manufacturers Shaping the Future of High-Performance Alloys

Leading companies in the scandium foil arena are advancing competitive strategies through vertical integration, technology licensing, and joint ventures. Several refiners have secured upstream mining stakes to guarantee raw material supply, while others have established toll-processing agreements with smelters to optimize throughput and minimize capital expenditure. On the innovation front, proprietary alloy formulations are being developed to balance mechanical performance against production costs, enabling manufacturers to tailor offerings for application-specific requirements.In parallel, key players are investing in capacity expansion, deploying advanced rolling mills capable of producing homogenous foil at sub-0.05-millimeter gauges. Quality assurance protocols bolstered by AI-enabled inspection systems ensure that tolerance thresholds are consistently met, reducing rework and scrap. To broaden market reach, leading suppliers are forging distribution alliances that span both direct sales teams and digital platforms, ensuring that high-performance foil grades are accessible to emerging technology firms. As competition intensifies, these strategic initiatives are shaping a landscape where agility, technological differentiation, and supply chain control become critical determinants of market leadership.

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities in the Scandium Foil Sector

To harness the latent potential of scandium foil, industry leaders should prioritize strategic investments in flexible manufacturing assets capable of scaling across multiple thickness classes and configurations. Adopting an integrated supply approach-combining direct ore procurement with toll refining contracts-will mitigate exposure to raw material shortages and tariff volatility. Furthermore, forging collaborative research programs with end-users in aerospace, electronics, and energy sectors can accelerate customization cycles and foster early adoption of novel foil grades.Operationally, embedding digital traceability solutions across distribution channels will enhance visibility into inventory levels and shipment timelines, enabling just-in-time delivery models. Investing in advanced testing laboratories to expedite certification processes for medical and defense applications will also reduce time-to-market. Finally, expanding recycling initiatives to reclaim scandium from scrap and end-of-life components can create a circular resource loop, lower overall feedstock costs, and strengthen sustainability credentials.

Outlining Robust Research Methodology Employed to Ensure Comprehensive and Accurate Insights in Scandium Foil Market Analysis

This analysis is underpinned by a rigorous methodology blending qualitative and quantitative insights. Primary research encompassed in-depth interviews with executives across the scandium value chain, including refiners, fabricators, and end-user engineers, providing firsthand perspectives on technological challenges and adoption drivers. Secondary research drew upon a comprehensive review of trade journals, metallurgical publications, patent filings, and government trade data to validate supply dynamics and regulatory shifts.Data triangulation was achieved through cross-referencing annual reports, technical white papers, and proprietary shipment databases. Expert validation panels convened at multiple stages to ensure interpretive accuracy and refine emerging hypotheses. Statistical normalization methods were applied to harmonize disparate data sets, while scenario analysis explored the implications of tariff regimes, capacity expansions, and recycling thresholds. Collectively, these methodological pillars ensure that the insights presented are both robust and actionable for decision-makers operating in the scandium foil domain.

Drawing Strategic Conclusions on the Evolution Trajectory and Critical Success Factors in the Global Scandium Foil Industry

The evolution of the scandium foil market reflects a broader trend toward materials that deliver unparalleled performance in weight-sensitive and high-temperature environments. From the integration of precision rolling techniques to the restructuring of supply chains in response to policy shifts, the industry has demonstrated remarkable adaptability. Segmentation analysis underscores the importance of aligning product specifications with application demands, while regional insights highlight the value of diversified sourcing strategies across established and emerging manufacturing hubs.Looking ahead, competitive differentiation will hinge on the ability to leverage technological innovations-such as AI-driven quality control and closed-loop recycling-and on forging strategic alliances that secure upstream resources. By embracing these imperatives, stakeholders can position themselves at the forefront of a market poised for accelerated growth, driven by the relentless pursuit of performance, efficiency, and sustainability.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Pure Scandium Foil

- Scandium Alloy Foil

- Thickness

- 0.1 mm to 1 mm

- Above 1 mm

- Below 0.1 mm

- Form

- Custom Cut

- Rolls

- Sheets

- Distribution Channel

- Offline

- Online

- Applications

- Aerospace Components

- Aircraft Structural Parts

- Fasteners

- Fuselage

- Defense & Military Applications

- Electronics & Semiconductor Substrates

- Memory Cell Coatings

- Sputtering Targets

- Energy

- Aerospace Components

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- ESPI Metals

- Goodfellow Cambridge Ltd.

- American Elements Inc.

- Avantor, Inc.

- Central Drug House Pvt. Ltd.

- CG Material

- ChangSha Zegen Advanced Materials Limited

- Chemazone Inc.

- EdgeTech Industries LLC

- Heeger Materials Inc.

- Hunan Oriental Scandium Co., Ltd.

- IREL (India) Limited

- LTS Research Laboratories, Inc.

- Merck KGaA

- Metalysis Ltd.

- Nilaco Corporation

- QS Advanced Materials Inc

- QS Advanced Materials Inc

- Reade International Corp.

- Scandium International Mining Corp.

- Solvay SA

- Stanford Advanced Materials

- Super Conductor Materials, Inc.

- Thermo Fisher Scientific Inc.

- Viridis Materials LLC

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Scandium Foil market report include:- ESPI Metals

- Goodfellow Cambridge Ltd.

- American Elements Inc.

- Avantor, Inc.

- Central Drug House Pvt. Ltd.

- CG Material

- ChangSha Zegen Advanced Materials Limited

- Chemazone Inc.

- EdgeTech Industries LLC

- Heeger Materials Inc.

- Hunan Oriental Scandium Co., Ltd.

- IREL (India) Limited

- LTS Research Laboratories, Inc.

- Merck KGaA

- Metalysis Ltd.

- Nilaco Corporation

- QS Advanced Materials Inc

- QS Advanced Materials Inc

- Reade International Corp.

- Scandium International Mining Corp.

- Solvay SA

- Stanford Advanced Materials

- Super Conductor Materials, Inc.

- Thermo Fisher Scientific Inc.

- Viridis Materials LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

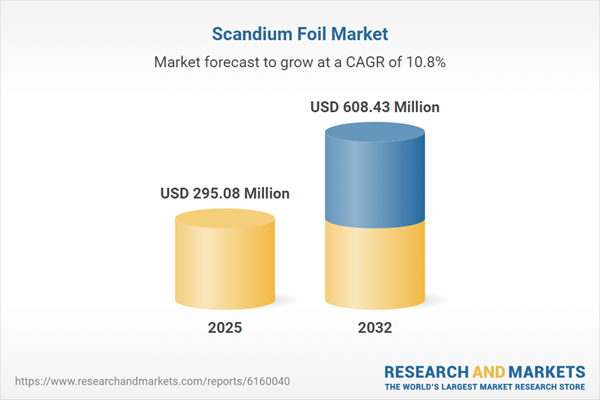

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 295.08 Million |

| Forecasted Market Value ( USD | $ 608.43 Million |

| Compound Annual Growth Rate | 10.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |