Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Catalysts Driving the Rise of Ecofriendly Plant-Based Organic Fertilizer Adoption Across Diverse Agricultural Practices Worldwide

The emergence of plant-based organic fertilizers marks a pivotal shift in agricultural inputs as growers, policymakers, and consumers prioritize environmental stewardship and soil vitality over conventional synthetics. This executive summary introduces the core themes shaping the global plant-based organic fertilizer sector by examining the interplay between sustainability imperatives, technological breakthroughs, and evolving regulatory frameworks that are reshaping farming practices.Amid increasing scrutiny of synthetic chemicals, the agricultural community is embracing bioactive solutions derived from plant residues, seaweed extracts, and microbial byproducts that enrich soil microbiomes and promote healthier crop growth. This transformation has been fueled by the recognition that regenerative approaches not only address nutrient management challenges but also mitigate carbon footprints, preserve biodiversity, and support long-term farm resilience.

Policy incentives from leading agricultural economies have accelerated reformulation efforts, prompting manufacturers to innovate at the intersection of agronomy and biotechnology. Concurrently, end users are seeking transparent supply chains and product authenticity, catalyzing industry collaboration across research institutions, production facilities, and distribution networks. As a result, this landscape presents a dynamic environment where investment in plant-based organic fertilizers is driven by ecological benefits, economic viability, and consumer demand for sustainably produced food.

Examining How Regulatory Incentives Technological Breakthroughs and Consumer Preferences Are Rewriting the Organic Fertilizer Landscape

The plant-based organic fertilizer market is undergoing rapid transformation propelled by a convergence of regulatory support, scientific advancements, and shifting consumer preferences. Governments across key producing regions have introduced stringent mandates on chemical runoff and nutrient leaching, prompting mandatory adoption of certified organic inputs and incentivizing R&D collaborations aimed at improving natural formulations.In parallel, breakthroughs in microbial consortia and enzymatic delivery systems have enhanced nutrient bioavailability and stress tolerance in crops, enabling plant-based organic fertilizers to rival conventional counterparts in both efficacy and cost efficiency. Precision agriculture tools, including remote sensing and data analytics, are further amplifying this shift by optimizing application timing and rates, thereby maximizing resource use efficiency and reducing environmental externalities.

Consumer focus on clean-label produce and sustainable farming stories has elevated the market profile of plant-based organic fertilizers. Retailers and foodservice providers are increasingly demanding traceability and verifiable environmental benefits, incentivizing farmers to transition away from petrochemical derivatives. As a result, manufacturers are aligning product portfolios with integrated sustainability metrics and transparent supply chain narratives, creating a feedback loop that accelerates adoption and drives continuous innovation.

Understanding the Far Reaching Effects of US Trade Tariffs Implemented in 2025 on the Plant-Based Organic Fertilizer Supply Chain

The introduction of new trade tariffs by the United States in 2025 created wide-ranging effects across the plant-based organic fertilizer supply chain. Increased duties on imported raw materials such as plant residues and carrier substrates led to elevated input prices for manufacturers, which, in turn, pressured profit margins for both domestic and international suppliers. This catalyzed a strategic pivot toward localized sourcing and onshoring of critical feedstocks to mitigate exposure to trade volatility.As distributors grappled with longer lead times and higher logistical overhead, some industry players responded by securing tariff exemptions through cross-border partnerships and value-add processing agreements. Others accelerated investments in domestic processing capacity to safeguard against future trade disruptions. Over time, these efforts fostered a more resilient supply network that balances import dependencies with regional production hubs.

Looking beyond immediate cost impacts, the tariff landscape has prompted companies to reevaluate their product portfolios and explore alternative plant-based inputs with lower exposure to trade barriers. By streamlining formulations and optimizing blends for targeted geographies, manufacturers have been able to sustain customer engagement while complying with evolving trade regulations. This adaptive response underscores the sector’s growing emphasis on supply chain agility and strategic sourcing as foundations for long-term growth.

Revealing Key Insights Derived from Product Type Crop Type Application Method Packaging Type and Distribution Channel Segmentation for Precision Targeting

Analyzing the market from the perspective of product type reveals that granular formulations continue to dominate in large-scale grain production due to ease of mechanized application, while liquid blends have gained traction among high-value fruit and vegetable growers for their rapid nutrient release. Powder concentrates, by contrast, have found niche applications in specialty crops that require precise micronutrient dosing and compatibility with foliar spray systems.Examining crop type segmentation shows distinct deployment patterns across cereals and grains, where cost efficiency and bulk nutrient delivery remain paramount, in contrast to fruits and vegetables that benefit from tailored biostimulant properties. Oilseeds and pulses, valued for their nitrogen-fixing potential, are increasingly supplemented with plant-based organic amendments to boost soil organic matter and reduce reliance on synthetic nitrogen fertilizers.

When considering application method, foliar application channels are prized for rapid stress recovery and targeted nutrient correction, whereas soil application methods deliver sustained nutrient release and soil health benefits through improved structure and microbial activity. Packaging considerations also influence buyer preferences, with bags favored for ease of handling at small farms and drums adopted by larger operations seeking economies of scale. Distribution channels further diversify access, as traditional retailers and wholesale networks coexist with digital storefronts on e-commerce platforms and manufacturer websites, catering to both legacy buying habits and emerging procurement trends.

Highlighting Regional Dynamics in the Americas Europe Middle East Africa and Asia-Pacific Shaping the Adoption of Plant Based Organic Fertilizers

In the Americas, robust demand for regenerative farming practices has spurred the adoption of plant-based organic fertilizers, supported by federal and state-level incentive programs that reward reduced chemical inputs and improved soil carbon sequestration. Large agricultural enterprises leverage their distribution networks to deliver specialized blends, while emerging organic cooperatives collaborate on bulk procurement to drive down unit costs.Across Europe, the Middle East, and Africa, stringent environmental regulations and a long-standing tradition of organic agriculture have created fertile ground for advanced plant-based formulations. Premium pricing dynamics prevail in markets with well-established organic certification systems, and the rising prominence of carbon trading further bolsters investments in regenerative inputs. In emerging African markets, partnerships between local producers and global suppliers are unlocking new growth opportunities.

The Asia-Pacific region presents a highly heterogeneous landscape, where smallholder farmers in South and Southeast Asia adopt cost-efficient plant-based amendments to restore degraded lands, while Australia and New Zealand focus on high-performance blends tailored to intensive horticulture. Government extension services and agritech startups are pivotal in scaling awareness and facilitating access to novel bioactive solutions across remote and underserved areas.

Profiling Leading Innovators and Strategic Collaborators Driving Growth and Innovation in the Plant Based Organic Fertilizer Industry Worldwide

A number of leading innovators have emerged at the forefront of plant-based organic fertilizer development by forging cross-disciplinary partnerships between agronomists, microbiologists, and materials engineers. Global agribusiness conglomerates are expanding their portfolios with proprietary bioformulations, while specialized biostimulant producers are investing in advanced extraction techniques to enhance active ingredient concentrations.Strategic collaborations between startups and established farming cooperatives are accelerating field trials across diverse agroecological zones, providing critical performance data and enabling rapid iteration of product blends. In parallel, several players have pursued acquisitions of niche biotechnology firms to secure intellectual property and streamline R&D pipelines.

Competitive differentiation increasingly hinges on integrated solution offerings that combine plant-based fertilizers with digital agronomy platforms, soil health monitoring tools, and sustainable packaging innovations. As a result, the market landscape is defined by a mix of deep-pocketed incumbents leveraging global distribution channels and agile newcomers pushing the envelope on product customization and traceability.

Actionable Strategic Roadmap for Industry Leaders to Optimize Sustainability Initiatives Enhance Market Position and Drive Long Term Success

Industry leaders should prioritize sustained investment in research to refine bioactive ingredient profiles and optimize crop-specific formulations that align with agronomic best practices. Collaborating with academic and extension institutions will accelerate validation of emerging technologies and foster broader acceptance among growers.To differentiate in a crowded marketplace, companies must obtain recognized sustainability and organic certifications, ensuring transparency through batch-level traceability systems. Complementary digital platforms that offer application guidance, performance analytics, and soil health monitoring can enhance customer loyalty and unlock premium pricing opportunities.

Optimization of packaging and distribution strategies is essential for balancing cost efficiency with end-user convenience. Adapting drum sizes for large-scale operations while maintaining bag options for smallholders will broaden market reach. Finally, consistent engagement with trade associations and policy stakeholders will enable proactive management of tariff risks and regulatory shifts, ensuring resilience and long-term growth.

Detailing a Robust Research Framework Combining Primary Insights Secondary Data and Multi Stage Analysis to Ensure Comprehensive Reliability

This research framework integrates comprehensive primary engagements with growers, distributors, formulation experts, and regulatory authorities to capture real-world insights across the value chain. Qualitative interviews provided nuanced understanding of application challenges and market drivers, while structured surveys quantified adoption patterns and feature preferences.Secondary analysis encompassed peer-reviewed agronomic journals, patent filings, company disclosures, and policy documents to map technological trajectories and incentive structures. Rigorous data triangulation ensured consistency by cross validating findings from multiple sources and reconciling discrepancies.

The study employs multi-stage analysis techniques, including thematic coding of qualitative inputs and statistical evaluation of quantitative data. Regional case studies were developed to reflect local nuances in soil characteristics, cropping systems, and distribution models. Advanced segmentation analysis supported precision targeting of product and channel strategies. Together, these methodological layers underpin the reliability and depth of the strategic recommendations presented.

Concluding on the Strategic Imperatives Lessons Learned and the Future Outlook for the Sustainable Plant Based Organic Fertilizer Sector

As the agricultural sector embraces regenerative paradigms, plant-based organic fertilizers stand out as a pivotal innovation that balances productivity with ecological stewardship. The interplay of policy incentives, cutting-edge bioformulation techniques, and evolving buyer expectations has created a dynamic ecosystem ripe for strategic intervention.Tariff-induced supply chain adjustments have underscored the importance of sourcing agility and product portfolio resilience, while granular insights from segmentation and regional analyses highlight pathways for tailored market penetration. Leading companies are distinguishing themselves through integrated offerings that marry advanced formulations with digital agronomy tools and sustainable packaging solutions.

Looking ahead, success will favor stakeholders who combine rigorous R&D, collaborative partnerships, and proactive policy engagement to navigate evolving trade landscapes and regulatory frameworks. By capitalizing on emerging trends and leveraging robust market intelligence, industry participants can drive meaningful impact across environmental, economic, and social dimensions, securing a competitive foothold in a rapidly maturing plant-based organic fertilizer market.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Granular

- Liquid

- Powder

- Crop Type

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Application Method

- Foliar Application

- Soil Application

- Packaging Type

- Bags

- Drums

- Distribution Channel

- Offline

- Retailers

- Wholesalers

- Online

- E-Commerce Platforms

- Manufacturer Websites

- Offline

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Nutrien Ltd.

- Benefert B.V.

- California Organic Fertilizers Inc.

- Coromandel International Limited

- Haifa Group Ltd.

- ICL Group Ltd

- Indogulf BioAg LLC

- Italpollina S.p.A.

- Kingenta Ecological Engineering Group Co., Ltd.

- Krishak Bharati Cooperative Limited

- Marrone Bio Innovations, Inc.

- Midwestern BioAg

- Nature Care Fertilizers

- Suståne Natural Fertilizer, Inc.

- Tata Chemicals Ltd.

- The Andersons, Inc.

- The Mosaic Company

- The Scotts Company LLC

- The Scotts Miracle-Gro Company

- Valagro Group S.p.A.

- Wesfarmers Limited

- Yara International ASA

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Plant-Based Organic Fertilizers market report include:- Nutrien Ltd.

- Benefert B.V.

- California Organic Fertilizers Inc.

- Coromandel International Limited

- Haifa Group Ltd.

- ICL Group Ltd

- Indogulf BioAg LLC

- Italpollina S.p.A.

- Kingenta Ecological Engineering Group Co., Ltd.

- Krishak Bharati Cooperative Limited

- Marrone Bio Innovations, Inc.

- Midwestern BioAg

- Nature Care Fertilizers

- Suståne Natural Fertilizer, Inc.

- Tata Chemicals Ltd.

- The Andersons, Inc.

- The Mosaic Company

- The Scotts Company LLC

- The Scotts Miracle-Gro Company

- Valagro Group S.p.A.

- Wesfarmers Limited

- Yara International ASA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | October 2025 |

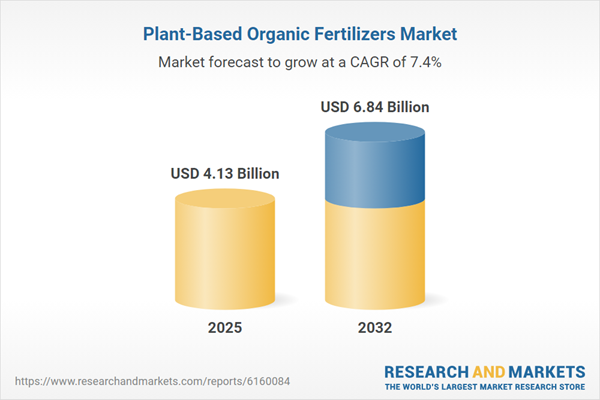

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 4.13 Billion |

| Forecasted Market Value ( USD | $ 6.84 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |