Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Core Dynamics of the Wood Adhesives and Binder Sector Via Evolving Material Chemistry Advancements and Sustainability Imperatives Driving Growth

The wood adhesives and binder landscape has evolved into a dynamic convergence of material science, industrial needs, and environmental stewardship. As engineered wood products, furniture assembly, and packaging solutions demand ever-improving performance, raw material chemistries and formulation strategies have grown more sophisticated. Market participants have steadily shifted emphasis toward resins that offer superior bonding strength, moisture resistance, and thermal stability while reducing formaldehyde emissions and other volatile organic compounds. Regulatory bodies across key markets have introduced stringent limits on emissions and sustainability mandates, prompting a reorientation toward bio-based and water-borne technologies.In recent years, advances in polymer science have unlocked novel resin systems that blend traditional thermosetting chemistries with next-generation crosslinkers and nanocomposite reinforcements. These breakthroughs have translated into adhesives that cure faster, adhere at lower temperatures, and deliver enhanced durability under demanding conditions. Concurrently, industry stakeholders have embraced lean manufacturing, digital quality management, and supply chain transparency to keep pace with shifting end-use requirements and heightened consumer awareness. As a result, companies have redefined best practices, from R&D investments and pilot-scale trials to large-scale production optimization and circularity initiatives.

Against this backdrop of technical innovation and regulatory evolution, this executive summary outlines the transformative shifts reshaping the arena, evaluates the cumulative impact of new trade measures in the United States, distills segmentation and regional insights, and identifies actionable strategic recommendations. By synthesizing the core trends and competitive dynamics of the global wood adhesives and binder sector, decision-makers will gain a holistic understanding of where value is generated and how to position for sustained success.

Examining Technological Disruption and Sustainable Material Innovations Reshaping Global Wood Adhesives and Binder Development Paths in the Coming Decade

Over the past five years, the wood adhesives and binder ecosystem has undergone a profound metamorphosis driven by disruptive technologies and sustainability agendas. Cutting-edge developments in resin chemistry, spanning next-generation polyurethanes to advanced melamine-based crosslinkers, have unlocked previously unattainable adhesion performance under harsh environmental conditions. At the same time, breakthroughs in bio-based raw materials have accelerated the gradual displacement of petro-derived feedstocks, spurred by mounting regulatory pressures and consumer demand for greener solutions.With a growing emphasis on low-VOC formulations, water-borne systems have captured an expanding share of laboratory trials and commercial launches, underpinned by innovative additive packages that replicate the moisture resistance and bond strength of solvent-borne variants. Digitalization has permeated production through automated viscosity monitoring, AI-driven process control, and real-time quality analytics, enabling formulators to fine-tune cure profiles and optimize throughput without sacrificing performance consistency.

In parallel, circular economy principles have gained traction as stakeholders explore post-consumer wood recycling and adhesive separation techniques, seeking to recover resin fractions and repurpose waste streams. Collaborative consortia involving material suppliers, original equipment manufacturers, and research institutions are co-developing scalable solutions to minimize end-of-life disposal and integrate renewable biopolymers. As a result, leading players are reconfiguring their portfolios to balance high-performance thermoset chemistries with emerging biodegradable binders, cementing their competitive edge in a market increasingly defined by both technological sophistication and ecological accountability.

Assessing the Cumulative Effects of 2025 United States Tariffs on Supply Chains and Market Positioning in Wood Adhesives and Binder Industry

The introduction of new United States tariffs in 2025 has reshaped supply chain strategies, cost structures, and competitive dynamics throughout the wood adhesives and binder industry. With certain resin and specialty monomer imports subject to elevated duties, formulators have encountered steeper initial procurement costs, prompting a reassessment of regional sourcing footprints. Many domestic producers have accelerated plans to near-shore or onshore critical resin production, mitigating import exposures while leveraging local incentives and streamlined logistics.Pricing strategies have adapted accordingly, with downstream manufacturers renegotiating long-term contracts to reflect duty-driven input cost inflation. Several mid-sized formulators have absorbed incremental tariff impacts through productivity gains, investing in continuous reactor upgrades and refining catalyst efficiencies to offset duty-related cost pressures. However, smaller entities lacking scale advantages face margin erosion, compelling them to explore alternatives such as collaborative toll manufacturing or co-processing alliances to economize raw material flows.

In parallel, the tariff environment has catalyzed a shift in market positioning, as companies with diversified global networks capitalize on tariff exemptions or preferential trade arrangements within free trade zones. Strategic partnerships with third-party logistics providers and bonded warehouses have emerged to orchestrate duty suspension mechanisms, enabling flexible inventory deployment. Looking ahead, the ability to navigate evolving trade landscapes and recalibrate supply chains in real time will be a decisive factor in maintaining pricing competitiveness and safeguarding long-term profitability.

Deriving Strategic Insights from Resin Type Product Form End Use Applications and Distribution Channel Perspectives to Drive Market Engagement

A nuanced segmentation analysis reveals distinct pathways where value is created and captured across the wood adhesives and binder space. Within resin typology, epoxy systems excel in demanding structural applications, whereas melamine formaldehyde chains dominate high-performance decorative laminates. Phenol formaldehyde resins remain the backbone of exterior-grade plywood and oriented strand board, while polyurethanes continue to surface in specialized furniture adhesives. Urea formaldehyde formulations retain prominence in low-cost laminated boards, albeit under pressure from formaldehyde-free alternatives.Turning to product configuration, one component solutions offer ease of handling and simplified application for industrial woodworking lines, whereas two component systems deliver unparalleled bond strength and heat tolerance for customized manufacturing processes. The physical form of adhesives further stratifies the market into liquid and solid segments. Liquid formats bifurcate into solvent-based variants prized for rapid drying and water-borne innovations lauded for their reduced emissions. Solid presentations encompass film adhesives that streamline lamination, hot melts that facilitate high-speed assembly, and pelletized blends engineered for precise dosing.

End use contexts underscore diverse demands across construction, packaging, and woodworking sectors. Within construction, non-structural sealants and structural load-bearing adhesives each dictate specific curing profiles and mechanical resilience. Packaging embraces corrugated board, solid board, and specialty paperboard applications, each necessitating tailored wet-end or surface-coating adhesives. Meanwhile, bespoke woodworking adhesive solutions accommodate furniture, cabinetry, and millwork. Finally, distribution modalities range from traditional offline bulk supply to digital online markets that cater to small-batch and prototyping needs. By mapping performance attributes to application requirements, stakeholders can align R&D and go-to-market strategies with the most lucrative segments.

Uncovering Distinct Regional Growth Dynamics Across the Americas Europe Middle East Africa and Asia Pacific Illuminating Drivers and Barriers in Varied Markets

Regional landscapes in the wood adhesives and binder industry exhibit markedly different growth drivers and structural challenges. In the Americas, robust construction activity and home-improvement trends underpin continued demand for formaldehyde-controlled phenolic and melamine resins, while packaging innovations in e-commerce drive adoption of fast-curing water-borne laminating adhesives. Leading North American producers are extending capacity for moisture-resistant and low-odor formulations to meet evolving building codes and environmental standards, demonstrating agility in scaling production to match volatile housing markets.Across Europe Middle East & Africa, harmonized regulations on emissions and occupational safety have propelled investments in advanced bio-based and water-borne binder portfolios. Manufacturer alliances in Western Europe have pooled R&D resources to expedite the development of non-toxic resin systems, while firms in the Middle East are leveraging petrochemical feedstocks to create hybrid formulations optimized for arid climates. African markets, still in early stages of industrialization, are gradually adopting standardized adhesive specifications, with market entrants focusing on affordable urea formaldehyde solutions.

Asia-Pacific remains the largest consumption center, characterized by expansive furniture manufacturing hubs in Southeast Asia and mass-housing projects in China and India. Local producers are enhancing export capabilities by blending cost-competitive resin blends with premium performance modifiers to satisfy both domestic and international quality expectations. However, fragmentation and price sensitivity persist in emerging markets, reinforcing the importance of targeted regional strategies that balance global best practices with localized application support.

This regional mosaic underscores the necessity of differentiated market approaches that reflect distinct regulatory regimes, infrastructure maturity, and end-use preferences.

Analyzing Strategic Initiatives Competitive Positioning and Innovation Portfolios of Leading Manufacturers in the Wood Adhesives and Binder Industry Landscape

Leading participants in the wood adhesives and binder arena have pursued a combination of strategic acquisitions, sustainable innovation, and customer-centric programs to solidify their market positions. Several global polymer giants have integrated specialty binder lines into broader resin platforms, capitalizing on scale economies and cross-selling opportunities. These organizations have prioritized investments in low-emission production technologies, launching eco-certified product tiers that comply with stringent health and safety directives.Mid-sized companies have differentiated through application expertise and localized technical support, establishing regional innovation centers that collaborate closely with furniture manufacturers and plywood producers. By deploying pilot-scale demonstration labs at key customer sites, these players expedite formulation optimization and shorten time to market. A number of regional champions have forged partnerships with university research groups to explore biodegradable binder chemistries and closed-loop adhesive recycling technologies.

In parallel, nimble specialty firms have carved out niche roles by focusing on high-value applications such as acoustic panels and flame-retardant composites. These innovators leverage proprietary additives and crosslinking agents to deliver performance advantages unattainable with off-the-shelf resins. Across all tiers, digital customer portals and e-commerce channels are emerging as complementary engagement tools, enabling real-time ordering, technical query resolution, and transparent supply-chain tracking. Collectively, these strategic and operational initiatives illustrate how market leaders harness a mix of global reach and localized agility to navigate competitive pressures while driving next-generation binder excellence.

Leveraging Innovation and Strategic Partnerships to Drive Material Performance Operational Excellence and Sustainable Growth in Wood Adhesives and Binder Sector

To secure and expand competitive advantage, industry leaders should prioritize robust innovation roadmaps that integrate renewable feedstocks and next-generation crosslinkers. Investing in dedicated pilot facilities will accelerate the validation of bio-based resin formulations under real-world assembly conditions, while collaborating with academic and supply-chain partners can de-risk early-stage development and share technical know-how.Simultaneously, forging strategic partnerships with original equipment manufacturers and engineering firms will ensure that new adhesive chemistries align precisely with evolving application requirements. Co-development agreements can streamline approval cycles and embed proprietary binder systems into high-value product platforms. To further enhance operational performance, companies should deploy advanced analytics across production lines, capturing live cure-profile data and implementing predictive maintenance to minimize downtime and reduce scrap rates.

From a market-engagement standpoint, customized customer portals and e-commerce integrations will be critical in addressing small-batch and prototype demands from boutique woodworking and packaging converters. Training programs and virtual reality simulations can augment technical service offerings, enabling remote troubleshooting and fostering deeper brand loyalty. Finally, establishing transparent sustainability reporting frameworks-aligned with global carbon reduction targets-will strengthen stakeholder trust and open doors to green procurement contracts in regulated end-use segments. By weaving these actionable strategies into a cohesive plan, decision-makers can unlock differentiated growth and lead the sector toward a more sustainable future.

Outlining Rigorous Research Approach Incorporating Comprehensive Data Collection Expert Consultations and Robust Analytical Frameworks for Industry Insights

The research underpinning this executive summary employs a multi-faceted approach to ensure analytical rigor and credibility. Initially, secondary research tapped publicly available sources, including industry journals, patent filings, regulatory publications, and technical white papers authored by leading polymer science organizations. This foundation was supplemented by a comprehensive review of supplier product catalogs and academic research studies focused on sustainable binder chemistries.Primary research was conducted through in-depth interviews with senior executives, R&D directors, and procurement managers at both global and regional adhesive manufacturers. These discussions provided firsthand perspectives on formulation challenges, capital investment priorities, and evolving end-use requirements. Additionally, site visits to pilot-scale laboratories and production facilities enabled observational validation of key technology enablers and process optimization practices.

Data triangulation was achieved by cross-verifying interview insights with quantitative data derived from trade association reports, customs databases, and capital expenditure announcements. An analytical framework combining porters five forces, technology lifecycle curves, and supply chain resilience indices was applied to distill strategic imperatives. Throughout the project, strict data-quality protocols were maintained, ensuring that findings reflect the most current market realities and anticipate emerging trends with precision.

Synthesizing Core Findings and Strategic Imperatives to Guide Executive Decision Making and Drive Ongoing Innovation in the Wood Adhesives and Binder Domain

In synthesizing the core findings, several themes stand out as pivotal for industry insiders and executives alike. The transition toward sustainable resin systems is not a peripheral trend but a central driver shaping investment decisions, product portfolios, and regulatory compliance strategies. Concurrently, rapid developments in digital process controls and additive manufacturing techniques are redefining what constitutes high-performance bonding under diverse end-use conditions.The impact of new trade measures underscores the necessity of agile supply-chain architectures that can respond to shifting duty regimes and raw material availability. Meanwhile, segmentation analysis reveals that no single adhesive solution will dominate; rather, success will come from the ability to align customized formulations with the specific demands of construction, packaging, and woodworking applications.

Geographically, growth trajectories will continue to diverge, with the Americas focusing on eco-certified high-performance resins, EMEA accelerating bio-based innovations to meet emissions targets, and Asia-Pacific balancing scale-driven cost leadership with rising demand for premium solutions. Corporate strategies that combine global R&D investment with localized application support are most likely to capture value across these disparate markets.

By integrating these insights into a cohesive strategic roadmap-emphasizing sustainable innovation, operational excellence, and collaborative partnerships-stakeholders can chart a path toward resilient growth and enduring leadership in the wood adhesives and binder domain.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Resin Type

- Epoxy

- Melamine Formaldehyde

- Phenol Formaldehyde

- Polyurethane

- Urea Formaldehyde

- Product Type

- One Component

- Two Component

- Form

- Liquid

- Solvent Based

- Water Based

- Solid

- Film

- Hot Melt

- Pellet

- Liquid

- End Use

- Construction

- Non Structural

- Structural

- Packaging

- Corrugated

- Solid Board

- Specialty Paperboard

- Woodworking

- Construction

- Distribution Channel

- Offline

- Online

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- 3M Company

- Akzo Nobel N.V.

- Arkema S.A.

- Ashland Global Holdings Inc.

- BASF SE

- Benson Polymers Ltd.

- Bondloc UK Ltd.

- Casco Adhesives AB

- Collano AG

- Dow Inc.

- Dynea AS

- Eastman Chemical Company

- Franklin International

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hexion Inc.

- Huntsman International LLC

- Jowat SE

- Master Bond Inc.

- NANPAO Resins Chemical Group

- Parson Adhesives Inc.

- Permabond Engineering Adhesives Ltd.

- Sika AG

- Soudal Group

- Wacker Chemie AG

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Wood Adhesives & Binder market report include:- 3M Company

- Akzo Nobel N.V.

- Arkema S.A.

- Ashland Global Holdings Inc.

- BASF SE

- Benson Polymers Ltd.

- Bondloc UK Ltd.

- Casco Adhesives AB

- Collano AG

- Dow Inc.

- Dynea AS

- Eastman Chemical Company

- Franklin International

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hexion Inc.

- Huntsman International LLC

- Jowat SE

- Master Bond Inc.

- NANPAO Resins Chemical Group

- Parson Adhesives Inc.

- Permabond Engineering Adhesives Ltd.

- Sika AG

- Soudal Group

- Wacker Chemie AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | November 2025 |

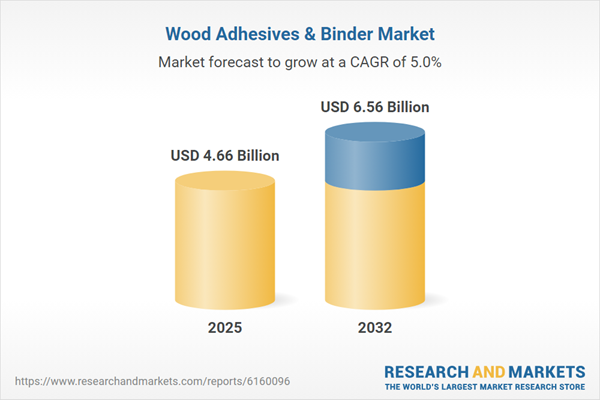

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 4.66 Billion |

| Forecasted Market Value ( USD | $ 6.56 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |