Speak directly to the analyst to clarify any post sales queries you may have.

Navigating the Evolving Turtle Food Market Landscape with a Comprehensive Overview of Essential Drivers and Emerging Opportunities

The turtle food sector has undergone remarkable evolution in recent years, driven by a convergence of shifting consumer preferences, technological innovations, and a growing emphasis on nutritional science. Pet ownership patterns are changing, with more households seeking specialized diets that address the unique physiological needs of turtles. As a result, manufacturers and retailers are compelled to explore novel formulations that balance health benefits, palatability, and sustainability. Concurrently, regulatory agencies are tightening quality standards, underscoring the necessity for transparent ingredient sourcing and rigorous safety protocols.Amid this dynamic landscape, stakeholders must navigate a complex interplay of market drivers and challenges. On one hand, rising awareness of reptile health has fueled demand for enriched and functional feeds. On the other, global supply chain disruptions and raw material volatility have heightened cost pressures. As consumer expectations continue to evolve, industry participants are prioritizing product differentiation through customized textures, fortified nutrient blends, and eco-friendly packaging solutions. Transitioning from traditional commodity models to value-added offerings is becoming essential for brands aiming to capture discerning buyers and achieve long-term growth.

Unveiling the Generational and Technological Paradigm Shifts Reshaping the Turtle Food Ecosystem and Consumer Behavior Trends

In recent years, the turtle food ecosystem has experienced transformative shifts that are redefining production practices and end-user engagement. Advanced formulation technologies have enabled the development of precision-crafted feeds, integrating bioactive compounds that promote shell integrity and immune resilience. Meanwhile, sustainability considerations have gained prominence, prompting the incorporation of responsibly sourced proteins and natural additives. These changes reflect a broader pivot toward environmentally conscious pet care, where manufacturers reassess ingredient traceability and lifecycle impact.Moreover, digital channels are reshaping how brands connect with reptile enthusiasts. Direct-to-consumer platforms and eCommerce marketplaces offer tailored educational content alongside targeted product recommendations, facilitating deeper consumer relationships. At the same time, industry alliances and collaborative research initiatives are accelerating knowledge exchange, enabling quicker adoption of best practices and standardized quality benchmarks. As a result, companies that embrace cross-sector partnerships and invest in digital innovation are well positioned to capture emerging niches and sustain competitive advantage.

Assessing the Far Reaching and Long Lasting Strategic Implications of the 2025 United States Tariff Adjustments on Turtle Food Supply Chains, Pricing and Distribution Channels

The implementation of new tariff measures by the United States in 2025 has introduced a host of strategic implications for turtle food supply chains and pricing frameworks. Increased duties on imported feed ingredients have driven procurement teams to reassess long-standing supplier contracts and explore diversified sourcing options. As a consequence, stakeholders are balancing cost containment with the imperative to maintain nutrient quality and consistency in finished products.In response, many producers have accelerated investments in localized manufacturing and regional distribution hubs to mitigate cross-border friction. This transition has necessitated closer collaboration between ingredient suppliers and feed formulators, ensuring that alternative raw materials meet rigorous nutritional profiles. Simultaneously, downstream channels-ranging from independent pet stores to online retailers-are recalibrating price structures, often diffusing cost pressures through targeted promotions and value packaging. Looking ahead, organizations that proactively optimize procurement strategies and strengthen logistical partnerships will be better prepared to navigate tariff-induced volatility and safeguard market share.

Analyzing Critical Market Segmentation Dimensions to Illuminate Turtle Food Demand Patterns Across Product Types, Species, Forms, and Channels

Understanding the multifaceted dimensions of market segmentation is critical for aligning product portfolios with consumer needs. When evaluating product types, stakeholders observe that flakes remain a foundational offering, with fortified flakes commanding a premium among buyers focused on enhanced vitamin and mineral content, while regular flakes serve entry-level budgets. Gel food has emerged as an innovation segment prized for its moisture retention and textural appeal. Pellets occupy a significant niche, subdivided into compressed pellets favored for slow release feeding and extruded pellets engineered for uniform buoyancy. Sticks continue to appeal to species that exhibit surface-feeding behaviors, offering tactile engagement and portion control.Diversification across species further refines targeting strategies. Aquatic turtles present distinct nutritional requirements compared to terrapins and tortoises, leading to species-tailored formulations that optimize protein-to-fiber ratios and shell-strengthening complexes. Form preferences, whether dry food designed for extended shelf life or wet food that mimics natural foraging, influence packaging and labeling practices. Distribution channels also shape market reach: offline retail environments, including pet stores and veterinary clinics, provide tactile experiences and expert guidance, whereas digital storefronts-whether direct-to-consumer websites or eCommerce platforms-leverage personalized recommendations and subscription models. By integrating these segmentation insights, decision-makers can fine-tune marketing messages, architectural assortment plans, and R&D roadmaps to resonate with specialized audiences.

Delineating Region Specific Growth Drivers and Consumer Preferences Informing Turtle Food Market Expansion in the Americas, EMEA and Asia-Pacific

Regional dynamics play an instrumental role in charting growth trajectories for turtle food suppliers. In the Americas, mature pet care cultures and high disposable incomes fuel demand for premiumized feeds, with eCommerce adoption accelerating alongside omnichannel strategies. Market players benefit from partnerships with veterinary networks and advocacy organizations that foster trust and reinforce nutritional claims. Meanwhile, in Europe, Middle East & Africa, regulatory frameworks in the EU promote stringent safety standards and eco-friendly practices, whereas the Middle East’s burgeoning luxury segment favors bespoke feeding solutions. African markets, though nascent, display potential as rising incomes and urbanization spur pet ownership.Shifting focus to the Asia-Pacific, rapid urban expansion and digital connectivity are transforming distribution landscapes. In markets such as China, professional aquarist communities and online forums drive awareness of specialized turtle diets, while in Southeast Asia, trade shows and localized events facilitate product launches. Japan’s emphasis on quality and animal welfare incentivizes brands to spotlight ingredient provenance and manufacturing certifications. Across all regions, consumer education initiatives and tailored promotional campaigns are proving essential for bridging knowledge gaps and enhancing product adoption rates.

Profiling Leading Industry Players, Strategic Alliances, and Competitive Moves That Are Defining the Future of the Turtle Food Sector

Leading companies within the turtle food arena are distinguishing themselves through a combination of product innovation, strategic collaborations, and sustainability commitments. Some global feed pioneers have launched research ventures focused on novel protein sources, including insect-based meal, to reduce carbon footprint and address ethical sourcing concerns. In parallel, established reptile nutrition brands continue to expand their portfolios via acquisitions of niche formulators, enhancing their ability to serve specialty segments.Partnerships between ingredient producers and packaging specialists are yielding breakthrough solutions, such as biodegradable pouches and portion-controlled sachets, aligning with consumer demand for sustainable and convenient feeding formats. Companies with robust R&D infrastructures are deploying advanced analytics to refine nutrient stability and flavor profiles, while those with integrated distribution networks are leveraging direct-to-consumer channels to drive recurring revenue streams. Together, these strategic endeavors underscore the competitive landscape and highlight the importance of agility, technological adoption, and brand differentiation.

Delivering Proactive Strategic Recommendations to Help Industry Stakeholders Capitalize on Emerging Turtle Food Trends and Regulatory Shifts

To capitalize on evolving market dynamics, industry leaders should adopt a multi-pronged strategic approach that balances innovation with operational resilience. First, prioritizing the development of next-generation feeds-such as formulations enhanced with probiotics, prebiotic fibers, and plant-derived antioxidants-can help brands address growing consumer interest in gut health and holistic wellness. Concurrently, diversifying ingredient portfolios to include sustainable protein alternatives and regionally sourced materials will mitigate tariff-induced risks and support environmental objectives.Furthermore, forging closer ties with veterinary professionals and aquatic life experts can amplify credibility and facilitate educational outreach. Investing in digital ecosystems-encompassing interactive product configurators, subscription-based replenishment models, and data-driven personalization-will deepen consumer engagement and foster long-term loyalty. Finally, establishing agile supply chain frameworks that incorporate dual sourcing, real-time inventory monitoring, and collaborative forecasting with channel partners will fortify resilience against logistical disruptions.

Outlining Rigorous Research Design, Data Collection Approaches, and Analytical Techniques Underpinning the Turtle Food Market Study

The research underpinning this market analysis is grounded in a rigorous methodological framework designed to ensure accuracy, reliability, and relevance. Primary data were gathered through in-depth interviews with key stakeholders, including feed formulators, aquatics veterinarians, distribution executives, and end-user communities. These qualitative insights were complemented by structured surveys distributed to reptile enthusiasts and retail channel representatives.Secondary research entailed comprehensive reviews of industry publications, trade association reports, regulatory filings, and proprietary databases to contextualize market developments. Data triangulation processes were employed to cross-validate findings, while statistical techniques were applied to identify trend patterns and correlation factors. Qualitative content analysis further facilitated the interpretation of consumer preferences and brand positioning strategies. Throughout the study, adherence to ethical research standards and data integrity protocols was maintained, ensuring that conclusions rest on a solid evidentiary basis.

Synthesizing Key Findings and Strategic Imperatives to Navigate the Dynamic Turtle Food Marketplace With Confidence and Agility

This analysis has illuminated the intricate interplay of consumer behavior, regulatory environments, supply chain dynamics, and competitive forces shaping the turtle food landscape. Key takeaways highlight the critical importance of segmentation guidance, regional adaptation, and strategic foresight in navigating tariff pressures and evolving preferences. Organizations that invest in innovation-both in product formulation and digital engagement-while cultivating resilient sourcing networks will be best positioned to thrive.Ultimately, sustained success in this sector hinges on an agile mindset that embraces collaboration, continuous learning, and data-driven decision making. As the market continues to mature, the ability to anticipate shifts, tailor offerings to diverse species and regional contexts, and articulate compelling value propositions will distinguish industry leaders from followers. By internalizing these strategic imperatives, stakeholders can unlock new growth pathways and foster enduring relationships with both trade partners and end users.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Flakes

- Fortified Flakes

- Regular Flakes

- Gel Food

- Pellets

- Compressed Pellets

- Extruded Pellets

- Sticks

- Flakes

- Species

- Aquatic Turtles

- Terrapins

- Tortoises

- Form

- Dry Food

- Wet Food

- Distribution Channel

- Offline Retail

- Pet Stores

- Veterinary Clinics

- Online Retail

- Direct To Consumer

- eCommerce Platforms

- Offline Retail

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Zoo Med Laboratories, Inc.

- Fluker Farms

- Central Garden & Pet Company

- Fish Fuel Co.

- PMI Nutrition International, LLC

- Spectrum Brands, Inc.

- Taiyo Feed Mill Limited

- Josh's Frogs, LLC.

- JBL GmbH & Co. KG

- Xin Yang Aquarium and Pets Sdn Bhd

- Ocean Nutrition

- Nature Zone Pet Products

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Turtle Food market report include:- Zoo Med Laboratories, Inc.

- Fluker Farms

- Central Garden & Pet Company

- Fish Fuel Co.

- PMI Nutrition International, LLC

- Spectrum Brands, Inc.

- Taiyo Feed Mill Limited

- Josh's Frogs, LLC.

- JBL GmbH & Co. KG

- Xin Yang Aquarium And Pets Sdn Bhd

- Ocean Nutrition

- Nature Zone Pet Products

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | October 2025 |

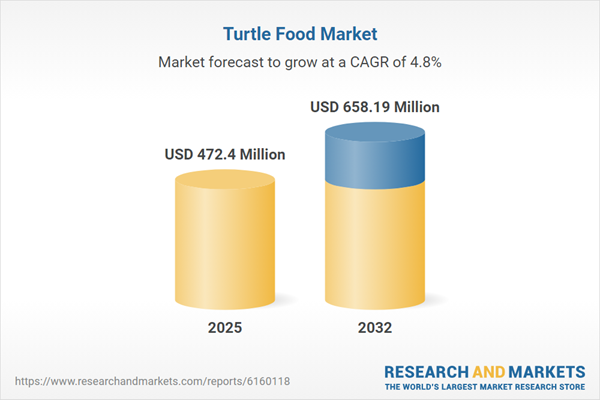

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 472.4 Million |

| Forecasted Market Value ( USD | $ 658.19 Million |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |